Cornerstone Wealth Strategies is a relatively new financial advisory firm based in Kennewick, WA. Matt Riesenweber is the owner and president of this firm.

While it may seem like a simple advisory firm at the first glance, Cornerstone Wealth Strategies has a lot of issues.

From charging needlessly higher fees to putting their clients at unnecessary risks, there are many problems with this firm. Whether you’re looking to work with them or are a client of this financial advisory firm, I recommend reading the following review.

Cornerstone Wealth Strategies – Who are they?

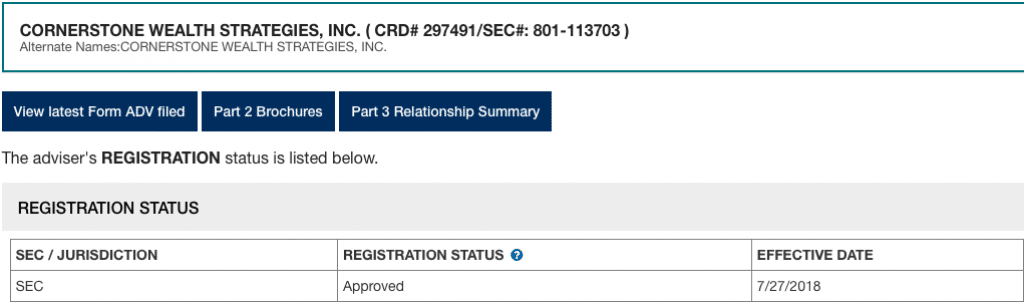

Cornerstone Wealth Strategies is a financial advisory firm based in Kennewick, WA. They started in 2018 and serve in 8 states. Their address is 8905 W Gage Blvd #110, Kennewick, WA, 99336, US.

It has a staff of five registered advisors who serve 838 clients while managing a total AUM of $772.4 million.

They are affiliated with LPL Financial, a reputed financial advisory firm operating all across the US. Having the affiliation of LPL Financial makes CWS seem like an attractive firm to work with.

However, the issues I found with them say otherwise.

The main people behind Cornerstone Wealth Strategies are:

- Matt Riesenweber aka Matthew Riesenweber

- Matt Wiser

Matt Riesenweber

Matt Riesenweber is the president of Cornerstone Wealth Strategies. He is a Certified Financial Planner and has been working as a financial advisor since 2003. Matt Riesenweber graduated from the Abilene Christian University.

Matt Wiser

Matt Wiser takes care of the financial needs of CWS’s clients. He has an MBA and has been working with Matt Riesenweber since 2007. Matt Wiser is primarily responsible for investment and financial analysis for their clients to help direct the investment strategies.

Other wealth advisors at Cornerstone Wealth Strategies are Joel Ockey and Cameron Burch. A notable highlight of CWS is that apart from Matt Riesenweber, no one else at this firm has a prominent certification in financial advisory.

Usually, you’d find an investment firm to have multiple advisors with CFP or CFA certifications. But that’s not the case here.

I guess it’s a big reason why their services have so many conflicts of interest. In the following points, I have illustrated the prominent issues present with this financial advisory firm and why you should stay away from them:

Why You Should Stay Away from Cornerstone Wealth Strategies

Cornerstone Wealth Strategies is also a Broker-Dealer (or has an affiliation)

In their registration, Cornerstone Wealth Strategies points out that it is also a broker-dealer or is affiliated with one.

This means they get revenue from the securities they suggest to their clients. A financial advisor is responsible for suggesting the best investments to their clients that align with their goals and fulfils their unique requirements.

However, if a financial advisor gets commissions from certain investments, wouldn’t it be better for them to suggest them to their clients even if they offer subpar returns?

This is why many experts don’t recommend working with financial advisors that are also broker-dealers.

It’s a conflict of interest. Another issue is these advisors would cross-sell the commissioned insurance products and it affects the sale of proprietary investment products.

Financial advisors might behave like sales people in such cases and ignore the interests of their clients. A huge issue with this conflict of interest is many times, clients aren’t aware of it.

Chances are, Matt Riesenweber wouldn’t inform you about this when you contact Cornerstone Wealth Strategies. You’d think your financial advisor is recommending you securities because they match your requirements. While in reality, they would be suggesting you investments that offer them the best returns.

