Trevor B. Rahn: Customers Disputes Exposed His Truth (2024)

Disputes & Complaints: Trevor B. Rahn

These disputes and complaints are often hidden by paid PR articles. This makes it easier for finance professionals to convince clients that they are legitimate. It is unethical to hide the truth from a client and it often leads major financial losses.

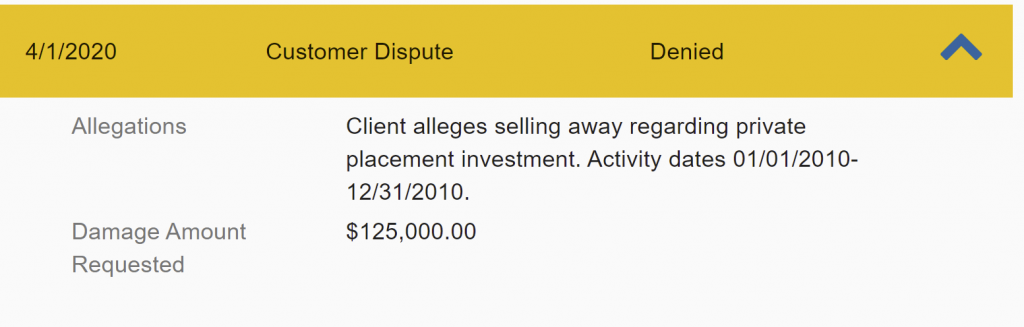

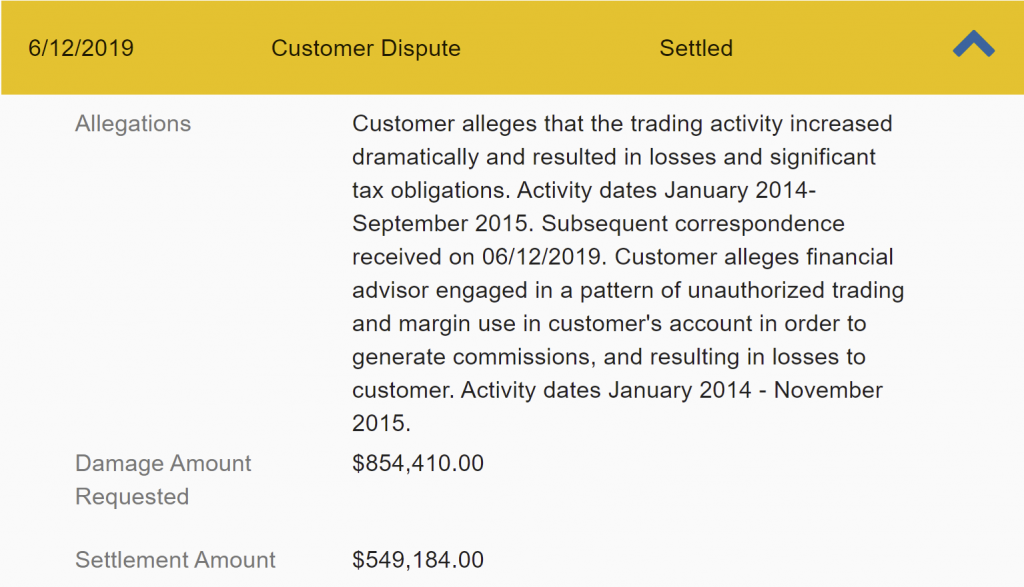

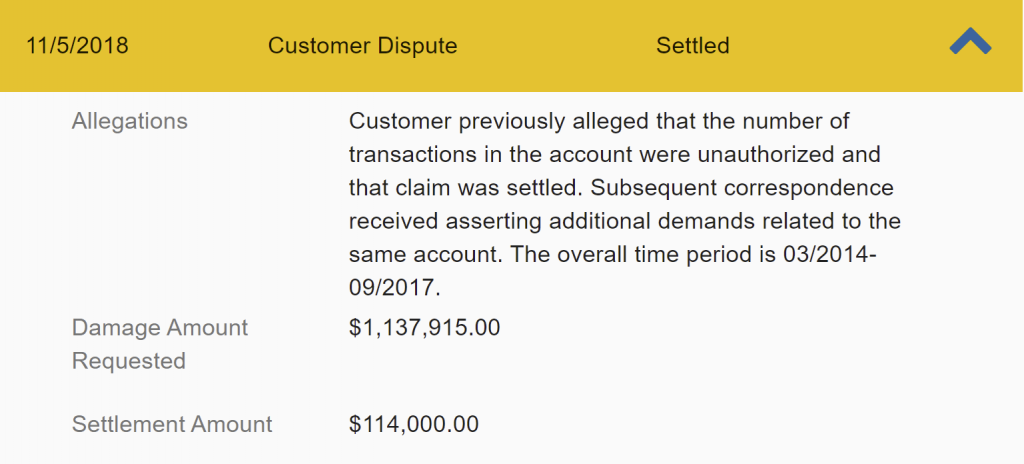

Here are all the client complaints and disputes:

History Of Trevor B. Rahn

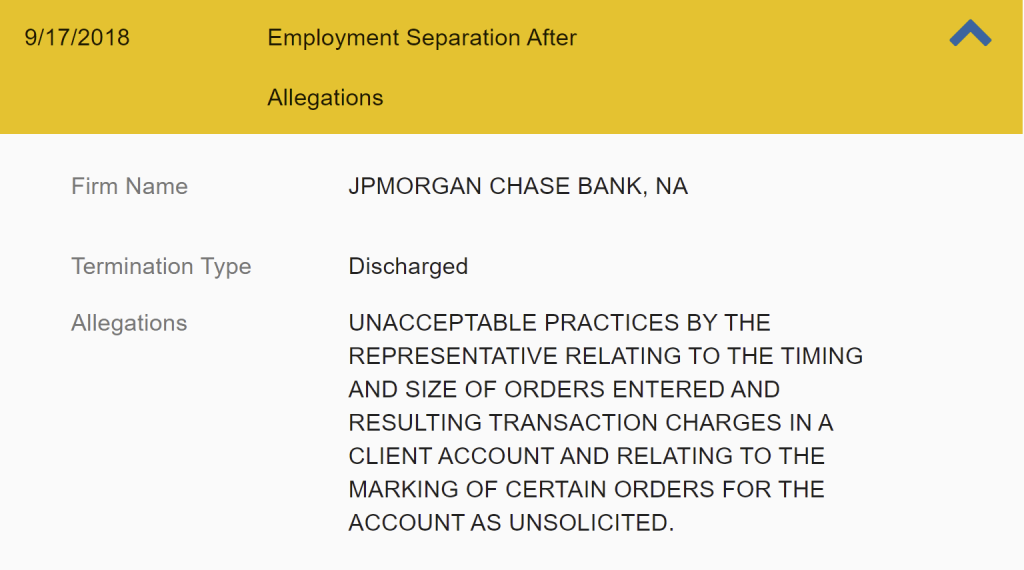

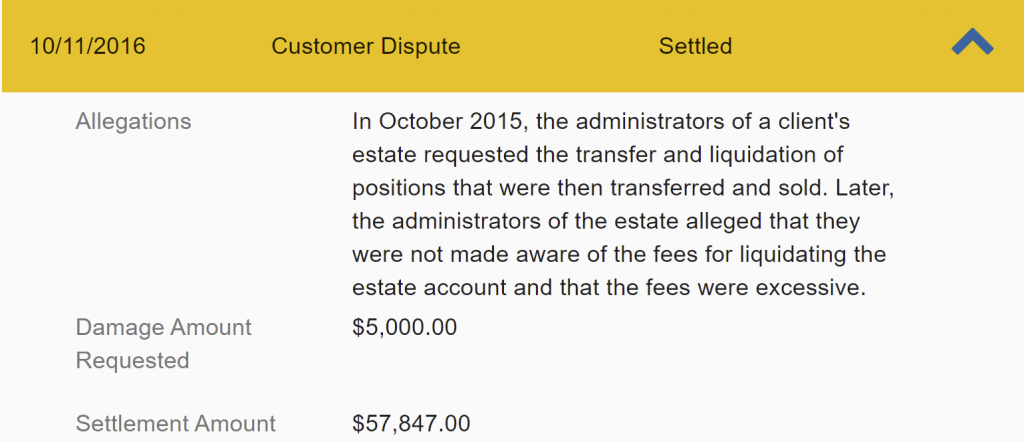

Rahn joined the securities industry in 1991. Ile became associated with J.P. Morgan

Securities LLC (JPMS) on July 30, 2010 as a General Securities Representative. In a

Uniform Termination Notice for Securities Industry Registration (Form 155) filed on

September 27, 2018, JPMS reported that it had discharged Rahn on September 17, 2018

for “unacceptable practices by the representative relating to the timing and size of orders

entered and resulting transaction charges in a client account and relating to the marking

of certain orders for the account as unsolicited.” JPMS subsequently amended Ralufs

Form US on December 20, 2018, March 14, 2019, and April 24, 2020 to disclose three

customer complaints.

Rahn has not been associated with any FINRA member since his discharge from

WMorgan but .remains subject to FINRA’s jurisdiction under Article V, Section 4(a)(i) of

FINRA’s By-Laws, Rahn does not have any relevant disciplinary history.

Trevor B. Rahn Report

A. Rahn’s “Average Pricing” Investment Strategy

FINRA Rule 2111(a) requires an associated person to “have a reasonable basis to believe

that a recommended transaction or investment strategy involving a security or securities

is suitable for the customer.- The recommendation must be based on reasonable diligence

demonstrating it is suitable for at least some investors. Moreover, the reasonable

diligence must provide the associated person with an understanding of the potential risks

and rewards associated with the recommended security or strategy. The lack of such an

understanding when recommending a security or strategy violates the suitability rule. A

violation of FINRA Rule 2111(a) is also a violation of FINRA Rule 2010, which requires

associated persons to -observe high standards of commercial honor and just and equitable

