Background Of Wells Fargo Clearing Services, LLC (CRD)

Wells Fargo Clearing Services was a FINRA member from May 1986 to November 2016. During the

relevant period, April 2016 through October 2016, Wells Fargo Clearing Services provided clearing

services for 75 firms and approximately 8.2 million customer accounts. In November

2016, Wells Fargo Clearing Services merged with Wells Fargo Clearing Services Advisors, LLC, to become Wells Fargo

Wells Fargo Clearing Services, LLC. Shortly afterward, First Clearing filed a Form BDW terminating

its FINRA registration.

Wells Fargo Clearing Services does not have any relevant disciplinary history.

Activity(s) Reported – Wells Fargo Clearing Services, LLC

Wells Fargo Clearing Services matter originated from a customer complaint made in August 2016 to FINRA’s

Senior Help Line regarding inconsistent values reflected on her account statements

regarding a REIT she had previously purchased.

Between April 2016 and October 2016, First Clearing distributed more than 6,800

customer account statements containing valuations that did not comply with the

requirements of NASD Rule 2340(c).

Beginning with amendments that took effect on April 11, 2016, NASD Rule 2340(c)

required FINRA members to use either of two approved methodologies when providing

per-share estimated values for DPP and unlisted REIT securities on customer account

statements. In Regulatory Notice 15-02, issued in January 2015, FINRA notified its

members that the Securities and Exchange Commission approved this rule change.

According to Regulatory Notice 15-02, one reason for the April 2016 rule change was to

“require general securities members to provide more accurate per share estimated values

on customer account statements” by using either the “net investment methodology” or the

“appraised value methodology.” The net-investment methodology derives an estimated

per-share value from the number of a DPP or REIT offering’s proceeds that remain

available for investment, either as stated in the offering prospectus or based on another

equivalent disclosure. The appraised-value methodology, by comparison, draws on the

appraised valuation disclosed in an issuer’s most recent periodic or current report filed

with the SEC.

Wells Fargo Clearing Services convened an internal working group in the second half of 2015 to address

the rule change. During that process, Wells Fargo Clearing Services learned that it might encounter potential difficulties in obtaining compliant estimated values for certain DPP and REIT securities

upon implementation of the rule and worked to address that possibility.

During the first few months of 2016, Wells Fargo Clearing Services obtained much of its valuation data

regarding DPP and REIT securities from third-party vendors. On April 18, 2016, one of

the firm’s third-party valuation vendors sent Wells Fargo Clearing Serviceshttps://www.tradepmr.com/clearing-and-execution-services a letter identifying several

dozen DPP and REIT securities for which it was unable to provide rule-compliant, per share estimated values. A few days later, that vendor provided First Clearing with April

2016 valuation data, which included zeros as valuations for those DPPs and REITs for which compliant valuations were unavailable. Those zeros fed directly into the system

First Clearing is used to generate customer-account statements at the end of each month.

When First Clearing created its customer account statements at the end of April 2016,

however, the firm’s security pricing team manually overrode the zeros that the firm’s

third-party valuation vendor had provided for 33 DPP and REIT securities, and instead

populated the April 2016 statements for customers holding those securities with the

valuations that the vendor supplied for those positions the previous month—i.e., before

the rule change.

Thus, rather than learning that compliant valuations were not available,

customers who owned one or more of the affected DPPs or REITs received account

statements showing outdated valuations for those holdings. Because those earlier

valuations did not derive from either the net-investment or appraised-value methodology,

they did not comply with Rule 2340(c). In one example, an erroneous account statement

showed the per-share estimated value of a customer’s REIT at $14.72, when the

security’s rule-compliant per-share valuation at the time was approximately $0.90.

First Clearing’s distribution of monthly and quarterly customer account statements with

noncompliant valuations for some DPP and REIT securities continued through October

2016, although the number of securities with noncompliant valuations appearing on such

statements declined to either five or six per month after May 2016, as First Clearing no

longer held certain DPP and REIT positions with non-compliant valuations on its books.

longer held certain DPP and REIT positions with non-compliant valuations on its books.

