PaysTree – Is It a Scam? The Truth Exposed (Update 2024)

PaysTree Ltd., a payment system located in the UK, provides clients in Europe and the CIS with electronic financial services. The primary offices are in London, and several clients have inquired about this.

The electronic payment system provides purchasing services and accepts SEPA and SWIFT payments. PaysTree asserts that it is dedicated to making financial transactions simpler everywhere. As a result, a personal private banker is allocated to each client and company.

Numerous users have, however, expressed their dissatisfaction, alleging that the business takes unfair advantage of helpless people. Customers claim that the business never provides accurate information about charges and that when the customer refuses to pay, they threaten them.

What PaysTree is?

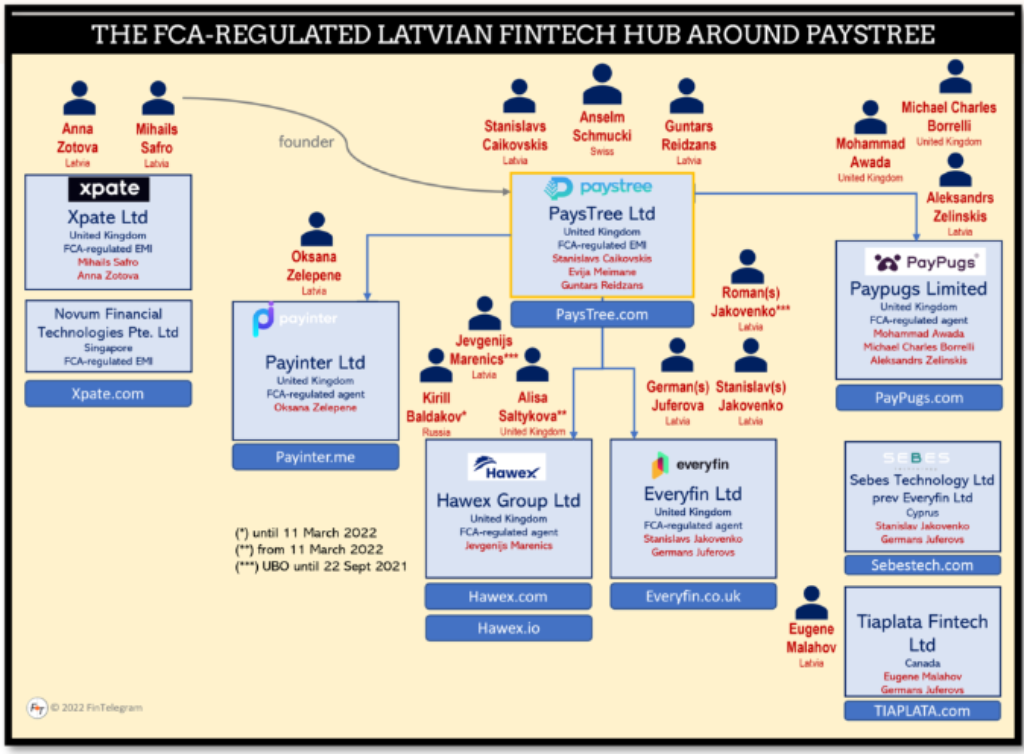

Since August 2018, PaysTree Ltd. has been an e-money provider subject to FCA regulation. It was established in December 2017 by Latvian Mihails “Mike” Safro (shown on the left), who was initially registered at UK Companies House as a director and controlling person. He quit PaysTree in the summer to found Xpate Ltd, another EMI subject to FCA regulation.

Anselm Schmucki, a Swiss citizen, presently runs PayTrees. The directors are Guntars Reidzans, Evija Meimane, and Stanislavs Caikovskis. LinkedIn connections report that the company employed 21, the bulk of whom were headquartered in Latvia, in 2020.

The corporation (Firm Reference 900900) is incorporated in England and Wales and is subject to Financial Conduct Authority regulation. PaysTree provides e-money services and passports on a business-to-consumer (B2C) and business-to-business (B2B) basis to all EU and EEA countries.

The business plan of the organization is built on standard banking services that are enhanced by IT solutions for faster payments than traditional banks.

Key Data

| Hub operator | PaysTree |

| Business activity | e-Money Institution andMerchant Service Provider |

| Domain | https://paystree.com |

| Legal entity | PaysTree Ltd (UK) |

| Authorization | FCA-regulated e-Money Institutionwith reference no 900900 |

| Jurisdiction | United Kingdom |

| Related entities | payinter ltd d/b/a payinter (agent for PaysTree)Everyfin Ltd d/b/a everyfin (agent for PaysTree)Hawex Group Ltd d/b/a Hawex (agent for PaysTree)Paypugs Limited d/b/a PayPugs (agent for PaysTree)Sebes Technology Ltd, Cyprus, d/b/a SEBES TechnologyTiaplata Fintech Ltd, Canada, d/b/a TIAPLATAXpate Ltd d/b/a xpate regulated by FCA as EMI |

| Related individuals | Mihails Safro, LatviaAnna Zotova, Latvia Stanislavs Caikovskis, LatviaEvija Meimane, LatviaGuntars Reidzans, LatviaOksana Zelepene, LatviaKirill Baldakov, RussiaGerman(s) Juferova, LatviaRoman(s) Jakovenko, LatviaStanislav(s) Jakovenko, LatviaEugene Malahov, LatviaAleksandrs Zelinskis, LatviaMohammad Awada, UKMichael Charles Borrelli, UKAnselm Schmucki, SwissAlisa Saltykova, UK |

What services does PaysTree provide?