principles of trade” in the conduct of their business.

From January 2014 to September 2018. Rahn recommended an “average pricing”

investment strategy to customers in which he executed orders in 32 accounts by breaking

them into multiple smaller trades that he entered at different times on the same day.

When entering the smaller trades, Rahn often entered a separate commission on each

trade that was greater than the amount that would be charged under the firm’s standard

commission schedule. Rahn relied on the firm’s system to automatically assign

commissions in accordance with the firm’s commission schedule without taking steps to

confirm it actually did so. Because Rahn failed to conduct the necessary reasonable

diligence to understand the cost implications of his recommended strategy, he lacked a

reasonable basis to recommend his “average pricing” strategy to his customers.

Therefore, Rahn violated FINRA Rules 2111(a) and 2010.

Also, to implement his “average pricing” strategy, Rahn exercised time and price

discretion by breaking up 1.106 customer orders into over 7.500 smaller trades.

NASD Rule 2510(b) generally prohibits a registered representative from exercising

discretionary power in a customer’s account without prior written authorization from the

customer and written acceptance from the member firm. While NASD Rule 2510(d)(1)

provides an exception for same-day time and price discretion, any exercise of time and

price discretion must be reflected on the order ticket.”

Rahn did not have written authority from any of his customers, or written acceptance

from JPMS, to exercise discretion in any customer accounts. None of the tickets for the

over 7,500 trades reflected an exercise of time and price discretion. Instead, Rahn entered

all of these trades as “held” orders, meaning that each order was intended to be promptly

placed. Therefore, Rahn violated NASD Rule 2510(b) and FINRA Rule 2010.

