You can help us put a stop to online scams before they grow too big and end up ruining thousands of lives. A scam is a scam, doesn’t matter if it’s big or small. Now that this is out of the way, let’s get started with the review.

Serial entrepreneur Kevin Mulleady claims that he has started or co-founded more than 25 profitable businesses. His skill set encompasses executive leadership as well, and he has a successful track record that includes board and management experience.

We look at 34 different data points when analyzing and rating businesses & individuals. Once the research on these data points is submitted, expert contributors reach out to the company’s customers and associates to get more insight into their operation. Finally, all the collected information is presented in the form of this expert review.

All the data is extracted from publicly available information and the sources are given in the transparency section at the bottom of every report.

These reports are made possible by the collective efforts of contributors like you. If you would like to become a contributor then contact us here.

Who Is ‘Pharma Bro’?

Shkreli, who has been appropriately called “Pharma Bro” by the media, is the ideal and dreadful amalgam of hubris, youth, and avarice. Because of how his profession as a pharmaceutical executive contrasts with that of his clients—people who are frequently ill, impoverished, and vulnerable—he has our attention.

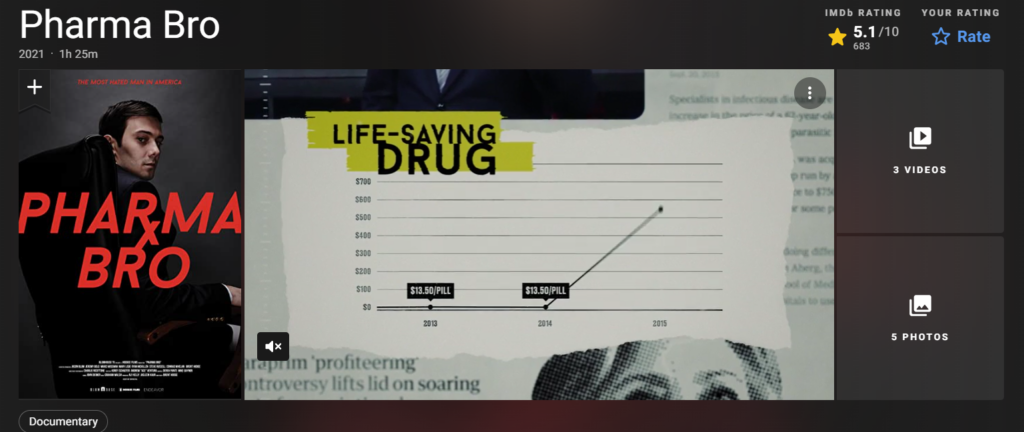

In September, Shkreli paid $2 million to purchase the sole copy of a Wu-Tang Clan record and increased the cost of a life-saving medication from $13.50 to $750. James Hamblin referred to him as “the face of unrepentant profiteering from the suffering of humans” in a September article for The Atlantic.

Shkreli was detained on suspicion of securities fraud. Earlier this week, Daisy Hernández reported in The Atlantic that Shkreli had a new scheme that would increase the cost of a medication used to treat Chagas disease, a condition that primarily affects immigrants from Latin America. According to a Doctor Without Borders consultant, “Chagas is a disease of the poor, so it’s not a disease where people have access if prices are high.

Given the 32-year-old executive’s background, this most recent proposal sounds revolutionary. He comes from a working-class area of Brooklyn, and his parents were immigrants from Albania and Croatia who were janitors.

Victor Luckerson at Time reported, “He dropped out of high school and got his start as an intern on Jim Cramer’s CNBC show Mad Money. Later, he established Elea Capital and MSMB Capital, two hedge funds.

The New York Times alleged that Shkreli staked $2.6 million on the 2007 stock market crash, which led to Elea’s downfall. In the end, he was correct, but it was too late.

Shkreli, a chess and guitar enthusiast, stated at the time, “I learned a lot about employing leverage, the pitfalls of leverage. “At the time, which was about ten years ago, I was hurriedly pursuing success. I placed a huge wager that the market would crash, but I lost.

More About Pharma Bro (2021) and Kevin Mulleady’s Connection

Pharma Bro is a film that tells the story of Martin Shkreli, a financial entrepreneur and pharmaceutical mogul from Brooklyn, New York, who is well-known for having raised the cost of an AIDS medicine by 5500% overnight, for having paid $2 million for the lone copy of a Wu-Tang Clan album, and for having been found guilty of securities fraud. Pharma Bro Martin Shkreli is the most despised person in the country.

