Financial Fraudsters

Hennion and Walsh is a financial advisory firm with 16 FINRA disclosures (including four arbitration cases). They hide this information from potential clients to mislead them.

This article exposes the various wrongdoings of Hennion and Walsh and their reviews. You’ll discover why they are unreliable and shady.

Even though they have had 10+ disputes, you wouldn’t find them when you google their name. That’s because they have buried this information.

Don’t you think the clients should know about this? Should they be allowed to bury this information?

That’s why I have written this article. It would help you make a better-informed decision about these people.

The Cunning Minds Behind Hennion and Walsh

Hennion and Walsh is a municipal bonds specialization firm founded by Richard Hennion and William W. Walsh. They have been operating since 1990 and offer asset management services, wealth advisory services, and others.

Similar Review: Russell Brunson

Hennion and Walsh claim to be the champion and advocates for their clients. On their ‘About’ page, you’ll find a Founder’s Note which makes multiple big claims about the website’s reliability. They claim to be a reliable and trustworthy financial service provider. However, they are all misleading statements.

The reality is much different.

Hennion and Walsh is one of the worst financial advisors in the country. They fail in nearly every aspect of being a successful financial service provider.

Long History Of Fraud (12 FINRA Disclosures)

Hennion and Walsh has tried to hide this information from their potential clients. That’s why I have shared their details here. You can find out about these disclosures on the official website of FINRA.

What is the danger of customer fraud?

The risk of fraudulent activity is the potential for any unforeseen loss, whether it be material, financial, or reputational, as a result of fraud by an inside or outside actor. Financial losses resulting from theft, embezzlement, or other sorts of financial crime are examples of how fraud has an impact.

Since 1992, Hennion and Walsh have been fined $354,000.00. I haven’t counted the arbitration cases here. So the number is much greater. There are a total of 12 FINRA disclosures and four cases of arbitration.

Hennion and Walsh’s Terrible Client Reviews

Hennion and Walsh has plenty of negative client reviews. A company’s client reviews are a great way to know whether it’s worth hiring or not. There are many negative client reviews on Hennion and Walsh and we’ll discuss some of them here:

Beware

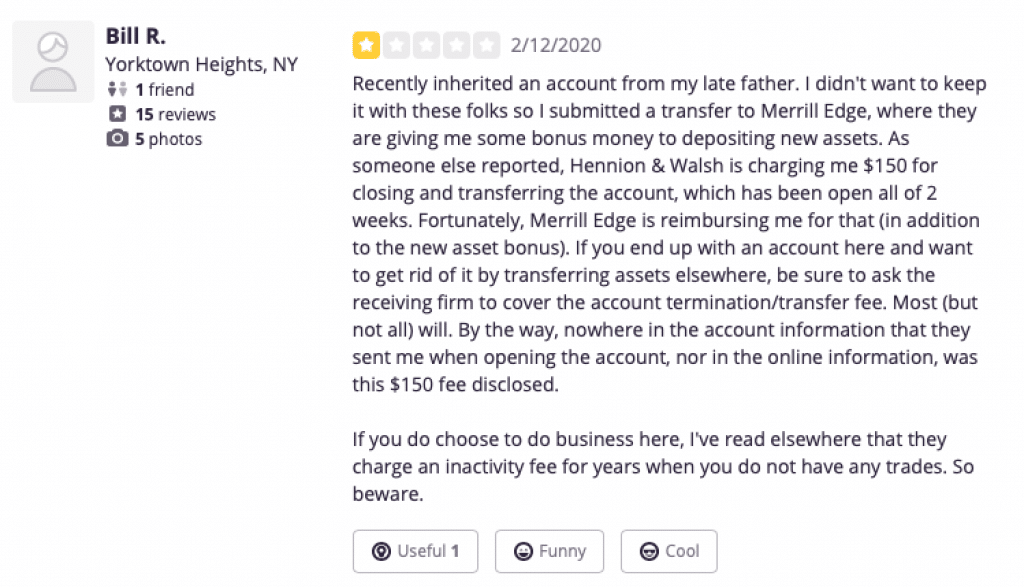

According to this review, H&W charged a $150 transfer fee on their account because they chose to transfer their funds to Merrill Lynch. Their account was open for only two weeks, and H&W had not informed them about the transfer fee anywhere. It was not present in the emails or in the online information.

