Timothy David O’Brien Review 2024

History Of Timothy David O’Brien

O’Brien entered the securities industry as a general securities representative of a broker-dealer in October 1983. From May 4, 2012, to August 18, 2020, O’Brien was registered

with FINRA as a general securities representative through an association with Felt! &

Company. He voluntarily terminated his association with Feld in August 2020. FINRA

retains jurisdiction over O’Brien pursuant to Article V, Section 4 of FINRA’s By-Laws.

From July 2012 through February 2013, O’Brien exercised discretion without written

authorization in two customers’ accounts, in violation of NASD Rule 2510(b) and

FINRA Rule 2010. In December 2014, O’Brien signed an AWC agreeing to a 10-day

suspension and a $5,000 fine.’

I See AWC No. 2013036967201 (December 2014).

Timothy David O’Brien Report

FINRA Rule 2010 requires associated persons to observe high standards of commercial

honor and just and equitable principles of trade. A registered representative violates

FINRA Rule 2010 by, among other things, executing unauthorized transactions.

On October 27, 2017, while associated with Feltl, O’Brien sold a limited partnership

position in a customer’s account and purchased Class A shares of a mutual fund. O’Brien

attempted to call the customer to discuss the trades but did not reach her before executing

the transactions. The customer complained to Felt! about O’Brien’s unauthorized trades

in her account, but ultimately declined to reverse the transactions.

Through this conduct, O’Brien violated FINRA Rule 2010.

Can you expose the broker trying to trick you?

FINRA offers the free web tool BrokerCheck, which allows users to check a broker’s credentials, registration, and employment history. The disclosure part of BrokerCheck includes information on client conflicts, disciplinary proceedings, and specific financial and legal issues on the broker’s record.

Penalties, Punishments & Sanctions

• A 45-day suspension from associating with any broker-dealer

in any capacity, and

• A $10,000 fine.

The fine shall be due and payable either immediately upon re-association with a member

Firm, or prior to any application or request for relief from any statutory disqualification

resulting from this or any other event or proceeding, whichever is earlier.

Respondent specifically and voluntarily waives any right to claim an inability to pay, now

or at any time hereafter, the monetary sanctions imposed in this matter.

Respondent understands that, if he is suspended from associating with any FINRA

member, he becomes subject to a statutory disqualification, as that term is defined in

Article III, Section 4 of FINRA’s By-Laws, incorporating Section 3(a)(39) of the

Securities Exchange Act of 1934. Accordingly, he may not be associated with any

FINRA member in any capacity, including clerical or ministerial functions, during the

period of the bar or suspension. See FINRA Rules 8310 and 8311

The sanctions imposed herein shall be effective on a date set by FINRA staff.

Timothy David O’Brien Review

In October 2017, O’Brien placed two unauthorized trades in a customer’s account, in violation of FINRA Rule 2010.

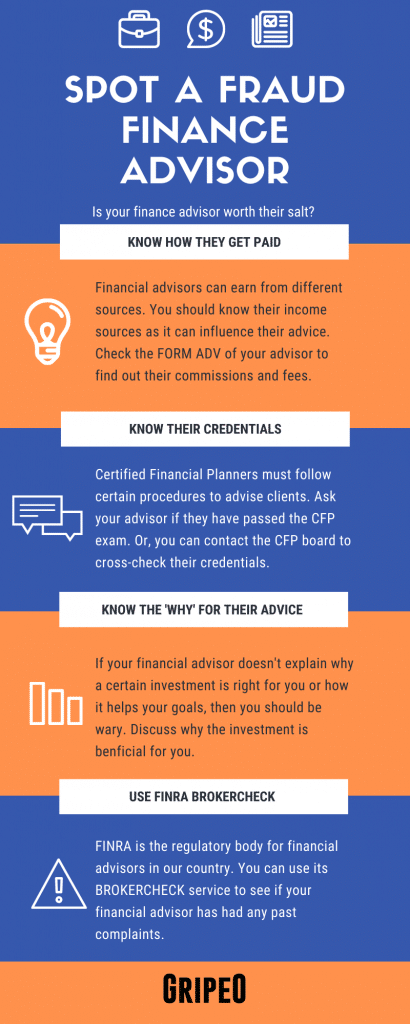

How To Spot A Fraud Finance Advisor (Infographic)

Help For Victims Of Timothy David O’Brien

If you have lost funds because of misrepresentation, unsuitable investment, or unsuitable investment strategy from Timothy David O’Brien. Then you can take legal action and get justice. Fraud, Malpractice & dereliction of duty should not be taken lightly, especially in this industry. We highly suggest that you notify authorities or seek legal action if your financial advisor or brokerage firm fails to abide by FINRA’s rules are regulations.

Financial advisors are regulatory & legally obligated to suggest (recommend) the most suitable investments/investment strategies to their clients. Their suggestions should have their client’s best interests and should be appropriate for their client’s goals and needs. Similarly, the brokerage firm which hires financial advisors also has a regulatory & legal obligation to keep a close watch and supervise their Financial Advisors’ practices & behavior. They need to make sure that the financial advisor is not being manipulative or having an unreasonable bias towards certain investments. If the financial advisor and/or the brokerage firm breaches these duties, then the client/customer may be entitled to a full or partial recovery of their losses.

Financial advisors need to have the interest of their clients when giving suggestions related to investments and investment strategies. Reasonable basis suitability requires the advisor to do their best to analyze & identify the risks and rewards associated with their suggested investment and/or investment strategy.