Who is Robert Bancroft (CRD#: 1971458)

Robert Bancroft specializes in learning, modifying, and teaching private wealth management approaches for high-net-worth people, families, and fiduciaries. Robert Bancroft has worked as an OTC stock trader, built high net worth and institutional offices for a national brokerage firm, and served as a broker, branch manager, and district manager over his 30-plus-year career. Robert Bancroft’s vast professional and academic background, along with a rigorous approach to wealth management, has aided in leading his customers through the financial markets’ numerous hurdles.

Robert Bancroft is one of fewer than 4% of Morgan Stanley Financial Advisors as of February 2021.

who has completed the Family Wealth Director (FWD) certification program? Robert Bancroft’s training allows him to better assist you with a wide range of wealth management issues, building on his experience working with ultra-high-net-worth families.

- Planning for business succession and monetizing business ownership

- Alternative investments

- Control and restricted securities

- Equity and interest rate risk management

- Wealth transfer

- Family Governance and Dynamics

- Philanthropic Services

Robert Bancroft received a B.A. in finance from Michigan State University in 1989 and has gone on to earn designations as a Certified Investment Management Analyst, Certified Investment Management Consultant.

From 2014 to 2022, Bob was named one of Barron’s Top 1,200 Financial Advisors.

Robert Bancroft has been named to the Financial Times Top 400 Financial Advisors list in 2014 and 2018, as well as to Forbes Magazine’s list of America’s Wealthiest People.

Best in State Wealth Advisors from 2018 to 2022.

About Morgan Stanley Wealth Management:

Morgan Stanley Wealth Management, an American multinational financial services corporation, specializes in retail brokerage and asset management. As a division of Morgan Stanley, it serves a wide range of clients, from individual investors and small-to-mid-sized businesses to large corporations, non-profit organizations, and family foundations. With a strong history and a proven track record, Morgan Stanley Wealth Management has become a leading choice for those seeking expert financial advice and guidance.

Early Beginnings: Smith Barney & Co.

Morgan Stanley Wealth Management has its roots in the 1938 merger of Charles D. Barney & Co. and Edward B. Smith & Co., which formed Smith Barney & Co. Charles D. Barney & Co., founded by Charles D. Barney in 1873, was a New York and Philadelphia-based firm that emerged from the failure of its predecessor, Jay Cooke & Company. Edward B. Smith & Co., founded in 1892, became a significant player in securities underwriting in 1934 after absorbing the professionals from the securities business of Guaranty Trust Company, following the passage of the Glass-Steagall Act.

Morgan Stanley Wealth Management offers a comprehensive suite of financial services to cater to the diverse needs of its clients. Some of these services include:

Investment Management

Morgan Stanley Wealth Management provides many investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. Their financial advisors help clients develop tailored investment strategies to meet their specific financial goals and risk tolerance levels.

Financial Planning

Financial planning services offered by Morgan Stanley Wealth Management include retirement planning, education planning, estate planning, and more. Their financial advisors work with clients to understand their financial objectives and develop a comprehensive financial plan to help them achieve those goals.

What is a Financial Advisor?

A financial advisor is a specialist who offers professional financial advice to people looking to accomplish particular financial goals. You work with a financial advisor to develop a thorough financial plan that is specific to your situation, much like you would hire an architect to construct the blueprint for your home. Understanding your existing financial condition, including your income, costs, savings, and spending patterns, is a requirement for this collaboration.

Banking and Lending

Morgan Stanley Wealth Management offers banking and lending solutions, such as cash management accounts, mortgages, home equity loans, and lines of credit to help clients manage their day-to-day financial needs and achieve their long-term financial goals.

Insurance and Annuities

To help clients protect their financial future, Morgan Stanley Wealth Management offers insurance and annuity products, including life insurance, long-term care insurance, and annuities, designed to provide financial stability and peace of mind.

Philanthropy and Social Impact Investing

Morgan Stanley Wealth Management offers philanthropic advisory services and social impact investing options for clients who want to align their investments with their values and positively impact society.

Robert Bancroft Disclosures: BrokerCheck, FINRA, And SEC

The brokerCheck report of Robert Bancroft includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, arbitration awards, and disclosure events.

There is no disclosure against Robert Bancroft.

BrokerCheck

Source: individual_1971458.pdf (finra.org)

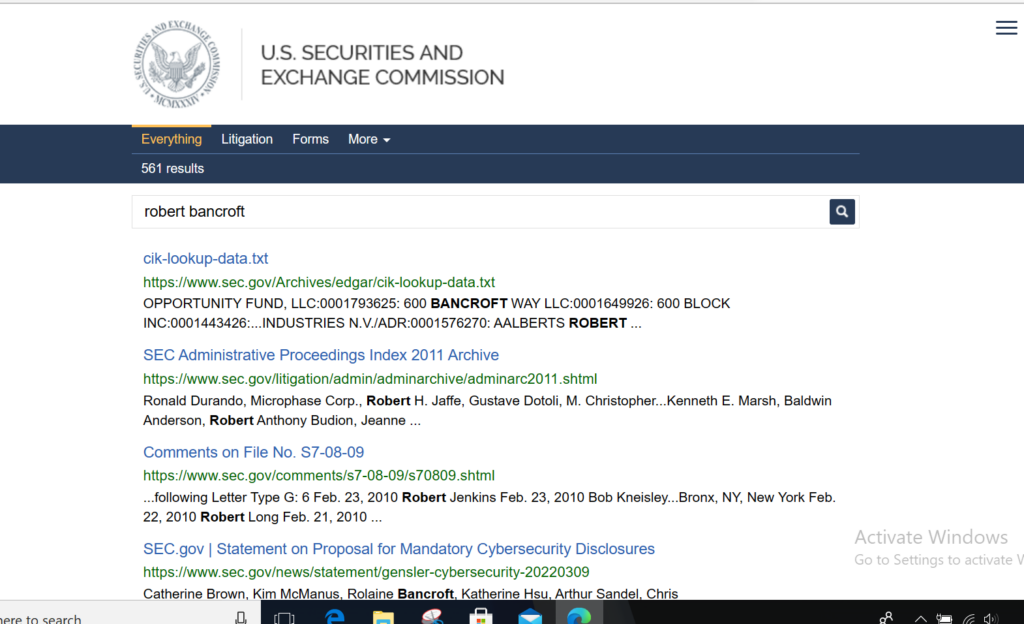

SEC Litigations & Forms

Source: robert bancroft – SEC Site Search Search Results

Robert Bancroft Lawsuits

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, and Trellis. law and Law360. If Robert Bancroft has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Robert Bancroft which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Robert Bancroft on these websites, then you can contact the local authorities and check if they have a physical copy of any lawsuits.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Robert Bancroft Complaints & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Robert Bancroft using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

Better Alternatives To Robert Bancroft:

Manages Assets Worth

- $6,427,792,177

Services

- Financial planning

- Portfolio management

- Selection of other advisors (including private fund managers)

- Family office and consulting services

Manages Assets Worth

- $4,465,757,285

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors (including private fund managers)

Manages Assets Worth

- $302,000,000

Services

- Financial planning

- Portfolio management