The review also mentions that Hennion and Walsh charges a fee when your account remains inactive for several years. H&W should work on making such information accessible to its clients.

It is unethical and immoral for a financial service provider to hide such information from their clients. Clearly, they seem very unreliable because of this.

Not a Fan

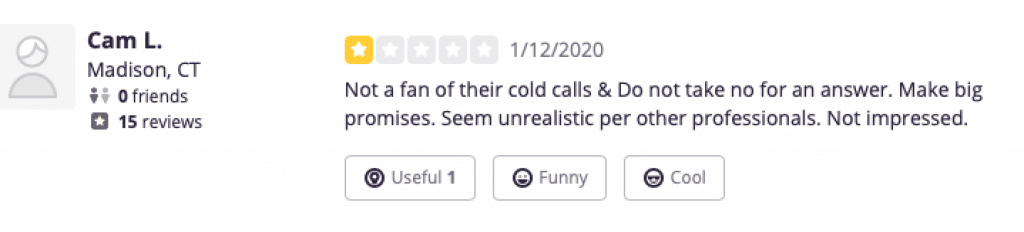

This review is kind of an alert. They claim that H&W’s people don’t take no for an answer during cold calls and make unrealistic promises to their clients. I don’t think it is a good way to approach potential clients in any industry, let alone in finance.

Watch Your Money

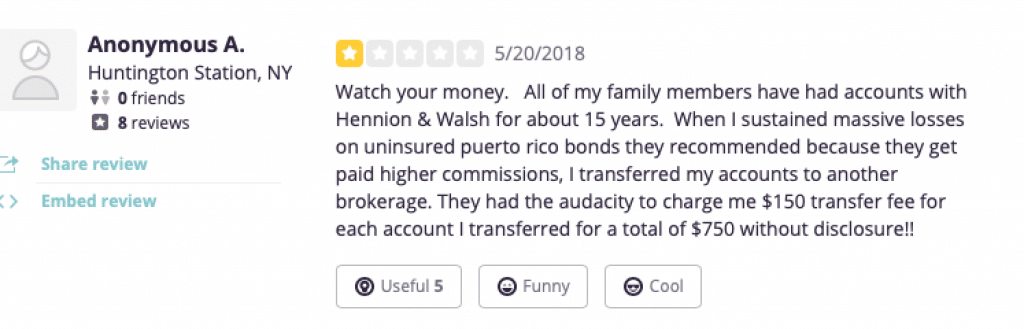

This reviewer had a horrible experience with Hennion and Walsh. According to the review, all of their family members had accounts with this company for nearly 15 years.

However, they suffered financial losses because of poor recommendations from H&W’s advisors. So they chose to transfer their accounts.

Still, Hennion and Walsh charged a $150 transfer fee. It shows the unprofessional and rude behaviour this company has. H&W has many complaints from its clients regarding its poor client service.

Terrible Behaviour

According to this review, they received a call from someone named Ryan. The reviewer told Ryan that they weren’t interested in H&W’s services however he continued to give his sales pitch.

But when they declined his request, he hung up abruptly, which is quite rude by any standards. In the finance sector, client service matters a lot. The reviewer pointed out that if an associate of this firm can’t even respond properly to a simple declination, then it would be best to avoid them.