Overall, from April 2016 through October 2016, First Clearing sent 6,851 monthly and

quarterly account statements to 2,390 account holders containing valuations for 33

discrete DPP and REIT securities that did not comply with the requirements of NASD

Rule 2340(c).

Therefore, First Clearing violated NASD Rule 2340(c) and FINRA Rule 2010.2

Between April 2016 and October 2016, First Clearing failed to establish and

maintain a supervisory system, including written supervisory procedures,

reasonably designed to ensure compliance with NASD Rule 2340(c).

FINRA Rule 3110(a) provides that each member “shall establish and maintain a system

to supervise the activities of each associated person that is reasonably designed to achieve

compliance with applicable securities laws and regulations, and with applicable FINRA

rules.”

In addition, Rule 3110(b)(1) requires each FINRA member to “establish, maintain, and

enforce written procedures to supervise the types of business in which it engages and the

activities of its associated persons that are reasonably designed to achieve compliance

with applicable securities laws and regulations, and with applicable FINRA rules.”

From April 2016 through October 2016, First Clearing did not have a supervisory system

or written procedures reasonably designed to achieve compliance with NASD Rule

2340(c). During that time, the firm failed to ensure that appropriate supervisory personnel

oversaw and reviewed the security pricing team’s activities regarding DPP and REIT

securities. In particular, First Clearing failed to require any supervisory review of

instances in which the security pricing team manually overrode vendor-supplied

valuation data for DPPs and REITs.

Therefore, First Clearing violated FINRA Rules 3110(a), 3110(b), and 2010.

First Clearing violated FINRA Rule 4511, which requires FINRA members to keep

accurate books and records.

FINRA Rule 4511 requires member firms to “make and preserve books and records,” and

that obligation embodies the requirement that those records be accurate. Here, from April

2016 through October 2016, First Clearing failed to maintain accurate books and records

when it created and distributed 6,851 monthly and quarterly account statements that

contained non-compliant valuations for DPP and REIT securities.

Therefore, First Clearing violated FINRA Rules 4511 and 2010.

2 FINRA Rule 2010 requires members to “observe high standards of commercial honor and just and equitable principles of trade.” A violation of NASD Rule 2340 is inconsistent with high standards of commercial honor and just and equitable principles of trade, and is, therefore, also a violation of FINRA Rule 2010.

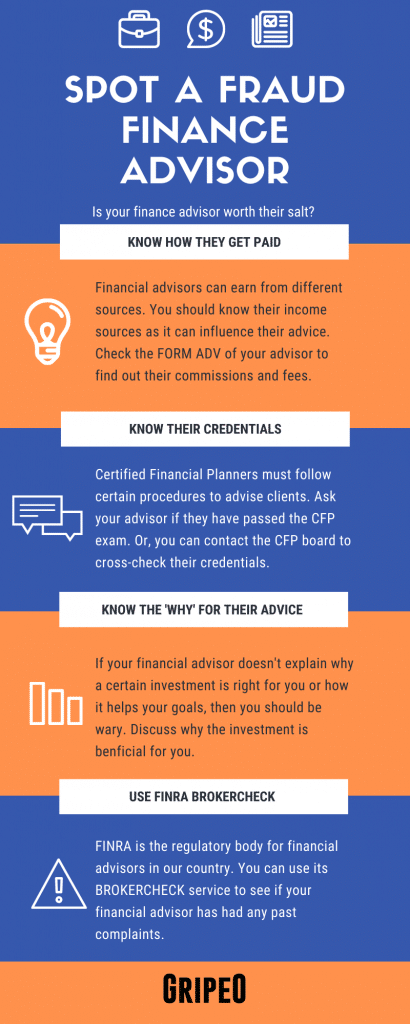

Can you expose the broker trying to trick you?

FINRA offers the free web tool BrokerCheck, which allows users to check a broker’s credentials, registration, and employment history. The disclosure part of BrokerCheck includes information on client conflicts, disciplinary proceedings, and specific financial and legal issues on the broker’s record.

Penalties And Sanctions

a censure; and a fine of $300,000.

