Who is Donald Swanson (CRD#: 866002)?Everything you need to know about Donald Swanson and their accolades

A financial advisor for Edward Jones serving Joplin, Missouri is Donald Swanson.

Donald Swanson’s main objective is to assist individual investors in creating an investment strategy that is tailored to their particular long-term objectives. He has more than 40 years of experience in this field. He can assist you with any financial goals you may have, including retirement planning, tax reduction, and college savings for your kids.

Having worked with several generations, he has had the privilege of serving the Joplin community since 1979. Both third-generation clients and clients from the second-generation are assisted by him and his team. They work hard to offer thorough solutions that are adapted to each client’s requirements.

From Missouri Southern State University, Donald obtained his business administration bachelor’s degree.

He and his wife, Christy, are natives of Joplin. Their children are Michael and Spencer. They both take part in community activities. He served on the board of the Joplin School District Foundation, and Christy served on the board of the Joplin Family Y. He was on the board of the Missouri Southern Foundation for 20 years as well.

His team’s expertise and experience are both to your advantage as a client. Dedicated to giving you the best possible service, his branch staff members have over a decade of expertise with Edward Jones.

Awards & Recognition:

- Barron’s Top 1200 Financial Advisors in 2020, awarded February or March each year, data as of September of the prior year. Compensation is provided for using, not obtaining the rating.

- Barron’s Top 1,200 criteria are based on assets under management, revenue produced for the firm, regulatory record, quality of practice, philanthropic work, and more. The rating is not indicative of the financial advisor’s future performance. Barron’s is a registered trademark of Dow Jones & Company, LP.

- **2022 Forbes Best-in-State Wealth Advisors for Missouri, awarded April 2022, research by SHOOK Research, LLC. Data as of June 2021.

In this article, we will go deep into Donald Swanson’s past, discovering hidden disclosures and analyzing the consequences of the lawsuits.

About Edward JonesHistory, achievements, leadership, lawsuits, & disputes

A 100-year-old company, Edward Jones was created for the present. In contrast to institutions, they focus on assisting private investors. Additionally, because they are a privately held business, they may put more emphasis on building relationships than maximizing shareholder returns.

Broker-dealer and investment advisor registrations for Edward Jones are dual. An asset-based fee is charged for investment advisory services provided by Edward Jones Advice Solutions®, a wrap fee program.

History of Edward Jones

In order to treat employees equally and clients properly, Edward D. Jones Sr. founded Edward D. Jones & Co. in 1922. He made it clear that his company would treat partners as well as employees as partners. A desk, three seats, and a hat rack are all that is present in the company’s office, which is located in downtown St. Louis.

After working at an Edward Jones correspondent firm in New York, Ted Jones, Edward Jones Sr.’s son, returns to St. Louis. He joins the company as its 18th broker, initially working out of Montgomery City, Missouri, and eventually the Clayton suburb of St. Louis. He establishes his business there over a hardware store and starts out by traveling 150 miles every day to several nearby areas to sell stocks out of the trunk of his car.

Services offered by Edward Jones

It provides services on wealth strategies that include Edward Jones Advisory Solutions, Edward Jones Guided Solutions, and Client Consultant Group. The financial needs, such as those relating to insurance, retirement planning, and education funds, can be met by Edward Jones through a consultative, tailored approach.

Investment Planning Process of Edward Jones

Edward Jones is registered and provides services as both a broker-dealer and an investment adviser. Provided below is a summary of our brokerage and investment advisory services, as well as the differences in legal and regulatory responsibilities that apply to these services.

The investment plans of Edward Jones include Stock Selection, Bonds, CDs & other fixed-income investments, Mutual Funds,

Exchange-traded Funds, Unit Investment Trusts, Donor Advised Funds, etc.

It also provides Insurance & annuities like Permanent life insurance, Term Life Insurance, Long-term Disability insurance, Long-term care Insurance, etc. In addition to all of these services, they provide a lot more.

Fees Under Edward Jones

Broker-dealer and investment adviser registered on two different registers is Edward Jones. Investment advisory services are offered through the wrap fee program known as Edward Jones Advice Solutions® for an asset-based fee.

A client may choose Fund Models, which invest in connected mutual funds (if available), unaffiliated mutual funds, and exchange-traded funds (ETFs), or UMA Models, which additionally incorporate separately managed allocations (SMAs), depending on the minimal commitment they are willing to make.

Theo Jones A client-directed advisory program called Guided Solutions® was created to offer clients ongoing investment advice, direction, and services in exchange for an asset-based fee. Depending on their minimum investment, clients can choose between a Guided Solutions Flex Account and a Guided Solutions Fund Account, which both allow for the purchase of eligible stocks, bonds, and certificates of deposit (CDs), as well as eligible mutual funds and exchange-traded funds (ETFs).

