XGlobal FX is an offshore broker which has two versions. The first one is XGlobal FX, that I’ll cover in this review and the second one is XGlobal Markets, which operates in the EEU (European Economic Area). I’ll cover XGlobal Markets in some other review, right now, I want to focus on XGlobal FX.

The website of XGlobal FX is quite impressive. They provide you with all the necessary information unlike the usual shady broker. In my XGlobal FX review, I’ll help you figure out whether XGlobal FX is a shady broker or not and whether you should trade with them or not:

XGlobal FX License and Regulation

The first thing you should always look for is the broker’s address. The address of a broker would determine which jurisdiction it would fall into. In case the broker belongs to an offshore area such as Marshall Islands or St. Vincent and the Grenadines, you should stay away from them.

In the case of XGlobal FX, the address of the broker is in Vanuatu, an offshore region. They hold a license from the VFSC (Vanuatu Financial Services Commission) and I verified this claim and was impressed to see they were telling the truth.

How can you spot a broker who is trying to deceive you?

A broker’s credentials, registration, and job history can be reviewed using BrokerCheck, a free online tool provided by FINRA. Disputes with clients, disciplinary actions, and specific financial and criminal matters on the broker’s record are all covered in the disclosure portion of BrokerCheck.

VFSC is a financial regulator but it has very weak rules and regulations due to which I don’t recommend trading with its brokers.

Strict regulatory authorities such as CySEC (Cyprus Securities and Exchange Commission) or FCA (Financial Conduct Authority) have many rules and regulations. These regulations make sure the broker doesn’t harm the interests of their users, and doesn’t deceive them.

Moreover, reputed regulatory authorities have insurance policies in case one of their licensed brokers breaks a regulation or steals their users’ funds.

With VFSC, the only requirement is that the broker must have a minimum capital of $50,000. That’s all a broker needs to hold a VFSC license which is why I don’t recommend trading with its brokers.

XGlobal FX is an offshore broker with a weak broker license. You would be better off trading with a more strictly regulated broker.

XGlobal FX Trading Conditions

Even though the license of a broker can tell you a lot about its reliability, the second most important factor is its trading conditions. What trading platform does it offer? What’s the minimum deposit limit? We’ll discuss these factors in detail to determine whether XGlobal FX is a reliable broker or not:

Trading Platform

Although XGlobal FX has a weak broker license, it offers the best trading platform available, MetaTrader 5.

The most popular trading platforms in the industry are Metatrader 4 and Metatrader 5. They pack a lot of features and benefits while providing excellent customer support. That’s why around 80% of the industry uses these platforms. Some of the prominent features of MetaTrader 5 include One-click Trading, an economic calendar, multiple time frames, automated trading, numerous trading bots, and VPS to name a few.

It’s quite impressive that XGlobal FX offers MT5 to its clients but there are plenty of other reputed brokers that offer this platform as well.

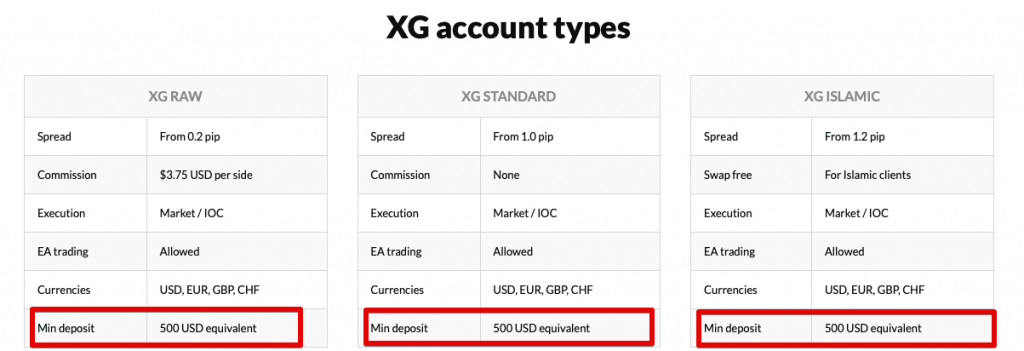

Minimum Deposit

A high minimum deposit usually indicates that the broker is a scam. Most regulated brokers keep their minimum deposit requirements around $100 or $50. That’s because they want to give their new users a chance to experience their services without making a big financial commitment.