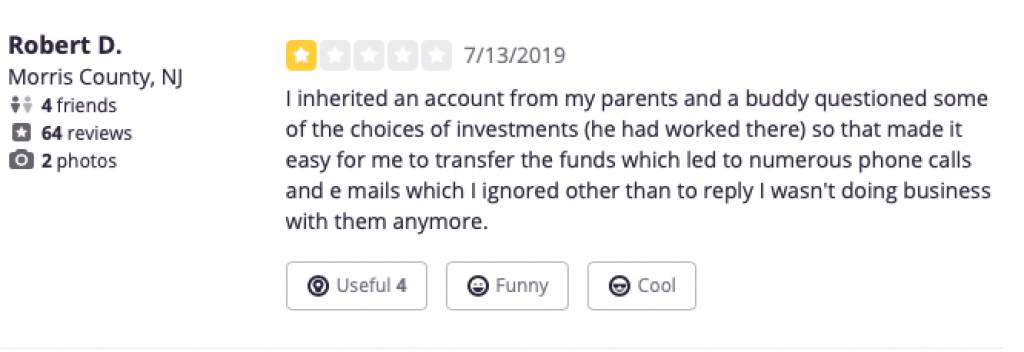

Not Doing Business With Them Anymore

This person had a terrible experience with H&W too. According to the review, they had inherited an account from their parents and one of their friends who used to work at this company questioned some of their investment choices. So they decided to transfer their account. Apparently, this person received plenty of calls and emails from H&W when they made this decision.

How Hennion and Walsh Is Exploiting Its Employees

While working on this article, I found several employee complaints about Hennion and Walsh. Clearly, those people don’t treat their employees properly. There were too many employee complaints, so I felt it’s important to share them here.

It was very sad to read these reviews. However, you can find out a lot about a company’s ethics by reading its employee reviews.

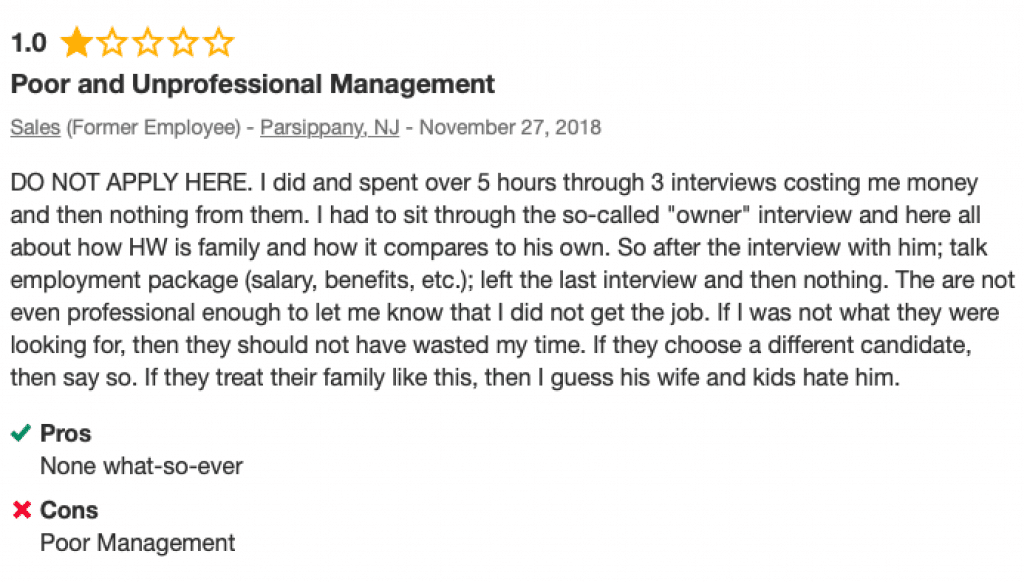

Poor and Unprofessional Management

This reviewer has complained about the management of H&W. According to them, they had given three interviews and spent more than five hours on them. Even though the interviewers claimed that this company runs like a family, they didn’t care enough to inform this person that they didn’t get the job.

This is really unprofessional behaviour. And I don’t think a sophisticated firm should operate like this.

