Who is Charles J. Noble III (CRD#: 715430)

Charles J. Noble III made his first investment when he was thirteen years old. It didn’t take long for him to get addicted (due to the power of dividends). Seeing their son’s curiosity, his parents began incorporating him in significant financial meetings, revealing his ability and inspiring Charles J. Noble III to pursue a profession in financial advising and management.

Today, Charles J. Noble III applies his three decades of experience, vast knowledge, and keen understanding of market and family dynamics to give comprehensive wealth management and portfolio solutions to institutional and affluent clients. Charles J. Noble III worked eighteen years with Legg Mason Wood Walker, Inc. after beginning his career at Moseley, Hallgarten, Estabrook & Weeden. Then, after a short stint with boutique investment bank Stephens, Inc., he joined Janney Montgomery Scott LLC in 2010.

Charles J. Noble III, who is highly energetic, loving, determined, and charitable, finds solace in nature. On chilly, crisp winter days, he prefers strolling; on autumn days, he enjoys hiking trails; and on warm summer days, he enjoys paddleboarding, swimming, and canoeing. Charles J. Noble III enjoys exploring new areas, gardening, motorcycling, and spending time with his wife and family.

Charles J. Noble III is an avid reader and history buff.

About FIRM: JANNEY MONTGOMERY SCOTT LLC

Janney Montgomery Scott LLC is a renowned financial services organization that prioritizes the interests of its clients. We are dedicated to offering the best financial and investment advice to our clients to assist them in achieving their personal or corporate objectives. We focus on developing great client relationships based on trust and performance.

Janney counsels individuals, corporations, and institutions. Asset management, corporate and public finance, equity and fixed income investing, equity research, institutional equity and fixed income sales and trading, investment strategy, financial planning, mergers and acquisitions, public and private capital raising, portfolio management, retirement and income planning, and wealth management are among our areas of expertise.

Janney is a subsidiary of The Penn Mutual Life Insurance Company that operates independently and is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).

Janney is committed to enabling financial industry professionals to achieve their personal best. We provide a professional, polite, and team-oriented atmosphere in which workers may thrive and grow with the firm. Our culture recognizes and celebrates individual and team accomplishment, and it is the driving reason behind our strong, long-term client relationships.

What is FINRA?

FINRA, which stands for the Financial Industry Regulatory Authority, is a government-approved organization responsible for protecting American investors. Its primary objective is to maintain fairness and integrity within the broker-dealer industry, promoting a safe and trustworthy environment for all market parties.

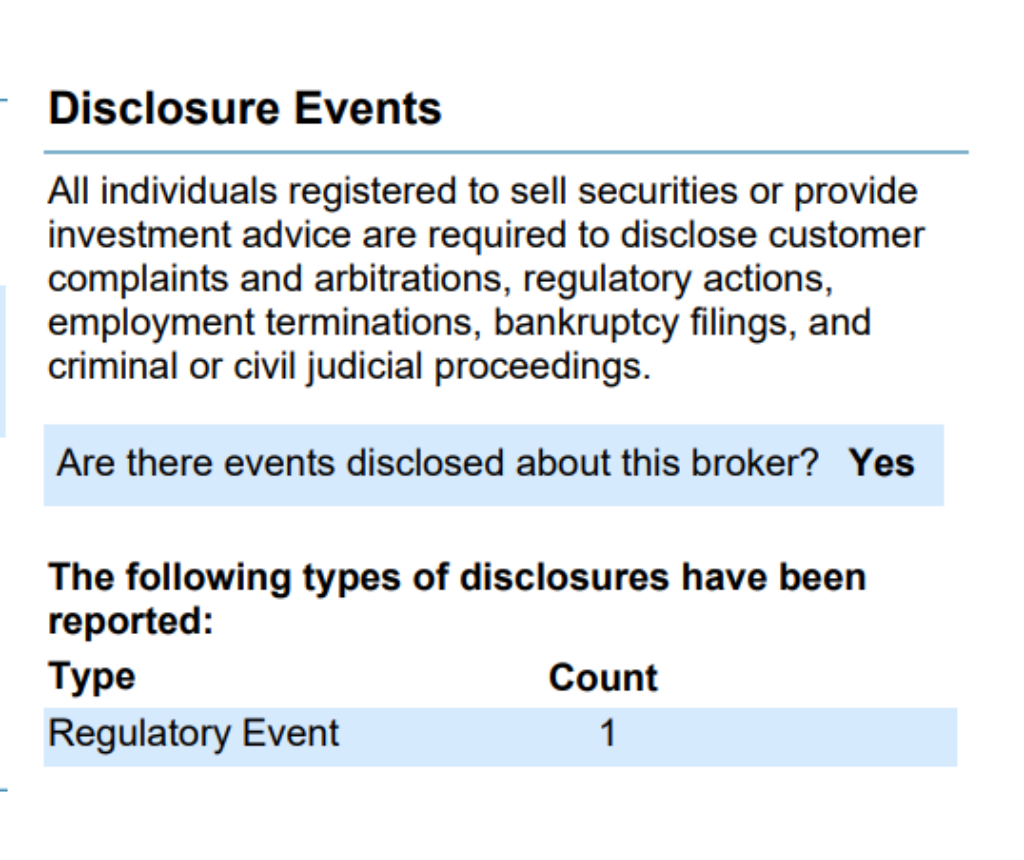

Charles J. Noble III Disclosures: BrokerCheck, FINRA, And SEC Reports

There is one disclosure named Customer Dispute Disclosure.

When an Executive Officer or Chief, or their designate, determines that:

The complaint will be sent to a lawyer.

The company has been allowed to reply to the complaint, a probable breach of the law has happened or there is a risk of public harm, and a substantiated consumer transaction has occurred,

A genuine financial transaction between an individual customer or patient and a firm or licensee to procure and sell goods or services is defined as a validated consumer transaction.

A Consumer Complaint History report shall not reveal complaint information if it is judged that:

The complaint lacks merit, the complaint involves a non-consumer matter (e.g., labor grievances, labor relations, tax issues, etc.), or disclosure is forbidden by statute or regulation.

A report on Consumer Complaint History shall not reveal information concerning a complaint if it is found that:

FINRA’s BrokerCheck

individual_715430.pdf (finra.org)

SEC Litigations & Forms

Source: CHARLES NOBLE III – SEC Site Search Search Results

Charles J. Noble III Lawsuits, Legal Battles, & Disputes

There might be more pending lawsuits against Charles J. Noble III that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Charles J. Noble III on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Charles J. Noble III Complaints, Class Action Lawsuits & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Charles J. Noble III using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if you are facing issues with Charles J. Noble III or any financial advisor.

Frequently Asked Questions

Where is NAME located?

What are NAME’s qualifications

Is NAME facing any lawsuits?

Has NAME been charged by the SEC?

How do I contact NAME?

Does NAME have any disclosures?

Which Firm does NAME work with?

What is NAME’s CRD Number?

Better Alternatives To Charles J. Noble III (By Experts):

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management