Martin Shkreli’s relationship with Kevin Mulleady

Martin Shkreli had Kevin Mulleady on his side for a long time. He first worked for one of the hedge funds run by the pharmaceutical CEO, and then he was an executive at the business where Mr. Shkreli famously hiked the cost of a life-saving prescription by 5,000 percent.

Currently, Kevin Mulleady is working with activist investors to convince his fellow shareholders to give them control of the parent company of that drugmaker, Phoenixus. (Turing Pharmaceuticals, Phoenixus’ operating subsidiary, is now known as Vyera.) He claims that even though Mr. Shkreli is incarcerated for securities fraud and won’t get released until late 2023, he still has power there.

Phoenixus shareholders will be asked to decide whether to support the activists’ alternate slate of six candidates or vote to re-elect the company’s five directors. To cut as many ties to Mr. Shkreli as possible is at the heart of the activist investors’ argument. They claim that the present board is still too connected to the imprisoned executive.

Daraprim, a medication used to treat toxoplasmosis, is still owned by the business, whose headquarters are in Switzerland. Mr. Shrkeli unrepentantly increased the price of Daraprim to exorbitant heights, earning him the nickname “Pharma Bro.

Martin Shkreli is a blight on this industry,” declared Jason Aryeh, the activist campaign’s driving force and a hedge fund manager.

It was unable to get in touch with Mr. Shkreli through his attorney Brianne Murphy.

Averill Powers, chairman, and CEO of Phoenixus, did not reply to inquiries for comment. The organization claimed in a letter to investors sent last month that its board was acting “independently from instructions from Martin Shkreli (except to the extent Martin Shkreli votes his shares).

Despite being confined to a federal prison in central Pennsylvania, Mr. Shkreli is legally permitted to vote his shares in Phoenixus, which account for around 44 percent of the business. Despite being required to surrender approximately $7.4 million as part of his 2018 imprisonment, including his unique Wu-Tang Clan CD and a Picasso picture, he has preserved his stake.

Phoenixus has questioned attempts to paint Kevin Mulleady as a sort of heroic figure, saying in a letter to investors that he has been a member of the board of the business for more than three years and has even held the position of CEO at one point. The Federal Trade Commission and New York State have named him, Mr. Shkreli, and the business as co-defendants in an antitrust case wherein they are charged with illegally attempting to prevent generic Daraprim competitors from entering the market.

According to a 2019 Wall Street Journal article that was part of the F.T.C.’s lawsuit, Mr. Shkreli had continued to do business while incarcerated, including maintaining regular touch with Kevin Mulleady.

Since relocating to the Allenwood low-security jail, Mr. Shkreli has relied heavily on collect calls to stay in touch with the outside world. He “has maintained his influence over Phoenixus and Vyera through associates as well as his position as Phoenixus’ largest shareholder,” according to the F.T.C. and New York prosecutors’ complaint.

When generic versions of Daraprim entered the market, Phoenixus suffered a severe blow: It lost over $20 million, witnessed a roughly 50% decline in sales, and drastically downsized its employees. In a letter to investors, the business attributed the layoffs to the epidemic. In the first quarter of this year, it also disclosed an operational loss of $5.5 million, according to an investor presentation.

Unwinding the Daraprim price hike is one of the activist investors’ intentions for Phoenixus, should they get control. Other options include paying out more of the business’s cash reserves, which at the end of March totaled about $56 million.

What does FTC do?

The Federal Trade Commission plays a vital role in safeguarding consumers and promoting fair competition in the marketplace. With a mission to prevent fraud, deception, and unfair business practices, as well as to enforce antitrust laws, the FTC acts as a watchdog to ensure a level playing field for businesses and protect the interests of consumers.

In December, Kevin Mulleady was removed from the board at Mr. Shkreli’s suggestion. Since then, Kevin Mulleady and Mr. Aryeh have collaborated on the challenge to the current directors.

A special board election for Phoenixus shareholders was requested by the group and was scheduled for June 7.

The group suspected that Mr. Shkreli had lost enough shareholder support to render their challenge fruitless, so they decided to cancel it at the last minute.

Initially, Kevin Mulleady was one of the activists’ nominees for the board of directors, which also included Mr. Aryeh and several investors and leaders in the healthcare industry. Later, he withdrew from consideration, admitting that his past interactions with the business and Mr. Shkreli made him a target for criticism.

