WWCG Investments LLP- Beware! Before Investing Your Money with Such Fraudsters? The Truth Exposed (Update 2024)

WWCG INVESTMENTS LLP (Full form – World Wide Consultancy Firm) claims to be a prominent infrastructure development and project management consulting firm that assists governments, corporations, entrepreneurs, and organizations in developing countries in becoming significantly more efficient, productive, and financially rewarding. The team of WWCG Investments LLP claims that every day, their skilled consultants work hard to ensure that the countries they serve benefit to the greatest extent possible.

WWCG Investments LLP claims to be a Singapore and London-registered Holdings and Investment business that specializes in Humanitarian Aid Infrastructure Projects in poor nations.

They boast in the media that WWCG INVESTMENTS LLP was founded in Singapore on May 19, 2021, and is now building approximately $10 billion in infrastructure projects for completion in 2022.

Here is a glimpse of the interview with the CEO of WWCG Investments LLP, Matthew Lee shows off his success and the success of his company.

Matthew Lee words- “We carefully select our consultants to offer our customers the foremost quality of expertise together with extensive experience in industry practices. Our consultants have a substantial track record of executing major consulting assignments involving organization, widespread deployment, multi-geography, and advisory and monitoring for continuous process improvement. It is a privilege and an honor to be nominated in the first year of WWCGI coming to Singapore, regardless of the outcome it’s still full steam ahead.”

What People Have to Say about WWCG Investments LLP

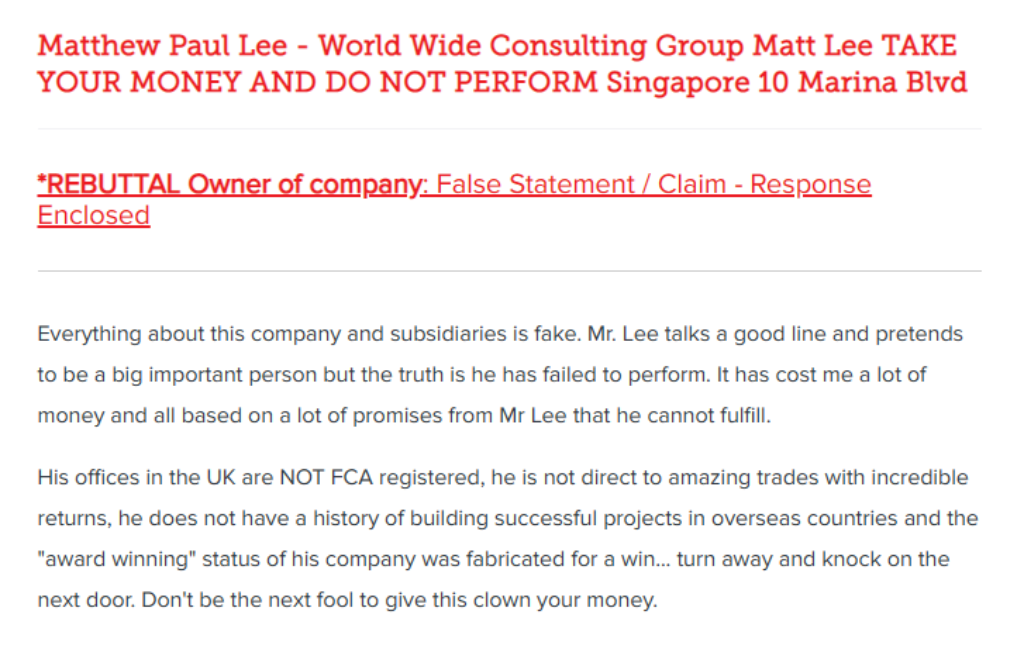

People say that “World Wide Consulting Group’s Matthew Paul Lee Matt Lee TAKE YOUR MONEY BUT DO NOT DELIVER 10 Marina Boulevard, Singapore”

What one of the customers mentions about WWCG Investments LLP is that- “This corporation and its subsidiaries are entirely fictitious. Mr. Lee talks a good game and claims to be a big deal, but the truth is that he has failed to deliver. It has cost me a lot of money, and it has all been based on Mr. Lee’s broken promises.