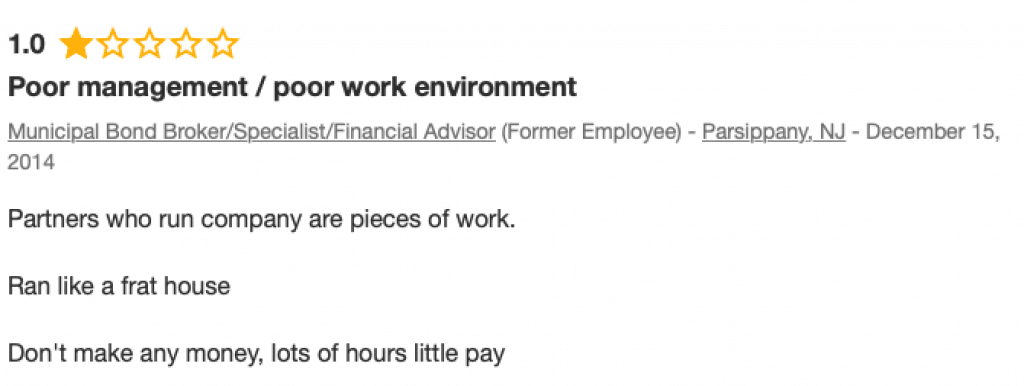

Poor Work Environment

This reviewer has complained about the leadership of Hennion and Walsh. They even claim that the leaders are running this company like a frat house. It alerts potential candidates that this company doesn’t pay sufficiently and demands a lot of hard work. Such a work environment shows the level of greed H&W’s founders have. They are concentrated on making the most money, regardless of their employees’ conditions. When a company doesn’t care about its employees, you can understand what kind of services it must provide to its clients.

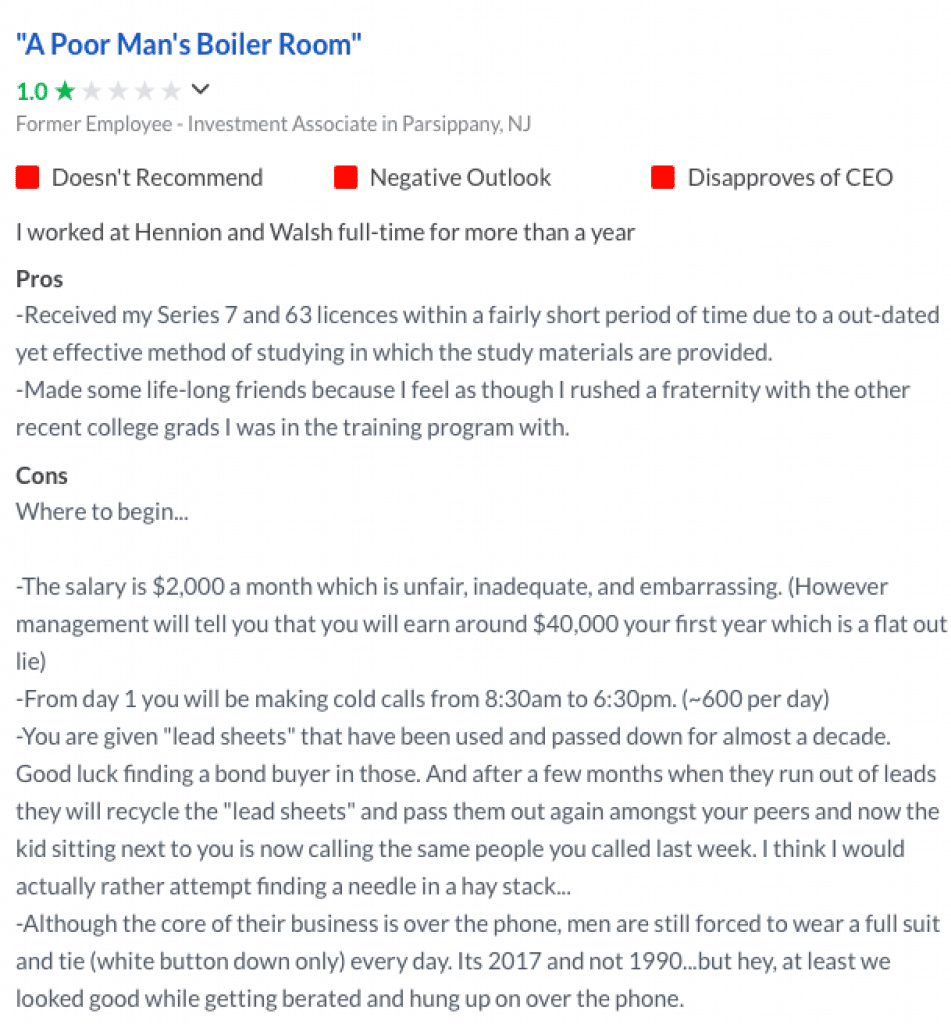

Poor Man’s Boiler Room

It is probably the most detailed review I found on Hennion and Walsh. According to the reviewer, there are many problems in this company. First, the company doesn’t pay its employees properly. Apparently, the salary for investment associates here is $2,000. However the worse thing is that the company’s leaders claim that you will earn $40,000 per year, which is a lie. They shouldn’t lie to their new employees about their pay. It affects their morale.

