Who is Brett Berry (CRD#: 1926468)

Brett Berry joined First Republic Investment Management in 2006 as a Senior Managing Director and Wealth Manager.

Brett Berry works with a small group of individuals, families, and institutions across the United States to deliver specialized wealth plans and seamless implementation. Brett Berry is acutely aware of the opportunities and challenges that come with protecting and transmitting large wealth. He specializes as an investment manager in creating unique, smart, tax-sensitive investment strategies with a focus on risk minimization.

He is also well-versed in concentrated wealth solutions. Brett Berry, as a financial advisor, is adept at identifying and prioritizing planning issues, and he collaborates with the firm’s financial planning professionals in coordinating the delivery of holistic advice to clients in collaboration with their attorneys, accountants, and family office personnel.

Before joining First Republic, he worked for U.S. Trust Company as a Senior Vice President and Portfolio Manager. He was previously a Senior Vice President of Bailard, Biehl, and Kaiser. Brett Berry has also worked as an analyst at Hughes Investment Management Company and Wilshire Associates.

About FIRM: Merrill Lynch Wealth Management

Jim Herbert started First Republic in 1985 with the notion that a differentiated culture devoted to great client service would result in a very successful banking organization.

First Republic Security Company says- “We opened our doors at 201 Pine Street in San Francisco on July 1, 1985, with fewer than ten colleagues and only one office. We were one of the smallest banks in the United States, with an enterprise value of $8.8 million, out of around 14,000.

By the time we celebrate our 35th anniversary in July 2020, we will have over 5,000 employees spread throughout more than 80 offices in seven states. First Republic has grown organically to become the 14th largest bank in the United States, with a market capitalization of more than $19 billion.

This represents a record of growth in total enterprise value of 25% per annum compounded for 35 years.

Our growth has never been the goal, however, only the outcome of taking exceptional care of our clients, communities, and one another. “

The First Republic believes in tailored solutions rather than one-size-fits-all approaches. We create wealth management programs that take into account your entire financial picture. Clients of First Republic Private Wealth Management work with a single wealth advisor who oversees a team of banking, investment management, trust, and brokerage specialists who collaborate and collaborate with you to effectively address your specific circumstances.

First Republic Private Wealth Management is comprised of the following entities: First Republic Trust Company; First Republic Trust Company of Delaware LLC; First Republic Investment Management Inc., an SEC Registered Investment Advisor; and First Republic Securities Company, LLC, Member FINRA / SIPC.

First Republic Securities Company, LLC, Member FINRA/SIPC, DBA Grand Eagle Insurance Services, LLC, CA Insurance License # 0I13184, provides insurance agency services.

INVESTMENT MANAGEMENT SERVICES: First Republic provides unbiased, personalized wealth management solutions. Our wealth managers provide tailored financial advice to individuals, businesses, governments, and a variety of charity organizations.

BROKERAGE SERVICES: Our professionals offer full-service and self-directed brokerage services, with the express purpose of developing the best strategy for you. Our one-of-a-kind platform offers brokerage, trading, and custody services.

TRUST SERVICES: First Republic Trust Company and First Republic Trust Company of Delaware LLC provide hands-on, individualized trust services, handling delicate matters with experience, objectivity, and intelligent decision-making.

Advisory, investment, and insurance products and services are not FDIC-insured, are not guaranteed, and may lose value.

We customize financial solutions for our clients and offer a wide range of brokerage, trading, and custody services at First Republic Securities Company, LLC (Member FINRA/SIPC).

Money Management

Fixed income management from the First Republic provides you with an objective, approachable financial partner who can assist you in making decisions that are in your best interests.

Strategies for Concentrated Wealth

First Republic Securities Company, LLC (Member FINRA/SIPC) provides hedging transactions, employee stock options, and corporate selling plans (rule 10b5-1 plans) to help you diversify your concentrated equity holdings.

Brokerage with Full Service

First Republic Wealth Managers can collaborate with you to create a customized plan with alternatives tailored to your investing goals.

Brokerage Services Available Online

Using our Online Brokerage platform, you can easily manage assets from a desktop or mobile device.

Alternative Investments

Our brokerage services feature a variety of tools for tracking, optimizing, and growing your investment portfolio.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

