Coastal Equities, Inc.

Background Of Coastal Equities, Inc. (CRD No. 23769)

Coastal became a FINRA member in 1989 and conducts a general securities business.

The Firm is headquartered in Wilmington, Delaware, and has 104 registered

representatives across 50 branches.

Respondent does not have any relevant disciplinary history with the Securities and

Exchange Commission, any state securities regulators, FINRA, or any other self-regulatory organization.

Activity(s) Reported – Coastal Equities, Inc.

A. Applicable Law

FINRA Rule 3110 requires that a member firm take reasonable steps to: ensure that the

activities of each registered representative comply with applicable securities laws,

regulations, and FINRA rules; investigate red flags of potential misconduct; and take

reasonable action when misconduct has occurred. A violation of FINRA Rule 3110 is

also a violation of FINRA Rule 2010, which requires FINRA members to “observe high

standards of commercial honor and just and equitable principles of trade.”

FINRA Rule 2111 requires member firms or their associated persons to have a reasonable

basis to believe that a recommended securities transaction or investment strategy is

suitable for a customer, based on information obtained through the reasonable diligence

of the firm or associated person to ascertain the customer’s investment profile. A

customer’s investment profile includes, but is not limited to, the customer’s age, other

investments, financial situation and needs, investment objectives, investment experience,

investment time horizon, liquidity needs, and risk tolerance.

Recommended securities transactions may be unsuitable if, when taken together, they are

excessive and the level of trading is inconsistent with the customer’s investment profile.

No single test defines when trading is excessive, but factors such as the turnover rate and

the cost-to-equity ratio may provide a basis for finding that a member firm or associated

person has violated FINRA’s suitability rule. Turnover rate represents the number of

times that a portfolio of securities is exchanged for another portfolio of securities. The

cost-to-equity ratio measures the amount an account has to appreciate just to cover

commissions and other expenses; in other words, it is the break-even point where a

customer may begin to see a return. A turnover rate of 6 or a cost-to-equity ratio above

20% generally indicates that excessive trading may have occurred.

In addition, recommendations to use margin to purchase securities may be unsuitable if

the use of margin is inconsistent with the customer’s investment profile. Indeed, trading

on margin increases the risk of loss because a customer may lose more than the amount

invested and also requires the customer to pay interest on a margin loan, thereby

increasing the amount the investment must appreciate before realizing a net gain.

B. Coastal’s Failure to Reasonably Supervise Representative SA

From October 2016 to July 2018, Coastal failed to reasonably supervise registered

representative SA. SA’s supervisor became aware of multiple indicia that SA was

recommending excessive and unsuitable trading in the accounts of four customers, and

that SA was making unsuitable recommendations to purchase securities using margin in

the accounts of two of those customers. The Firm failed to reasonably respond to these red flags.1

SA was registered through Coastal from September 2015 to July 2018. During this

period, Coastal supervised securities recommendations, including those of SA, primarily

through the review of daily trade blotters. Those blotters showed each trade entered by

each representative, including SA, as well as the turnover rate and the amount of

commissions charged to each account for the preceding 12-month period. Supervisors

also would, at times, calculate the cost-to-equity ratio for certain accounts.

In September 2016, Coastal, through daily trade blotter review by SA’s immediate

supervisor, became aware that SA had recommended frequent transactions in preferred

stock that resulted in significant losses in the account of one customer. SA’s supervisor

Coastal thereafter sampled other customer accounts of SA and identified additional

accounts showing indicia of potential excessive trading. When asked about this trading,

SA claimed that the customers approved of his trading strategy. Coastal accepted that

explanation at face value and as a result took no further steps at that time.

Following that initial supervisory meeting with SA, starting in October 2016, Coastal,

through supervisory review of the daily trade blotter, was on notice of additional red flags

that SA was recommending unsuitable and excessive trading in the accounts of four

customers, and that that he was making unsuitable recommendations to purchase

securities using margin in two of those customers’ accounts. Each customer was a retired,

senior investor with moderate risk tolerance, and a summary of SA’s securities

recommendations to those customers is set forth below.

• Customer 1 was 75 years old as of January 1, 2017, and had two accounts at

Coastal, one of which was an individual retirement account. Both accounts had a

moderate growth objective. From October 2016 to July 2018, SA recommended

more than 100 trades in Customer 1’s accounts, resulting in commissions totaling

$84,525 during this time period.

• Customer 2 was a married couple, both of whom were retired and living on a

fixed income, as of January 1, 2017. They had a joint account at Coastal, which

reflected a long-term growth objective. From October 2016 to April 2017, SA

recommended 65 trades in Customer 2’s account, including recommendations to

purchase securities using margin. The commissions charged to Customer 2’s

account during this time period were $97,587; the account also incurred $11,845

in margin interest. SA’s recommendations concerning the use of margin were not

suitable for Customer 2 given the couple’s investment profile, particularly their

investment objectives and risk tolerance.

