Kishan Parikh: Charged by FINRA? The Truth Exposed (2024)

Kishan Parikh Review 2024

- Respondent Kishan, while associated with FINRA member Aegis Capital

Corp. (“Aegis” or the “Firm”), made unsuitable recommendations and excessively traded the

accounts of five of his customers, Customers A, B, C, D and E (collectively, the “Customers”)

from August 2014 through November 2016 (the “Relevant Period”). - controlled the trading in the Customers’ accounts and, during the Relevant Period, executed 442 trades with a total principal value of approximately $31.1 million.he excessive and unsuitable trading in the Customers’ accounts resulted in annualized turnover rates ranging from 10.9 to 199.8 and annualized cost-to-equity ratios (or break-even points) ranging from 27.5% to 59.7%, and caused

combined losses of more than $33,000. At the same time, his trading generated gross sales

credits and commissions of $179,112, of which he received at least $89,000. By engaging in

excessive and unsuitable trading in the Customers’ accounts, he violated FINRA Rules 2111

and 2010. - Also during the Relevant Period, he executed 53 trades with a total principal.

- value of approximately $4.2 million in the accounts of Customers C and D without their prior

- authorization. By engaging in unauthorized trading in Customers C and D’s accounts, he

- violated FINRA Rule 2010

RESPONDENT AND JURISDICTION

- he entered the securities industry in 2007. From May 2012 through April

2019,hewas registered with FINRA as a General Securities Representative through an

association with Aegis where he worked in the Firm’s Wall Street branch office. - In a Uniform Termination Notice for Securities Industry Registration dated April

3, 2019, Aegis reported he’s voluntary termination. - Although he is no longer registered or associated with a FINRA member firm,

he remains subject to FINRA’s jurisdiction for purposes of this proceeding pursuant to Article V,

Section 4 of FINRA’s By-Laws, because (i) the Complaint was filed within two years after April

3, 2019, which was the effective date of termination of he registration with Aegis; and

(ii) the Complaint charges he with misconduct committed while he was registered or

associated with a FINRA member.

Read About: Aegis Capital Corp

FACTS

I. Parikh’s Trading in the Customers’ Accounts

- During the Relevant Period, he recommended active short-term trading.

combined with the use of margin. Although none of the Customers’ accounts was listed on

Aegis’s books and records as a discretionary account,he decided which stocks to buy and

sell and determined the volume and frequency of trading in each of the Customers’ accounts. - Parikh did not calculate cost-to-equity or turnover rates, or consider the

cumulative trading costs the Customers incurred when determining which stocks to buy and sell

Parikh also did not consider the interest costs associated with his use of margin, which allowed

him to trade more frequently and thus increased the costs the Customers incurred.

- When Parikh did contact the Customers before making securities trades, the

Customers relied on and followed his trading recommendations. - However, Parikh frequently used time and price discretion when trading in the

account of Customer A and engaged in unauthorized trading in the accounts of Customers C and

D. - Parikh earned at least $89,000 from his improper trading in the Customers’

accounts during the Relevant Period.

II. Customer A - Customer A is a 64 year-old insurance and real estate agent who resides in Ohio.

During the Relevant Period, Customer A held two brokerage accounts at Aegis: an individual

brokerage account and an IRA account. Customer A opened these accounts in December 2012

after receiving a cold call from Parikh. - Customer A funded his Aegis accounts with approximately $115,000 in cash from

his savings. Aegis recorded Customer A’s investment objective for his individual brokerage

account as “growth,” and his risk tolerance as “low.” Aegis recorded Customer A’s estimated

annual income as $30,000, his liquid net worth as $10,000, and his total net worth as $100,000. - In November 2014, the value of Customer A’s individual brokerage account was

$21,273. From November 2014 through September 2015, Parikh executed 127 purchases and

sales of securities totaling approximately $15 8 million in Customer A’s account, at times relying

on time and price discretion, resulting in an annualized turnover rate of 199.8 and an annualized

cost-to-equity of 57.6.%. Although Customer A deposited a total of $69,100 in the account

during this period, by the end of September 2015, Customer A’s account had a value of $35,841.

