Who is Steven Minkoff (CRD#: 1979259)?

Steven Minkoff is a Private Wealth Advisor at Ameriprise Financial Services’ Minkoff Wealth Partners. He has over 32 years of finance experience. Minkoff Wealth Partners is a boutique private wealth advising practice situated in San Francisco that serves the needs of individuals, families, and corporations both locally and nationally.

This article will go deeper into Steven Minkoff’s past, uncovering hidden disclosures and SEC litigations, as well as analyzing the legal consequences.

What is Ameriprise Financial?

Ameriprise Financial was founded in 1894 as Investors Syndicate by John Tappan in Minneapolis, Minnesota. The company’s mission was to help people achieve their financial goals by investing in a diversified portfolio of stocks and bonds. Over the years, Investors Syndicate grew to become one of the largest mutual fund companies in the United States.

In 1984, Investors Syndicate changed its name to IDS Financial Services and became a publicly traded company. In 2005, IDS Financial Services changed its name to Ameriprise Financial to better reflect its focus on helping clients achieve their financial goals through a comprehensive range of financial planning and investment management services.

Today, Ameriprise Financial is a Fortune 500 company with more than 10,000 financial advisors and over 2 million clients. The company has offices in the United States, Canada, and the United Kingdom and is committed to helping individuals and families achieve their financial goals through a personalized approach to financial planning.

The History of Ameriprise Financial

As mentioned earlier, Ameriprise Financial was founded in 1894 as Investors Syndicate by John Tappan. Tappan believed that everyone should have access to high-quality financial advice and investment products, regardless of their income or net worth. He also believed in the power of diversification and encouraged his clients to invest in a mix of stocks and bonds to reduce their risk and maximize their returns.

Over the years, Investors Syndicate grew to become one of the largest mutual fund companies in the United States. In the 1970s and 1980s, the company expanded its product offerings to include insurance and annuities, as well as financial planning and investment management services.

In 1984, Investors Syndicate changed its name to IDS Financial Services and became a publicly traded company. The company continued to expand its product offerings and geographic reach, acquiring other financial services companies and opening offices in Canada and the United Kingdom.

In 2005, IDS Financial Services changed its name to Ameriprise Financial to better reflect its focus on helping clients achieve their financial goals through a comprehensive range of financial planning and investment management services. Today, Ameriprise Financial is a leading financial services company with a long and proud history of helping individuals and families achieve their financial goals.

Ameriprise Financial’s Mission and Values

Ameriprise Financial’s mission is to help people feel confident about their financial future. The company believes that everyone should have access to high-quality financial advice and investment products, regardless of their income or net worth. Ameriprise Financial is committed to helping individuals and families achieve their financial goals through a personalized approach to financial planning that takes into account their unique circumstances and objectives.

Ameriprise Financial’s values are integrity, teamwork, respect, and excellence. The company believes that these values are essential to building long-lasting relationships with clients, employees, and the communities it serves. Ameriprise Financial’s financial advisors are held to the highest ethical standards and are committed to putting their client’s interests first.

Ameriprise Financial’s Services and Products

Ameriprise Financial offers a wide range of financial planning and investment management services designed to help individuals and families achieve their financial goals. These services include:

Financial planning:

Ameriprise Financial’s financial advisors work with clients to develop a comprehensive financial plan that takes into account their unique circumstances and objectives. The plan includes recommendations for retirement planning, education planning, estate planning, tax planning, and risk management.

What is a Financial Advisor?

A financial advisor is a specialist who offers professional financial advice to people looking to accomplish particular financial goals. You work with a financial advisor to develop a thorough financial plan that is specific to your situation, much like you would hire an architect to construct the blueprint for your home. Understanding your existing financial condition, including your income, costs, savings, and spending patterns, is a requirement for this collaboration.

Investment management:

Ameriprise Financial’s investment management services include access to a wide range of investment products, including mutual funds, exchange-traded funds (ETFs), individual stocks and bonds, and alternative investments. Ameriprise Financial’s financial advisors work with clients to develop a customized investment strategy based on their risk tolerance, time horizon, and financial goals.

Insurance:

Ameriprise Financial offers a wide range of insurance products, including life insurance, disability insurance, long-term care insurance, and annuities. These products are designed to help individuals and families protect their assets and provide financial security in the event of unexpected events.

Ameriprise Financial’s Approach to Financial Planning

Ameriprise Financial’s approach to financial planning is based on a personalized, comprehensive, and holistic approach to financial planning. The company’s financial advisors work with clients to develop a customized financial plan that takes into account their unique circumstances and objectives.