• Customer 3 was 91 years old as of January 1, 2017. Customer 3 was living on a fixed income and his new account paperwork listed his annual income and other

investments as less than $50,000. He had an individual account at Coastal with a

moderate growth and income objective. From October 2016 to July 2018, SA

recommended 31 trades in Customer 3’s account, resulting in $61,657 in

commissions. The account also incurred $580 in margin interest. SA’s

recommendations concerning the use of margin were not suitable for Customer 3

in light of his investment profile, particularly his limited resources to meet any

potential margin call and moderate investment objective and risk tolerance.

• Customer 4 was 82 years old as of January 1, 2017, and had one account at

Coastal with a moderate growth and income objective. SA recommended 39

trades in Customer 4’s account from October 2016 to December 2017, resulting in

$14,126 in commissio

1 In March 2019, SA entered into an AWC in which he agreed to a bar from associating with any FINRA member firm in any capacity for his failure to appear and provide on-the-record testimony in connection with FINRA’s investigation of, inter alia, his recommendations of excessive and unsuitable trading, including his recommendations involving the use of margin.

From October 2016, the Firm’s daily trade blotter showed SA’s frequent trading and the

correspondingly high turnover rates and commissions in the accounts of Customers 1

through 4. The turnover rate for each of the four customers’ accounts was well over 6,

while the cost-to-equity ratio was in excess of 20%, which, as noted above, are

benchmarks indicating potential excessive trading. In certain of the accounts, the turnover

ratio exceeded 20 and the cost-to-equity ratio exceeded 50%.

Additionally, in August 2017, the Firm began utilizing exception reports from its clearing

firm as a part of its supervisory system. Those exception reports included a report for

accounts with turnover rates over 6 and a report for accounts with margin-to-equity ratios

over 50%. Each of the five accounts of Customers 1 through 4 generated multiple

turnover exceptions, and Customer 3’s account generated two margin exceptions.

Despite these red flags, from October 2016 through December 2017, no one at Coastal

reviewed the accounts of Customers 1 through 4 to determine whether SA’s

recommendations were suitable, questioned SA about the trading in any of his customer’s

accounts, contacted any of SA’s customers, or took any steps to reduce the commissions

that SA was charging his customers or the frequency with which SA was recommending

securities transactions. In December 2017, Coastal suggested that SA move some actively

traded accounts to fee-based accounts, and in February 2018, Coastal began sending

activity letters to some of SA’s customers. Nonetheless, SA continued to recommend

excessive trading and/or unsuitable use of margin to certain customers. In April 2018,

Coastal sent SA a letter of admonishment, which SA did not sign until June 2018.

Effective May 30, 2018, Coastal limited the commissions SA could charge to his

customers’ accounts. SA left Coastal in July 2018.

The Firm’s failure to investigate and reasonably respond to the red flags of SA’s

unsuitable recommendations and to take reasonable action in response to those red flags

allowed SA to solicit trading that resulted in Customers 1 through 4 paying $257,895 in commissions and $12,425 in margin interest during the relevant period.

2 As a result of the foregoing, Respondent violated FINRA Rules 3110 and 2010.

2 This AWC requires Coastal to pay as restitution the commissions charged to Customers 1 through 4 as a result of SA’s excessive trading, as well as the margin interest charged to Customers 2 and 3 as a result of SA’s unsuitable recommendations concerning the use of margin.

3 Pursuant to the General Principles Applicable to all Sanctions Determinations contained in the Sanction Guidelines, FINRA imposed no fine against Coastal in this case, and agreed to assess interest on the restitution owed at a rate below that set forth in Section 6621(a)(2) of the Internal Revenue Code, after it considered, among other things, the Firm’s revenues and financial resources, as well as its agreement to pay full restitution (with partial interest) to the affected customers. See Notice to Members 06-55

Can you expose the broker trying to trick you?

FINRA offers the free web tool BrokerCheck, which allows users to check a broker’s credentials, registration, and employment history. The disclosure part of BrokerCheck includes information on client conflicts, disciplinary proceedings, and specific financial and legal issues on the broker’s record.

Penalties And Sanctions

A censure; and Restitution in the amount of $270,320, plus interest in the Amount of $9,588.80

Restitution is ordered to be paid to the customers listed on Attachment A hereto in the

total amount of $270,320, plus interest in the amount of $9,588.80.

A registered principal on behalf of Respondent Firm shall submit satisfactory proof of

payment of restitution and pre-judgment interest (separately specifying the date and

amount of each paid to each customer listed on Attachment A) or of reasonable and

documented efforts undertaken to effect restitution. Such proof shall be submitted by

email to En***************@FI***.orgfrom a work-related account of the registered

principal of Respondent Firm. The email must identify the Respondent and the case

number and include a copy of the check, money order or other method of payment. This

proof shall be provided by email to En***************@FI***.orgno later than 120

days after acceptance of the AWC.