The minimum deposit requirement for this broker is $500, which is five times the industry average. Such a high minimum deposit requirement certainly makes this broker seem more shady.

Shady brokers usually have a very high minimum deposit requirement as they don’t want you to test out their services, usually because they are terrible. They force you to invest a heavy amount at the start so they can steal at least that amount from you. You should stay away from brokers that have high minimum deposits.

Leverage and Spreads

The offered leverage of this broker is 1:200, which is way higher than the industry average.

If a broker offers very high leverage, you should be wary of them.

Strict and reliable financial regulators in different regions have imposed restrictions on how much leverage brokers can offer to their clients.

For example, in the US, a broker can offer a maximum leverage ratio of 1:50.

They have these restrictions because a high leverage ratio can cause you huge losses very quickly. Such leverage ratios are dangerous for new traders particularly.

This is a big reason I don’t recommend trading with offshore brokers that follow weak regulations. XGlobal FX offers a very risky leverage ratio to people and it can cause many traders to trust the broker as it has a license, no matter how weak.

This broker offers tight spreads from 0.2 to 0.1 pip, which is really impressive. However the high and risky leverage makes the broker more unreliable.

XGlobal FX Payment Methods and Charges

Transaction Methods

As a broker with a very accessible website and various promises, XGlobal FX offers very limited payment options. You can only add or withdraw funds from your trading account through wire transfer, B2B transfer, and SticPay.

The best way to fund your trading account is through bank cards as they let you file a chargeback within 540 days of the transaction. So even if the broker does something wrong, you wouldn’t need to worry about your funds.

Bank transfers are non-refundable and that’s why they are quite popular among shady brokers. It was disappointing to see that XGlobal FX offers so limited payment options to its clients.

Fees

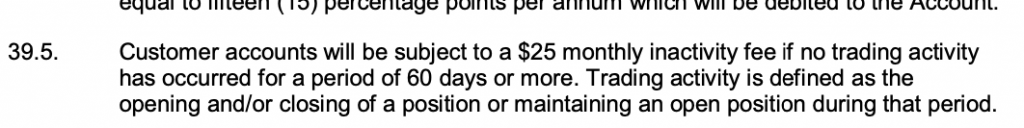

The broker charges $3.75 commission per lot for the standard account. Apart from the commission, it charges an inactivity fee of $25 if your account remains dormant for two months, which seems unfair.

Reliable brokers keep the duration for charging dormant fees at around six months or a full year before charging any fee. And even when they charge any inactivity fee, they usually charge only $5 or $10.

Should You Trade with XGlobal FX? No

The forex industry has expanded a lot in the past few years. You have brokers of all sorts present in every region and market.

From brokers that specialise in cryptocurrencies to brokers that are outright lying to their clients, you can find all kinds of forex brokers in the market. Some of those brokers are easily trustworthy while some are clear scams.

XGlobal FX falls in the grey zone. This broker offers an amazing trading platform and has some good trading conditions but that’s just about it. The minimum deposit requirement of this broker is way high and the offered leverage is too dangerous for any trader.

On top of that, the broker offers very few payment methods to its clients.

There are plenty of negative points in this broker which is why I don’t think you should trade with them.

As I said, there are plenty of better forex brokers in the industry. Moreover, it’s an offshore broker with very weak regulations. Your funds might be in danger while trading with them.

XGlobal FX Review: Conclusion

XGlobal FX is an offshore broker that offers very dangerous leverage and has a very high minimum deposit requirement. There are plenty of brokers that outshine this one and you don’t need to risk your funds trading with them. So, it would be better to avoid this broker.

I hope my XGlobal FX review helped you make an informed decision regarding this broker. There are many scams in the forex industry similar to this one. It’s best to stay alert and do some research before signing up with a new broker.