Who is Jeff Roberts (CRD#: 4082177)?

Jeff Roberts is an Ameriprise financial advisor and the founder of MavenCross Wealth Advisors. He has worked in finance for nearly 31 years.

He primarily focuses on Retirement Planning Strategies, Wealth Preservation Strategies, Investments, Business Retirement Plans, Cash Flow Management Strategies, Estate Planning Strategies, Insurance, Retirement Income Strategies, Social Security Retirement Benefits, and Tax Planning Strategies.

Jeff Roberts, an Ameriprise financial advisor serving clients in the Birmingham, AL area, claims to take the time to understand clients and their goals, as well as changing markets, and how they can help clients confidently focus on the future.

The article will go deeper into Jeff Roberts’ past, finding hidden disclosures and analyzing the implications of the lawsuits against him.

About Ameriprise Financial:

Ameriprise Financial was founded in Minneapolis, Minnesota in 1894 as Investors Syndicate by John Tappan. The company’s purpose was to help customers reach their financial goals by investing in a diversified portfolio of equities and bonds. Investors Syndicate has grown to become one of the largest mutual fund companies in the United States over time.

Investors Syndicate changed its name to IDS Financial Services and became a publicly traded business in 1984. In 2005, IDS Financial Services changed its name to Ameriprise Financial to better represent its focus on assisting clients in achieving their financial objectives through a broad range of financial planning and investment management services.

Ameriprise Financial is now a Fortune 500 company with over 10,000 financial advisors and over 2 million clients. The firm, which has offices in the United States, Canada, and the United Kingdom, is dedicated to helping individuals and families in achieving their financial goals through a personalized approach to financial planning.

History of Ameriprise Financial

As said before, John Tappan launched Ameriprise Financial in 1894 as an investor syndicate. Tappan felt that everyone, regardless of fortune or net worth, should have access to high-quality financial advice and investment products. He also believed in the value of diversity and advised his clients to invest in a combination of equities and bonds to decrease risk and maximize returns.

Investors Syndicate grew over time to become one of the leading mutual fund companies in the United States. The company expanded its product offerings in the 1970s and 1980s to include insurance and annuities, as well as financial planning and investment management services.

Investors Syndicate changed its name to IDS Financial Services and went public in 1984. The company keeps expanding its product offerings and geographic reach by acquiring additional financial services firms and creating branches in Canada and the United Kingdom.

IDS Financial Services changed its name to Ameriprise Financial in 2005 to better stand for its focus on helping clients achieve their financial goals through a broad range of financial planning and investment management services. Ameriprise Financial is a prominent financial services firm with a long and proud history of helping individuals and families in achieving their financial goals.

Ameriprise Financial’s Services and Products

Ameriprise Financial offers a wide range of financial planning and investment management services to assist individuals and families in achieving their financial goals. Some of these services are:

Financial Planning:

Ameriprise Financial’s financial advisors work with clients to develop a comprehensive financial plan that takes their particular circumstances and goals into account. Retirement preparation, education planning, estate planning, tax planning, and risk management are all recommended in the plan.

What is a Financial Advisor?

A financial advisor is a specialist who offers professional financial advice to people looking to accomplish particular financial goals. You work with a financial advisor to develop a thorough financial plan that is specific to your situation, much like you would hire an architect to construct the blueprint for your home. Understanding your existing financial condition, including your income, costs, savings, and spending patterns, is a requirement for this collaboration.

Investment management:

Ameriprise Financial’s investment management services provide access to a diverse portfolio of investment products such as mutual funds, exchange-traded funds (ETFs), individual stocks and bonds, and alternative investments. Financial advisors at Ameriprise Financial help customers create customized investment strategies based on their risk tolerance, time horizon, and financial goals.

Insurance:

Ameriprise Financial offers a variety of insurance products, such as life insurance, disability insurance, long-term care insurance, and annuities. These products are intended to assist individuals and families in safeguarding their assets and providing financial stability in the event of unexpected disasters.

Ameriprise Financial’s Approach to Financial Planning

Ameriprise Financial’s financial planning technique is built on a personalized, comprehensive, and holistic approach. Financial advisors at the firm work with customers to create customized financial plan that takes into account their specific circumstances and goals.

