Who is Brian Doyle (CRD#: 4867689)?Everything you need to know about Brian Doyle and their accolades

The Doyle and Loughman Wealth Management Group’s Managing Director of Investments is Brian Doyle. He has been a financial advisor for more than 19 years and has a special combination of expertise and experience. He looks forward to many more years of assisting customers and their families in achieving their objectives.

The group of advisers at Wells Fargo Clearing Services in Lebanon, New Hampshire includes Brian Doyle. Brian Doyle has 18 years of employment under his belt. They are employed with Wells Fargo Clearing Services at the moment. In Michigan, New Hampshire, Ohio, and Texas, Brian Doyle is authorized to give investment advice because he has already passed the Series 66 exams in those states. Per any applicable state’s exemption from registration or notice filing, Brian Doyle is also permitted to offer advisory services in other states.

After earning his degree from Brown University, Brian followed his dream of becoming a coach and spent ten years as the head coach of the Dartmouth Sailing Team, leading the group to a national championship. He also spent six years as the head coach of the U.S. Olympic Developmental Sailing Team. In 2002, Brian received the US Olympic Committee’s Developmental Coach of the Year award. 2003 saw him win a World Sailing Championship.

Brian uses a thorough planning approach to assist his customers and their families in creating tailored investment plans that will help them accumulate and protect wealth as well as plan for, prioritize, and achieve their retirement goals. He informs customers about the value of long-term planning and making knowledgeable financial decisions at every stage of life by drawing on his background in coaching and knowledge of investments and the markets.

Fundamental Choice Portfolio Manager is among Brian’s credentials.

Brian was named a Barron’s Top 1,200 State Advisor by State Advisors1 in 2015–2022, and he was named a Wells Fargo Premier Advisor in 2014. A Forbes Magazine Best-in-State Wealth Advisor2 for the years 2018 to 2022, he is also acknowledged in this regard.

Outside of work, Brian devotes his time to instructing ski racing. He and his wife have three kids and live in Hanover. They take advantage of the Upper Valley’s many winter and summer sports, like as skiing, hiking, bicycling, and sailing.

In this article, we will go deep into Brian Doyle’s past, discovering hidden disclosures and analyzing the consequences of the lawsuits.

About Wells Fargo AdvisorsHistory, achievements, leadership, lawsuits, & disputes

Wells Fargo is a broker-dealer as well as an investment advising organization. Individuals, pension or profit-sharing plans, trusts, estates, charity organizations, corporations, governmental entities, educational institutions, and banks or thrift institutions are among its clientele.

According to Barron’s 2017 rating, Wells Fargo is the fifth-largest wealth management company, while being best recognized for its banking services.

Wells Fargo Advisors History

Wells Fargo has been in business for more than 160 years, founded in 1852 by William G. Fargo. The company began operations in San Francisco, offering banking and quick delivery services. Its express business led it to become involved in the stagecoach business, and it eventually grew to own and run the world’s largest stagecoach operation, resulting in the Wells Fargo logo we see today.

Wells Fargo Advisors and Wells Fargo Advisors Financial Network, LLC, both of which are networks of independent contractor representatives, offer broker-dealer and investment advice services.

Services Offered by Wells Fargo Advisors

Wells Fargo offers investment advising services through both Wells Fargo Advisors and Wells Fargo Advisors Financial Network, which operates through a network of independent contractor representatives. Prospective consumers can receive a free introductory consultation. The company provides the following products and services:

- Advisory services

- Asset management

- Brokerage services

- Estate planning strategies

- Retirement planning

- Portfolio analysis and monitoring

Wells Fargo also offers comprehensive financial planning as one of its investment advisory services, though this service is not integrated with existing accounts and only includes the creation of a plan.

Investment Planning Process of Wells Fargo Advisors

The investment planning process at Wells Fargo focuses on the client’s long-term objectives. The Envision procedure is an eight-step procedure that the firm takes clients through. This entails determining your primary life goals and then developing an investment strategy and asset allocation to support those goals.

