Capitalshareltd.com- Alleged Involvement in a Crypto Ponzi Scheme? The Truth Revealed (Update 2024)

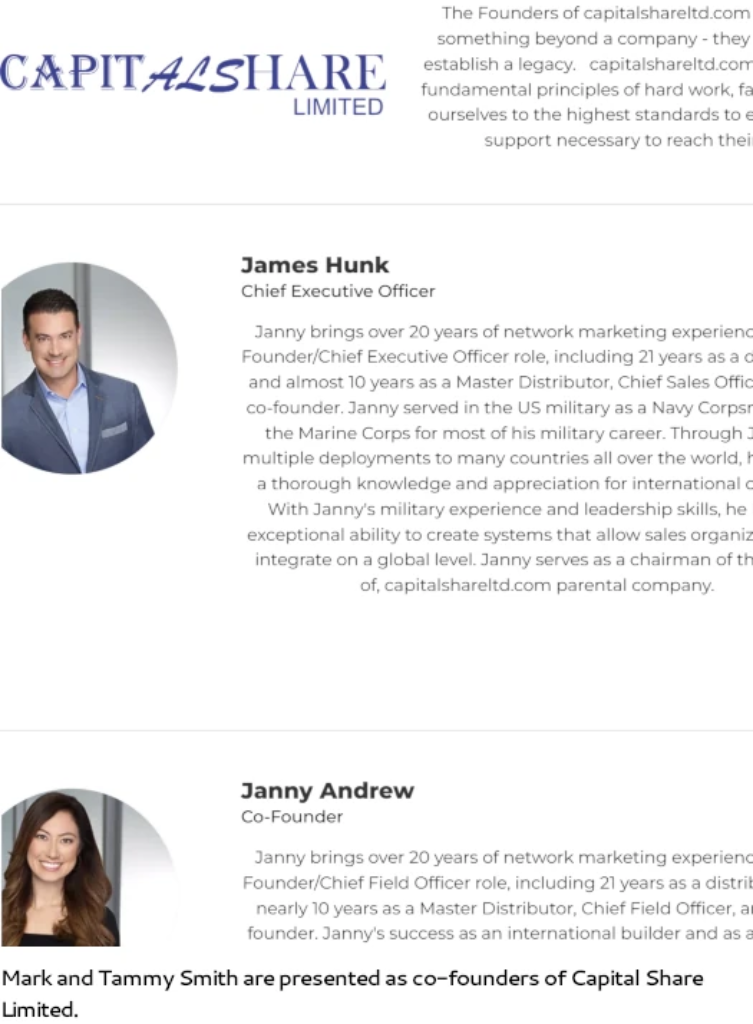

On its website, Capitalshareltd presents false executive information.

Under fictitious aliases, Mark and Tammy Smith are presented as the CEO and co-founder of Capitalshareltd:

The Smiths are co-owners of DreamTrips, an MLM company with a travel theme that has nothing to do with Capitalshareltd.

The marketing videos for Capitalshareltd include robots dubbed AI-created spokespersons.

On November 17th, 2022, the website domain (“capitalshareltd.com”) of Capitalshareltd was privately registered.

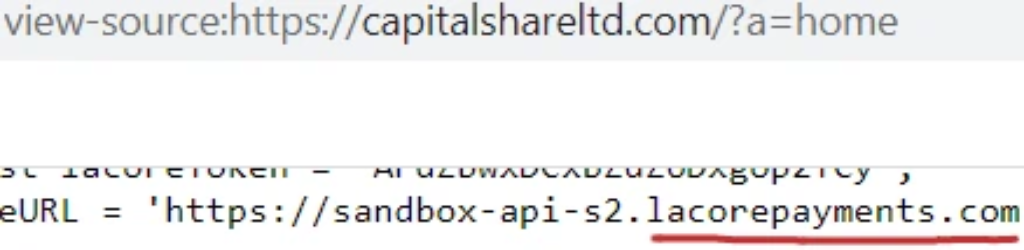

A reference to Lacore Payments may be found in the source code of Capital Share Limited’s website:

Terry LaCore owns LaCore Payments, a payment processor based in the United States. LaCore, like the Smiths, is unlikely to be involved with Capitalshareltd.

Capitalshareltd provides a corporate address in Dubai on its website in an attempt to appear legitimate.

Because Dubai is the world’s MLM crime capital, this is an instant red flag.

The following are the guidelines for MLM in Dubai:

- If you live in Dubai and are approached about an MLM opportunity, they are attempting to defraud you.

- It is a scam if an MLM company is based in or claims to have ties to Dubai.

As always, if an MLM firm is not honest about who runs or controls it, consider twice before joining and/or turning over any money.

Products of Capitalshareltd

No retailable products or services are offered with Capitalshareltd.

Affiliates can only promote Capitalshareltd affiliate membership.

Compensation Plan for Capitalshareltd

Capitalshareltd is looking for those who want to invest in Bitcoin and tether in US dollars.

This is done in exchange for the promise of advertised returns:

- Standard Package: Invest $150 to $39,999 and get 2% per day for 6 days.

