Brian Sheth – Was he part of Tax Evasion and Scandal? The Truth Exposed (Update 2024)

In recent years, Brian Sheth claims, Vista Equity Partners has acquired more software than any other company or investor. It appears that neither Brian Sheth nor anyone else was included in the call’s invitations. Smith has been in the most legal problems because of his involvement in a large tax cover-up.

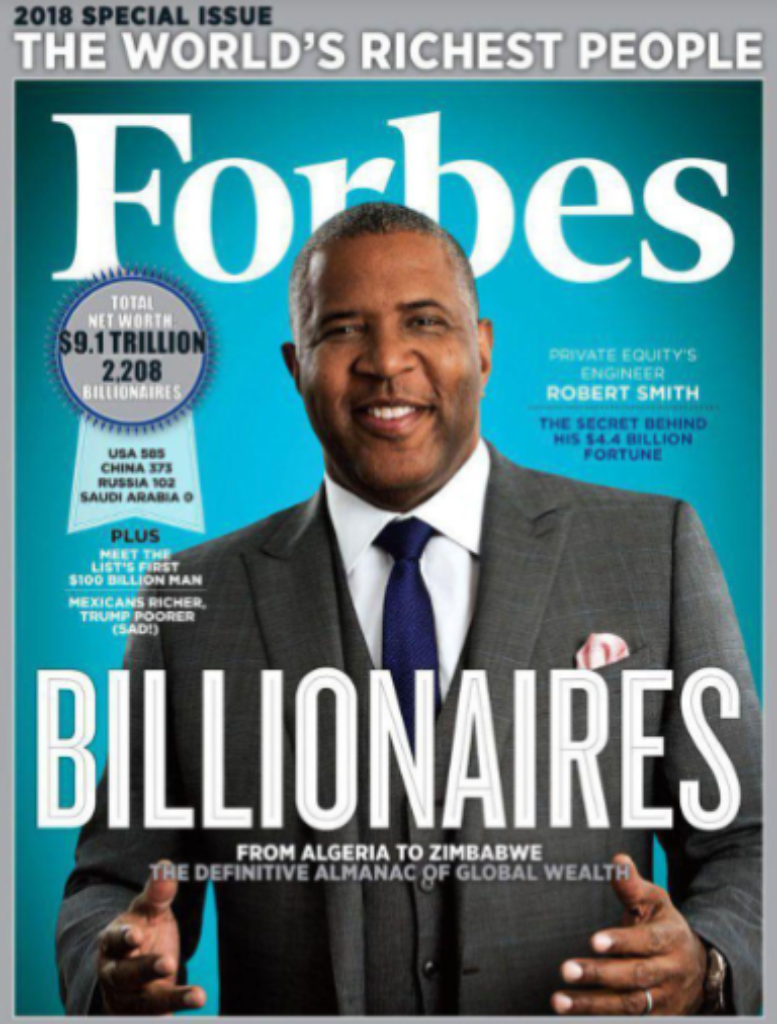

Vista was grown by Brian Sheth into a $73 billion private equity powerhouse

Robert Smith and Brian Sheth have dominated Wall Street for the past ten years thanks to the software takeover and their growth of Vista into a $73 billion private equity powerhouse with results that nearly put every competitor to shame. Vista was valued at $7 billion by outside parties because investors thought it was so great.

Brian Sheth & Robert Smith’s wealth has grown up

It became the most sought-after ticket on Wall Street, doubling the wealth of Smith and Sheth. The bond served purposes that went far beyond financial gain. Best friends who frequently traveled together and enjoyed fly-fishing for trout in streams fed by the Rocky Mountains.

Smith introduced Sheth to philanthropy, which has since grown to be one of his primary passions and elevated him to the status of one of the most prominent young environmental campaigners worldwide.

Why does Brian Sheth permanently depart Vista?

While Americans prepared their turkeys and stuffing for Thanksgiving, Smith and Sheth were putting the finishing touches on a contentious divorce that will see Sheth permanently leave Vista and hand back his minority ownership in the company, which Forbes originally valued at over $1 billion. A phalanx of pricey lawyers from across the country helped Smith and Sheth.

While Smith’s legal difficulties were being settled, Sheth, Vista’s most active dealmaker, may have had the potential to succeed Smith as the company’s CEO, but that chance has already passed. Sheth is essentially referring to Robert F. Smith, who was once his closest friend, even though Smith will be helping Vista’s dealmakers from outside the organization. Sheth explains that it is Robert’s business. He continues, “I’m grateful for the chance he offered me to undertake ground-breaking work so early in my career.

A hungry banker in his mid-20s looking for an opportunity, Brian Sheth worked at Vista for more than 20 years before becoming a successful millionaire dealmaker who assisted in running one of the busiest and most prosperous businesses in the world. The company’s co-founders became two of the wealthiest investors in the nation as a result of the tens of billions of dollars in revenues that Vista returned to its investors under Sheth’s stringent daily oversight.

“At Vista, we were able to do incredible things,” Sheth claims. He keeps talking about selling his tiny firm ownership. We are looking out for the next group of leaders and providing them an opportunity to take the helm. It was necessary in my opinion to provide a large financial incentive for this new generation of individuals to sustain Vista’s performance beyond its prior twenty-one years. However, seen as substantially the opposite of what he was asserting.

