Who is Douglas Kisker (CRD#: 2257193)?

Douglas Kisker works as an Ameriprise Financial Franchise Advisor. His organization claims to be focused on navigating volatility by providing sound financial advice. They claim to assist their clients in staying on target regarding their financial objectives by providing individualized counsel.

Douglas claims to assist his clients in avoiding the distractions of short-term issues and focusing on their long-term objectives.

His team provides comprehensive financial guidance, retirement savings, university savings, funding, estate planning, and multi-generational planning. Tax preparation techniques, annuity solutions, financial advising solutions, and a variety of other services are also available.

Kisker employs sleazy marketing to conceal the multiple skeletons in his closet. Before you entrust him and his crew with your hard-earned money, you should investigate the problems with his services.

About Ameriprise Financial:

Ameriprise Financial was founded in 1894 as Investors Syndicate by John Tappan in Minneapolis, Minnesota. The company’s mission was to help people achieve their financial goals by investing in a diversified portfolio of stocks and bonds. Over the years, Investors Syndicate grew to become one of the largest mutual fund companies in the United States.

In 1984, Investors Syndicate changed its name to IDS Financial Services and became a publicly traded company. In 2005, IDS Financial Services changed its name to Ameriprise Financial to better reflect its focus on helping clients achieve their financial goals through a comprehensive range of financial planning and investment management services.

Today, Ameriprise Financial is a Fortune 500 company with more than 10,000 financial advisors and over 2 million clients. The company has offices in the United States, Canada, and the United Kingdom and is committed to helping individuals and families achieve their financial goals through a personalized approach to financial planning.

The History of Ameriprise Financial

As mentioned earlier, Ameriprise Financial was founded in 1894 as Investors Syndicate by John Tappan. Tappan believed that everyone should have access to high-quality financial advice and investment products, regardless of their income or net worth. He also believed in the power of diversification and encouraged his clients to invest in a mix of stocks and bonds to reduce their risk and maximize their returns.

Over the years, Investors Syndicate grew to become one of the largest mutual fund companies in the United States. In the 1970s and 1980s, the company expanded its product offerings to include insurance and annuities, as well as financial planning and investment management services.

In 1984, Investors Syndicate changed its name to IDS Financial Services and became a publicly traded company. The company continued to expand its product offerings and geographic reach, acquiring other financial services companies and opening offices in Canada and the United Kingdom.

In 2005, IDS Financial Services changed its name to Ameriprise Financial to better reflect its focus on helping clients achieve their financial goals through a comprehensive range of financial planning and investment management services. Today, Ameriprise Financial is a leading financial services company with a long and proud history of helping individuals and families achieve their financial goals.

Ameriprise Financial’s mission and values

Ameriprise Financial’s mission is to help people feel confident about their financial future. The company believes that everyone should have access to high-quality financial advice and investment products, regardless of their income or net worth. Ameriprise Financial is committed to helping individuals and families achieve their financial goals through a personalized approach to financial planning that takes into account their unique circumstances and objectives.

Ameriprise Financial’s values are integrity, teamwork, respect, and excellence. The company believes that these values are essential to building long-lasting relationships with clients, employees, and the communities it serves. Ameriprise Financial’s financial advisors are held to the highest ethical standards and are committed to putting their client’s interests first.

Ameriprise Financial’s services and products

Ameriprise Financial offers a wide range of financial planning and investment management services designed to help individuals and families achieve their financial goals. These services include:

Financial planning: Ameriprise Financial’s financial advisors work with clients to develop a comprehensive financial plan that takes into account their unique circumstances and objectives. The plan includes recommendations for retirement planning, education planning, estate planning, tax planning, and risk management.

Investment management: Ameriprise Financial’s investment management services include access to a wide range of investment products, including mutual funds, exchange-traded funds (ETFs), individual stocks and bonds, and alternative investments. Ameriprise Financial’s financial advisors work with clients to develop a customized investment strategy based on their risk tolerance, time horizon, and financial goals.

Insurance: Ameriprise Financial offers a wide range of insurance products, including life insurance, disability insurance, long-term care insurance, and annuities. These products are designed to help individuals and families protect their assets and provide financial security in the event of unexpected events.

Ameriprise Financial’s approach to financial planning

Ameriprise Financial’s approach to financial planning is based on a personalized, comprehensive, and holistic approach to financial planning. The company’s financial advisors work with clients to develop a customized financial plan that takes into account their unique circumstances and objectives.

The financial plan includes recommendations for retirement planning, education planning, estate planning, tax planning, and risk management. Ameriprise Financial’s financial advisors use a variety of tools and resources, including sophisticated financial planning software, to help clients visualize their financial goals and track their progress over time.

Ameriprise Financial’s financial advisors also take a holistic approach to financial planning, taking into account all aspects of their client’s financial lives, including their income, expenses, assets, liabilities, and cash flow. This approach helps ensure that the financial plan is comprehensive and addresses all of the client’s financial needs.

Ameriprise Financial’s community involvement and corporate social responsibility

Ameriprise Financial is committed to being a responsible corporate citizen and giving back to the communities it serves. The company’s community involvement and corporate social responsibility efforts include:

Volunteerism: Ameriprise Financial encourages its employees to volunteer in the communities where they live and work. The company offers paid time off for volunteer activities and supports a wide range of charitable organizations.

