Who is John Acker (CRD#: 3024367)

John Acker has worked in the finance industry for over 30 years. John Acker began his career in corporate finance at First Interstate Bank and afterward, at Banque Paribas, where John Acker focused on the media and telecommunications industries. John Acker then worked in investment management for almost 20 years, first at Morgan Stanley and subsequently at UBS.

John Acker applies his experience in investment banking and investment management to assist families with everyday challenges such as retirement planning, investing, college savings, selling tightly held businesses, and estate preparation.

John Acker earned his MBA from the Marshall School of Business at the University of Southern California and his BS from the University of Colorado, Boulder. John Acker also became a CERTIFIED FINANCIAL PLANNER and a Certified Investment Management Analyst. John Acker and his wife and two children live in Manhattan Beach. John, an Eagle Scout, is deeply committed to serving others through his work with the Boy Scouts, Rotary, and organizations that serve the developmentally disabled. Among other activities, John Acker enjoys golf, tennis, and skiing.

About FIRM: UBS Financial Services

What is UBS Financial Services

UBS Financial Services is a global financial services company that provides a wide range of financial products and services to individuals, corporations, and institutions. The company has a long history in the financial services industry, dating back to its founding in Switzerland in 1862. Today, UBS is one of the largest and most well-known financial institutions in the world, with a presence in over 50 countries and a vast network of clients.

The primary goal of UBS Financial Services is to help clients achieve their financial objectives through a combination of expert advice, innovative solutions, and exceptional service. The company prides itself on its ability to provide tailored solutions to meet the unique needs of each client, whether they are looking to build wealth, preserve capital, or generate income. In this article, we will explore the various products and services offered by UBS Financial Services and discuss some of the investment options available to clients.

One of the key factors that set UBS Financial Services apart from other financial institutions is its commitment to client satisfaction. The company believes that by putting the needs of its clients first and maintaining a strong focus on ethical business practices, it can build long-lasting relationships and create lasting value for both its clients and the company itself. This approach has helped UBS Financial Services establish itself as a trusted partner to clients around the world, and it continues to drive the company’s success today.

UBS Financial Services Products and Services

UBS Financial Services offers a comprehensive range of financial products and services designed to meet the diverse needs of its clients. These offerings can be broadly categorized into four main areas: wealth management, asset management, investment banking, and retail banking.

Wealth Management

Wealth management is a core focus of UBS Financial Services, and the company provides a wide range of solutions to help clients manage their wealth effectively. These services include financial planning, investment management, estate planning, and tax planning. UBS Financial Services also offers specialized services for high-net-worth individuals and families, such as philanthropy and family office services.

Asset Management

Asset management services from UBS Financial Services are designed to help clients maximize their investment returns while managing risk. The company offers a variety of investment solutions, including equities, fixed-income, real estate, and alternative investments. UBS Financial Services also provides customized solutions to meet the specific needs of institutional clients, such as pension funds and endowments.

Investment Banking

UBS Financial Services’ investment banking division provides a range of services aimed at helping clients raise capital, manage risk, and execute transactions. These services include mergers and acquisitions advisory, debt and equity capital markets, and corporate lending. The company also offers research and analytics to help clients make informed investment decisions.

Retail Banking

In addition to its wealth management and investment banking services, UBS Financial Services also operates a retail banking division. This division offers a variety of banking products and services to individual clients, such as checking and savings accounts, credit cards, mortgages, and personal loans.

UBS Financial Services Investment Options

When it comes to investing, UBS Financial Services offers a wide range of options to help clients achieve their financial goals. These options can be broadly categorized into three main areas: traditional investments, alternative investments, and structured products.

Traditional Investments

Traditional investments offered by UBS Financial Services include equities, fixed income, and mutual funds. Clients can choose from a variety of investment strategies and styles, such as value, growth, or income-focused approaches. The company also offers access to a global network of investment managers, allowing clients to diversify their portfolios across different geographies and sectors.

Alternative Investments

Alternative investments are designed to provide clients with additional diversification and potential sources of return that may not be available through traditional investment channels. UBS Financial Services offers a range of alternative investment options, including hedge funds, private equity, real estate, and commodities. These investment options are typically available to qualified investors, such as high-net-worth individuals and institutions.