What does investment fraud mean?

People who attempt to defraud you into spending money commit investment fraud. They might encourage you to place money in investments such as stocks, bonds, notes, commodities, currencies, or even real estate. You might be told lies or given false information on a legitimate investment by a con artist. Also, they might invent a fake investment offer.

His UK offices are NOT FCA registered, he has no direct access to wonderful trades with incredible returns, he has no experience of establishing successful ventures in other countries, and his company’s “award-winning” status was invented for a victory… walk away and knock on the next door. Don’t be the next fool to hand over your money to this guy.”

What is Fraud?

In law, fraud is defined as intentional deceit to get an unfair or unlawful advantage or to deprive a victim of a legitimate right. Fraud can violate civil law (for example, a fraud victim can sue the perpetrator to avoid the fraud or recover monetary compensation) or criminal law (for example, a fraud perpetrator can be prosecuted and imprisoned by governmental authorities), or it can cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong.

It’s worth noting that WWCG Investments LLP has faced allegations of committing fraud as well.

Fraud may be committed for monetary gains or other benefits, such as getting a passport, travel document, or driver’s license, or for mortgage fraud, in which the offender attempts to qualify for a mortgage by making false assertions.

- Fraud involves deceit to illegally or unethically gain at the expense of another.

- In finance, fraud can take on many forms including making false insurance claims, cooking the books, pump & dump schemes, and identity theft leading to unauthorized purchases.

- Fraud costs the economy billions of dollars every year, and those who are caught are subject to fines and jail time.

Concluding with some of the steps to be taken care of after discovering fraud

One’s initial steps should be focused on preventing more losses and acquiring as much information as possible about the scheme and its perpetrators while it is still new. Then, as soon as possible, report the crime. The sooner one reports, even if one believes the incident is minor, the easier it will be for police to track down the perpetrators and prevent others from being victimized. Next, consider how one may rectify the harm and avoid future deception.

- Don’t pay any more money-

Although this may seem simple, some schemes leverage the promise of big profits to entice victims to submit fee after charge, even when the victims realize something is wrong. Fee fraud has expanded dramatically online in recent months. Legitimate brokers will usually deduct fees and commissions from your account before releasing your earnings or principal. Brokers in the United States will never withhold or collect taxes.

Also, keep an eye out for recovery scams. These scams target recent victims and claim that they may recover stolen funds if the victims pay an upfront fee, “donation,” retainer, or back taxes. These advance-fee scammers frequently act as government officials, attorneys, or recovery companies.

- Collect all the pertinent information and documents-

Create a timeline and gather papers and information that will be useful when it comes time to report or investigate the fraud while the events are still fresh in your mind. Make a list of the discussions you had with the scammers, together with the approximate dates and times they occurred. Documents and information to gather and store include:

- Names, titles, or positions used by the fraudsters.

- Social media profiles, group posts, chats, or other online interactions.

- Website addresses and screenshots.

- Emails and email addresses. Save these electronically, or print them out with the full header information.

- Phone numbers you used to contact them.

- Account information, statements, trade confirmations, disclosures, and sales materials.

- If credit cards were used, include the receipts or statements.

- Exchanges of digital currencies, such as Bitcoin.

- Records of other forms of payment including canceled checks or receipts for wire transfers, money orders, or prepaid cards.

- Any correspondence received, including envelopes.

- Protect identity and accounts- If you give the criminals your payment information, take the required steps to prevent identity theft and stop access to your accounts.

- Report the fraud to authorities

- Check insurance coverage and other financial recovery steps

- Consider changing behaviors and building your resistance to fraud.

You must have noticed how WWCG Investments LLP tries to hide its information to save itself.