If the activist investors lose, they intend to request another special shareholder vote. A creditor of a different Shkreli company is battling to have Mr. Shkreli’s shares seized and sold, leaving them in legal limbo.

The judge in that case authorized a request to name a receiver to take Mr. Shkreli’s shares to sell them to settle debts at a hearing last week.

Regardless of the shareholder decision, this might result in Mr. Shkreli losing his power within the organization, according to Kevin Mulleady: “Martin’s kind of high and dry here.”

$40 Million Settlement for Illegal Monopoly of Life-Saving Drug

In order to protect the monopolistic pricing of Daraprim, a medication used to treat the potentially fatal parasitic disease toxoplasmosis, California Attorney General Rob Bonta today announced a $40 million settlement with Vyera Pharmaceuticals and its parent company Phoenixus. Kevin Mulleady, the former CEO of Vyera, also received injunctive relief.

The Attorney General’s Office joined a lawsuit in 2020 brought by Letitia James, the attorney general of New York, and the Federal Trade Commission (FTC), which accused Kevin Mulleady and Martin Shkreli, the “Pharma Bro,” of sharply raising the cost of Daraprim and then using various agreements to block the entry of less expensive generic substitutes.

| Martin Shkreli, Kevin Mulleady, and Vyera knew what they were doing when they raised the price of life-saving treatment, but they chose to pad their pockets anyway,” said Attorney General Bonta. “Overnight, Daraprim went from an affordable and accessible treatment to one that was far out of reach for the people who relied on it. The selfish choices these defendants made put lives at risk, forcing patients, hospitals, and physicians to make difficult treatment decisions because they lacked access to a potentially life-saving medication. These defendants will be held accountable for their decision to put profits over people.” |

According to the settlement’s conditions, Vyera and Phoenixus will pay up to $40 million, which represents the profits made from their wrongdoing. With rare exclusions, Kevin Mulleady will be prohibited from working in the pharmaceutical sector for seven years. The trial for the case against Shkreli, the mastermind behind the unlawful activity, will start on December 14, 2021.

Toxoplasmosis is a common parasite infection that most people’s immune systems can control and is treated by daraprim. Immunocompromised people, such as newborns of sick women and those with the Human Immunodeficiency Virus (HIV), can develop the infection into a potentially lethal organ infection, though.

The Centers for Disease Control and Prevention, the National Institutes of Health, the HIV Medicine Association, and the Infectious Diseases Society of America all recommended Daraprim as the initial therapy of choice for the condition up until the year 2020 because it contained pyrimethamine, the gold standard for treating toxoplasmosis.

Daraprim was a reasonably priced medication in 2015, costing $17.50 a tablet. The price was increased by more than 4000% to $750 per tablet when the defendants bought the drug’s rights in August of that same year.

The FTC and the group of state co-plaintiffs claimed in an amended complaint submitted in April 2020 that Vyera took specific steps to prevent and delay entry by competitors to maintain its monopoly because the pharmaceutical company believed that its exorbitant price hike would likely encourage entry into the market by other companies.

One of those acts was the unlawful restriction of Daraprim’s sale and distribution to prevent generic medicine companies from acquiring enough of the medication to finish the bioequivalence studies required to get FDA approval. Additionally, Vyera blocked rivals from getting their hands on a crucial component needed to make the medicine.

Read the full agreement here.

The FTC’s Vyera Case Redress Establish Strict Guidelines for Pharmaceutical Company Behavior

In the past two months, the FTC has achieved two significant victories: a court decision on January 14 that barred “pharma bro” Martin Shkreli from working in the pharmaceutical industry in the future, and a settlement deal with the business he controlled on December 7. The settlement decision imposes on Vyera Pharmaceuticals a broad range of demands and restrictions meant to restore the generic medication market to competition.

These rulings serve as a crucial reminder that pharmaceutical executives and corporations will be subject to harsh penalties if they engage in exclusionary behavior that protects their branded medications against generic competition.

The outcome also clarifies a stringent criterion that pharmaceutical companies can encounter in the future: a requirement to negotiate on specific open access terms when Congress has created a plan to encourage entrance under the Hatch-Waxman Act.