Structured Products

Structured products are financial instruments that combine various elements, such as derivatives and traditional securities, to create unique risk-return profiles tailored to specific investor needs. UBS Financial Services offers a wide range of structured products, including equity-linked notes, principal-protected notes, and structured funds. These products can help clients enhance their returns, manage risk, or achieve specific investment objectives.

UBS Financial Services Lawsuit

While UBS Financial Services is a well-respected financial institution, it is important to note that the company has faced legal issues in the past. One notable example is the lawsuit filed against the company in 2008 by the U.S. Securities and Exchange Commission (SEC) for alleged fraud related to the sale of auction-rate securities.

The SEC alleged that UBS Financial Services had misled customers by falsely representing that auction rate securities were safe, liquid investments when, in fact, the market for these securities had become increasingly illiquid. As a result, many investors were unable to sell their auction-rate securities, resulting in significant losses.

UBS Financial Services ultimately settled the lawsuit in 2008, agreeing to repurchase an approximately 150 million fine. The company also implemented internal reforms to improve its risk management and compliance processes.

SEC Fraud Charges

In addition to the auction rate securities lawsuit, UBS Financial Services has faced other legal issues related to securities fraud. In 2015, the company settled with the SEC for $19.5 million over allegations that it had failed to adequately disclose the risks associated with complex mortgage-backed securities it sold to investors between 2011 and 2014. The company neither admitted nor denied the allegations as part of the settlement.

Potential clients need to be aware of these past legal issues when considering working with UBS Financial Services. While the company has taken steps to address these issues and improve its internal processes, investors should carefully evaluate their options and weigh the potential risks and benefits of working with any financial institution.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

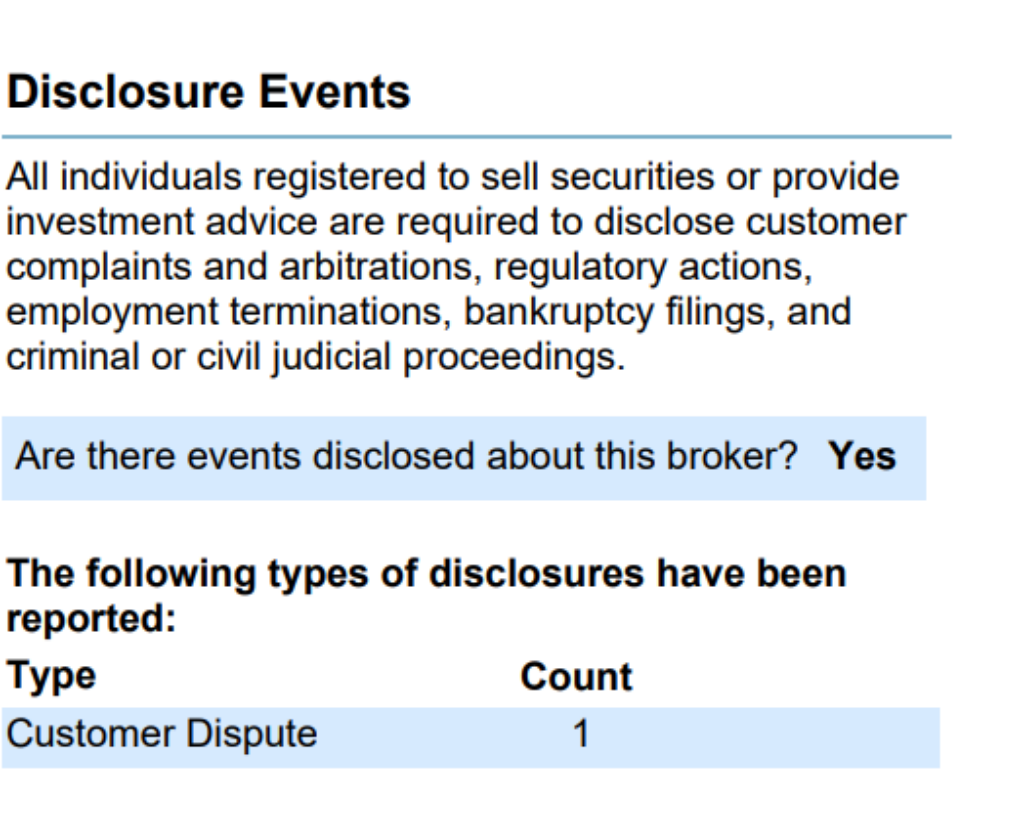

John Acker Disclosures: BrokerCheck, FINRA, And SEC Reports

There is one disclosure named Customer Dispute Disclosure.

