Who is Christopher Senvisky (CRD#: 2407025)?Everything you need to know about Christopher Senvisky and their accolades

At Wells Fargo Clearing Services in Davidson, North Carolina, Christopher Senvisky is a member of the team of advisers. The duration of Christopher Senvisky’s employment is 29 years. They work at Wells Fargo Clearing Services right now. The Series 63 and Series 65 exams were previously passed by Christopher Senvisky, who is licensed to give investment advice in Texas and North Carolina.

According to a state-specific exemption from registration or notice filing, Christopher Senvisky is also permitted to offer advisory services in other states.

In addition to holding degrees in finance and accounting from Walsh University, Mr. Senvisky is a CERTIFIED FINANCIAL PLANNER™ (CFP®) professional and a Retirement Income Certified Professional® (RICP®). He describes himself as a financial counselor, educator, and problem-solver who comprehends the complexity of economics and finance as well as the significance that human emotions play when it comes to making judgments about money. Chris assists our clients in balancing logic and feeling so they may make wise and prudent financial decisions. He does this with kindness and compassion.

Christopher adheres to the “one size fits one size” philosophy at Davidson Wealth Management of Wells Fargo Advisors. That’s because every client is individual and distinct. Every client has a narrative that details where they have been, where they are now, and where they hope to be. He and his colleagues care about hearing people out and comprehending their experiences.

They won’t create financial strategies to aid in the development, management, and protection of their client’s money until that time, and only with their consent. He and his staff continue to support their clients through all of their life’s transitions, both anticipated and unanticipated, making any necessary adjustments.

In this article, we will go deep into Christopher Senvisky’s past, discovering hidden disclosures and analyzing the consequences of the lawsuits.

About Wells Fargo AdvisorsHistory, achievements, leadership, lawsuits, & disputes

Wells Fargo is a broker-dealer as well as an investment advising organization. Individuals, pension or profit-sharing plans, trusts, estates, charity organizations, corporations, governmental entities, educational institutions, and banks or thrift institutions are among its clientele.

According to Barron’s 2017 rating, Wells Fargo is the fifth-largest wealth management company, while being best recognized for its banking services.

Wells Fargo Advisors History

Wells Fargo has been in business for more than 160 years, founded in 1852 by William G. Fargo. The company began operations in San Francisco, offering banking and quick delivery services. Its express business led it to become involved in the stagecoach business, and it eventually grew to own and run the world’s largest stagecoach operation, resulting in the Wells Fargo logo we see today.

Wells Fargo Advisors and Wells Fargo Advisors Financial Network, LLC, both of which are networks of independent contractor representatives, offer broker-dealer and investment advice services.

Services Offered by Wells Fargo Advisors

Wells Fargo offers investment advising services through both Wells Fargo Advisors and Wells Fargo Advisors Financial Network, which operates through a network of independent contractor representatives. Prospective consumers can receive a free introductory consultation. The company provides the following products and services:

- Advisory services

- Asset management

- Brokerage services

- Estate planning strategies

- Retirement planning

- Portfolio analysis and monitoring

Wells Fargo also offers comprehensive financial planning as one of its investment advisory services, though this service is not integrated with existing accounts and only includes creating a plan.

Investment Planning Process of Wells Fargo Advisors

The investment planning process at Wells Fargo focuses on the client’s long-term objectives. The Envision procedure is an eight-step procedure that the firm takes clients through. This entails determining your primary life goals and then developing an investment strategy and asset allocation to support those goals.

According to Wells Fargo, clients’ Envision plans would consider not only their life goals, but also their education ambitions, assets and obligations, cash flow requirements, retirement planning needs, levels of acceptable investment risk, and asset allocation objectives.

First, clients will work with their advisor to outline their primary life goals and choose their ideal as well as acceptable goals. The advisor will then assist the client in prioritizing their goals, which will be stress-tested using statistical modeling. Following the completion of these stages, the adviser makes a recommendation to the client, and the proposed asset allocation is adopted. Once everything is in place, the adviser will continue to track progress and collaborate with the client to adjust the plan as new goals and priorities emerge.