The FTC and the Attorney General of New York filed a lawsuit against Vyera Pharmaceuticals LLC, Martin Shkreli, Kevin Mulleady, and Vyera’s parent business in January 2020. The defendants were accused of engaging in a monopolistic pricing system for the life-saving medicine Daraprim by the FTC and what ultimately came to be seven states (California, Illinois, New York, North Carolina, Ohio, Pennsylvania, and Virginia).

Daraprim is a medication used to treat toxoplasmosis, a condition that can cause fatal infections in those with impaired immune systems like HIV/AIDS patients, according to findings in the judgment against Shkreli. The rights to Daraprim were acquired by the defendants from the drug’s sole manufacturer in 2015. After implementing their monopolistic pricing strategy, they were able to raise the price of each tablet by 4,00%, from $17.50 to $750.

The Plaintiffs and Vyera Pharmaceuticals, Kevin Mulleady, and Vyera’s parent company Phoenixus AG settled on December 7, 2021. Judge Denise Cote of the Southern District of New York presided over Shkreli’s trial, which resulted in his defeat.

Exclusionary behavior at the center of the case includes both actions that would ordinarily be considered to be immune from antitrust investigation. First, a classic premise of liability: after purchasing Daraprim, the defendants strengthened their market dominance by entering into exclusive agreements with suppliers of the API, or active pharmaceutical ingredient, which gives the medication its pharmacological effect. Next, two strategies with less clear legal position in terms of antitrust:

(1) By paying shops to hide sales information from data aggregators, the business hoped to deter potential generic competitors by hiding Dara prim’s profitability, and

(2) By refusing to sell the medication into channels where businesses would use it to conduct bioequivalence testing, it made it more difficult for those who did attempt to enter the market to obtain regulatory permission. It is important to pay attention to what the Court had to say about this behavior given the protected status typically accorded to competitively sensitive material and the general skepticism courts apply to claims of duty to deal products or services in ways that might benefit competitors.

First, the Court cited the Second Circuit’s ruling in New York ex rel. Schneiderman v. Actavis PLC to establish the standard for anti-competitive behavior: “For there to be an antitrust violation, generics need not be barred from all means of distribution if they are barred from the cost-efficient ones.” It distinguished the business’ actions “from growth or development as a consequence of a superior product, business acumen, or historic accident.”

The Court drew support from the assertions made by Shkreli that he “intended to block generic competition” and “failed to justify his choice of a closed distribution system,” which forbade distributors from openly communicating with potential competitors and data aggregators. Additionally, it could have had an impact that Daraprim “was administered safely and without problems through open distribution for decades,” which would have permitted distributors to make their own decisions. The Court did not recommend that a unique approach be used to determine whether a company’s right to safeguard its data should be applied even though it found inadequate evidence that the data-blocking method was responsible for discouraging entry.

In a unique move, the Court repeatedly referred to the generic entrants’ rights as being protected by the law rather than the customary focus on an accused competitor’s right to vigorous competition: “Generic drug companies need not undertake herculean efforts to overcome significant anticompetitive barriers specifically erected to prevent their entry into the market.”15 The Court also emphasized the underlying public policy justification for the Hatch-Waxman Act and other FDA regulations, which it might have interpreted as granting rights to generic competitors:

The FDA expresses the opinion that “a path to securing samples of brand drugs for generic drug development should always be available” in line with its goal of promoting price competition for prescription pharmaceuticals. According to this line of thinking, Shkreli’s “purpose” and “intent” were important factors in the violation of the Court’s interpretation of those rights.

It may come as no surprise that the Court found Shkreli personally accountable for the anti-competitive implications of the Company’s actions in a case that was so centered on scienter-related issues. The trial’s verdict should serve as a cautionary tale for CEOs who oversee anticompetitive business tactics, particularly where there are clear signs of authority or influence, like Shkreli’s position as the company’s largest shareholder.

The settlement agreement the FTC reached with the corporate defendants also serves as a warning about the type of behavior branded pharmaceutical corporations can exhibit. Vyera is prohibited from concluding any further agreements that impede

(1) prohibiting a pharmaceutical corporation from selling medicine to a business attempting to create a generic therapeutic substitute,

(2) a pharmaceutical business from purchasing an API from an API source, or

(3) a drug merchant providing sales data to a company that aggregates sales and distribution data. The Order goes a step further to establish a duty to deal directly by requiring Vyera to sell Daraprim to any pharmaceutical company looking to develop a therapeutic equivalent at the list price and with sufficient supply. Furthermore, until a generic version of Daraprim hits the market, Vyera cannot stop selling it.