Similar post: Glassman Wealth Services

The reviewer says that new employees make around 600 cold calls per day there. They also mention that the management gives used leads to you. Apparently, they have been using the same leads for over a decade. They pass around the same leads so the same people get contacted by Hennion and Walsh to buy tax-free bonds.

Another complaint in this review is that the company has a strict dress code. Men have to wear a full suit and tie even though their job is only to talk to potential leads on the phone. The senior employees look down on those who take personal days and make demeaning statements.

Talking to potential leads isn’t the only task you have here. The reviewer says that you might get the chance to clean the dishes, wash your boss’s car, and do similar tasks. At the end of their review, the person has advised people to avoid working at this company. The way they treat their new employees is simply terrible.

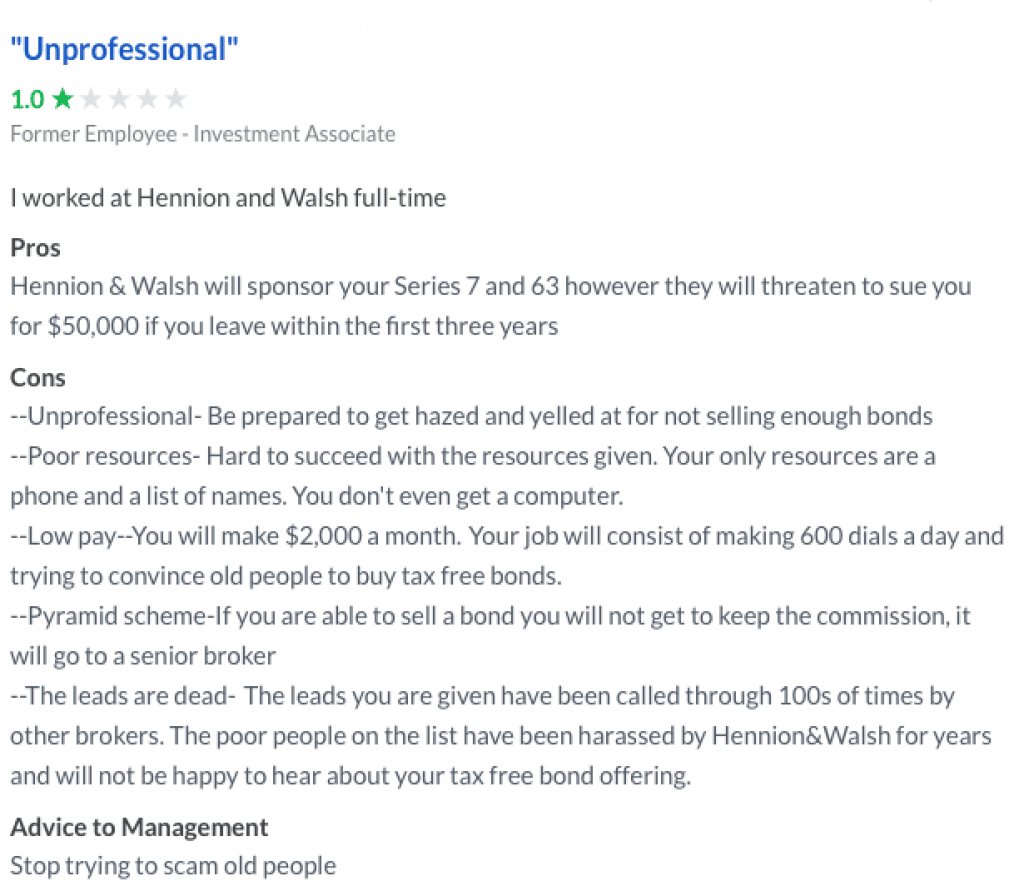

Unprofessional

This is another detailed Hennion and Walsh review. According to the reviewer, you get unprofessional treatment from other staff members. The company works like a pyramid scheme, because the bonds you sell don’t generate commission for you but for your superior.