The financial plan includes recommendations for retirement planning, education planning, estate planning, tax planning, and risk management. Ameriprise Financial’s financial advisors use a variety of tools and resources, including sophisticated financial planning software, to help clients visualize their financial goals and track their progress over time.

Ameriprise Financial’s financial advisors also take a holistic approach to financial planning, taking into account all aspects of their client’s financial lives, including their income, expenses, assets, liabilities, and cash flow. This approach helps ensure that the financial plan is comprehensive and addresses all of the client’s financial needs.

Ameriprise Financial’s Awards and Accolades

Ameriprise Financial has received numerous awards and accolades for its financial planning and investment management services, as well as its corporate social responsibility efforts. Some of the company’s recent awards and accolades include:

Forbes Best-In-State Wealth Advisors: Ameriprise Financial had more advisors on Forbes’ list of Best-In-State Wealth Advisors than any other firm.

Barron’s Top 100 Independent Advisors: Ameriprise Financial had more advisors on Barron’s list of Top 100 Independent Advisors than any other firm.

Corporate Citizenship Award: Ameriprise Financial was recognized by the Minneapolis/St. Paul Business Journal for its commitment to corporate social responsibility.

Ameriprise Financial’s Financial Strength and Stability

Ameriprise Financial is a financially strong and stable company with a long-term track record of success. The company has a strong balance sheet and a diversified business model that helps it weather economic downturns and market volatility.

Ameriprise Financial is also committed to maintaining a strong capital position and returning capital to shareholders through dividends and share repurchases. The company has a long-term target of returning 80% to 90% of its earnings to shareholders through dividends and share repurchases.

Ameriprise Financial Reviews and Customer Satisfaction

Ameriprise Financial has a strong reputation for customer satisfaction and has received numerous awards and accolades for its customer service. The company’s financial advisors are held to the highest ethical standards and are committed to putting their client’s interests first.

Ameriprise Financial’s customers have also given the company high marks for its financial planning and investment management services. The company has a 4.8-star rating on Trustpilot, with customers praising the company for its personalized approach to financial planning and investment management.

Steven Minkoff Disclosures: BrokerCheck, FINRA, And SEC

BrokerCheck report of Steven Minkoff includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosures events.

According to the BrokerCheck report, 2 customer dispute disclosures have been reported against Steven Minkoff:

- In the first disclosure, the clients alleged I did not provide the necessary services to recover a check that was misapplied to another account for six months. The client claimed when the check was found they were not given any options in order to make a decision about how the money should be applied to their accounts.

- In the second disclosure, the client alleged I mishandled her investments and provided recommendations for the purposes of front-end charges, fees, and commissions. The client alleges a loss of $48,000.00.

BrokerCheck

Source: https://brokercheck.finra.org/individual/summary/1979259

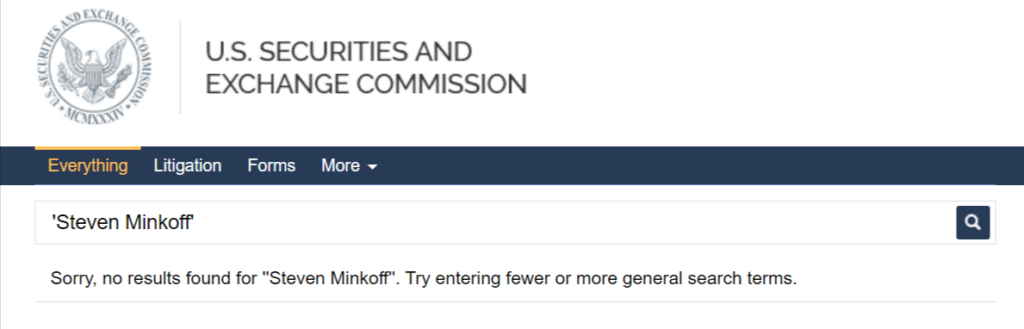

SEC Litigations & Forms

Source: https://secsearch.sec.gov/search?affiliate=secsearch&sort_by=&query=%27Steven+Minkoff%27

Steven Minkoff Lawsuits

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis, law, and Law360. If Steven Minkoff has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Steven Minkoff that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Steven Minkoff on these websites, then you can contact the local authorities and check if they have a physical copy of any lawsuits.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Steven Minkoff Complaints and Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Steven Minkoff using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

Better Alternatives To Steven Minkoff:

Manages Assets Worth

- $6,427,792,177

Services

- Financial planning

- Portfolio management

- Selection of other advisors (including private fund managers)

- Family office and consulting services

Manages Assets Worth

- $4,465,757,285

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors (including private fund managers)

Manages Assets Worth

- $302,000,000

Services

- Financial planning

- Portfolio management