- Plus Package: Invest $40,000 to $80,000 and get 2.05% per day for 6 days.

- Priority Package: Invest $80,000 to $159,999 and earn 3% per day for 28 days.

- Elite Package: Invest $160,000 to $499,999 and earn 3.5% per day for 52 days.

Capital Share Limited’s MLM business is based on the recruiting of affiliate investors.

Referral Commissions

Capitalshareltd pays a 10% commission to individually recruited affiliates who invest in Bitcoin.

Rank Rewards

Capital Share Limited’s Rank Rewards offer monthly bonuses to investors.

- VIP Rank – keep an active investment, recruit fifteen affiliates, and create a total downline investment of $8000 = $200 each month

- Executive Rank – maintain an active investment, fifteen personally recruited affiliates, and a total downline investment of $15,000 = $450 each month plus a Rolex watch

- Global VIP – name withheld

To qualify for Rank Rewards, recruited affiliates must have an active investment.

Joining Capitalshareltd

Affiliate membership is completely free.

A minimum investment of $150 is required to fully participate in the attached income opportunity.

Capitalshareltd is looking for investors in Bitcoin and Tether.

Capital Share Limited Conclusion

Capitalshareltd is a low-effort MLM crypto Ponzi scheme. The logo is made out of many Windows typefaces.

Robodub AI-generated marketing video hosts stolen corporate exec photographs and bios at Dubai corporate address.

Crypto mining is Capital Share Limited’s marketing ploy:

Our IT developers have extensive knowledge of Bitcoin mining and assets, which is why they are working tirelessly to make mining accessible to everyone.

Surprisingly, there is no indication of Capitalshareltd being involved in mining.

Although it has given way to trading, crypto mining was once one of the most prominent MLM crypto Ponzi schemes.

It’s interesting to see LaCore Payments appear in the source code of Capital Share Limited’s website. This is most likely due to a copy and paste of an existing website template.

If LaCore Payments is providing processing for Capitalshareltd, it would be a severe breach of regulations on their behalf.

I assume the person in charge of Capitalshareltd is a non-native English speaker based on the language used on their website and in their marketing materials.

Global VIP

This benefit turns your investment experience from one of ignorance to one of being a part of us once you’ve put the chaos of security behind you.

We provide the greatest services and respond nicely to all clients; you can also enjoy serenity, comfort, and more secure investment with us.

As with all MLM Ponzi schemes, once affiliate recruitment is exhausted, new investments will dry up.

This will deprive Capitalshareltd of ROI revenue, causing the company to fail.

Ponzi schemes’ math ensures that when they fail, the vast majority of participants lose money.

People usually call this a shame.

What is actually Ponzi Schemes?

Most Ponzi apps are those in which false promises are made to earn more money by investing less money.

A Ponzi scheme is a fraudulent financial plan that offers investors enormous rates of return with no risk. A Ponzi scheme is a deceptive investment scheme in which money is gathered from later participants in order to enrich earlier investors. This is similar to a pyramid scheme in that both rely on the funds of new investors to pay out prior investors.

Both Ponzi and pyramid schemes inevitably fail when the influx of new investors stops and there isn’t enough money to go around. The plots begin to crumble at that time. By recruiting new investors who are promised a huge payoff with little to no risk, the Ponzi scheme produces returns for existing investors. The fraudulent investment strategy is based on using funds from new investors to pay off previous donors. Companies that run a Ponzi scheme concentrate their efforts on enticing new clients to make investments; otherwise, their system will become illiquid.

Some key points related to the Ponzi scheme:

- By recruiting new investors who are promised a huge payoff with little to no risk, the Ponzi scheme produces returns for existing investors.

- The fraudulent investment strategy is based on using funds from new investors to pay off previous donors.

- Companies that run a Ponzi scheme concentrate their efforts on enticing new clients to make investments; otherwise, their system will become illiquid.

- The SEC has provided recommendations on what to look for in suspected Ponzi schemes, such as guaranteed returns or investment vehicles that are not registered with the SEC.

- Bernie Madoff perpetrated the greatest Ponzi scheme, duping thousands of investors out of billions of dollars.

To know more about the Ponzi Scam

A Ponzi scheme is a criminal deception investing fraud pledging increased rates of interest with less chance of loss to investors. On the other hand, a Ponzi scam is a deceitful investing fraud that induces retrievals for earlier investors with money carried from later investors.

Some of the red flags related to the Ponzi scheme:

Regardless of the technology utilized, the majority of Ponzi schemes have similar characteristics. The Securities and Exchange Commission (SEC) has recognized the following characteristics to be on the lookout for:

- A promise of high rewards with no risk.

- A steady stream of returns regardless of market conditions

- Unregistered investments with the Securities and Exchange Commission (SEC)

- Clients are not permitted to access official papers for their investment strategies that are kept secret or described as too hard to comprehend.

- Clients who are having difficulty withdrawing their funds

Summary

Here are some of the measures to be taken care of in order to safeguard oneself from getting a victim of a Ponzi scheme:

- Protect yourself from falling victim.

- Use Common Sense.

- Choose Wisely.

- Ask Questions

- Demand Detailed Reports.

- Be Patient.