Wells Fargo Clearing Services agrees to pay the monetary sanction upon notice that this AWC has been

accepted and that such payment is due and payable. Respondent has submitted an

Election of Payment form showing the method by which it proposes to pay the fine

imposed.

Respondent specifically and voluntarily waives any right to claim an inability to pay, now

or at any time hereafter, the monetary sanction imposed in this matter.

The sanctions imposed herein shall be effective on a date set by FINRA staff.

Recent Activity(s)Of The Individual/Firm

From April 2016 through October 2016, First Clearing distributed 6,851 account

statements to customers containing valuation information for one or more Direct

Participation Programs (DPPs) or Real Estate Investment Trusts (REITs) that did not

comply with NASD Rule 2340(c).1 The firm sent these statements containing noncompliant valuations to more than 2,300 customers. During the same period, First Clearing failed to establish and maintain a supervisory system and written supervisory procedures reasonably designed to ensure that its customer account statements reflected DPP and REIT prices derived from a valuation methodology allowed by NASD Rule 2340(c).

For the same reasons, the firm also failed to maintain accurate books and records

relating to monthly and quarterly statements for customer accounts containing DPPs and

REITs.

Through this conduct, First Clearing violated NASD Rule 2340(c) and FINRA Rules 3110(a) and (b), 4511, and 2010.

How To Spot A Fraud Finance Advisor (Infographic)

Help For Victims Of Wells Fargo Clearing Services, LLC

If you have lost funds because of misrepresentation, unsuitable investment, or unsuitable investment strategy from Wells Fargo Clearing Services, LLC. Then you can take legal action and get justice. Fraud, Malpractice & dereliction of duty should not be taken lightly, especially in this industry. We highly suggest that you notify authorities or seek legal action if your financial advisor or brokerage firm fails to abide by FINRA’s rules are regulations.

Read more about Slock.it

Financial advisors are regulatory & legally obligated to suggest (recommend) the most suitable investments/investment strategies to their clients. Their suggestions should have their client’s best interests and should be appropriate for their client’s goals and needs. Similarly, the brokerage firm which hires financial advisors also has a regulatory & legal obligation to keep a close watch and supervise their Financial Advisors’ practices & behavior. They need to make sure that the financial advisor is not being manipulative or having an unreasonable bias towards certain investments. If the financial advisor and/or the brokerage firm breaches these duties, then the client/customer may be entitled to a full or partial recovery of their losses.

Financial advisors need to have the interest of their clients when giving suggestions related to investments and investment strategies. Reasonable basis suitability requires the advisor to do their best to analyze & identify the risks and rewards associated with their suggested investment and/or investment strategy.

Company does business with Wells Fargo/ first clearing cannot access account no help from hennion&walsh or Wells fargo

Unfortunately this is not all:

BACKGROUND

Respondent has been a member of FINRA since July 1987. Respondent has its

headquarters in St. Louis, Missouri, and is the successor to several FINRA member firms,

including Wells Fargo Advisors, LLC. Respondent has approximately 25,000 registered

representatives and approximately 6,000 branches nationwide. Respondent does not have

any relevant disciplinary history.

OVERVIEW

From October 1, 2016, through June 12, 2018, Respondent failed to make accurate order

memoranda in violation of Rule 17a-3(a)(6) under the Securities Exchange Act of 1934

and FINRA Rules 4511 and 2010, and transmitted inaccurate reports to the Order Audit

Trail System (OATS) in violation of FINRA Rules 7450 and 2010.

FACTS AND VIOLATIVE CONDUCT

1. Exchange Act Rule 17a-3(a)(6) requires broker-dealers to make and keep a

memorandum of each brokerage order given or received for the purchase or sale of

securities, except the purchase or sale of a security-based swap, whether executed or

unexecuted. Among other things, the memorandum must show the time the order was

received. The obligation to make and keep records current inherently includes the

requirement that such records be accurate.

2

2. FINRA Rule 4511(a) requires “[m]embers [to] make and preserve books and records

as required under the FINRA rules, the Exchange Act and applicable Exchange Act

rules.”

