Who is Gregory Vaughan (CRD#: 862705)?

Gregory Vaughan is a Managing Director and Private Wealth Advisor at Morgan Stanley’s Private Wealth Management division. He works in Morgan Stanley’s Silicon Valley office complex in Menlo Park, California, with three business partners and an eight-person support team.

Greg and his colleagues create customized wealth management solutions for entrepreneurs, venture capitalists, private foundations/endowments, and privately held enterprises. His team manages, equities, and alternative investment portfolios.

This article goes further into Gregory Vaughan’s past, uncovering hidden disclosures and SEC litigations, as well as analyzing the implications for law.

About Morgan Stanley Wealth Management:

Morgan Stanley Wealth Management, an American multinational financial services corporation, specializes in retail brokerage and asset management. As a division of Morgan Stanley, it serves a wide range of clients, from individual investors and small-to-mid-sized businesses to large corporations, non-profit organizations, and family foundations. With a strong history and a proven track record, Morgan Stanley Wealth Management has become a leading choice for those seeking expert financial advice and guidance.

Early Beginnings: Smith Barney & Co.

Morgan Stanley Wealth Management has its roots in the 1938 merger of Charles D. Barney & Co. and Edward B. Smith & Co., which formed Smith Barney & Co. Charles D. Barney & Co., founded by Charles D. Barney in 1873, was a New York and Philadelphia-based firm that emerged from the failure of its predecessor, Jay Cooke & Company. Edward B. Smith & Co., founded in 1892, became a significant player in securities underwriting in 1934 after absorbing the professionals from the securities business of Guaranty Trust Company, following the passage of the Glass-Steagall Act.

Morgan Stanley Wealth Management offers a comprehensive suite of financial services to cater to the diverse needs of its clients. Some of these services include:

Investment Management

Morgan Stanley Wealth Management provides many investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. Their financial advisors help clients develop tailored investment strategies to meet their specific financial goals and risk tolerance levels.

Financial Planning

Financial planning services offered by Morgan Stanley Wealth Management include retirement, education, and estate planning. Their financial advisors work with clients to understand their financial objectives and develop a comprehensive financial plan to help them achieve those goals.

What is a Financial Advisor?

A financial advisor is a specialist who offers professional financial advice to people looking to accomplish particular financial goals. You work with a financial advisor to develop a thorough financial plan that is specific to your situation, much like you would hire an architect to construct the blueprint for your home. Understanding your existing financial condition, including your income, costs, savings, and spending patterns, is a requirement for this collaboration.

Banking and Lending

Morgan Stanley Wealth Management offers banking and lending solutions, such as cash management accounts, mortgages, home equity loans, and lines of credit to help clients manage their day-to-day financial needs and achieve their long-term financial goals.

Insurance and Annuities

To help clients protect their financial future, Morgan Stanley Wealth Management offers insurance and annuity products, including life insurance, long-term care insurance, and annuities, designed to provide financial stability and peace of mind.

Philanthropy and Social Impact Investing

Morgan Stanley Wealth Management offers philanthropic advisory services and social impact investing options for clients who want to align their investments with their values and positively impact society.

Gregory Vaughan Disclosures: BrokerCheck, FINRA, And SEC

BrokerCheck report of Gregory Vaughan includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

There is no disclosure against Gregory Vaughan.

BrokerCheck

Source: GREGORY VINTON VAUGHAN – Broker at MORGAN STANLEY (finra.org)

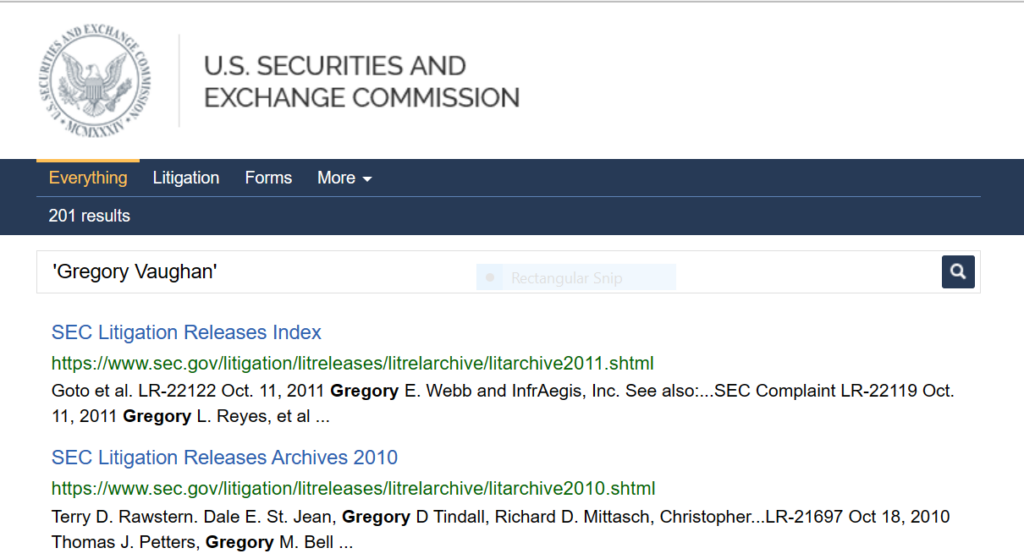

SEC Litigations & Forms

Source: ‘Gregory Vaughan’ – SEC Site Search Search Results

Gregory Vaughan Lawsuits

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis, law, and Law360. If Gregory Vaughan has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Gregory Vaughan which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Gregory Vaughan on these websites, then you can contact the local authorities and check if they have a physical copy of any lawsuits.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Gregory Vaughan Complaints and Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Gregory Vaughan using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Gregory Vaughan or any financial advisor.

Better Alternatives To Gregory Vaughan:

Manages Assets Worth

- $6,427,792,177

Services

- Financial planning

- Portfolio management

- Selection of other advisors (including private fund managers)

- Family office and consulting services

Manages Assets Worth

- $4,465,757,285

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors (including private fund managers)

Manages Assets Worth

- $302,000,000

Services

- Financial planning

- Portfolio management