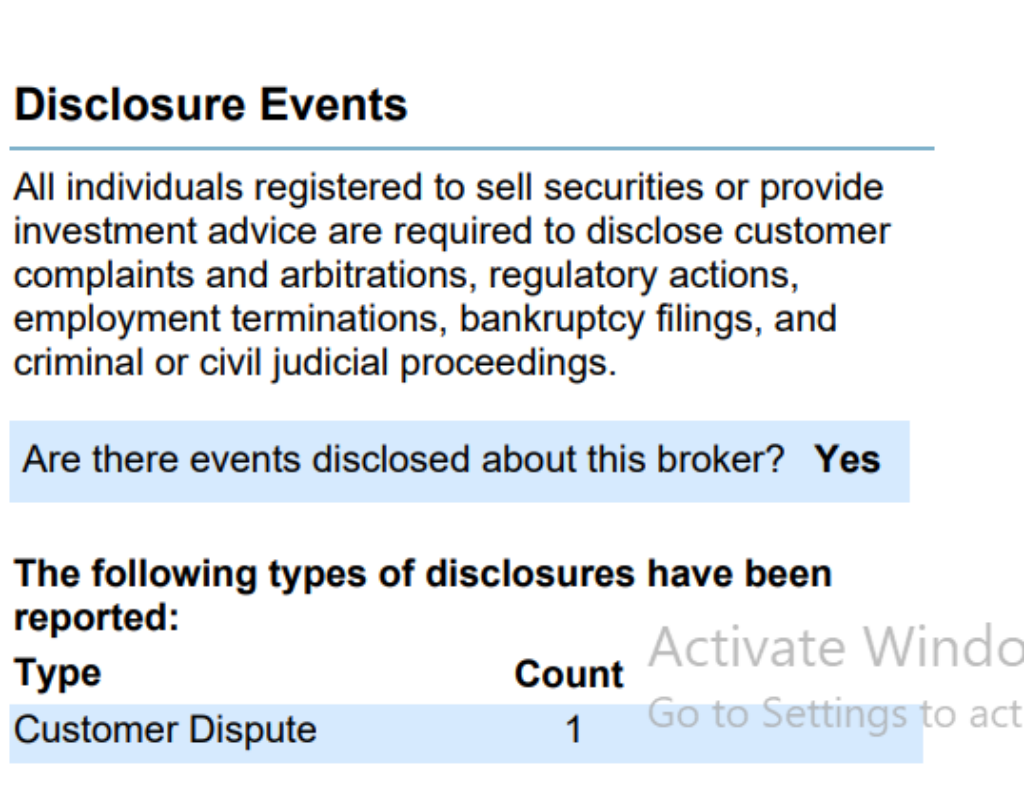

Brett Berry Disclosures: BrokerCheck, FINRA, And SEC Reports

There is one disclosure named Customer Dispute Disclosure.

When an Executive Officer or Chief, or their designate, determines that:

The complaint will be sent to a lawyer.

The company has been allowed to reply to the complaint, a probable breach of the law has happened or there is a risk of public harm, and a substantiated consumer transaction has occurred,

A genuine financial transaction between an individual customer or patient and a firm or licensee to procure and sell goods or services is defined as a validated consumer transaction.

A Consumer Complaint History report shall not reveal complaint information if it is judged that:

The complaint lacks merit, the complaint involves a non-consumer matter (e.g., labor grievances, labor relations, tax issues, etc.), or disclosure is forbidden by statute or regulation.

A report on Consumer Complaint History shall not reveal information concerning a complaint if it is found that:

Disclosure could jeopardize an investigation or prosecution, or it could endanger or hurt the complainant.

FINRA’s BrokerCheck

individual_1926468.pdf (finra.org)

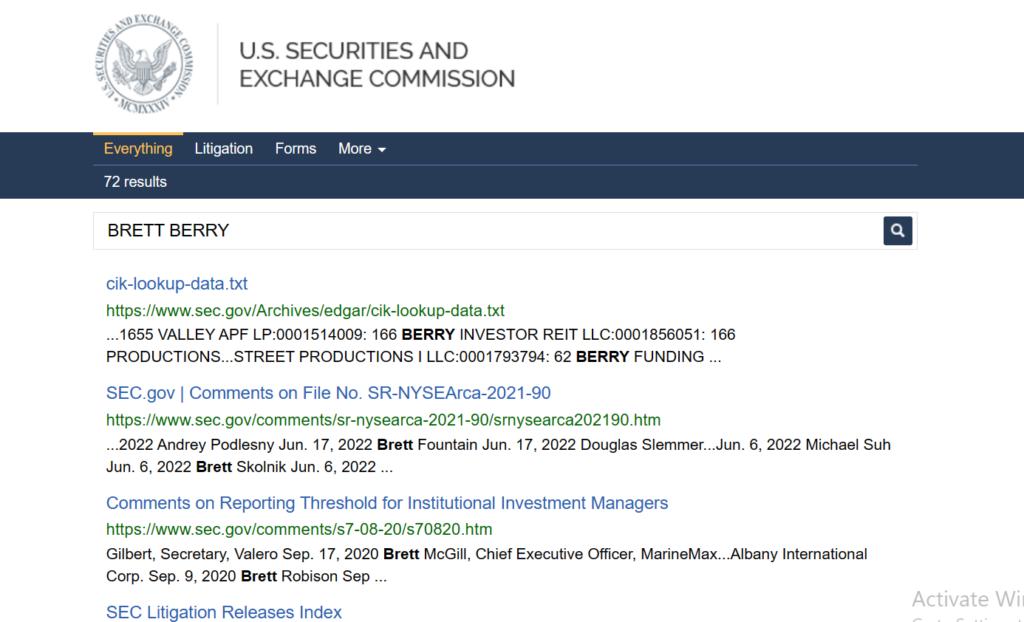

SEC Litigations & Forms

Source: BRETT BERRY – SEC Site Search Search Results

Brett Berry Lawsuits, Legal Battles, & Disputes

There might be more pending lawsuits against Brett Berry which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Brett Berry on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Brett Berry Complaints, Class Action Lawsuits & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Brett Berry using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Brett Berry or any financial advisor.

Frequently Asked Questions

Where is NAME located?

What are NAME’s qualifications

Is NAME facing any lawsuits?

Has NAME been charged by the SEC?

How do I contact NAME?

Does NAME have any disclosures?

Which Firm does NAME work with?

What is NAME’s CRD Number?

Better Alternatives To Brett Berry (By Experts):

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management