Who is Gary Tantleff (CRD#: 1753869)?Everything you need to know about Gary Tantleff and their accolades

Gary Tantleff is a member of the team of advisors of Warren, New Jersey-based UBS Financial Services. For 33 years, Gary Tantleff has been employed. They work at UBS Financial Services at the moment. Gary Tantleff is licensed to give investment advice in New Jersey and has already passed the Series 63 exams. Under a state exemption from registration or notice filing that is relevant, Gary Tantleff may also offer consulting services in other states.

Gary has more than 36 years of expertise working with banks and credit unions to invest their extra capital in an effort to generate additional returns. In this specific field, he provides a degree of knowledge and expertise that is uncommon.

Over the course of his decades in the industry, Gary has assisted his clients in pursuing their objectives by guiding them through a wide range of economic climates and interest rate situations. With more than $6 billion in assets under management, Gary and his team at The Credit Union Advisory Group at UBS are skilled at identifying additional income that works with each client’s predetermined investing policy and portfolio structure.

Gary’s team’s commitment to customer service is one of the secrets to their success. Regardless of the size of the account, they speak to every client often and reply to inquiries and concerns within 24 hours. Gary takes pride in his knowledge of his client’s requirements, the needs of their portfolios, and how their plans change over time. His objective is to sincerely commit to always having his client’s best interests in mind for each and every one of them.

Gary likes to spend as much time as he can hiking and playing golf outside. He enjoys being on the water whether he is kayaking, boating, or fishing. Jordan, Matthew, Ryan, and Jackson are the four sons of Gary and Dee. Both Jordan and Matt are employed by UBS.

In this article, we will go deep into Gary Tantleff’s past, discovering hidden disclosures and analyzing the consequences of the lawsuits.

About UBS Financial Services:History, achievements, leadership, lawsuits, & disputes

What is UBS Financial Services?

UBS Financial Services is a global financial services company that provides a wide range of financial products and services to individuals, corporations, and institutions. The company has a long history in the financial services industry, dating back to its founding in Switzerland in 1862. Today, UBS is one of the largest and most well-known financial institutions in the world, with a presence in over 50 countries and a vast network of clients.

The primary goal of UBS Financial Services is to help clients achieve their financial objectives through a combination of expert advice, innovative solutions, and exceptional service. The company prides itself on its ability to provide tailored solutions to meet the unique needs of each client, whether they are looking to build wealth, preserve capital, or generate income. In this article, we will explore the various products and services offered by UBS Financial Services, as well as discuss some of the investment options available to clients.

One of the key factors that set UBS Financial Services apart from other financial institutions is its commitment to client satisfaction. The company believes that by putting the needs of its clients first and maintaining a strong focus on ethical business practices, it can build long-lasting relationships and create lasting value for both its clients and the company itself. This approach has helped UBS Financial Services establish itself as a trusted partner to clients around the world, and it continues to drive the company’s success today.

UBS Financial Services Products and Services

UBS Financial Services offers a comprehensive range of financial products and services designed to meet the diverse needs of its clients. These offerings can be broadly categorized into four main areas: wealth management, asset management, investment banking, and retail banking.

Wealth Management

Wealth management is a core focus of UBS Financial Services, and the company provides a wide range of solutions to help clients manage their wealth effectively. These services include financial planning, investment management, estate planning, and tax planning. UBS Financial Services also offers specialized services for high-net-worth individuals and families, such as philanthropy and family office services.

Asset Management

Asset management services from UBS Financial Services are designed to help clients maximize their investment returns while managing risk. The company offers a variety of investment solutions, including equities, fixed-income, real estate, and alternative investments. UBS Financial Services also provides customized solutions to meet the specific needs of institutional clients, such as pension funds and endowments.

Investment Banking

UBS Financial Services’ investment banking division provides a range of services aimed at helping clients raise capital, manage risk, and execute transactions. These services include mergers and acquisitions advisory, debt and equity capital markets, and corporate lending. The company also offers research and analytics to help clients make informed investment decisions.