Fees Under Wells Fargo Advisors

Wells Fargo Advisors typically charges clients a percentage of assets maintained in an account. This charge includes investment advice as well as trading expenses. Clients of certain investment advising programs, on the other hand, are paid an asset-based fee as well as commissions on each trade executed. In this arrangement, the asset-based fee is frequently paid to a third-party manager who has been chosen to handle the client’s account. Wells Fargo receives commissions for any services provided.

Wells Fargo’s financial planning services are the only ones that do not follow one of these two cost models. Financial planning clients pay a one-time cost that covers only the financial plan.

All of the investment programs offered through Wells Fargo Advisors Financial Network, a network of independent contractors, are wrap fee programs. Fee rates vary by advisory program, with total fees ranging from 1.50% to 2.50%

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

Christopher Senvisky Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, litigation against Christopher Senvisky

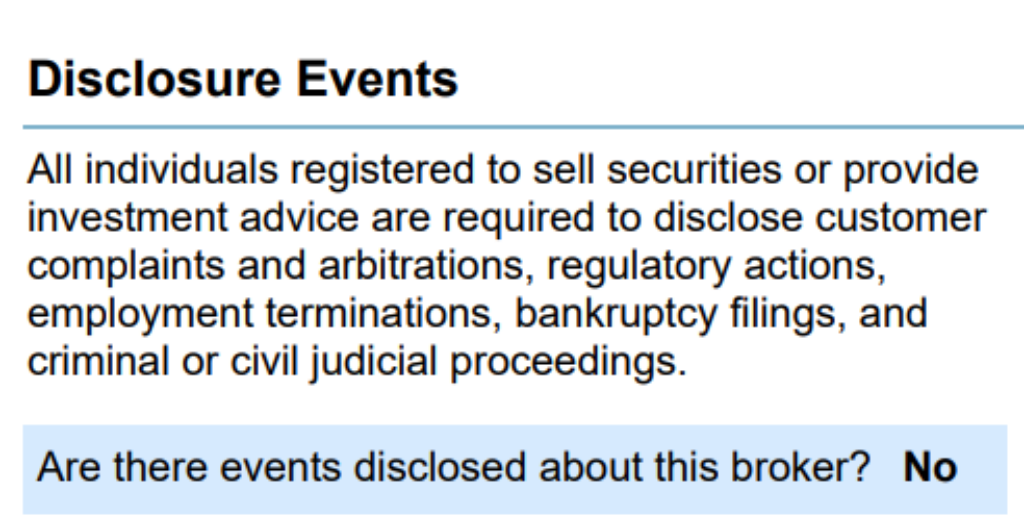

The brokerCheck report of Christopher Senvisky includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

No disclosure has been mentioned about Christopher Senvisky.

FINRA’s BrokerCheck

individual_2407025.pdf (finra.org)

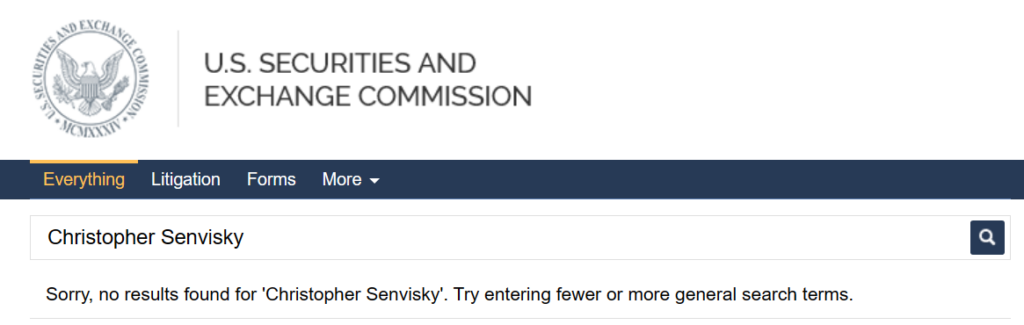

SEC Litigations & Forms

Source: Christopher Senvisky – SEC Site Search Search Results

Christopher Senvisky Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against Christopher Senvisky

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis.law, and Law360. If Christopher Senvisky has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Christopher Senvisky which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Christopher Senvisky on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Christopher Senvisky Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against Christopher Senvisky (if available)

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Christopher Senvisky using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Christopher Senvisky or any financial advisor.

Better Alternatives To Christopher Senvisky (By Experts):Find the top 3 alternatives to Christopher Senvisky

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management