B. Rahn’s Unauthorized Trades

An associated person who executes transactions in a customer’s account without the

customer’s authorization violates FINRA Rule 2010.

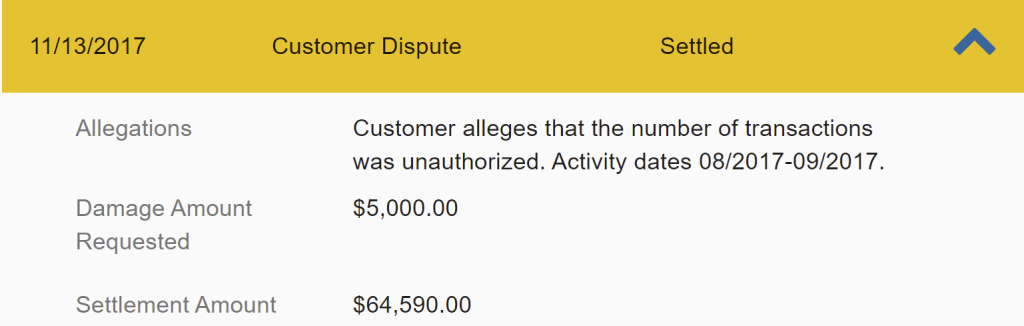

Between June 2016 and September 2017. Rahn executed 577 trades in the account of a

customer without her authorization. Theretbrc. Rahn violated FINRA Rule 2010.

• Rahn’s Mismarked Orders

F1NRA Rule 4511 provides that each member firm “shall make and preserve books and

records as required under the FINRA rules, the Exchange Act and the applicable

Exchange Act rules.” Exchange Act Rule 17a-3 requires firms to make a record of “each

brokerage order, and of any other instruction, given or received for the purchase or sale

of securities, whether executed or unexecuted.- This record “shall show the terms and

conditions of the order or instructions,- which includes whether the order was solicited or

unsolicited. An associated person who mismarks an order causes his member firm to

create an inaccurate record in violation of FINRA Rules 4511 and 2010.

Rahn mismarked 4,714 solicited trades in the accounts of three customers as

“unsolicited.” Therefore, Rahn caused JPMS to create inaccurate records in violation of

FINRA Rules 4511 and 2010.

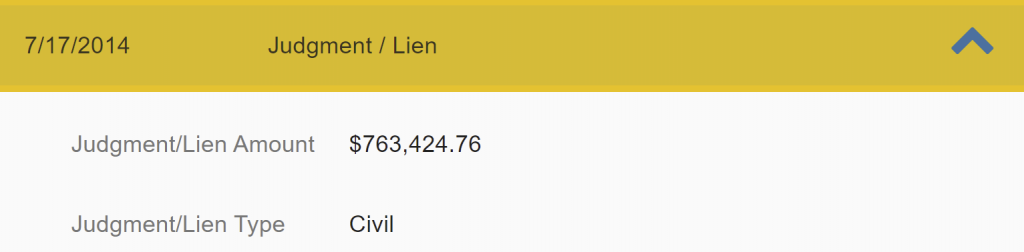

Penalties, Punishments & Sanctions

■ An 18-month suspension from associating with any FINRA member in all

capacities and

■ a S10,000 fine.

The fine shall be due and payable either immediately upon reassociation with a member

firm or prior to any application or request for relief from any statutory disqualification

resulting from this or any other event or proceeding, whichever is earlier.

Respondent specifically and voluntarily waives any right to claim an inability to pay, now

or at any time after the execution of this AWC. the monetary sanction imposed in this

matter.

Respondent understands that if he is barred or suspended from associating with any

FINRA member, he becomes subject to a statutory disqualification as that term is defined

in Article III, Section 4 of FINRA’s By-Laws, incorporating Section 3(a)(39) of the

Securities Exchange Act of 1934. Accordingly, he may not be associated with any

FINRA member in any capacity, including clerical or ministerial functions, during the

period of the bar or suspension. See FINRA Rules 8310 and 8311.