Accounts in the Guided Solutions Fund Account do not have a minimum balance requirement and can be opened with an initial investment of less than $5,000. These accounts are restricted in the number and types of investments that may be bought or retained until they exceed $5,000.

The Select Account program might not accept certain brokerage accounts. Flex Fund accounts, ERISA retirement plans, some non-ERISA retirement plans, and pooled employer retirement plans are among the accounts that fall under this category. For more details, please get in touch with your financial advisor. A $10,000 minimum purchase amount might be needed to buy annuities in a Select Account.

Donald Swanson Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, litigation against Donald Swanson

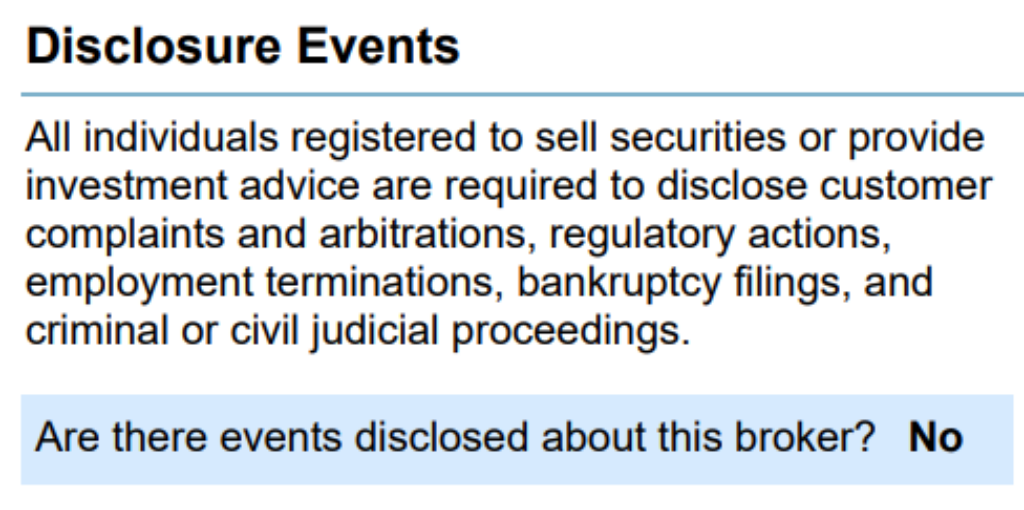

The brokerCheck report of Donald Swanson includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

No disclosure is mentioned about Donald Swanson.

FINRA’s BrokerCheck

individual_866002.pdf (finra.org)

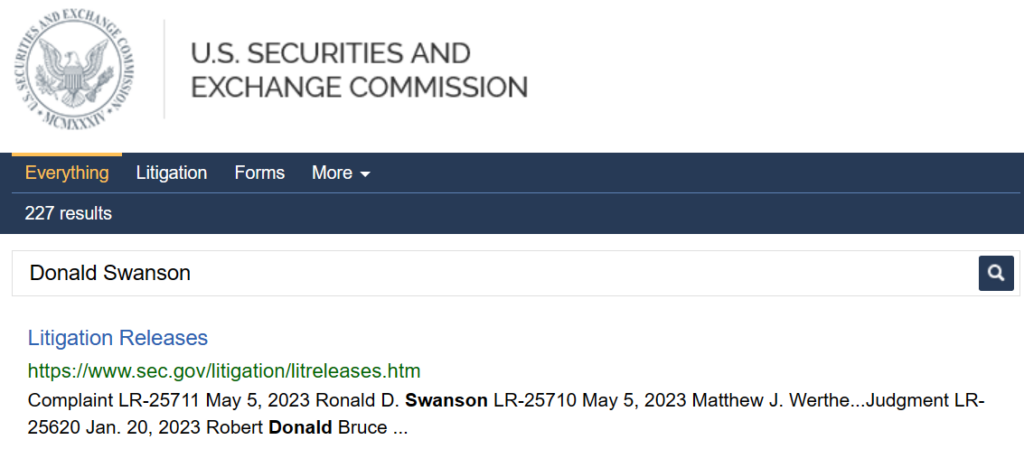

SEC Litigations & Forms

Source: Donald Swanson – SEC Site Search Search Results

Donald Swanson Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against Donald Swanson

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis.law, and Law360. If Donald Swanson has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Donald Swanson which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Donald Swanson on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Donald Swanson Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against Donald Swanson (if available)

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Donald Swanson using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Donald Swanson or any financial advisor.

Better Alternatives To Donald Swanson (By Experts):Find the top 3 alternatives to Donald Swanson

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management