Parikh’s excessive and unsuitable trading in Customer A’s brokerage account

during the period of November 2014 through September 2015 generated total trading costs of

$22,938, and caused losses of $61,260.

III. Customer B

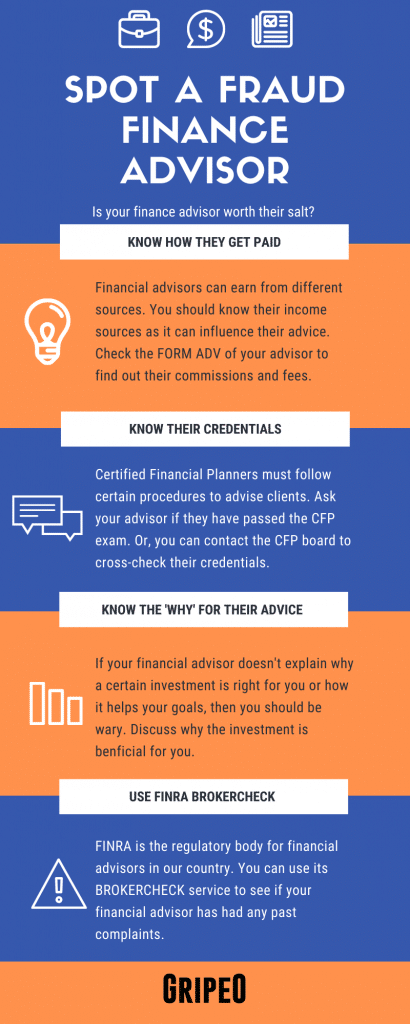

How can you spot a broker who is trying to deceive you?

A broker’s credentials, registration, and job history can be reviewed using BrokerCheck, a free online tool provided by FINRA. Disputes with clients, disciplinary actions, and specific financial and criminal matters on the broker’s record are all covered in the disclosure portion of BrokerCheck.

- Customer B is a 55 year-old engineering contractor who first became a customer

of Parikh while Parikh was employed at a prior broker-dealer. In 2012, Customer B followed

Parikh to Aegis and opened a brokerage account. In August 2014, Parikh updated Customer B’s

new account form, recording Customer B’s annual income as $500,000 – $749,000, his liquid net

worth as $250,000 – $499,999 and his total net worth as $1,000,000 – $2,999,999. Parikh also

incorrectly recorded Customer B’s investment objective as “speculation” and his risk tolerance

as “maximum risk,” when Customer B was not a speculative investor with a high risk tolerance. - In August 2014, the total value of Customer B’s Aegis account was $19,034.

From August 2014 through September 2015, Parikh executed 71 purchases and sales of

securities totaling approximately $4 2 million in Customer B’s account, resulting in an

annualized turnover rate of 38.4 and an annualized cost-to-equity of 35.3%. By the end of

September 2015, the value of Customer B’s account was $30,392.84, consisting of $127,174 in

securities, a -$93,636.16 cash balance, and -$3,145 in short positions. - Parikh also engaged in in-and-out trading in Customer B’s account, including in

UA stock. For example:

a. On January 20, 2015, Parikh purchased 900 shares of UA, charging

$2,250 in markups. On February 4, 2015, Parikh sold 450 shares of UA, generating a

$2,313 profit while charging $450 in markdowns on the sale. The markups and

markdowns Parikh charged on the initial purchase and the subsequent sale represented

approximately 116% of the profits generated by the trades.

b. On August 7, 2015, Parikh bought and sold 1,500 shares of UA,

generating $424 in profit on the round-trip trade. Parikh charged $405 in markdowns on

the sale, or approximately 95% of the profits generated by the trades.

c. On August 24, 2015, Parikh bought and sold 1,000 shares of UA,

generating only $26 in profit and no sales compensation.

d. On September 8, 2015, Parikh bought and sold 600 shares of UA,

generating only $162 in profit and no sales compensation.

- Parikh’s excessive and unsuitable trading in Customer B’s account during the

period of August 2014 through September 2015 generated total trading costs of $19,772, and

caused losses of $34,578.

