Who is Michael Allard (CRD#: 2211416)

Michael Allard is a financial advisor in Danville, CA. He has been in practice for 18 years, the last 18 years at Lpl Financial, Llc.

Mike has developed a reputation as a financial service professional and a leader in the Bay Area communities as the founder and Principal of CalBay Investments, Inc. (CBI). He is an Executive Council member at broker/dealer LPL Financial, where his team has been ranked in the top 15 of more than 21,000 independent financial advisors since 2016.

Mike was recognized to Barron’s “America’s Top 1,200 Advisors: State-by-State” list2 from 2018 through 2023, and on 4/17/19, he was also named to the Financial Times’ “The FT 400 Top Financial Advisers” list3. In addition, in 2011 and 2012, NABCAP named him one of the Top Wealth Advisors in the San Francisco Business Times.

A resident of the Diablo Valley, Mike has been a practicing financial planner since 1990. He has nurtured a culture at CBI focused on personal relationships. His goal is to guide each client toward making their retirement dreams a reality.

Mike enjoys golf and spending time with his wife, Wendy; daughter, Ava; stepdaughter, Rachel; and stepson, Mark. He is a graduate of Cal Poly, San Luis Obispo, with a B.S. in Business Administration/Marketing.

Licenses, Registrations, and Certifications:

CLU (Chartered Life Underwriter) – The American College

ChFC (Chartered Financial Consultant) – The American College

CFS (Certified Fund Specialist) – The Institute of Certified Fund Specialists

Life/Health/Disability Licenses (CA Insurance Lic # 0792088)

Securities Registrations held through LPL Financial: Series 6, 7, 24, 63, and 65.

Professional Affiliations:

Financial Planning Association

American Society of CLU and ChFC

The Institute of Certified Fund Specialists

Financial Preparation

An advisor who specializes in financial planning can assist you in developing an effective plan to achieve your financial objectives by analyzing your assets, which may include investment, savings, and retirement accounts. If you want to make a significant purchase, such as a house or car, this person can also advise you if it’s a good investment depending on your financial status.

Educational Seminars are available.

If you want to learn more about a financial topic, such as saving for your child’s college education, planning for your retirement, or getting a mortgage, this financial advisor offers instructional seminars.

Individual or Small Business Portfolio Management

Individuals and small-business owners can seek advice from a specialist in this field to help them get the most out of their financial portfolios. Advisors with this knowledge can assist you in selecting appropriate assets and advising you on whether to pursue an aggressive or conservative investing strategy.

Business Portfolio Management

Many firms require assistance in managing their financial investments. A portfolio manager is a financial advisor who creates and manages investment portfolios for midsize and big businesses that include bonds, equities, and funds. This type of portfolio management includes counseling clients on which investments to choose to maximize profits, as well as monitoring the portfolio performance of the company.

What is FINRA?

FINRA, which stands for the Financial Industry Regulatory Authority, is a government-approved organization responsible for protecting American investors. Its primary objective is to maintain fairness and integrity within the broker-dealer industry, promoting a safe and trustworthy environment for all market parties.

Pension Consulting Services

Pension plan administrators often need help from a financial advisor to create an effective investment strategy, choose brokers and money managers, pick mutual funds for participants, and track the performance of investments. An advisor who offers pension consulting services can assist in developing pension plans that provide the most value to beneficiaries and participants.

About FIRM: Merrill Lynch Wealth Management

CalBay Investments, Inc. (CBI) adheres to the same high standards that our customers expect from a premier wealth management organization. We have focused on developing long-term client relationships based on integrity, trust, and mutual respect since 1990. Many of our clients have been with CBI for more than 20 years, and we are excited to welcome future generations to the CBI family.

CBI keeps its pledge to provide you with comprehensive solutions that are tailored to your specific financial needs, goals, and preferences, ensuring that your interests are always prioritized in all parts of life and legacy planning.

As a CBI client, you will receive impartial counsel, assistance, and personalized service from professionals who take the time to get to know you and care about you and your family. These are the distinguishing features of the CBI’s entire wealth management experience.

CBI has no ties to any one investment firm or corporate bureaucracy, allowing us to provide customers with objective counsel so that they can make an informed decision.

CBI understands how important it is to provide you with cautious investment management and objective guidance. As independent consultants, we are exclusively concerned with servicing your needs and acting in your best interests at all times. This gives you the assurance you need to pursue financial success on your terms.

We spend our time establishing personalized plans for the unique issues you confront because we have no commitments to investment product manufacturers.

