Warner Music – Is this website running a Ponzi Scheme? The Truth Exposed (Update 2024)

Warner Music’s website does not reveal ownership or leadership information.

On December 4th, 2022, Warner Music’s website domain (“warnermusicc.com”) was registered. On April 15th, 2023, the private registration was last updated.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Their Products

Warner Music does not have any retailable items or services.

Affiliates can only market Warner Music affiliate membership.

Their Compensation Plan

Affiliates of Warner Music invest between $30 and $1000 in tether (USDT). This is done with the promise of a daily ROI of 3%.

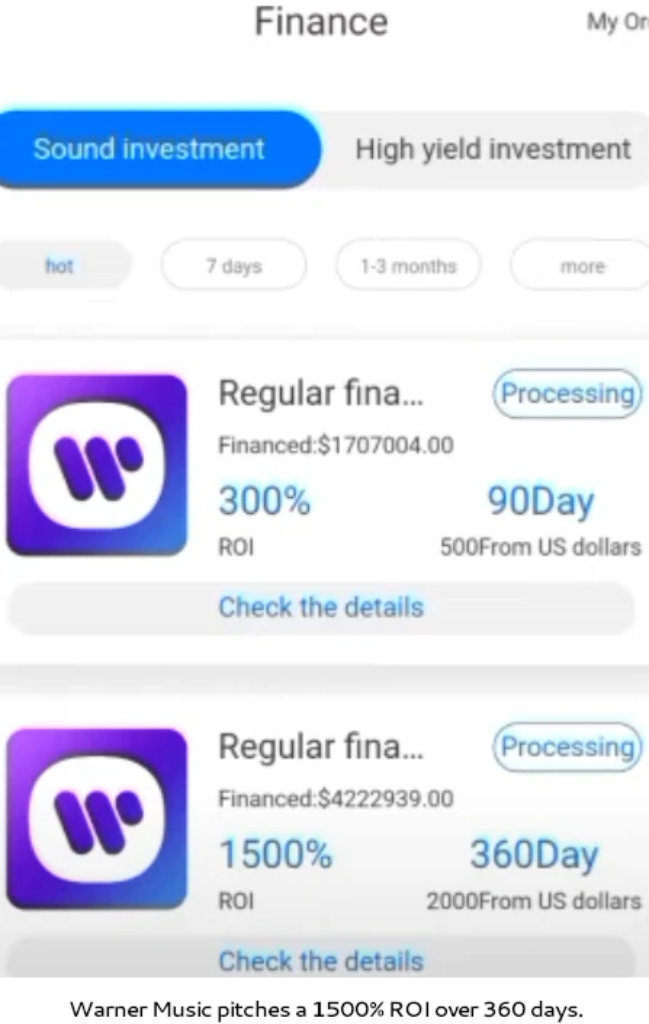

There appear to be some “sound investment” options as well:

I’ve observed the following Warner Music investment tiers:

- Spend $100-$1,000,000 and receive 50% after 15 days

- Spend $200-$1,500,000 and receive 200% after 45 days

- Invest $500-$2,000,000 and receive 400% after 90 days.

- Invest 1000 to 2,500,000 USDT and earn a return of 900% after 180 days.

- Invest 2000 to 3,000,000 USDT and receive a return of 2000 after 360 days.

Warner Music pays for the recruitment of affiliate investors in the MLM industry.

Referral Commissions

Warner Music pays a referral commission on payments down three levels of recruitment (unilevel) investments.

- level 1 (personally recruited affiliates) – 15%

- level 2 – 10%

- level 3 – 5%

Recruitment Bonuses

Warner Music offers a recruitment bonus for personal recruitment efforts:

- Recruit three affiliates and receive 15 USDT

- Recruit ten affiliates and receive 50 USDT

- Recruit twenty affiliates and receive 100 USDT

- Recruit fifty affiliates and receive 300 USDT

- Recruit one hundred affiliates and receive 1000 USDT

It is important to note that recruited affiliates must have invested to qualify for recruitment bonuses.

Monthly Salary

This company pays a “monthly salary” based on the following criteria:

- Recruit 20 affiliates and receive $200 USDT every month.

- Recruit 50 affiliates and receive 1000 USDT per month recruit 100 affiliates and receive 3000 USDT per month

It should be noted that recruited affiliates must have invested to count towards the monthly compensation qualification criterion.

How to Join

Their affiliate membership is free.

Full participation in the attached income opportunity requires a minimum 30 USDT investment.

Conclusion

Warner Music is yet another Ponzi scheme involving “click a button” apps.

Warner Music represents investors who purchase albums, which provides ROI money.

In actuality, clicking a button has no effect. Warner Music is simply recycling invested monies to compensate previous investors.