IV. Customers C and D - Customers C and D reside in North Carolina. Customer C is 67 years old and the

president of a company that specializes in software sales and development; his wife, Customer

D, is 64 years old and a marketing officer. - Customers C and D opened a joint account with Parikh at Aegis in December

2012; their investment objective was recorded as “speculation” and their risk tolerance as “high.” - Customer C also opened an IRA account with Parikh at Aegis in February 2013.

The investment objective for Customer C’s IRA account was recorded as “growth,” and his risk

tolerance as “moderate.” Customer C and D’s annual income was recorded as $100,000 –

$199,999, their liquid net worth as $100,000 – $249,000, and their total net worth as $500,000 –

$999,999.

A. Parikh’s Trading in Customer C and D’s Joint Account - In August 2014, the total value of Customers C and D’s joint account was

$50,635. From August 2014 through November 2016, Parikh executed 85 purchases and sales of

securities totaling approximately $1 9 million in the account, resulting in an annualized turnover

rate of 12.1 and an annualized cost-to-equity of 48.4%. By the end of November 2016, the value

of the joint account was $17,660, consisting of $67,702 in securities, a -$46,305.74 cash balance,

and -$3,716 in short positions.

- From April 2016 through February 2017, Parikh executed 24 transactions with a

total principal value of approximately $640,000 in Customers C and D’s joint account without

their prior knowledge or authorization. Parikh’s unauthorized trades are detailed in Exhibit A, a

copy of which is annexed hereto and incorporated herein by reference. - Parikh also engaged in in-and-out trading in Customers C and D’s joint account,

including in UA stock. For example:

a. On June 1 and 8, 2016, Parikh bought and sold 1,000 shares of UA,

generating a $1,390 profit. Parikh charged $250 in commissions on the purchase and

$1,500 in markdowns on the sale for a total of $1750, or approximately 126% of the

profits generated by the trades.

b. On June 14 and 20, 2016, Parikh bought and sold 1,000 shares of UA,

generating a $600 profit. Parikh charged $500 in markups on the purchase and $250 in

commissions on the sale for a total of $750, or 125% of the profits generated by the

trades.

c. On July 27 and August 5, 2016, Parikh bought and sold 1,200 shares of

UA, generating a $427 profit. Parikh charged $100 in commissions on the purchase and

$200 in commissions on the sale for a total of $300, or approximately 70% of the profits

generated by the trades.

6 6

securities totaling approximately $1.9 million in the account, resulting in an annualized turnover

rate of 12.1 and an annualized cost-to-equity of 48.4%. By the end of November 2016, the value

of the joint account was $17,660, consisting of $67,702 in securities, a -$46,305.74 cash balance,

and -$3,716 in short positions. - From April 2016 through February 2017, Parikh executed 24 transactions with a

total principal value of approximately $640,000 in Customers C and D’s joint account without

their prior knowledge or authorization. Parikh’s unauthorized trades are detailed in Exhibit A, a

copy of which is annexed hereto and incorporated herein by reference. - Parikh also engaged in in-and-out trading in Customers C and D’s joint account,

including in UA stock. For example:

a. On June 1 and 8, 2016, Parikh bought and sold 1,000 shares of UA,

generating a $1,390 profit. Parikh charged $250 in commissions on the purchase and

$1,500 in markdowns on the sale for a total of $1750, or approximately 126% of the

profits generated by the trades.

b. On June 14 and 20, 2016, Parikh bought and sold 1,000 shares of UA,

generating a $600 profit. Parikh charged $500 in markups on the purchase and $250 in

commissions on the sale for a total of $750, or 125% of the profits generated by the

trades.

c. On July 27 and August 5, 2016, Parikh bought and sold 1,200 shares of

UA, generating a $427 profit. Parikh charged $100 in commissions on the purchase and

$200 in commissions on the sale for a total of $300, or approximately 70% of the profits

generated by the trades.

- Parikh’s excessive and unsuitable trading in Customers C and D’s joint account

during the period of August 2014 through November 2016 generated total trading costs of

$38,106, and caused losses of $14,863.