When an Executive Officer or Chief, or their designate, determines that:

The complaint will be sent to a lawyer.

The company has been allowed to reply to the complaint, a probable breach of the law has happened or there is a risk of public harm, and a substantiated consumer transaction has occurred,

A genuine financial transaction between an individual customer or patient and a firm or licensee to procure and sell goods or services is defined as a validated consumer transaction.

A Consumer Complaint History report shall not reveal complaint information if it is judged that:

The complaint lacks merit, the complaint involves a non-consumer matter (e.g., labor grievances, labor relations, tax issues, etc.), or disclosure is forbidden by statute or regulation.

A report on Consumer Complaint History shall not reveal information concerning a complaint if it is found that:

Disclosure could jeopardize an investigation or prosecution, or it could endanger or hurt the complainant.

FINRA’s BrokerCheck

individual_3024367.pdf (finra.org)

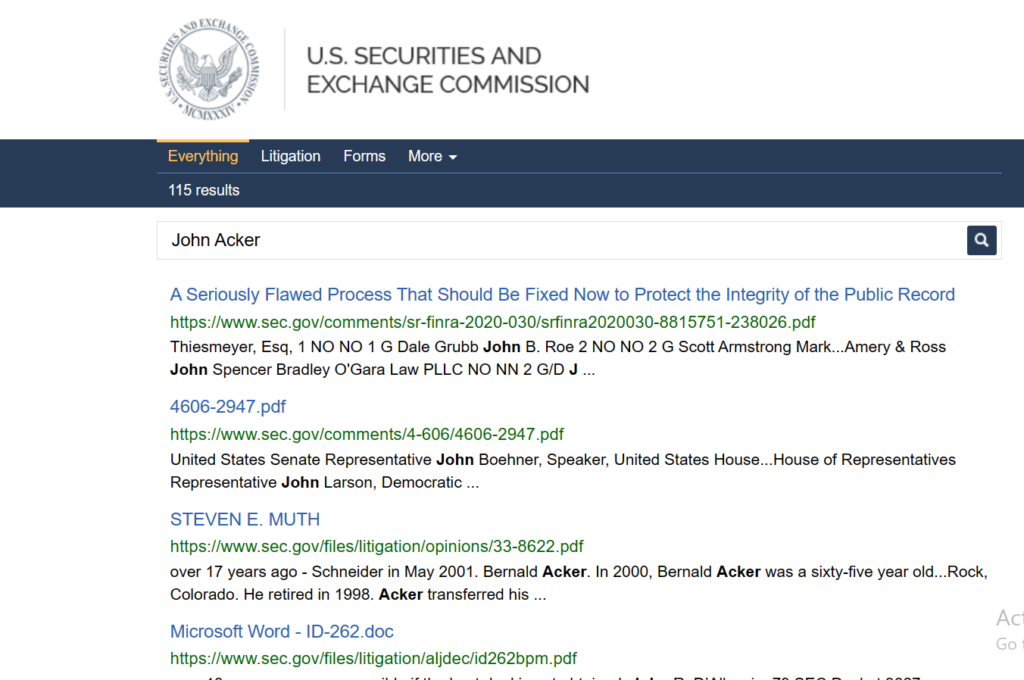

SEC Litigations & Forms

Source: John Acker – SEC Site Search Search Results

John Acker Lawsuits, Legal Battles, & Disputes

There might be more pending lawsuits against John Acker that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against John Acker on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

John Acker Complaints, Class Action Lawsuits & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against John Acker using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if you are facing issues with John Acker or any financial advisor.

Frequently Asked Questions

Where is NAME located?

What are NAME’s qualifications

Is NAME facing any lawsuits?

Has NAME been charged by the SEC?

How do I contact NAME?

Does NAME have any disclosures?

Which Firm does NAME work with?

What is NAME’s CRD Number?

Better Alternatives To John Acker (By Experts):

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management