Added to an interview. Our families are familiar with one another, and he observes longingly of his former workplace. I’m eager to keep following them and supporting them from a distance. We have made large financial investments. They still have a chance, in my humble view, to show the public their talent.

When Sheth begins his profession as an investor after taking a break, he plans to merge his love of ecology and conservation with investment. He will leverage his skills as a genius at turnarounds and a visionary negotiator to raise firms’ environmental bottom lines. Despite being very similar to Vista’s design, it doesn’t encroach on their domain.

In addition to working toward an honorable and just separation from Vista and his freedom to pursue a career on his own, Brian Sheth has been fighting for his life. He asserts that while receiving convalescent blood plasma treatments and spending a week in an Austin hospital, he contracted the coronavirus.

Dissatisfaction Reality

Unknown to many, Smith’s and Vista’s philanthropic activities were concealing a sinister, uncomfortable truth that might endanger any alliance, especially one as close as theirs. As Smith’s non-prosecution agreement, which acknowledged the disclosure of information regarding tax evasion, came to an end, Sheth wanted to give the agency a fresh start. During an hour-long Zoom session, Sheth and Smith debated who might be held accountable for Vista. The management level of the debate was won by Smith.

After the Department of Justice revealed its charges against Brockman and its non-prosecution deal with Smith, Sheth learned all the specifics of their significant connections. Even though the wealthy businessman was battling for his life in a hospital room at the Dell Seton Medical Center at The College of Texas in Austin, weeks of speculations about Sheth’s departure continued.

When asked whether Smith will be able to regain his status as one of the greatest businessmen in America and the architect of the American Dream, Sheth answers calmly.

He says nothing further about Smith and instead adds, “I feel more about Vista.” I’ve been incredibly pleased with the agency’s perseverance. Although it is clear that the staff at Vista had a particularly challenging year, they believe they performed admirably.

According to a press statement by Smith, “I need to thank Brian for his collaboration and dedication to Vista’s success, from working with us to design an engineering solution to non-public fairness, to set a standard of excellence across the Vista ecosystem.

Brian Sheth, An Unidentified Twitter User, Copyright Law

However, a Twitter user going by the handle @CallMeMoneyBags has been critical of Brian Sheth and other players in the private equity sector. MoneyBags tweeted about Sheth and occasionally included pictures of scantily clad ladies a year ago, about the same time Sheth left Vista. The phrasing of the tweets wasn’t particularly weak. One of them utilizes numerous hashtags and simply reads, “Brian Sheth is the King of Private Equity”:

The screenshots of those tweets show that the media is restricted due to copyright violation, which is the next level of this mystery.

What do you know about Brian Sheth?

Brian Sheth, the son of a working-class mother and father, was brought up in a Boston suburb and schooled about Carl Icahn and Michael Milken. His father was an immigrant from India, unlike his Irish-Catholic mother who worked as an insurance researcher. Sheth developed an early interest in both knowledge and Wall Street, a combination that would have made him a multibillionaire.

After graduating from Wharton College at the University of Pennsylvania, Sheth relocated to San Francisco to work with famed financing banker Frank Quattrone. When Quattrone left for Credit Suisse, Sheth wanted another choice. He was introduced to Smith, a rising star expertise banker at Goldman at the time, by a close friend.

How do you define tax evasion?

What are tax evasion, its methods, and associated penalties?

It is unlawful for you to evade paying your tax obligations, whether you are an individual or a business. Criminal charges and severe punishments are associated with the serious crime of tax evasion. For instance, it is considered tax fraud and falls under the category of tax evasion to pay no taxes or pay less than you should.

Smith left Goldman in 1999, and soon after, cofounders like Sheth and Stephen Davis, a business school classmate who worked behind him at Goldman, started keeping an eye on the company.

Sheth served as Vista’s go-to person in the interim at its Austin headquarters, where he oversaw the company’s distinctive playbook and an internal consulting team made up of several industry experts who assisted portfolio companies in growing. In contrast, Smith, a charismatic public speaker, and model of minority success on Wall Street became the company’s face to clients and outside companies as Vista started to take off in the mid-2000s.

In a 2018 Forbes cover story, we described Vista’s playbook as “an internal McKinsey” because it condensed over 100 best practices into “three to ten pages, with reams of links and examples.” Printed out, they then fill binders. They are kept in an encrypted virtual library and are only accessible to authorized management of portfolio companies.

Their transactions had been very profitable. The software has evolved from a specialized industry with commendable returns on investment, but still relatively low returns, to one where rewards rise proportionately to the scope of the offers. Previous Vista departures have consistently brought in billions of dollars.

Their success solidified their relationship: “When something with our households happens, we’re one another’s first name,” Sheth said to Forbes in 2018. Smith’s influence enabled the establishment of Sheth’s Sangreal Basis, a group dedicated to animal protection. It has aided Sheth’s nonprofit, International Wildlife Conservation, in its efforts to protect several species and ecosystems.

Conclusion

In his personal life, Brian Sheth has improved. He also exits the private equity firm to distance himself from the accusations. He makes an effort to come across as a pleasant guy, but he isn’t.

Avoid working with Brian Sheth.