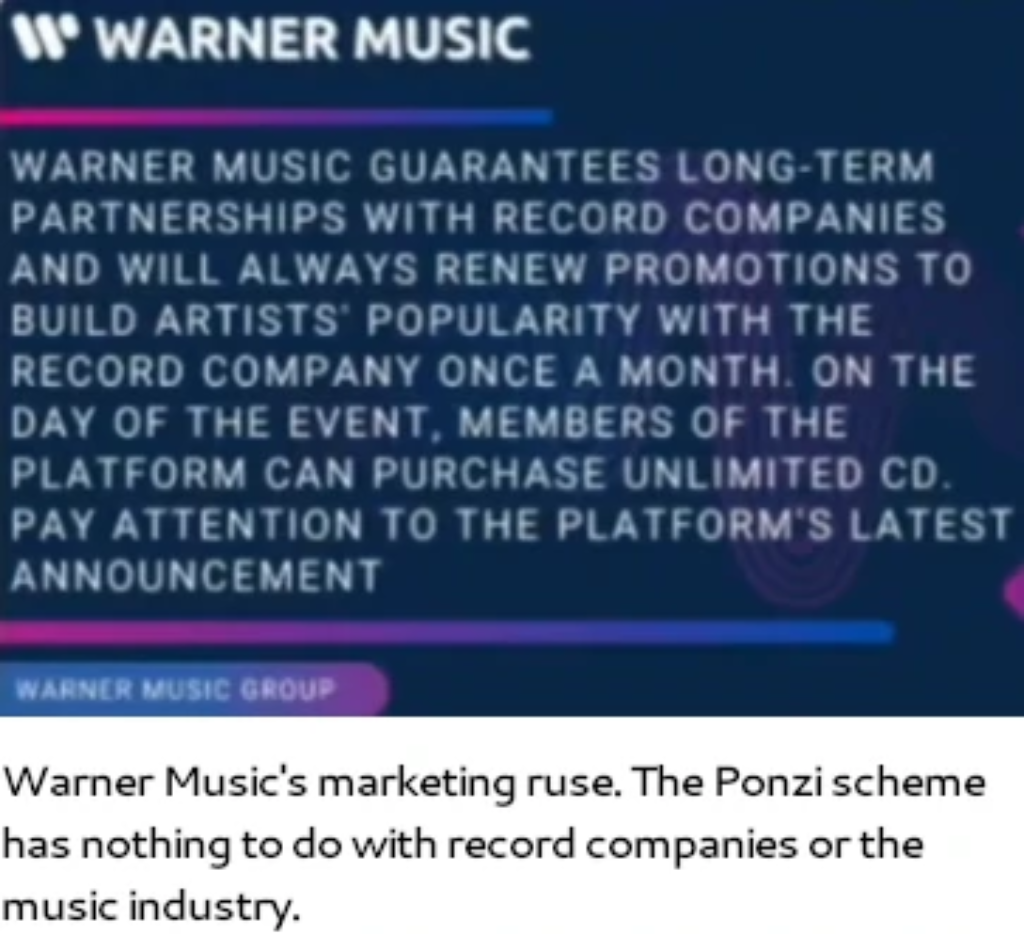

The misuse of Warner Music Group is linked to Warner Music’s fraud.

The genuine Warner Music Group is situated in the United States and is “one of the “big three” recording companies and the third-largest in the global music industry”

The Warner Music app Ponzi has stolen the name and logo of Warner Music Group. Their website domain is one letter short of “warnermusic.com,” which links to the website of Warner Music Group.

Warner Music is one of several “click a button” software Ponzi schemes that have appeared since late 2021.

BehindMLM has identified fifty-one “click a button” apps Ponzis, including Warner Music. Most of them live for a few weeks to a few months before succumbing.

In that vein, Warner Music is almost certainly on its way out. On May 6th, the following “notice” was given to Warner Music investors:

As the platform has discovered, many members have recently registered several accounts in huge numbers using the same IP address and got the platform’s rewarded vouchers, which gravely violates the platform’s rules.

How exactly does a Ponzi scheme operate?

An investment fraud known as a Ponzi scheme draws investors with claims of great returns and no risk but fails to invest the money as stated. Instead, it pays off earlier investors with money from future investors while maybe keeping a portion of the profits. These schemes typically fail when recruiting investors becomes challenging or when multiple investors attempt to cash out. They depend on a steady flow of new buyers to operate. They are called after Charles Ponzi, who ran a similar scam using postal stamps in the 1920s.

At the moment, the platform requires time for evaluation, which has prompted several members to postpone payment.

Please be patient, and those who pass the review without issue will be directed to them one by one.

“Click a button” application Ponzis vanishes by deactivating their websites and apps. This usually occurs without warning, resulting in a loss for the vast majority of investors (inevitable Ponzi math).

The same group of Chinese scammers is suspected of being behind the “click a button” app Ponzi epidemic.

What is a Ponzi scheme?

A Ponzi scheme is a deceptive investment strategy that promises high rates of return with no risk to investors. A Ponzi scheme is a fraudulent investment scheme in which money is collected from later participants to produce profits for earlier investors. This is comparable to a pyramid scam in that both rely on new investors’ finances to pay off previous investors.

Both Ponzi and pyramid schemes inevitably fail when the influx of new investors stops and there isn’t enough money to go around. The plots begin to crumble at that time.

- By recruiting new investors who are promised a huge payoff with little to no risk, the Ponzi scheme produces returns for existing investors.

- The fraudulent investment strategy is based on using funds from new investors to pay off previous donors.

- Companies that run a Ponzi scheme concentrate their efforts on enticing new clients to make investments; otherwise, their system will become illiquid.

- The SEC has provided recommendations on what to look for in suspected Ponzi schemes, such as guaranteed returns or investment vehicles that are not registered with the SEC.

- Bernie Madoff perpetrated the greatest Ponzi scheme, duping thousands of investors out of billions of dollars.

A Ponzi scheme is a type of investment scam in which clients are promised a high profit with little or no risk. Companies that run a Ponzi scheme devote all of their resources to acquiring new investors.

This new revenue is utilized to pay original investors’ returns, which are labeled as a profit from a valid transaction. Ponzi schemes rely on a steady stream of new investments to keep paying out profits to older investors. When this flow runs out, the scheme crumbles.

Conclusion

Regardless of the technology utilized, the majority of Ponzi schemes have similar characteristics. The Securities and Exchange Commission (SEC) has recognized the following characteristics to be on the lookout for:

- A promise of high rewards with no risk.

- A steady stream of returns regardless of market conditions

- Unregistered investments with the Securities and Exchange Commission (SEC)

- Clients are not permitted to access official papers for their investment strategies that are kept secret or described as too hard to comprehend.

- Clients who are having difficulty withdrawing their funds