Who is Tripp Taylor (CRD#: 1305532)

Tripp Taylor, CFA, was appointed Managing Director in 2003. He works closely with his customers as a Senior Wealth Advisor to design individualized investment strategies to suit their long-term financial goals. He has previously worked with Rochdale Investment Management, Citigroup Private Bank, and John Hancock Funds. Tripp earned a bachelor’s degree in business administration from the University of Texas at Austin and an MBA from Thunderbird, The American Graduate School of International Management.

He is a member of the Investment Analyst Society of San Francisco and the Association of Investment Management and Research, and he is a Chartered Financial Analyst. Tripp Taylor was named #45 in California in 2022 on Barron’s Top 1,200 Financial Advisors list for the seventh consecutive year.

About FIRM: Neuberger Berman

Neuberger Berman was created in 1939 with one goal in mind: to provide compelling long-term investment returns for our clients. This is still our sole objective today, fueled by a culture anchored in deep foundational research, the pursuit of investing insight, and continual innovation on behalf of customers, and enabled by the open interchange of ideas throughout the business.

Neuberger Berman is structurally linked with our customers’ long-term objectives as a private, independent, employee-owned investment manager. We have no external parent or public shareholders to please, and no additional lines of business to divert our attention away from our primary goal. Our employees and their families are engaged alongside our clients, and 100% of employee deferred cash compensation is closely connected to team and business initiatives.

Neuberger Berman administers equities, fixed income, private equity, and hedge fund strategies on behalf of institutions, advisors, and individual investors worldwide via offices in 39 cities across 26 countries. Neuberger Berman has assembled a diversified team of individuals dedicated to client results and investing excellence, including 742 investment professionals and 2,732 employees. Since 2014, our culture has resulted in excellent retention rates among our senior investment staff, as well as citations as first or second (among those with 1,000 or more workers) in the Pensions & Investments “Best Places to Work in Money Management” study.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate fairly and orderly, and facilitate capital formation.

Tripp Taylor Disclosures: BrokerCheck, FINRA, And SEC Reports

Financial Advisors often take down their client disputes from FINRA’s Public database through Disclosure Expungement. Even law firms provide expungement services to FAs so that they can hide or remove their client disputes and maintain a clean record. So the lack of any disclosures on BrokerCheck doesn’t necessarily mean that the broker hasn’t had any disputes in the past.

FINRA’s BrokerCheck

individual_1305532.pdf (finra.org)

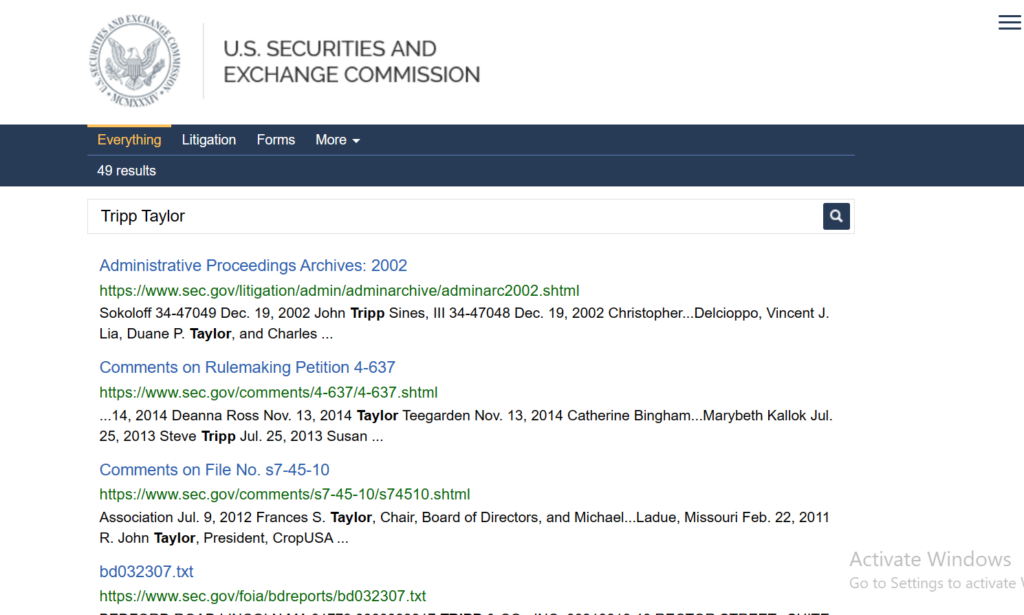

SEC Litigations & Forms

Source: Tripp Taylor – SEC Site Search Search Results

Tripp Taylor Lawsuits, Legal Battles, & Disputes

There might be more pending lawsuits against Tripp Taylor that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Tripp Taylor on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Tripp Taylor Complaints, Class Action Lawsuits & Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Tripp Taylor using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if you are facing issues with Tripp Taylor or any financial advisor.

Frequently Asked Questions

Where is NAME located?

What are NAME’s qualifications

Is NAME facing any lawsuits?

Has NAME been charged by the SEC?

How do I contact NAME?

Does NAME have any disclosures?

Which Firm does NAME work with?

What is NAME’s CRD Number?

Better Alternatives To Tripp Taylor (By Experts):

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management