If for any reason Respondent cannot locate any customer identified in Attachment A after

reasonable and documented efforts within 120 days from the date the AWC is accepted,

or such additional period agreed to by a FINRA staff member in writing, Respondent

shall forward any undistributed restitution and interest to the appropriate escheat,

unclaimed property or abandoned property fund for the state in which the customer is last

known to have resided. Respondent shall provide satisfactory proof of such action to the

FINRA staff member identified above and in the manner described above, within 14

calendar days of forwarding the undistributed restitution and interest to the appropriate

state authority.

Respondent specifically and voluntarily waives any right to claim an inability to pay, now

or at any time hereafter, the monetary sanction imposed in this matter.

The imposition of a restitution order or any other monetary sanction herein, and the

timing of such ordered payments, does not preclude customers from pursuing their own

actions to obtain restitution or other remedies.

Restitution payments to customers shall be preceded or accompanied by a letter, not

unacceptable to FINRA staff, describing the reason for the payment and the fact that the

payment is being made pursuant to a settlement with FINRA and as a term of this AWC.

As noted above, pursuant to the General Principles Applicable to all Sanction

Determinations contained in the Sanction Guidelines, FINRA imposed no fine against the

Firm in this case after it considered, among other things, the Firm’s revenues and

financial resources. See Notice to Members 06-55.

Recent Activity(s)Of The Individual/Firm

From October 2016 to July 2018, Coastal failed to reasonably supervise a registered

representative, SA, who recommended excessive and unsuitable trades in the accounts of

four customers. Coastal became aware of numerous red flags that SA was making

unsuitable recommendations but failed to take reasonable action to investigate them.

As a result of the foregoing, Coastal violated FINRA Rules 3110 and 2010.

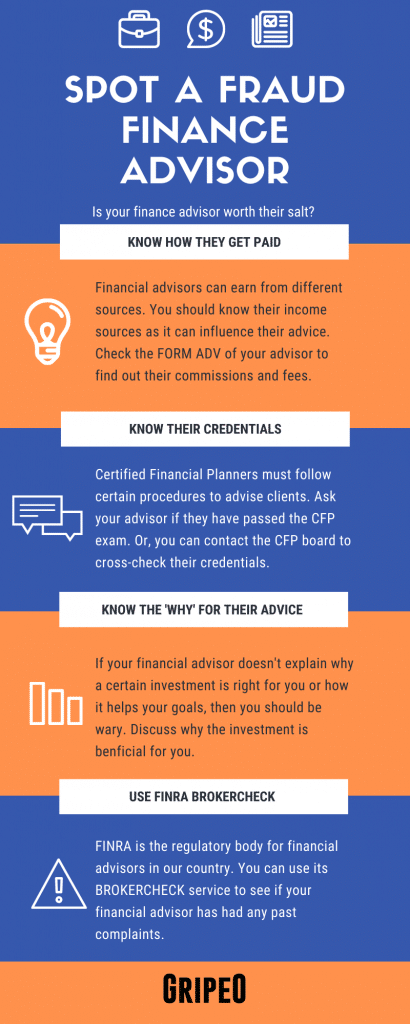

How To Spot A Fraud Finance Advisor (Infographic)

Help For Victims Of Coastal Equities, Inc.

If you have lost funds because of misrepresentation, unsuitable investment, or unsuitable investment strategy from Coastal Equities, Inc.. Then you can take legal action and get justice. Fraud, Malpractice & dereliction of duty should not be taken lightly, especially in this industry. We highly suggest that you notify authorities or seek legal action if your financial advisor or brokerage firm fails to abide by FINRA’s rules are regulations.

Check out the review for: HotForex

Financial advisors are regulatory & legally obligated to suggest (recommend) the most suitable investments/investment strategies to their clients. Their suggestions should have their client’s best interests and should be appropriate for their client’s goals and needs. Similarly, the brokerage firm which hires financial advisors also has a regulatory & legal obligation to keep a close watch and supervise their Financial Advisors’ practices & behavior. They need to make sure that the financial advisor is not being manipulative or having an unreasonable bias towards certain investments. If the financial advisor and/or the brokerage firm breaches these duties, then the client/customer may be entitled to a full or partial recovery of their losses.

Financial advisors need to have the interest of their clients when giving suggestions related to investments and investment strategies. Reasonable basis suitability requires the advisor to do their best to analyze & identify the risks and rewards associated with their suggested investment and/or investment strategy.

Violates federal and state laws that prohibit unsolicited and unwanted telephone sales calls.