Retirement preparation, education planning, estate planning, tax planning, and risk management are all included in the financial plan. Ameriprise Financial’s financial advisors use some tools and resources, including sophisticated financial planning software, to assist clients in visualizing and tracking their financial goals over time.

Ameriprise Financial’s financial advisors also take a comprehensive approach to financial planning, considering all areas of their client’s financial lives, including income, expenses, assets, liabilities, and cash flow. This method ensures that the financial plan is comprehensive and meets all of the client’s financial demands.

Financial Strength and Stability

Ameriprise Financial is a financially secure and successful firm with a long track record. The company’s strong balance sheet and diverse business model enable it to withstand economic downturns and market volatility.

Ameriprise Financial is also dedicated to keeping its capital position reliable and returning capital to shareholders through dividends and share repurchases. The company’s long-term goal is to return 80% to 90% of earnings to shareholders via dividends and share repurchases.

Reviews and Customer Satisfaction

Ameriprise Financial has an excellent reputation for customer service and received multiple awards and accolades for it. Financial advisers at the firm are held to the highest ethical standards and are dedicated to putting their client’s interests first.

Customers have also given Ameriprise Financial a positive review for its financial planning and investment management services. Customers praise the company’s personalized approach to financial planning and investment management, which has earned it a 4.8-star rating on Trustpilot.

Jeff Roberts Disclosures: BrokerCheck, FINRA, And SEC

BrokerCheck report of Financial Advisor Jeff Roberts includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosures events.

There is no disclosure against Jeff Roberts.

BrokerCheck

Source: JEFFREY LEE ROBERTS – Broker at AMERIPRISE FINANCIAL SERVICES, LLC (finra.org)

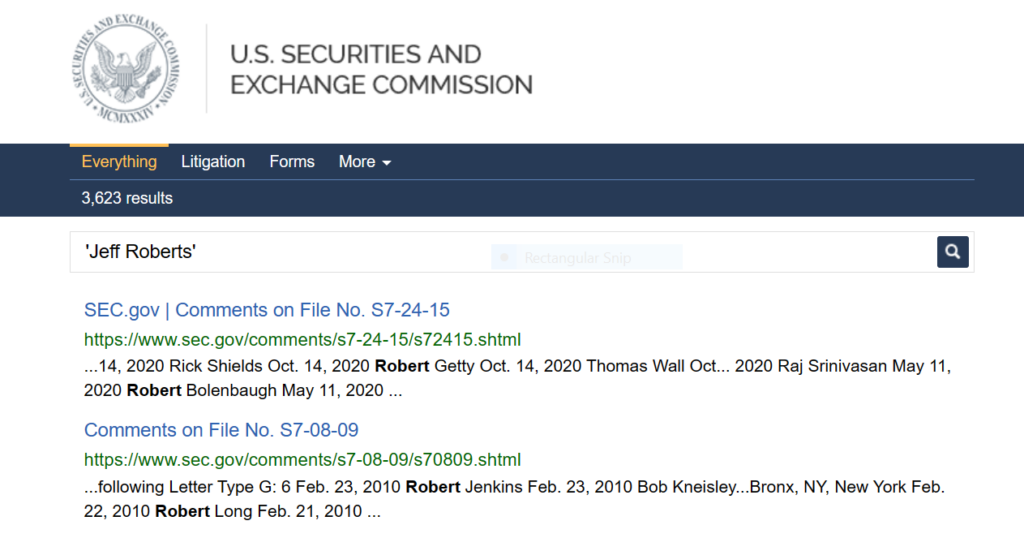

SEC Litigations & Forms

Source: Jeff Roberts – SEC Site Search Search Results

Jeff Roberts Lawsuits

The majority of court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, and Trellis. Law and Law360. If Jeff Roberts has been involved in any such lawsuits, the records can be found using the URLs below:

There might be more pending lawsuits against Jeff Roberts that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Jeff Roberts on these websites, then you can contact the local authorities and check if they have a physical copy of any lawsuits.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Jeff Roberts Complaints and Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Jeff Roberts using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

Better Alternatives To Jeff Roberts:

Manages Assets Worth

- $6,427,792,177

Services

- Financial planning

- Portfolio management

- Selection of other advisors (including private fund managers)

- Family office and consulting services

Manages Assets Worth

- $4,465,757,285

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors (including private fund managers)

Manages Assets Worth

- $302,000,000

Services

- Financial planning

- Portfolio management