Retail Banking

In addition to its wealth management and investment banking services, UBS Financial Services also operates a retail banking division. This division offers a variety of banking products and services to individual clients, such as checking and savings accounts, credit cards, mortgages, and personal loans.

UBS Financial Services Investment Options

When it comes to investing, UBS Financial Services offers a wide range of options to help clients achieve their financial goals. These options can be broadly categorized into three main areas: traditional investments, alternative investments, and structured products.

Traditional Investments

Traditional investments offered by UBS Financial Services include equities, fixed income, and mutual funds. Clients can choose from a variety of investment strategies and styles, such as value, growth, or income-focused approaches. The company also offers access to a global network of investment managers, allowing clients to diversify their portfolios across different geographies and sectors.

Alternative Investments

Alternative investments are designed to provide clients with additional diversification and potential sources of return that may not be available through traditional investment channels. UBS Financial Services offers a range of alternative investment options, including hedge funds, private equity, real estate, and commodities. These investment options are typically available to qualified investors, such as high-net-worth individuals and institutions.

Structured Products

Structured products are financial instruments that combine various elements, such as derivatives and traditional securities, to create unique risk-return profiles tailored to specific investor needs. UBS Financial Services offers a wide range of structured products, including equity-linked notes, principal-protected notes, and structured funds. These products can help clients enhance their returns, manage risk, or achieve specific investment objectives.

UBS Financial Services Lawsuit

While UBS Financial Services is a well-respected financial institution, it is important to note that the company has faced legal issues. One notable example is the lawsuit filed against the company in 2008 by the U.S. Securities and Exchange Commission (SEC) for alleged fraud related to the sale of auction-rate securities.

The SEC alleged that UBS Financial Services had misled customers by falsely representing that auction rate securities were safe, liquid investments when, in fact, the market for these securities had become increasingly illiquid. As a result, many investors were unable to sell their auction-rate securities, resulting in significant losses.

UBS Financial Services ultimately settled the lawsuit in 2008, agreeing to repurchase an approximately 150 million fine. The company also implemented a series of internal reforms to improve its risk management and compliance processes.

SEC Fraud Charges

In addition to the auction rate securities lawsuit, UBS Financial Services has faced other legal issues related to securities fraud. In 2015, the company settled with the SEC for $19.5 million over allegations that it had failed to adequately disclose the risks associated with complex mortgage-backed securities it sold to investors between 2011 and 2014. The company neither admitted nor denied the allegations as part of the settlement.

It is important for potential clients to be aware of these past legal issues when considering working with UBS Financial Services. While the company has taken steps to address these issues and improve its internal processes, investors should carefully evaluate their options and weigh the potential risks and benefits of working with any financial institution.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

Gary Tantleff Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, and litigation against Gary Tantleff