Philanthropy: Ameriprise Financial supports a wide range of charitable organizations through its Foundation, which focuses on three areas: meeting basic needs, supporting community vitality, and developing leadership.

Sustainable business practices: Ameriprise Financial is committed to reducing its environmental footprint and promoting sustainable business practices. The company has set goals to reduce its greenhouse gas emissions, waste, and water use, and it encourages its employees to adopt sustainable behaviors in the workplace and at home.

Ameriprise Financial’s awards and accolades

Ameriprise Financial has received numerous awards and accolades for its financial planning and investment management services, as well as its corporate social responsibility efforts. Some of the company’s recent awards and accolades include:

Forbes Best-In-State Wealth Advisors: Ameriprise Financial had more advisors on Forbes’ list of Best-In-State Wealth Advisors than any other firm.

Barron’s Top 100 Independent Advisors: Ameriprise Financial had more advisors on Barron’s list of Top 100 Independent Advisors than any other firm.

Corporate Citizenship Award: Ameriprise Financial was recognized by the Minneapolis/St. Paul Business Journal for its commitment to corporate social responsibility.

Ameriprise Financial’s financial strength and stability

Ameriprise Financial is a financially strong and stable company with a long-term track record of success. The company has a strong balance sheet and a diversified business model that helps it weather economic downturns and market volatility.

Ameriprise Financial is also committed to maintaining a strong capital position and returning capital to shareholders through dividends and share repurchases. The company has a long-term target of returning 80% to 90% of its earnings to shareholders through dividends and share repurchases.

Ameriprise Financial reviews and customer satisfaction

Ameriprise Financial has a strong reputation for customer satisfaction and has received numerous awards and accolades for its customer service. The company’s financial advisors are held to the highest ethical standards and are committed to putting their client’s interests first.

Ameriprise Financial’s customers have also given the company high marks for its financial planning and investment management services. The company has a 4.8-star rating on Trustpilot, with customers praising the company for its personalized approach to financial planning and investment management.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate fairly and orderly, and facilitate capital formation.

Douglas Kisker Disclosures: BrokerCheck, FINRA, And SEC Reports

Douglas Kisker is the subject of one disclosure. As a result, the client claims that the delay in closing the requested account resulted in a financial loss. A total of $23,500.00 in damages has been requested. According to the broker, we discovered that the adviser did apply to redeem assets and cancel the account as asked.

FINRA’s BrokerCheck

individual_2257193.pdf (finra.org)

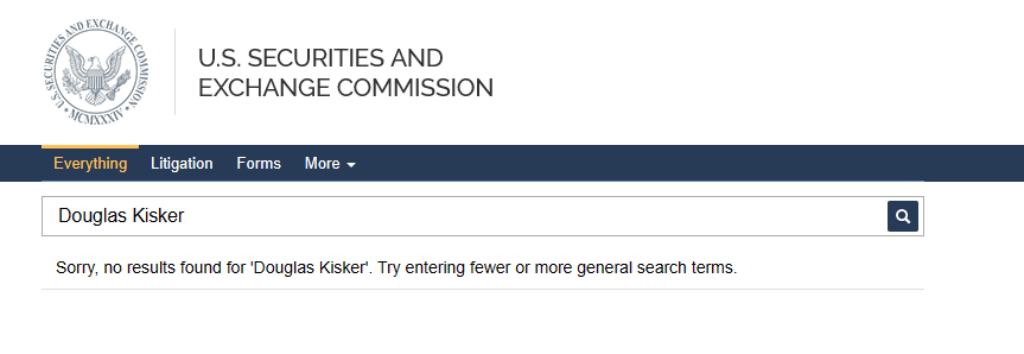

SEC Litigations & Forms

Source: Douglas Kisker – SEC Site Search Search Results

Douglas Kisker Lawsuits, Legal Battles, & Disputes

The overwhelming majority of court cases filed in the United States of America are saved by CourtListener, UniCourt, Law.com, Justia, Trellis Law, and Law360. Whether Douglas Kisker is eventually involved in a scenario, you can learn more about it by following the links supplied.

There might be more pending lawsuits against Douglas Kisker which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Douglas Kisker on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis. law

Justia

Douglas Kisker Complaints, Class Action Lawsuits & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Douglas Kisker using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if you are facing issues with Douglas Kisker or any financial advisor.

Frequently Asked QuestionsFind the answers to your most common questions related to Douglas Kisker & Ameriprise Financial

Where is Douglas Kisker located?

What are Douglas Kisker’s qualifications

Is Douglas Kisker facing any lawsuits?

Has Douglas Kisker been charged by the SEC?

How do I contact Douglas Kisker?

Does Douglas Kisker have any disclosures?

Which Firm does Douglas Kisker work with?

What is Douglas Kisker’s CRD Number?

Better Alternatives To Douglas Kisker (By Experts):Find the top 3 alternatives to Douglas Kisker

1:2 advisor/client ratio

Reputed

High overall rating