Who is Sean Fetterman (CRD#: 1918944)?Everything you need to know about Sean Fetterman and their accolades

Sean Fetterman is a Managing Director and Financial Advisor with the Fetterman Wealth Management Group at Morgan Stanley.

https://www.advisorhub.com/ubs-asks-court-to-muzzle-14-mln-team-that-jumped-to-morgan-stanley/

A Boca Raton, Florida, team worth $14 million that switched from UBS to Morgan Stanley earlier this month has been ordered by a judge to stop pursuing former clients until the first week of January 2021 and to surrender any personal information they may have possessed to UBS.

“I am not persuaded by Defendant Sean Fetterman’s argument that the preliminary injunction will cause substantial harm to his reputation,” wrote U.S. District Court Judge Donald Middlebrooks in a Palm Beach, Florida, order granting UBS’s request for a preliminary injunction on December 23. His reputation and customer ties have been cultivated over many years, so a brief injunction is unlikely to have a significant negative impact on them.

On December 4, Fetterman and five associates, including his brother and son, left UBS to join Morgan Stanley. The judge noted that “within a matter of just a few days” they were able to persuade former clients to ask for transfers of more than $200 million from roughly 30 accounts. More than $500 million then went to Morgan Stanley, according to testimony he referenced from the administrative manager of the UBS Boca Raton branch.

The Fetterman brothers and advisor David Raphan also broke solicitation agreements, the judge decided, and the team members violated client confidentiality obligations in their UBS job agreements.

About Morgan Stanley Wealth Management:History, achievements, leadership, lawsuits, & disputes

Morgan Stanley Wealth Management, an American multinational financial services corporation, specializes in retail brokerage and asset management. As a division of Morgan Stanley, it serves a wide range of clients, from individual investors and small-to-mid-sized businesses to large corporations, non-profit organizations, and family foundations. With a strong history and a proven track record, Morgan Stanley Wealth Management has become a leading choice for those seeking expert financial advice and guidance.

Early Beginnings: Smith Barney & Co.

Morgan Stanley Wealth Management has its roots in the 1938 merger of Charles D. Barney & Co. and Edward B. Smith & Co., which formed Smith Barney & Co. Charles D. Barney & Co., founded by Charles D. Barney in 1873, was a New York and Philadelphia-based firm that emerged from the failure of its predecessor, Jay Cooke & Company. Edward B. Smith & Co., founded in 1892, became a significant player in securities underwriting in 1934 after absorbing the professionals from the securities business of Guaranty Trust Company, following the passage of the Glass-Steagall Act.

Morgan Stanley Wealth Management offers a comprehensive suite of financial services to cater to the diverse needs of its clients. Some of these services include:

Investment Management

Morgan Stanley Wealth Management provides a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. Their financial advisors help clients develop tailored investment strategies to meet their specific financial goals and risk tolerance levels.

Financial Planning

Financial planning services offered by Morgan Stanley Wealth Management include retirement planning, education planning, estate planning, and more. Their financial advisors work with clients to understand their financial objectives and develop a comprehensive financial plan to help them achieve those goals.

What is a Financial Advisor?

A financial advisor is a specialist who offers professional financial advice to people looking to accomplish particular financial goals. You work with a financial advisor to develop a thorough financial plan that is specific to your situation, much like you would hire an architect to construct the blueprint for your home. Understanding your existing financial condition, including your income, costs, savings, and spending patterns, is a requirement for this collaboration.

Banking and Lending

Morgan Stanley Wealth Management offers banking and lending solutions, such as cash management accounts, mortgages, home equity loans, and lines of credit to help clients manage their day-to-day financial needs and achieve their long-term financial goals.

Insurance and Annuities

To help clients protect their financial future, Morgan Stanley Wealth Management offers insurance and annuity products, including life insurance, long-term care insurance, and annuities, designed to provide financial stability and peace of mind.

Philanthropy and Social Impact Investing

Morgan Stanley Wealth Management offers philanthropic advisory services and social impact investing options for clients who want to align their investments with their values and make a positive impact on society.

Sean Fetterman Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, litigation against Sean Fetterman

BrokerCheck report of Sean Fetterman includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

As per the report, 3 Customer Dispute disclosure has been reported against Sean Fetterman.

This type of disclosure event involves a consumer-initiated, investment-related complaint, arbitration proceeding or civil suit containing allegations of sale practice violations against the broker that resulted in a monetary settlement to the customer.

FINRA’s BrokerCheck

SEAN MARK FETTERMAN – Broker at MORGAN STANLEY (finra.org)

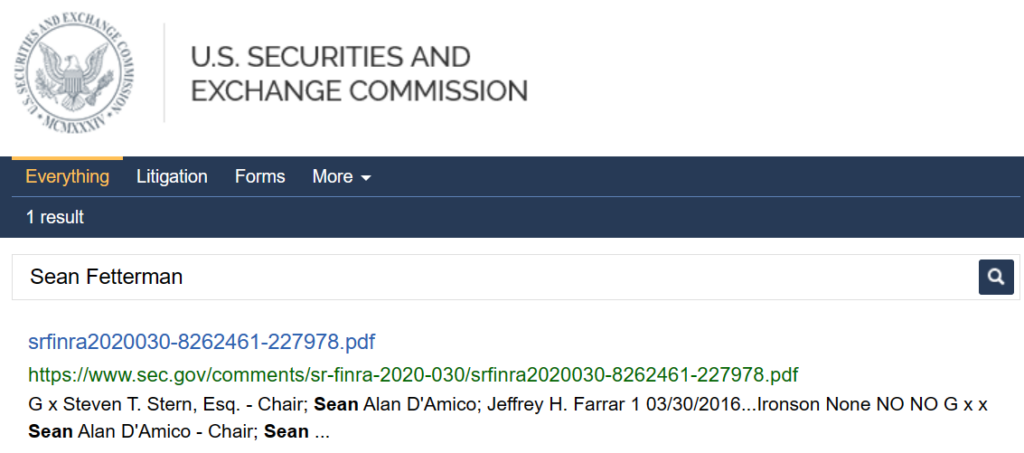

SEC Litigations & Forms

Source: Sean Fetterman – SEC Site Search Search Results

Sean Fetterman Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against Sean Fetterman

There might be more pending lawsuits against Sean Fetterman which are not listed on these directories. Lawsuit files are often deleted from online directories. So, if you cannot find any lawsuits against Sean Fetterman on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Sean Fetterman Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against Sean Fetterman (if available)

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Sean Fetterman using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with Sean Fetterman or any financial advisor.

Better Alternatives to Sean Fetterman (By Experts):Find the top 3 alternatives to Sean Fetterman

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management