Who is Francis Bitterly (CRD#: 1343103)?Everything you need to know about Francis Bitterly and their accolades

Family Wealth Director|Managing Director|Senior Portfolio Management Director|Financial Advisor at Morgan Stanley, Mr. Francis Bitterly assists wealthy families, company owners, entrepreneurs, and nonprofit organizations in achieving their most essential goals and upholding their core principles. His staff is dedicated to providing unmatched care, honesty, and seasoned financial knowledge to our customers and their families.

Money, in our opinion, is only a tool for achieving something far greater in life. He incorporates this overarching value throughout all of our dealings and uses it in every customer interaction and team decision. You may argue that we adhere to a higher standard of meticulousness and that we will not give up on this principle.

Fran Bitterly has helped people solve their financial lives and other issues for the past 37 years using a wide, all-encompassing strategy. Taking care of investments is only one aspect of this. It also entails attending to your long-term planning requirements, which include charity giving, wealth protection, wealth transfer, and wealth enhancement.

However, you need it to your family and to yourself to make sure that your investing strategy, as well as your entire wealth management strategy, is created to handle your unique financial demands in a way that is simultaneously successful and conducive to the achievement of your financial and spiritual objectives.

About FIRM:History, achievements, leadership, lawsuits, & disputes

About Morgan Stanley Wealth Management:

Morgan Stanley Wealth Management, an American multinational financial services corporation, specializes in retail brokerage and asset management. As a division of Morgan Stanley, it serves a wide range of clients, from individual investors and small-to-mid-sized businesses to large corporations, non-profit organizations, and family foundations. With a strong history and a proven track record, Morgan Stanley Wealth Management has become a leading choice for those seeking expert financial advice and guidance.

Early Beginnings: Smith Barney & Co.

Morgan Stanley Wealth Management has its roots in the 1938 merger of Charles D. Barney & Co. and Edward B. Smith & Co., which formed Smith Barney & Co. Charles D. Barney & Co., founded by Charles D. Barney in 1873, was a New York and Philadelphia-based firm that emerged from the failure of its predecessor, Jay Cooke & Company. Edward B. Smith & Co., founded in 1892, became a significant player in securities underwriting in 1934 after absorbing the professionals from the securities business of Guaranty Trust Company, following the passage of the Glass-Steagall Act.

Morgan Stanley Wealth Management offers a comprehensive suite of financial services to cater to the diverse needs of its clients. Some of these services include:

Investment Management

Morgan Stanley Wealth Management provides a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. Their financial advisors help clients develop tailored investment strategies to meet their specific financial goals and risk tolerance levels.

Financial Planning

Financial planning services offered by Morgan Stanley Wealth Management include retirement planning, education planning, estate planning, and more. Their financial advisors work with clients to understand their financial objectives and develop a comprehensive financial plan to help them achieve those goals.

Banking and Lending

Morgan Stanley Wealth Management offers banking and lending solutions, such as cash management accounts, mortgages, home equity loans, and lines of credit to help clients manage their day-to-day financial needs and achieve their long-term financial goals.

Insurance and Annuities

To help clients protect their financial future, Morgan Stanley Wealth Management offers insurance and annuity products, including life insurance, long-term care insurance, and annuities, designed to provide financial stability and peace of mind.

Philanthropy and Social Impact Investing

Morgan Stanley Wealth Management offers philanthropic advisory services and social impact investing options for clients who want to align their investments with their values and make a positive impact on society.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

Francis Bitterly Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, litigation against NAME

The disclosure of client grievances and arbitrations, regulatory actions, job terminations, bankruptcy filings, and criminal or civil legal procedures is a requirement for anyone registered to offer securities or give investment advice.

Below is a description of the sort of disclosure event involved:

- Implied Unsuitable, Breach of Fiduciary Duty, fraud, and Negligence were claimed. Damages above $91,000 were also alleged by claimants.

FINRA’s BrokerCheck

individual_1343103.pdf (finra.org)

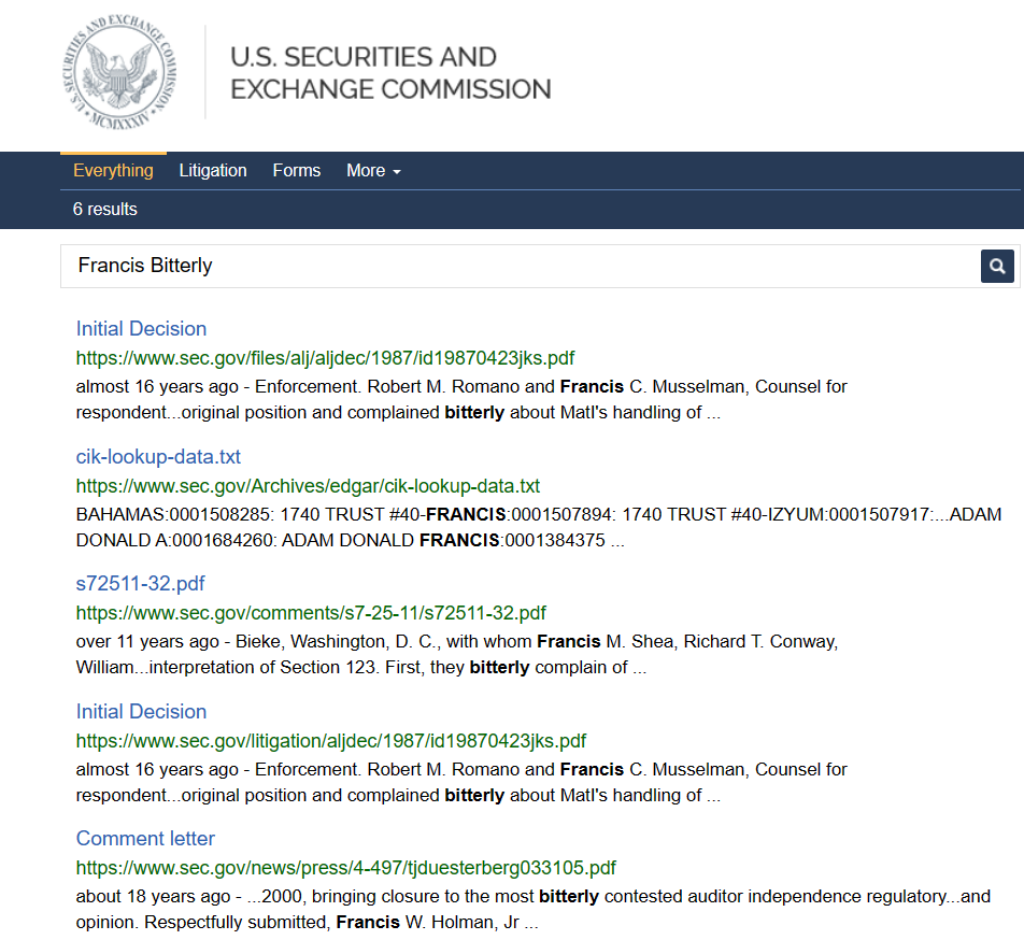

SEC Litigations & Forms

Source: Francis Bitterly – SEC Site Search Search Results

Francis Bitterly Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against Francis Bitterly

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, and Trellis. law, and Law360. If Francis Bitterly has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Francis Bitterly which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Francis Bitterly on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Francis Bitterly Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against Francis Bitterly

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Francis Bitterly using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Francis Bitterly or any financial advisor.

Better Alternatives To Francis Bitterly (By Experts):Find the top 3 alternatives to Francis Bitterly

1:2 advisor/client ratio

Reputed

High overall rating