The employee complained that the company only provides you with a phone and a list of names, nothing else. Apparently, they don’t even provide you with a working computer. However, that’s not the worst thing.

The reviewer has shared their opinion on how H&W harrasses its customers. They claim that the leads you get to contact are too tired of getting contacted by H&W.

The review has pointed out that the company doesn’t pay you sufficiently. It is a common issue I have found in nearly all of their employee complaints.

Did Not Have a Good Experience

This review was quite small. According to this review, the person claimed that H&W had too many cons and they didn’t have a good experience while working there.

There were plenty of other employee reviews. However, I think these are sufficient. As you can see, the employees working at this firm don’t get a good work environment too.

Associating with such a firm can be detrimental to your finances and image.

Hennion and Walsh has many negative employee reviews. People complain that they don’t pay their employees properly, have a terrible work environment, and give a terrible experience.

Hennion and Walsh Review Verdict 2020

Hennion and Walsh is an unethical firm. It has tried to bury its client reviews, employee reviews, and even FINRA’s disclosures to mislead potential clients.

If they hadn’t done anything wrong, they wouldn’t have needed to bury this information. So it’s obvious that something is wrong with this firm. Considering they have been fined for a total of $354.500 since their arrival, I wouldn’t recommend doing business with them.

There are plenty of other financial experts who can offer much better services. You should avoid dealing with a company that has so many FINRA disclosures. It is unsafe.

I hope you found this article useful. It’s important to take action against such unethical service providers. You can contribute to this fight by sharing this article with your peers. The more people know about it the better.

Hennion and Walsh FAQs

Is Hennion and Walsh legit?

Hennion and Walsh is a member of SIPC and FINRA. However, they have a total 16 FINRA disclosures and have been fined $354,000.00. That’s why it is not recommended to do business with them.

What are Hennion and Walsh fees?

Hennion and Walsh’s fees for investment management are: 1.50% for assets worth $250,000. 1.40% for assets worth $500,000, 1.25% for assets worth $1 million, 1% for assets worth $5 million, and 0.75% for assets worth $10 million.

Who is behind the Hennion and Walsh scam?

The people behind Hennion and Walsh are Richard Hennion and William W. Walsh. They founded this firm in 1990.

How can I help you fight against this scam?

You can fight against the Hennion and Walsh scam by raising awareness about their wrongdoings. Share this article with others who might find this useful.

I can dispute every argument made here. Complete fabrication and little proof and evidence of any of your claims. How could a scam company have grown to 4billion in assets and 20,000 clients in this heavily regulated industry? Only negative client comment is that they were charged $150 to transfer out bonds? Every big firm does that. Hennion and Walsh transfers out bonds for FREE if you ask your advisor. If you transfer in bonds they cover your charge from outside firm. Upset that people are calling because you took your account elsewhere and no courtesy to give a call or explain why? How dare they call to see what’s up and make sure everything’s ok…..

Can you give a reliable Bonds Broker for me to deal with?

I was considering H & W, after reading this review, I decided to find another broker. Do you know a reliable one?

Best Regards,

Michael Moore

What a hatchet job of an article. Must be disgruntled former employee. 12 disclosures for 30+ years of business with 20k+ clients…. That is your sole reason why not to do business with H&W.? Why don’t you provide context for the industry? Merrill Lynch settles multiple 10million dollar lawsuits annually (as well as other large wire houses you can google this info). It’s unfortunate but it does happen in the industry.

Claiming that wearing a suit and having to work hard is not a negative when you are in the development stage of your career. I am going through this now and it teaches professionalism and provide our clients with that same work ethic and drive we are expected to show.

Your entire article lacks specific examples and context of anything closely remote to a SCAM. Telling people it’s “unsafe to invest because of 13 disclosures (which context for the disclosure is extremely important because people can just file a complaint for any reason) over 30 years just proves you have no understanding of the actual industry as a whole.

Bad leads (which are people who have called in with interest in bonds and paid for by the firm)… expected to wear a suit… expected to perform in their position are your only negative reviews. It’s a difficult industry but they do provide you with the tools necessary to succeed. Unlike a lot of my fellow Gen Z you just have to show up and put your work in and then you’ll be rewarded. Not before.