Trevor B. Rahn Review

During his association with JPMS, Rahn engaged in a pattern of breaking *customer

orders for execution in violation of FINRA Rules. Specifically, from Januaty.2014 to September 2018, Rahn recommended an -average pricing investment strategy to his

customers in which he executed orders by breaking them into multiple small trades, each

generating a separate commission. Rahn lacked a reasonable basis to believe this strategy

was suitable for his customers in violation of FINRA Rules 2111(a) and 2010. In

connection with his strategy, Rahn exercised time and price discretion on over 7,500

trades without the required authorization in violation of NASD Rule 2510(b) and FINRA

Rule 2010.

Separately, between June 2016 and September 2017, Rahn executed 577 unauthorized

trades in a customer’s account in violation of FINRA Rule 2010. He also mismarked

4,714 solicited trades in three customer accounts as “unsolicited” in violation of FINRA

Rules 4511 and 2010.

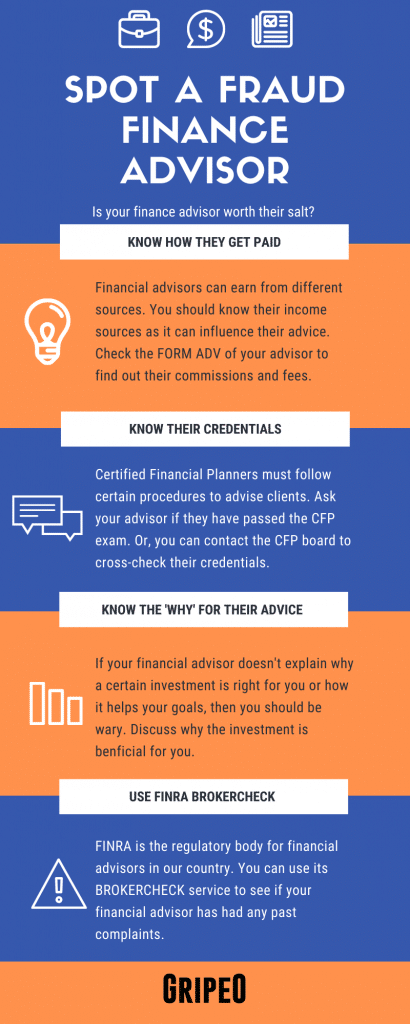

How To Spot A Fraud Finance Advisor (Infographic)

Help For Victims Of Trevor B. Rahn

If you have lost funds because of misrepresentation, unsuitable investment, or unsuitable investment strategy from Trevor B. Rahn. Then you can take legal action and get justice. Fraud, Malpractice & dereliction of duty should not be taken lightly, especially in this industry. We highly suggest that you notify authorities or seek legal action if your financial advisor or brokerage firm fails to abide by FINRA’s rules are regulations.

Consumer fraud is typically characterized as dishonest company tactics that result in losses for consumers, whether they be monetary or otherwise. The victims are actually being cheated while they think they are taking part in a legitimate and lawful business transaction.

Financial advisors are regulatory & legally obligated to suggest (recommend) the most suitable investments/investment strategies to their clients. Their suggestions should have their client’s best interests and should be appropriate for their client’s goals and needs. Similarly, the brokerage firm which hires financial advisors also has a regulatory & legal obligation to keep a close watch and supervise their Financial Advisors’ practices & behavior. They need to make sure that the financial advisor is not being manipulative or having an unreasonable bias towards certain investments. If the financial advisor and/or the brokerage firm breaches these duties, then the client/customer may be entitled to a full or partial recovery of their losses.

Read more about: Dr. George B. Isaac

Financial advisors need to have the interest of their clients when giving suggestions related to investments and investment strategies. Reasonable basis suitability requires the advisor to do their best to analyze & identify the risks and rewards associated with their suggested investment and/or investment strategy.