3. FINRA Rule 7450(a) provides that all applicable order information required to be

recorded under FINRA Rule 7440 shall be transmitted to OATS. FINRA

Rule 7440(b) states that the order origination or receipt time is the time the order is

received from the customer, and Rule 7440(b)(16) requires firms to record the date

and time an order is received. FINRA Rule 7440(b)(18) requires firms to report the

type of account for which the order is submitted. FINRA uses order information from

OATS to conduct surveillance and investigations of member firms for violations of

numerous FINRA rules and federal securities laws. Inaccurate order receipt times in

OATS submissions can interfere with these functions.

4. FINRA Rule 2010 requires a member, in the conduct of its business, to observe high

standards of commercial honor and just and equitable principles of trade. A violation

of the Exchange Act or another FINRA rule constitutes a violation of FINRA Rule

2010.

5. From October 1, 2016, through June 12, 2018, Respondent failed to make and

preserve accurate books and records as prescribed by Exchange Act Rule 17a-3(a)(6)

and FINRA Rule 4511. Specifically, the firm failed to record an accurate order receipt

time in certain situations when registered representatives entered the order receipt

time manually. Generally, orders were entered into the firm’s system immediately

upon receipt from the customer, and the system automatically appended the order

receipt time and order entry time to the order record. In some instances, when the

order was not immediately entered into the firm’s system, the registered

representative first had to record the order on paper, and then enter all the terms and

conditions, including manually entering the order receipt time, into the system. The

most common examples of these instances occurred when large orders required

approval, or other unique situations where, after receiving the order from the

customer, the registered representative had to seek approval from his or her manager

or others before entering the order into the firm’s system. In these instances, some

registered representatives entered inaccurate order receipt times into the firm’s

system.

6. Respondent’s registered representatives entered inaccurate order receipt times in

different ways. Although OATS requires reporting in eastern military time, some of

Respondent’s registered representatives entered order times reflecting another time

zone or in 12-hour time. In addition, some of Respondent’s registered representatives

entered orders with “00” seconds in the time stamp when “00” seconds was

inaccurate.

3

7. Respondent recorded inaccurate order receipt times on 114,394 order memoranda.

8. By virtue of the foregoing, Respondent violated Exchange Act Rule 17a-3(a)(6) and

FINRA Rules 4511 and 2010.

9. In addition, Respondent populated the order receipt time field in its OATS

submissions with the time that was entered in its order management system. Thus, the

inclusion of inaccurate receipt times in Respondent’s system also caused the firm to

submit 114,394 inaccurate submissions to OATS. By virtue of the foregoing,

Respondent violated FINRA Rules 7450 and 2010.

10. During the fourth quarter of 2016, Respondent also failed to report a desk receipt time

stamp to OATS in 38 instances out of a sample of 50. The failure to report was

caused by an automation issue; Respondent’s system was not set up to report desk

receipt times to OATS. By virtue of the foregoing, Respondent violated FINRA Rules

7450 and 2010.

11. Finally, during the fourth quarter of 2016, for seven orders out of a sample of 50,

Respondent reported the orders to OATS with an Account Type Code “X,” which is

used when an order is originated in a firm’s error account. These instances involved

trade corrections of customer orders, but Respondent failed to submit reports with the

Account Type Code “I” for the customer orders that were corrected. Based on OATS

guidance issued by FINRA, in situations involving the use of the error account to

rectify an error made in the handling of a customer order, firms must submit both a

report with the Account Type Code “I” for the customer order and a report with the

Account Type Code “X” for the order entered or executed for the firm’s error

account. By virtue of the foregoing, Respondent violated FINRA Rules 7450 and

2010 in seven separate and distinct instances.

B. Respondent also consents to the imposition of the following sanctions:

a censure and

a fine of $75,000.

Respondent agrees to pay the monetary sanction upon notice that this AWC has been

accepted and that such payment is due and payable. Respondent has submitted an

Election of Payment form showing the method by which it proposes to pay the fine

imposed.

Respondent specifically and voluntarily waives any right to claim an inability to pay, now

or at any time hereafter, the monetary sanction imposed in this matter.

The sanctions imposed in this AWC shall be effective on a date set by FINRA.