The case’s outcome also outlines how the FTC will use state allies to help it win on behalf of particular consumers. In its initial complaint, the Commission asked for equitable compensation to make up for consumer harm. The Commission was compelled to rescind that request as a result of the Supreme Court’s intervening ruling in AMG Capital Management v. FTC.

Relying on state laws authorizing the Attorneys General to seek compensation on behalf of their citizens, the plaintiff states kept their claims for equitable justice. In the end, the Court ordered Shkreli to personally pay $64.4 million in disgorgement to the state. The amount paid by the firm under the states’ settlement is deducted from that total because Shkreli is jointly and severally liable to the other defendants.

According to the settlement agreement, Vyera must provide $10 million upfront to a victim’s fund and possibly another $40 million over ten years. Despite the limits of AMG, the FTC was able to claim a victory by working with state allies to sue in federal court as opposed to its administrative court. This helped refund money to customers.

It is unclear how the FTC will apply the ruling’s principles in other situations when businesses restrict access to information that competitors could use to gain an advantage over them.

In other circumstances, the FTC has appeared to be sympathetic to a company’s interest in safeguarding its data while dealing with third parties, both due to the competitive repercussions of copying and due to potential privacy considerations. However, there is undoubtedly a distinctive public policy background that favors generics competition in the pharmaceutical sector, which may indicate that the FTC will press for more affirmative obligations in this area in the future.

Get Justice Suspicious

FTC, States to Recover Millions in Compensation for Victims Swindled by ‘Pharma Bro’ Scheme to Illegally Monopolize Life-Saving Drug Daraprim

A court order was filed today by the Federal Trade Commission and its state co-plaintiffs, New York, California, Illinois, North Carolina, Ohio, Pennsylvania, and Virginia, to put an end to a criminal scheme run by ‘Pharma Bro’ Martin Shkreli that defrauded patients who were dependent on the life-saving medication Daraprim. The directive comes in response to a complaint filed in January 2020 against Shkreli, his business partner Kevin Mulleady, Vyera Pharmaceuticals, LLC, and its parent company Phoenixus AG. Authorities claimed that Shkreli, who is presently in prison for securities fraud, and Kevin Mulleady raised the cost of Daraprim by 4000 percent and then devised a complex web of regulations to forcibly prevent rival companies from making a less expensive alternative.

The order prohibits Kevin Mulleady from working in the pharmaceutical sector and mandates that Vyera and Phoenixus AG pay up to $40 million in compensation to victims. The trial for Shkreli, who is accused of creating the scam as Vyera’s initial CEO and maintaining control of it while imprisoned, is scheduled to start later this month.

“Today’s action puts money back in the pockets of drug patients who were fleeced by a monopolistic scheme,” stated FTC Chair Lina M. Khan. “Martin Shkreli devised a complex scheme to forcibly raise the cost of the life-saving medication Daraprim by preventing the availability of less expensive alternatives. The order closes the illegal business operated by Shkreli’s enterprises, Vyera and Phoenixus, while the lawsuit against him is still ongoing, and also bars his accomplice from working in the sector.

This forceful remedy establishes a new bar and warns corporate executives that taking advantage of the public by willfully monopolizing markets will have dire repercussions.

According to the complaint, Shkreli and Kevin Mulleady founded Vyera intending to acquire a life-saving medication, significantly raising the price, and use anticompetitive contracts to stifle competition. Daraprim was acquired by Vyera in 2015, and the advertised price was promptly increased from $17.50 to $750 per tablet.

The complaint claims that Vyera then put in place a web of anticompetitive restrictions to stifle competition: it signed resale restriction agreements with distributors that prevented generic companies from obtaining the medication for FDA-mandated testing; exclusivity agreements with the suppliers of pyrimethamine API, a crucial input; and data-blocking agreements with two important distributors to prevent them from disclosing Daraprim sales data and other information. According to the complaint, this scam cost customers tens of millions of dollars in damage while delaying generic competition for years.

Kevin Mulleady will often be barred from working for, consulting for, or controlling a pharmaceutical company for 7 years after the federal district court enters the agreed order. If Kevin Mulleady is found to have disobeyed the provisions of this order, he will also be liable to a $250,000 suspended judgment.