B. Parikh’s Trading in Customer C’s IRA Account - In August 2014, the total account value of Customer C’s IRA account was

$127,502. From August 2014 through November 2016, Parikh executed 108 purchases and sales

of securities totaling approximately $7.9 million in Customer C’s IRA account, resulting in an

annualized turnover rate of 10.9 and an annualized cost-to-equity of 27.5%. By the end of

November 2016, the value of Customer C’s IRA account was $187,379, consisting primarily of

6,000 shares of UA. - From May 2016 through November 2016, Parikh executed 29 transactions with a

total principal value of approximately $3 6 million in Customer C’s IRA account without his

prior knowledge or authorization. Parikh’s unauthorized trades are detailed in Exhibit A, a copy

of which is annexed hereto and incorporated herein by reference. - Parikh also engaged in in-and-out trading in Customer C’s IRA account, including

in UA stock. For example:

a. On December 2, 2015, Parikh bought 1,000 shares of UA, charging $1,500

in markups. On January 26, 2016, Parikh bought 900 shares of UA, charging $2,025 in

markups. Parikh sold the 1,900 shares of UA on January 28, 2016 for a loss of -$1,293

and charged $5,420 in markdowns on the sale, for total sales compensation of $8,945 on

the trades.

b. On May 16, May 20, and May 24, 2016, Parikh bought and sold 4,800

shares of UA, generating a $3,209 profit. Parikh charged $2,016 in markdowns on the

sales, or approximately 63% of the profits generated by the trades.

c. Between June 1 and June 23, 2016, Parikh bought and sold 7,500 shares of

UA, generating a $7,863 profit. Parikh charged a total of $9,700 in markups and

markdowns, or approximately 123% of the profits generated by the trades.

d. On August 8 and 11, 2016, Parikh bought and sold 2,500 shares of UA,

generating a $471 profit. Parikh charged $300 in commissions on the sale, or

approximately 64% of the profits generated by the trades.

- Parikh’s excessive and unsuitable trading in Customer C’s IRA account during

the period of August 2014 through November 2016 generated total trading costs of $99,935.

V. Customer E - Customer E is a 66 year-old self-employed farmer with limited prior investment

experience. Customer E first opened an account with Parikh at Aegis in February 2013. - Parikh recorded Customer E’s investment objective as “speculation” and his risk

tolerance as “high” on Customer E’s new account form at Aegis even though his objective was

growth with a moderate amount of risk. As of August 2014, Customer E’s estimated annual

income was recorded as $200,000 – $299,999, his liquid net worth as $100,000 – $249,000, and

his total net worth as $500,000 – $999,999. - In August 2014, the total value of Customer E’s Aegis account was $37,192.

From August 2014 through July 2015, Parikh executed 51 purchases and sales of securities

totaling approximately $1.3 million in Customer E’s account, resulting in an annualized turnover

rate of 13.2 and an annualized cost-to-equity of 59.7%. By the end of July 2015, the value of

Customer E’s Aegis account was $47,124, consisting of $183,640 in securities, a -$130,791.17

cash balance, and -$5,725 in short positions. - Parikh’s excessive and unsuitable trading in Customer E’s account during the

period of August 2014 through July 2015 generated total trading costs of $31,131.

FIRST CAUSE OF ACTION

Excessive Trading/Quantitative Unsuitability

Violations of FINRA Rules 2111 and 2010

- Enforcement realleges and incorporates by reference all preceding paragraphs.

- FINRA Rule 2111, the suitability rule, is “fundamental to fair dealing and is

intended to promote ethical sales practices and high standards of professional conduct.” The

operable version of FINRA Rule 2111, Supplementary Material .05(c), that was in effect from

July 9, 2012 through June 29, 2020 required, among other things, an associated person “who has

actual or de facto control over a customer account to have a reasonable basis for believing that a

series of recommended transactions, even if suitable when viewed in isolation, are not excessive

and unsuitable for the customer when taken together in light of the customer’s investment

profile.” As set forth in Supplementary Material .05(c) of FINRA Rule 2111, “factors such as the

turnover rate, the cost-equity ratio, and the use of in-and-out trading in a customer’s account may

provide a basis” for finding quantitatively unsuitable trading. - Excessive trading occurs, and is unsuitable, when a registered representative has

actual or de facto control over trading in a customer’s account and the overall level of activity in

that account is excessive in light of the customer’s investment profile. - A violation of FINRA Rule 2111 also constitutes a violation of FINRA Rule