The following are their four main services, as listed on their website:

-Aid with foreign company registration

-Establishing an account with a foreign bank or payment system

-Foreign businesses receive assistance with auditing and accounting.

-Advice on taxes, CFCs, and other matters relating to international law

How to Sign Up for PaysTree?

Opening an account involves the following two steps:

-The initial phase and

-The last step in creating an account.

Gathering and organizing all the paperwork needed to open an account is the first step. The terms of the preliminary stage are fully up to you.

An electronic money institution is what?

An organization that has been granted permission to issue electronic money in conformity with the European Communities (Electronic Money) Regulations 2011, as amended (EMR), is referred to as an “e-money institution.”

After providing the payment system with all necessary papers, the account is opened after 10 to 15 working days.

It adheres to the KYC policy and reserves the right to ask for further documents, which could cause the account opening period to be surpassed and the account to be rejected without cause or justification.

What Does It Cost To Open An Account With Them?

Here, an account can be opened for 650€.

– 10 EUR for residents of the EU/EEA and the United Kingdom (client verification may incur an additional fee of 50 EUR);

– 50 euros for visitors from other countries;

– 250 EUR for law firms with offices in the United Kingdom and the EU/EEA zone;

– 1500 EUR for lawful businesses with foreign registrations.

PaysTree Reviews

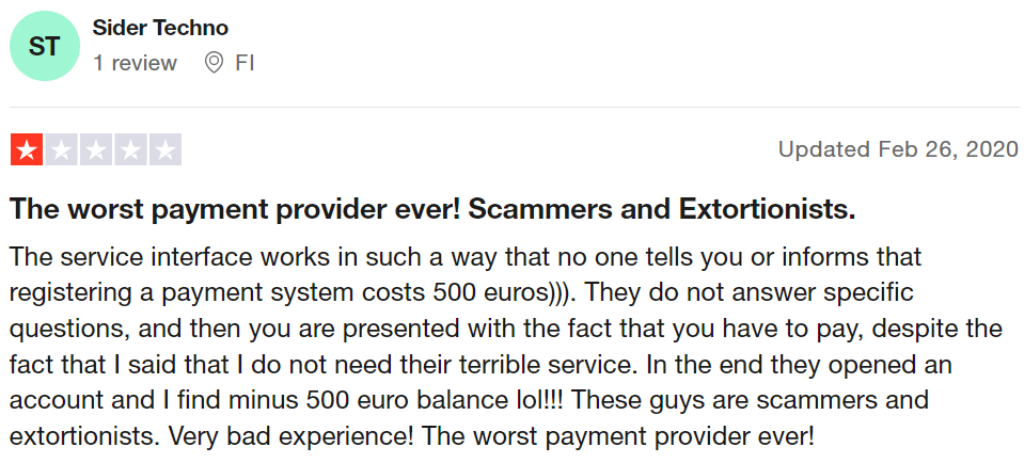

“The worst payment provider ever! Scammers and Extortionists.”

Sider Tecno wrote-

The way the user interface for the service operates is that you are never informed or told that registering a payment system costs 500 euros)). Even though he claimed he did not require their horrible service, they refuse to answer specific inquiries before informing you that you must pay. They finally created an account, and he discovered a negative 500 euro balance, hehe! These men are extortionists and con artists. Awful experience! Most awful payment processor ever!

Conclusion

The first report on the FCA-regulated e-money Institution PaysTree and its network of companies and people appeared in May 2022. The network is run by Latvians. One of their FCA-registered agents is The Hawex Group. Swiss national Anselm Oskar Schmucki is the proprietor of House PaysTree.

However, the business misled consumers by making false promises concerning their users and customers. Additionally, the business does not offer pertinent information about its clientele, and PaysTree‘s legitimacy cannot be established by any pertinent favorable reviews.

These bogus platforms are only created to deceive people as their customer services are poor and every time give unwanted information to the people sometimes they hold the money of the people, and it clearly shows these sites are unreliable for the people.

How these platforms are still working they duped many newbies and most people are unaware of these sites, as they are the red flag, they hold the money of the clients. The salesperson of the PaysTree tries to register their platform so, they can earn more money by doing illegal activities.

Many naive people become trapped by this payment system, suffer heavy financial losses, and make false promises to the consumer as these are fake market tactics to con people and steal their hard-earned.

These websites are managed by scammers whose main goal is to steal people’s money. It is quite traumatic when people are defrauded by these fraudsters, and they are powerless to stop them. Regulators should take strict action in this matter.

I agree with you Slider Techno as these are the worst interfaces for online payment as these are the sites found to be suspicious and famous for their horrible services, I’m also in the same situation where I’m unable to get the notification of the transaction and when inquiring to their customer service they were not responding to my phone.

It’s better to check the platform before going for further steps on their past performance and the services, what are the customer points on the platform, as there are fake applications and websites are increased and many individuals have to suffer heavy losses while dealing with these platforms.