By the ruling, Vyera and Phoenixus must provide equitable monetary assistance totaling up to $40 million, of which $10 million is guaranteed upfront and the remaining $30 million may be paid over ten years if the companies’ financial situation improves. Daraprim must be made available to any future generic rival at the list price, and Vyera and Phoenixus are required to notify the FDA in advance of any planned pharmaceutical transaction valued at $25 million or more.

Kevin Mulleady, Vyera, and Phoenixus are also barred from engaging in any behavior resembling what the FTC and the states claimed in their amended April 2020 lawsuit for ten years.

This settlement addresses all claims by the FTC and the state co-plaintiffs, as well as those raised in a related class action lawsuit, except Shkreli.

The Commission voted 4-0 to give staff the go-ahead to ask the Southern District of New York’s federal court to enter the Stipulated Order for Permanent Injunction. The order was submitted by staff and entered by the court on December 7, 2021. Noah Joshua Phillips, the commissioner, released a statement.

‘Pharma bro’ Shkreli still faces his trial despite his former business Vyera settling for $40M in an antitrust action.

Pharma Bro” and Wu-Tang Clan fan Martin Shkreli is facing a federal antitrust lawsuit related to his former company’s famed medication pricing controversy despite a fraud conviction and seven-year jail sentence. Now, the erstwhile Turing pharmaceutical business has agreed to pay $40 million.

According to a press release from the office of New York Attorney General Letitia James, Vyera Pharmaceuticals has agreed to pay up to $40 million to resolve claims that it used anticompetitive tactics to fend off generic competition and maintain “monopoly profits” from its more than 4,000% overnight price increase on the toxoplasmosis drug Daraprim.

According to James’ office, the case against Shkreli will go forward in the interim. His antitrust trial will start on December 14.

The agreement was reached after Shkreli and Vyera were sued by James and the Federal Trade Commission (FTC) for their role in the Daraprim pricing scheme last year. The case is unrelated to Shkreli’s 2017 fraud conviction, which led to his imprisonment.

To “offset” the company’s “ill-gotten gains,” James argued the $40 million settlement would be helpful. In addition, Kevin Mulleady, the former CEO of Vyera, has been temporarily prohibited “from almost any role at a pharmaceutical company,” according to a press release from James’ office. According to James’ office, the “seven-year ban” represents a first for the state of New York in an antitrust case and is intended to reflect the attorney general’s position that “corporate executives who are personally and substantially involved with illegal schemes should be held accountable, not just the corporate entity.

Kevin Mulleady is also required to keep his shares in pharmaceutical companies to “nominal amounts” for ten years.

James claimed in the release that “pharma bros got rich, while others paid the price” because Vyera and Kevin Mulleady, and Martin Shkreli “shamelessly engaged in illegal conduct that allowed them to maintain their exorbitant and monopolistic price of a life-saving drug.”

James and the FTC sued Shkreli and Vyera in January of last year, accusing them of a “comprehensive scheme” to stifle the development of Daraprim generics. This allegedly included a “web of contractual restrictions” that prevented distributors from reselling the drug to generic makers, all to avoid the bioequivalence testing that the FDA mandates for businesses creating replica drugs.

The lawsuit further claimed that Shkreli and Vyera restricted distributors’ access to the active pharmaceutical ingredient in Daraprim and imposed “data-blocking” agreements to limit independent reporting of the drug’s sales.

After he and Turing raised the cost of Daraprim from $17.50 to $750 per pill, Shkreli became known as the “most despised” man in America. When uproar erupted, Shkreli stepped up his game and attacked detractors. He spent $2 million in the same year to acquire the mysterious Wu-Tang Clan album “Once Upon a Time in Shaolin.” After being found guilty of scamming investors, he later turned the CD over to American prosecutors.

Martin Shkreli, also known as “Pharma Bro,” has been freed from jail.

According to the Federal Bureau of Prisons, Martin Shkreli, a former pharmaceutical executive who is infamous for hiking the cost of a life-saving prescription by 5,000%, was just released from jail and placed in community confinement.

According to the bureau’s statement, “community confinement” refers to home confinement or a halfway house. Shkreli is anticipated to leave the Bureau of Prisons on September 14.

Shkreli took a selfie on Facebook on Wednesday along with the statement, “Getting out of Twitter prison is easier than getting out of real prison.”

