Sean M. Johnson Review 2024

History Of Sean M. Johnson

Johnson entered the securities industry on August 9, 2019, when he became associated in

a non-registered capacity with NYLIFE Securities LLC, a FINRA member. On October

29, 2019, NYLIFE Securities filed a Uniform Application for Securities Registration

(Form U4), opening a window for Sean M. Johnson to take the Series 6 exam. On January 22,

2020, NYLIFE Securities filed a Uniform Termination Notice (Form U5) terminating

Johnson’s association with the firm.

Form U5 disclosed that the firm had terminated Johnson’s association after “he admitted he violated company policy by impersonating two clients during telephone interviews conducted as part of the underwriting process for life insurance.”

Sean M. Johnson is not currently registered or associated with any FINRA member but is subject

to FINRA’s jurisdiction pursuant to Article V, Section 4 of FINRA’s By-Laws.

Sean M. Johnson Report

This matter originated from NYLIFE Securities’ Form U5 termination of Johnson.

FINRA Rule 2010 requires associated persons to “observe high standards of commercial

honor and just and equitable principals of trade.” Impersonating another individual in a

business-related matter is a violation of FINRA Rule 2010.

On October 31, 2019, Johnson impersonated a non-firm customer on a phone call to the

firm’s affiliate insurance company without the customer’s knowledge or consent. He

impersonated the customer in order to complete the customer’s whole life insurance

policy application.

On November 18, 2019, Johnson impersonated a second non-firm

customer on a phone call, and also to the firm’s affiliate insurance company, without the

customer’s knowledge or consent. As before, Johnson impersonated the customer in

order to complete the customer’s whole life insurance policy application. While

impersonating these customers on the phone, Johnson answered personal and health-related questions about the customers and confirmed that all answers to the questions

were true and complete.

Therefore, the Respondent violated FINRA Rule 2010.

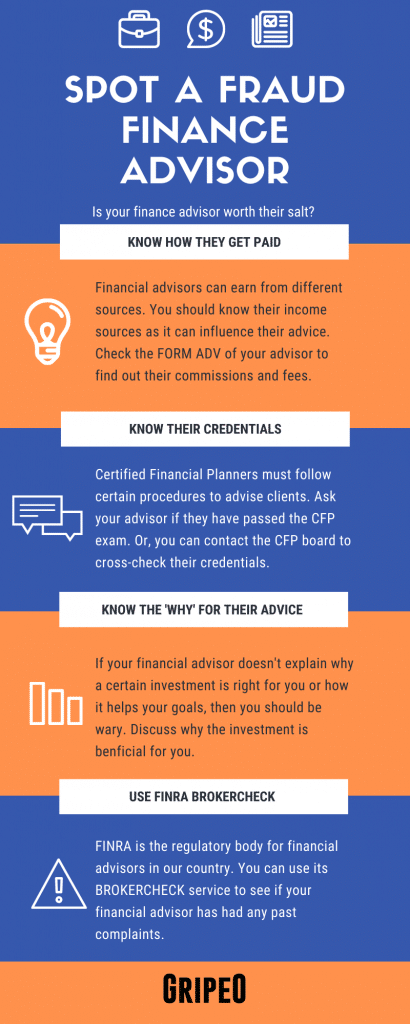

How can you spot a broker who is trying to deceive you?

A broker’s credentials, registration, and job history can be reviewed using BrokerCheck, a free online tool FINRA provides. Disputes with clients, disciplinary actions, and specific financial and criminal matters on the broker’s record are all covered in the disclosure portion of BrokerCheck.

Penalties, Punishments & Sanctions

■ a four-month suspension from associating with any FINRA member in any

capacity; and

■ a $5,000 fine

The fine shall be due and payable either immediately upon reassociation with a member

firm or prior to any application or request for relief from any statutory disqualification

resulting from this or any other event or proceeding, whichever is earlier

Sean M. Johnson Review

On October 31, 2019, and November 18, 2019, Johnson impersonated two customers on

phone calls to the firm’s affiliate insurance company, without the customers’ knowledge

or consent, thereby violating FINRA Rule 2010

How To Spot A Fraud Finance Advisor (Infographic)

Help For Victims Of Sean M. Johnson

If you have lost funds because of misrepresentation, unsuitable investment, or unsuitable investment strategy from Sean M. Johnson. Then you can take legal action and get justice. Fraud, Malpractice & dereliction of duty should not be taken lightly, especially in this industry. We highly suggest that you notify authorities or seek legal action if your financial advisor or brokerage firm fails to abide by FINRA’s rules are regulations.

Financial advisors are regulatory & legally obligated to suggest (recommend) the most suitable investments/investment strategies to their clients. Their suggestions should have their client’s best interests and should be appropriate for their client’s goals and needs. Similarly, the brokerage firm which hires financial advisors also has a regulatory & legal obligation to keep a close watch and supervise their Financial Advisors’ practices & behavior. They need to make sure that the financial advisor is not being manipulative or having an unreasonable bias towards certain investments. If the financial advisor and/or the brokerage firm breaches these duties, then the client/customer may be entitled to a full or partial recovery of their losses.

Financial advisors need to have the interest of their clients when giving suggestions related to investments and investment strategies. Reasonable basis suitability requires the advisor to do their best to analyze & identify the risks and rewards associated with their suggested investment and/or investment strategy.