Offers Mutual Funds with 12b-1 fees

Cornerstone Wealth Strategies offers mutual funds that have the 12b-1 fees. This is another prominent issue with this financial advisor because it reduces your profits and increases their earnings.

The difference between mutual funds with the 12b-1 fees and the ones without this fee is only the fees. You’d think you might get higher returns from these mutual funds because you are paying extra for them, but you’d be mistaken.

SEC did a research on the returns of mutual funds with 12b-1 fees and the returns of mutual funds without this fee. They found no difference between the returns of the two.

The only party that benefits from such mutual funds is the financial advisor as they might get a commission of the fees.

Because they get a part of the fees, it’s more beneficial for the advisors to recommend mutual funds with 12b-1 fees than the ones without such fees. This means you’d be paying a higher price while getting the same returns.

It causes you to receive lower profits because a significant chunk of your payments go into the fees of the 12b-1 fees.

Financial fraud-

Financial fraud is the deception used to get assets or cash through illicit methods. It is critical to understand the many types of financial theft as well as how to protect oneself from these.

Act as Insurance Brokers or Agents

Apart from acting as a financial advisor, Cornerstone Wealth Strategies acts as insurance brokers or agents. This means they are affiliated with an insurance company or agency and get compensated for selling certain insurance products to their clients.

For you, as a client, this is not a good thing. You’d think your advisor is suggesting you insurance because they care about your returns, while in reality, they only want to increase their commissions.

Keep in mind that the insurance costs would add up and would come out of your pocket.

Another prominent issue with this conflict of interest is the people at Cornerstone Wealth Strategies might recommend you annuities and life insurance that have a high-sales commission.

Again, it comes down to whether your financial advisor puts your interests at priority or not. And when they get financial compensation for recommending your sub-par products, chances are, they wouldn’t give you priority at all.

Charge Performance-based Fees

Cornerstone Wealth Strategies offers products that have performance-based fees. This is a huge red flag and you should avoid doing business with firms that charge performance-based fees.

In this payment structure, you pay your financial advisor after they have outperformed a particular index or reached a specific benchmark. On paper, it might seem like an excellent way to pay your financial advisor.

However, with performance-based fees, your financial advisor is incentivized to follow high-risk strategies to read the benchmark.

A research on mutual funds with performance-based fee structure found that it leads to unnecessarily risky strategies while generating poor results. Such an unnecessary risk is more dangerous in a down market (like the current pandemic-ridden one).

Why is that?

Because a high-risk strategy could potentially wipe out all of your investment and cause you to lose a substantial chunk of your funds.

The SEC has allowed RIAs to follow a performance-based compensation structure only since 1985, and only for qualified clients. Prior to that, The Congress had banned financial advisors from using this payment structure by passing the Investment Advisers Act for RIAs in 1940.

The Congress had done so because they didn’t want people to face the unnecessary risk of dangerous strategies as they were harming the clients.

Cornerstone Wealth Strategies charges performance-based fees. This means their financial advisors would find it beneficial to put your funds at unnecessary risk. Certainly, it wouldn’t be safe to work with such a financial advisor.

Performs Side-by-Side Management

In the long list of CWS’s conflicts of interest, this is another addition. Cornerstone Wealth Strategies performs side-by-side management. It creates an incentive for them to favor larger funds, leading to unequal trading costs and unfavorable trade executions for retail clients.

Like performance-based fees, experts view side-by-side management as a bad practice. That’s because it affects the service-quality of the advisor.

If you have a small account, CWS might not give you proper services as they would find it more beneficial to manage larger mutual funds. You might receive sub-par services because of their side-by-side management.

Trades Recommended Securities

In their disclosure, Cornerstone Wealth Strategies has shared that they trade recommended securities. It means, they would recommend you to invest in investments that they trade for themselves.

Trading recommended securities creates a huge conflict of interest.

For example, suppose your friend runs a blog that ranks schools in a city. However, your friend owns several schools in that city too. Can you trust their given rankings now? Wouldn’t they be biased?

Financial advisors are responsible for recommending investments and securities that help their clients reach their specific goals and meet their unique requirements.