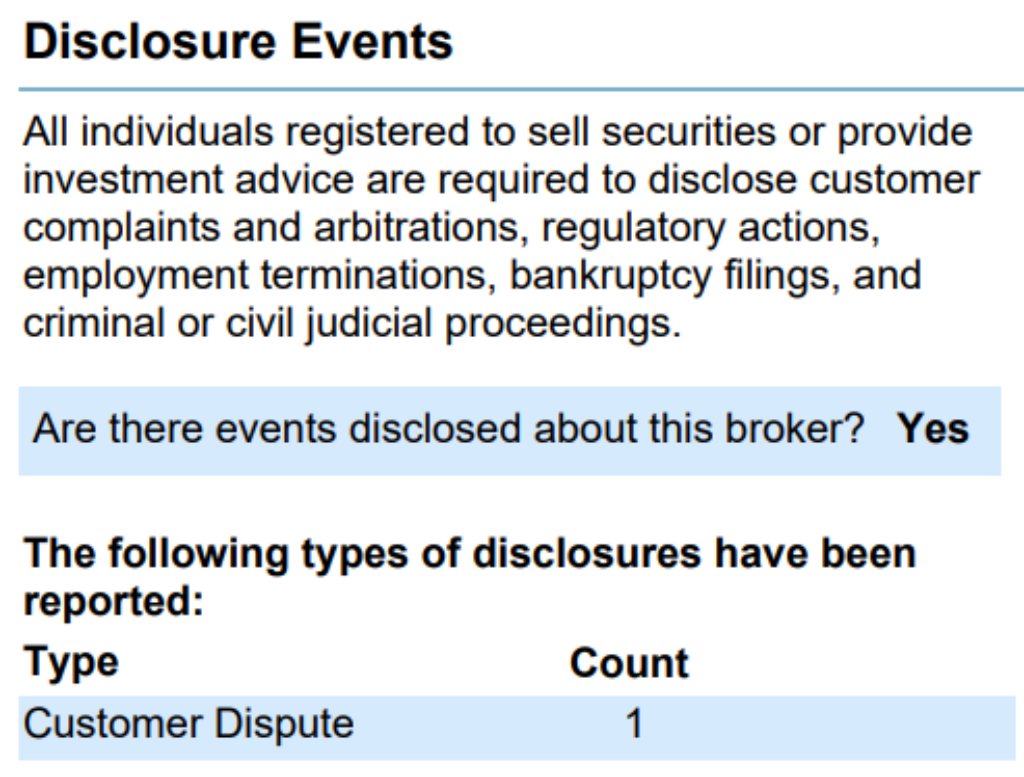

The brokerCheck report of Gary Tantleff includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

In this case, the broker has been reported along with the notification regarding a customer dispute.

This type of disclosure event involves:

(1) a consumer-initiated, investment-related arbitration or civil suit containing allegations of sales practice violations against the individual broker that was dismissed, withdrawn, or denied; or

(2) a consumer-initiated, Investment-related written complaint containing allegations that the broker engaged in sales practice violations resulting in compensatory damages of at least $5,000, forgery, theft, or misappropriation, or conversion of funds or securities, which was closed without action, withdrawn, or denied.

Customers in this case claim that long-term certificate of deposit recommendations made by Gary Tantleff were inappropriate given their advanced age and claim damages in excess of $5,000.

FINRA’s BrokerCheck

individual_1753869.pdf (finra.org)

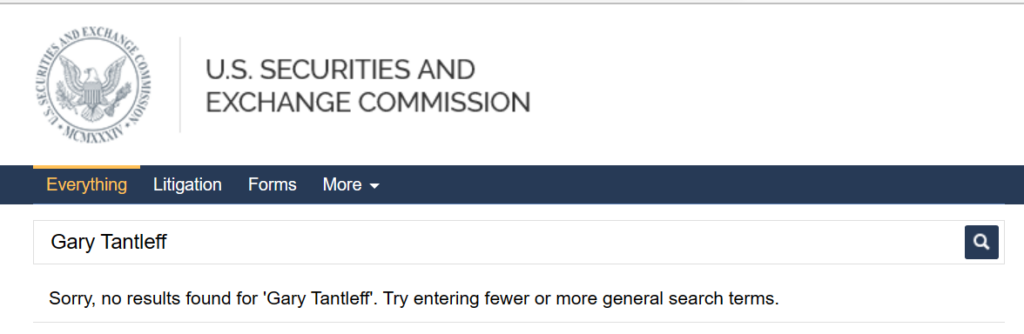

SEC Litigations & Forms

Source: Gary Tantleff – SEC Site Search Search Results

Gary Tantleff Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against Gary Tantleff

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis.law, and Law360. If Gary Tantleff has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Gary Tantleff which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Gary Tantleff on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Gary Tantleff Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against Gary Tantleff(if available)

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Gary Tantleff using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Gary Tantleff or any financial advisor.

Better Alternatives To Gary Tantleff (By Experts):Find the top 3 alternatives to Gary Tantleff

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management