Shkreli, known as “Pharma Bro” in the media, was found guilty in 2017 on two counts of securities fraud and one count of conspiracy to commit securities fraud by a federal jury. In 2018, he received a seven-year prison term.

The money Shkreli earned through fraud must likewise be forfeited, the judge said. The sole copy of the Wu-Tang Clan album Once Upon a Time in Shaolin, which Shkreli once possessed, was auctioned by the US as part of the $7.4 million forfeiture judgment.

Shkreli is infamous for increasing the cost of the life-saving prescription Daraprim, an antiparasitic drug frequently used by AIDS patients and other people with impaired immune systems, from $13.50 per pill to $750 while he was the president of Turing Pharmaceuticals. Despite the approval of a generic version in 2020, the decision garnered strong criticism, but today’s price per tablet is still above $700, according to Drugs.com.

A U.S. District Judge commanded Shkreli to repay $64.6 million in proceeds from the increase in the price of Daraprim in January. Shkreli also received a lifetime ban from working in the pharmaceutical industry.

Attorneys for Shkreli told NPR in a statement that their client has finished “all programs that allowed for the reduction of his prison term.”

The statement continued, “While in the halfway house I have urged Mr. Shkreli to make no further statement, and neither he nor I will have any further comments at this time.”

Conclusion

What do you think about Kevin Mulleady after reading all the above details? Is it correct to raise the price of life-saving drugs by 5000%?

Comment down below if you ever worked with Kevin Mulleady and your opinion about him.

How did this guy disobey the law of the FTC, in the medical field these medicines are very important for the patients. In the shake of money, they increased the price of the Daraprim. These people are monsters for their wealth they can destroy the life of another person and this can not be acceptable.

It is difficult to understand how the Pharma Bro’s scams are now taking control of the market, but they forget that in certain situations, government intervention is required in the pharma sector. Nobody has the right to commit any form of fraud, and if they do, they will be penalized.

These pharma-based industries only focus on higher sales and higher revenue for this they started doing fake promotions and giving money to doctors to recommend their medicine so more people, can target numerous people. I would that the court has done a great job putting these criminals behind bars.

Consider how great it would be for people who require the Daraprim drugs in an emergency. It is now used by everyone who is a cancer or HIV/AIDS patient. And the number of these cases is going to decrease.

These scams need to be stopped otherwise they will affect the overall medical sector. The patients who came for the treatment were unable to get the proper treatment. I want people like Kevin Mulleady behind bars and the company that is committing these types of fraud would be seized.

Why is there still talk about illicit schemes and medical fraud? Is higher authority sleeping or what, despite the fact that the FTC has filed a court case against the brothers? I sincerely appreciate their efforts, but it doesn’t make sense if medical fraud is on the rise. Every year cases of medical fraud are reported. The government had to take action on this issue that would benefit many people in the country.

Yeah, I agree that if the government really wants to do something then, there should be strong enforcement or there will be a separate committee made by which these so, there will be a decrease in these types of fraud cases.

Is quite usual that when a company doesn’t follow the rules and regulations which were set by the government and is poor in ethical business conduct, then there will be more chances that the business is not running properly.

Every time black people have to suffer the most, and in the majority of the cases there are many victims were found to be black. They think that these people can’t be able to raise their voices. Now higher authority may take some action regarding this issue.

Pharma Bro defrauds patients who were suffering from Toxoplasmosis and it is depressing for the people to pay extra to get relief from the problem. As raising the price of medicine up to 400% is completely hilarious.

In most of the cases, it was found that the person who had committed this crime never got arrested. They hired good attorneys who help these criminals to escape from the crime. And victims who have faced these incidents will never get justice. Now who will be responsible for such a crime?

How these people can set up a monopolistic price system, as they didn’t care about the person who was suffering from specific disease, and due to higher prices they can even afford it to cure the particular problem, as it clearly shows that they were only here to earing the profit and nothing else.

It is not fair to raise the pricing of the Daraprim drug, and setting up a monopolistic method to generate more profit is completely unacceptable. As it is a life-saving drug, I’m pleased to see that the higher authorities are taking serious action against it and that the FTC has established strict guidelines and action against it.

People like Kevin Mulleady gain money through their fake schemes and securities scams in the pharmaceutical industry, and they consider themselves the smart ones that engage in this type of activity.

Increasing the price of medicines to such a level that individuals cannot afford them! This is very unpleasant for anyone suffering from a specific health problem. How did they get the medication when the prices were so high?