Education Strategy

Whether you’re paying tuition now or saving for a future goal, it’s critical to make sure your education approach aligns with your retirement income and other financial goals.

Income Preparation

Choosing the best combination of investments and assets to fulfill your retirement income goals is a highly customized process. Many consumers are misled into believing that there is a magic figure or rule of thumb for determining a “safe” or comfortable spending rate.

Financial planning is at the heart of the life planning services we offer to people and families who want to accumulate, protect, and manage wealth over time. Services include retirement income planning, education planning, tax and estate planning, and risk management cross-sell quotas or home-office directives.

A solid approach is essential whether you are in the accumulation phase or have already retired. Meeting your retirement income requirements, aspirations, and costs Maintaining lifestyle priorities and choices Ensuring that long-term goals and desires for travel, healthcare, and estate planning are met.

Services with a monetary value

We provide several value-added services to help you achieve your financial objectives. Portfolio analysis, insurance analysis, qualified plan beneficiary planning, and intergenerational wealth transfer are examples of these services.

Tax Planning

Many financial decisions have tax consequences. As a result, without careful preparation and analysis, tax liabilities associated with income, inheritance, and gift taxes, as well as other state, excise, and sales taxes, can have a significant impact on your wealth.

Michael Allard Disclosures: BrokerCheck, FINRA, And SEC Reports

Financial Advisors often take down their client disputes from FINRA’s Public database through Disclosure Expungement. Even law firms provide expungement services to FAs so that they can hide or remove their client disputes and maintain a clean record. So the lack of any disclosures on BrokerCheck doesn’t necessarily mean that the broker hasn’t had any disputes in the past.

FINRA’s BrokerCheck

individual_2211416.pdf (finra.org)

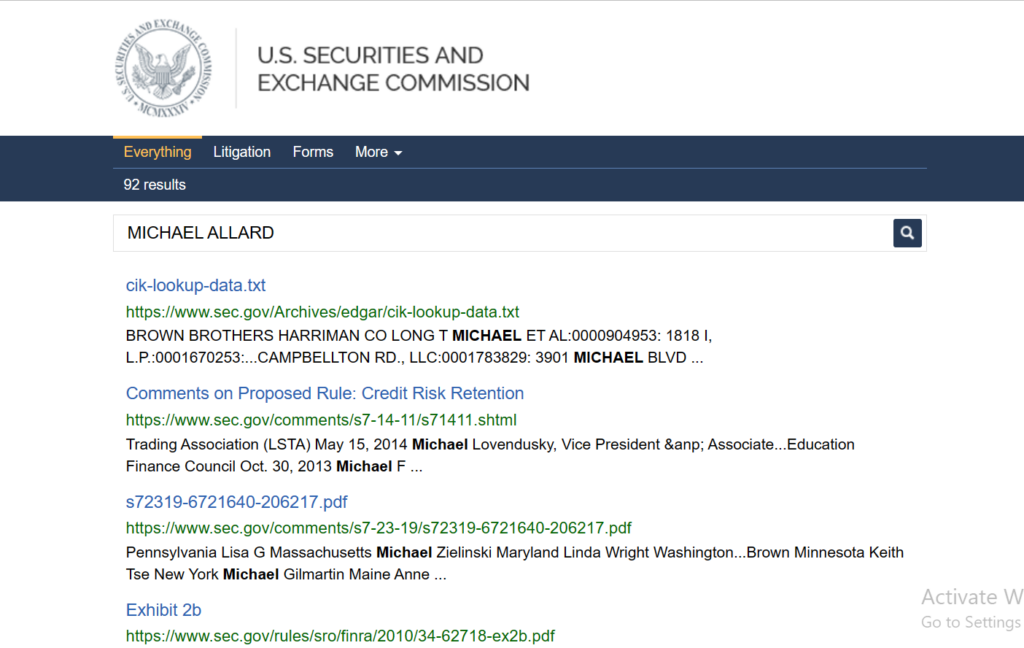

SEC Litigations & Forms

Source: MICHAEL ALLARD – SEC Site Search Search Results

Michael Allard Lawsuits, Legal Battles, & Disputes

There might be more pending lawsuits against Michael Allard which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Michael Allard on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Michael Allard Complaints, Class Action Lawsuits & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Michael Allard using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Michael Allard or any financial advisor.

Frequently Asked Questions

Where is NAME located?

What are NAME’s qualifications

Is NAME facing any lawsuits?

Has NAME been charged by the SEC?

How do I contact NAME?

Does NAME have any disclosures?

Which Firm does NAME work with?

What is NAME’s CRD Number?

Better Alternatives To Michael Allard (By Experts):

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management