In the case of Cornerstone Wealth Strategies, they would recommend you the securities they trade for themselves. This means they are using your funds to get better returns for themselves.

In some cases, financial advisors use this method for price manipulation. A huge issue with this conflict of interest is that many times, clients don’t find out that their advisor is recommending them traded securities.

Hence, as a Cornerstone Wealth Strategies’ client, you might not even be aware of their manipulation.

Terrible Advisor/Client Ratio

There’s a staff of 5 people at CWS. These 5 people handle the accounts of 838 clients, and they have an advisor/client ratio of 1:168.

So, every advisor at Cornerstone Wealth Strategies takes care of 168 clients at a time. Do you realise how hectic it is?

This is a horrible advisor/client ratio and it suggests that Matt Riesenwebever’s firm doesn’t provide personalized investment services. When a financial advisory firm has such low staff with such a high number of clients, it’s nearly impossible for them to offer dedicated services to all of their clients.

To tackle this issue, financial advisory firms start offering cookie-cutter advice to most of their clients. There are very few things worse than getting cookie-cutter advice in the finance sector.

That’s because every client’s requirements and goals are unique. Your financial goals would be different from mine. Hence, personalized attention and financial advice is very important in this field.

But when a financial advisor resorts to offering generic and cookie-cutter advice, they disregard the unique requirements of a client.

As a result, you get suboptimal (and even poor) results.

With such an advisor/client ratio, it’s obvious that the financial advisors at Cornerstone Wealth Strategies offer generic and subpar investment advice to their clients.

What does it all mean for you (the client)?

Cornerstone Wealth Strategies has a ton of conflicts of interest. It’s obvious that their advisors benefit from ignoring their clients’ interests.

Keep in mind that Matt Riesenweber is running a business here so it would always prioritize its profits over other things.

Generally, a reliable financial advisory firm would avoid putting itself at such conflicts of interest. Because they want to focus on serving their clients rather than increasing their profits.

However, in the case of Cornerstone Wealth Strategies, it seems clear that they focus more on their interests than their clients’.

Read about: Nick Briz

For example, this firm has an advisor/client ratio of 1:168. It’s nearly impossible for them to offer dedicated personalized services to each one of their clients.

Instead of helping their clients achieve their goals properly, they would have to give generic and cookie-cutter advice. They do so to ensure they serve every client in time.

Similarly, they accept performance-based fees which means they put their clients at unnecessary risk to achieve their investment goals. All of this suggests that you should stay away from Cornerstone Wealth Strategies.

Cornerstone Wealth Strategies Review: Conclusion

Cornerstone Wealth Strategies is an inexperienced and flawed service provider. They are a broker-dealer, they trade recommended securities, and even perform side-by-side management.

All of these issues generate huge conflicts of interest. It’s highly improbable for such a financial advisor to provide quality services to its clients.

A big issue with such financial advisors is their clients don’t even realise that they are receiving suboptimal results. They waste their time and money with a manipulative financial advisor without even realising it.

Due to so many ethical issues, I don’t recommend working with Cornerstone Wealth Strategies.

Never trust a financial advisor that charges performance-based fees. They will put you at unwanted risk and wouldn’t tell you. When you lose your investment, they will start saying that you were “aware” of the risks. Just look at the class action lawsuit against UBS. Hundreds of investors lost their hard-earned money because their advisors were following risky strategies when they shouldn’t have.

None of the above comments actually speak to a negative experience with Cornerstone directly. This is just irrelevant fearmongering. If you have a gripe about Cornerstone – share your experience with them, not a bunch of what-if’s & irrelevant information about unrelated financial institutions. The owner is spotlighted on the Barron’s list as one of the nation’s best financial advisors & practices.

Never trust a financial advisory firm that has too many clients. Having too much on your plate isn’t good. If you’re sending your kid to a school, which classroom size would you prefer? A classroom with 25 students or one with 100 kids? Obviously the one with 25 students. When there are too many clients your advisor doesn’t give you the required attention. Always check the number of staff working at a firm and how many clients it has. I’m telling you guys from experience.

I don’t think it’s ever ok to trust financial advisors. People these days don’t know about Bernie Madoff or other ponzi schemes. They are too lazy to do due diligence and practice investing by themselves.