According to Wells Fargo, clients’ Envision plans would consider not only their life goals, but also their education ambitions, assets and obligations, cash flow requirements, retirement planning needs, levels of acceptable investment risk, and asset allocation objectives.

First, clients will work with their advisor to outline their primary life goals and choose their ideal as well as acceptable goals. The advisor will then assist the client in prioritizing their goals, which will be stress-tested using statistical modeling. Following the completion of these stages, the adviser makes a recommendation to the client, and the proposed asset allocation is adopted. Once everything is in place, the adviser will continue to track progress and collaborate with the client to adjust the plan as new goals and priorities emerge.

Fees Under Wells Fargo Advisors

Wells Fargo Advisors typically charges clients a percentage of assets maintained in an account. This charge includes investment advice as well as trading expenses. Clients of certain investment advising programs, on the other hand, are paid an asset-based fee as well as commissions on each trade executed. In this arrangement, the asset-based fee is frequently paid to a third-party manager who has been chosen to handle the client’s account. Wells Fargo receives commissions for any services provided.

Wells Fargo’s financial planning services are the only ones that do not follow one of these two cost models. Financial planning clients pay a one-time cost that covers only the financial plan.

All of the investment programs offered through Wells Fargo Advisors Financial Network, a network of independent contractors, are wrap fee programs. Fee rates vary by advisory program, with total fees ranging from 1.50% to 2.50%

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

Brian Doyle Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, litigation against Brian Doyle

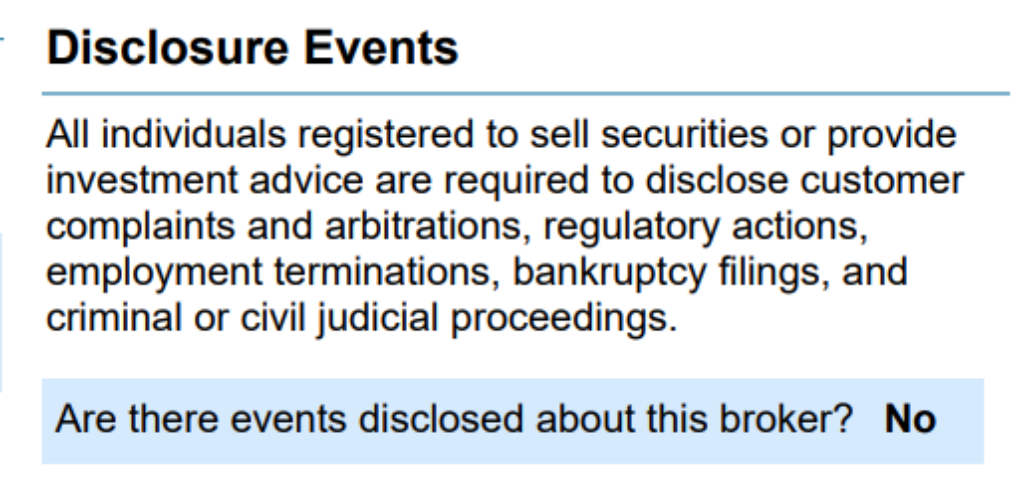

The brokerCheck report of Brian Doyle includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

No disclosure has been mentioned about Brian Doyle.

FINRA’s BrokerCheck

individual_4867689.pdf (finra.org)

SEC Litigations & Forms

Source: Brian Doyle – SEC Site Search Search Results

Brian Doyle Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against Brian Doyle

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis.law, and Law360. If Brian Doyle has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Brian Doyle which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Brian Doyle on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Brian Doyle Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against Brian Doyle (if available)

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Brian Doyle using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Brian Doyle or any financial advisor.

Better Alternatives To Brian Doyle (By Experts):Find the top 3 alternatives to Brian Doyle

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management