2010, which requires associated persons to “observe high standards of commercial honor and just

and equitable principles of trade.” - During the Relevant Period, Parikh excessively traded the accounts of Customers

A through E. - Parikh exercised de facto control over the Customers’ accounts, controlling the

volume and frequency of trading, deciding what securities to buy and sell, the quantities, the

price, and when each transaction would occur. Parikh also frequently made unauthorized trades

in the accounts of two Customers and utilized time and price discretion in another Customer’s

account.

- Parikh’s trading in the Customers’ accounts was excessive and quantitatively

unsuitable, as evidenced by the annualized turnover rates and cost-to-equity ratios, the total

principal value and frequency of the transactions, the in-and-out trading, and the transaction

costs the Customers incurred. Parikh executed 442 trades with a total principal value of

approximately $31 1 million in the Customers’ accounts, resulting in annualized turnover rates

ranging from 10.9 to 199.8 and annualized cost-to-equity percentages (or break-even points)

ranging from 27.5% to 59.7%. - The high trading costs associated with Parikh’s intentional, active trading caused

the Customers to incur more than $179,000 in costs and more than $33,000 in losses, while

Parikh received substantial income from trading the accounts. - Parikh did not have a reasonable basis to believe that the level of trading he

recommended was suitable for each of the Customers. - As a result of the foregoing conduct, Parikh violated FINRA Rules 2111 and 2010.

SECOND CAUSE OF ACTION

Unauthorized Trading

Violation of FINRA Rule 2010

- Enforcement realleges and incorporates by reference all preceding paragraphs.

- Unauthorized trading occurs when a registered representative effects trades in a

customer’s account without first obtaining the customer’s authorization or consent.

- Unauthorized trading is a breach of the duty to observe high standards of

commercial honor and just and equitable principles of trade and, thus, a violation of FINRA Rule- From April 2016 through February 2017, Parikh effected 53 trades in the accounts

of Customers C and D without first obtaining authorization or consent for the trades from these

customers. Parikh’s unauthorized trades are detailed in Exhibit A, a copy of which is annexed

hereto and incorporated herein by reference.

- From April 2016 through February 2017, Parikh effected 53 trades in the accounts

- By effecting 53 trades in the Firm accounts of Customers C and D without their

prior authorization or consent, Parikh engaged in unauthorized trading and violated FINRA Rule

Read Also: Richard C. Wayne & Associates

How To Spot A Fraud Finance Advisor (Infographic)

Help For Victims Of Kishan Parikh

If you have lost funds because of misrepresentation, unsuitable investment, or unsuitable investment strategy from Kishan Parikh. Then you can take legal action and get justice. Fraud, Malpractice & dereliction of duty should not be taken lightly, especially in this industry. We highly suggest that you notify authorities or seek legal action if your financial advisor or brokerage firm fails to abide by FINRA’s rules are regulations..

You may be interested in: Launch of Total Diversity Announced by Total Clinical Trial Management

Financial advisors are regulatory & legally obligated to suggest (recommend) the most suitable investments/investment strategies to their clients. Their suggestions should have their client’s best interests and should be appropriate for their client’s goals and needs. Similarly, the brokerage firm which hires financial advisors also has a regulatory & legal obligation to keep a close watch and supervise their Financial Advisors’ practices & behavior. They need to make sure that the financial advisor is not being manipulative or having an unreasonable bias towards certain investments. If the financial advisor and/or the brokerage firm breaches these duties, then the client/customer may be entitled to a full or partial recovery of their losses.

Financial advisors need to have the interest of their clients when giving suggestions related to investments and investment strategies. Reasonable basis suitability requires the advisor to do their best to analyze & identify the risks and rewards associated with their suggested investment and/or investment strategy.