Who is John Patterson(CRD#: 1588308)?Everything you need to know about John Patterson and their accolades

With two years of total relevant experience, John Patterson is a certified financial planner working in Charlotte, North Carolina. Currently, Patterson is employed with Wealth Enhancement Advisory Services, LLC.

They have worked for companies like United Technologies Corporation, Carroll Financial Associates, Full-Time Education, Wells Fargo Advisors, The Club At Longview, Uber, Cetera Advisor Networks, Lpl Financial LLC, Wealth Enhancement Advisory Services, Wealth Enhancement Group, and Wealth Enhancement Brokerage Services throughout their career. Patterson is licensed to assist investors in North Carolina and holds a Series 66 license that permits them to act as both a securities agent and an investment advisor representative.

Over the past thirty years, John has assisted clients in managing their finances. John has led numerous financial planning workshops for staff members of Fortune 500 organizations. He specializes in retirement planning and asset management for corporate employees and business owners.

John has spoken on financial planning topics on television news and has been quoted in The New York Times and other business journals. Additionally, he has won the Forbes Best-In-State Wealth Advisors (2019-2023) and Barrons Top Financial Advisors (2014–2015, 2017–2023) awards on multiple occasions.

Barron’s Top 1200 Financial Advisors list is determined by several factors, including the firm’s income generated, regulatory history, practice standards, charitable efforts, and assets under management. Awarded on February 24, 2014, February 23, 2015, March 6, 2017, March 10, 2018, March 8, 2019, March 13, 2020, March 12, 21, and 22, for the calendar year that ended on September 30 of the prior year.

In this article, we will go deep into John Patterson’s past, discovering hidden disclosures and analyzing the consequences of the lawsuits.

About Wealth Enhancement GroupHistory, achievements, leadership, lawsuits, & disputes

One of the biggest independent wealth management companies in the US is Wealth Enhancement Group. Financial planning, estate planning, retirement income planning, insurance, tax planning, and investment management are just a few of the services that Wealth Enhancement Group offers to clients nationwide. These services are comprehensive and personalized.

History of Wealth Enhancement Group

Wealth Enhancement Group, which was established in 1997, is an organization that specializes in giving retail clients the team-based information and tools they require to make their financial lives simpler. Financial advisor, author, speaker, and host of the Your Money Radio Show Bruce Helmer is a co-founder.

How Does the Wealth Enhancement Group Work?

They put your plan into motion, keep an eye on its efficiency, and remain involved, making adjustments as necessary as you advance toward your objectives. Cover every conceivable aspect. Reach out for any objective. They provide a genuinely all-inclusive strategy and deep experience in every aspect of wealth management.

Taking into account portfolio risk levels, savings practices, life insurance coverage, revolving credit card balances, and emergency savings, research has shown that households working with a professional financial planner were more likely to make better financial decisions than those without a planner.

How much do the services of Wealth Enhancement Group cost?

Wealth Enhancement Group offers a fee-based arrangement that includes both comprehensive, long-term financial planning and assets under management. Our cost structure is quite affordable because we don’t charge separate fees for investments and guidance.

The size and complexity of your case will decide your specific cost, which typically varies from 1.0% to 1.5% of the assets under management. To safeguard your investment returns, we actively collaborate with our custodians and product partners to reduce non-value-added costs like transaction fees. This is what we do as your advocate. The result is that you are only paid for services that, in our opinion, provide genuine value.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate fairly and orderly, and facilitate capital formation.

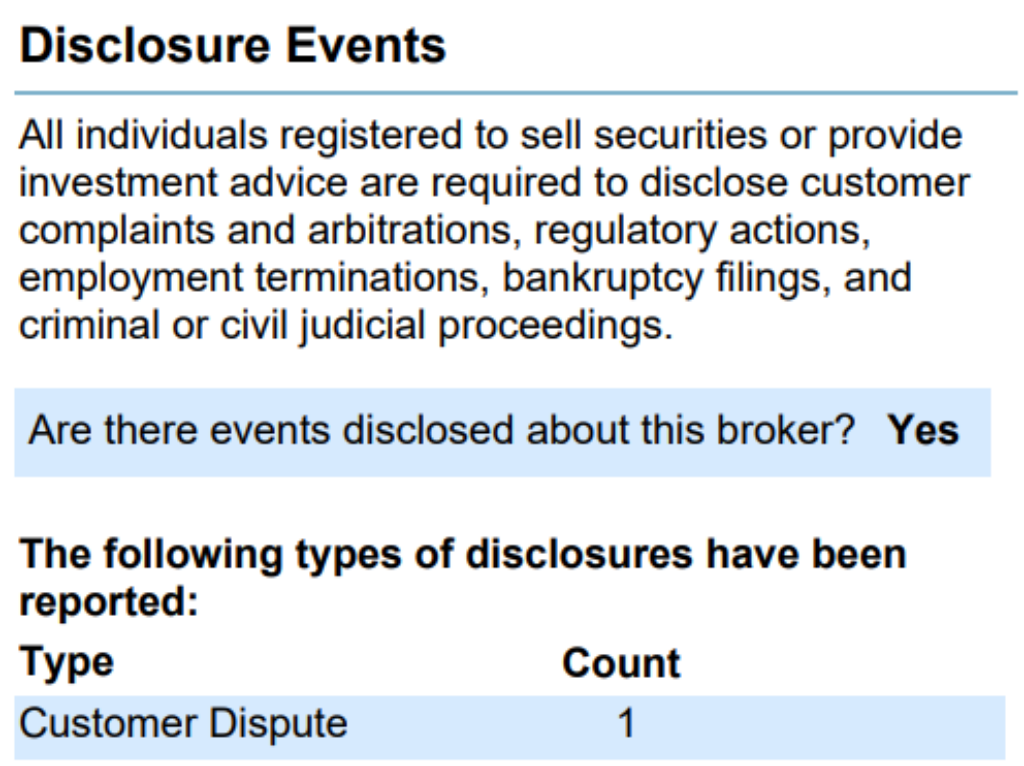

John Patterson Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, and litigation against John Patterson

The brokerCheck report of John Patterson includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

In this instance, the broker has been informed of a customer dispute along with the notification.

This type of disclosure event involves a consumer-initiated, investment-related complaint, arbitration proceeding, or civil suit containing allegations of sale practice violations against the broker that resulted in a monetary settlement to the customer.

Here, it is alleged that the salesperson did not renew the stop-sale order. On August 24th, 2004, a stop-sell order was placed on WMT. Due to the company’s 180-day policy, the stop-sell order was canceled in March 2005.

FINRA’s BrokerCheck

individual_1588308.pdf (finra.org)

SEC Litigations & Forms

Source: John Patterson – SEC Site Search Search Results

John Patterson Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against John Patterson

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis.law, and Law360. If John Patterson has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against John Patterson that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against John Patterson on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

John Patterson Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against John Patterson (if available)

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against John Patterson using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with John Patterson or any financial advisor.

Better Alternatives To John Patterson (By Experts):Find the top 3 alternatives to John Patterson

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management