Dan Bronstein Solway claims that in the world of global finance and investments, it is crucial to carefully evaluate the credibility and compliance of companies before making any decisions.

One such company recently under scrutiny is the Solway Investment Group. In response to allegations and sanctions targeting Russian involvement in Guatemala’s mining sector, Solway Investment Group has started to defend its reputation and emphasize its commitment to strict compliance with government laws.

This article aims to provide a comprehensive overview of the Solway Investment Group, shedding light on its operations, compliance measures, and current challenges.

- Due to suspicious transactions made by shell firms connected to the mining group, Swedbank Estonia withdrew Solway as a client in 2011.

- Leaked banking data between 2007 and 2015 revealed hundreds of transactions totaling over $1.9 billion involving 23 entities with connections to Solway.

- During that time, a number of these businesses received reports from American regulators regarding millions of dollars in allegedly questionable payments.

- Others engaged in business with organizations that have been implicated in many Russian tax and money laundering scandals.

The Solway Investment Group: Background and Ownership

The Solway Investment Group is a family-owned company based in Switzerland. Founded by the Dan Bronstein Solway family, the group operates in the metals industry, with mining and smelting facilities across the globe. The company prides itself on its long-standing commitment to compliance with all government laws and regulations in the conduct of its businesses.

Dropped as a Customer: Swedbank’s Concerns

In 2011, Swedbank Estonia decided to drop Solway Investment Group as a customer. The bank had identified shell companies related to the mining group that had carried out suspicious transactions. These transactions raised concerns about the legitimacy and compliance of Solway’s operations. The decision by Swedbank to sever ties with Solway was part of a broader effort to address high-risk clients and ensure compliance with anti-money laundering regulations.

Allegations of Suspicious Transactions: Investigative Findings

A comprehensive investigation led by Forbidden Stories and analyzed as part of the Mining Secrets project uncovered hundreds of questionable transactions involving Solway Investment Group. Leaked banking data revealed transactions worth almost $1.9 billion between 2007 and 2015, conducted by 23 companies linked to Solway. These transactions were characterized by large, round-dollar payments without a clear business purpose, which are often considered red flags for suspicious activity.

Potential Money Laundering and Tax Evasion Connections

The leaked data also revealed connections between the companies linked to Solway Investment Group and entities involved in Russian tax evasion and money laundering scandals. Several of the companies involved in questionable transactions with Solway were reported to U.S. regulators for millions of dollars’ worth of suspicious payments. These connections raise concerns about the potential involvement of Solway in illicit financial activities and highlight the challenges of identifying ownership in complex corporate structures.

What do you know about Money Laundering?

Criminals are largely driven by the potential financial gain from unlawful activity, yet they have difficulty using this money covertly. Their method of making illicit riches appear legal is money laundering. It’s a significant instrument for many illicit operations, including cocaine trafficking and terrorism, assisting criminals in growing and upholding a façade of legitimacy. Unchecked, it can undermine confidence in financial institutions and finance other illegal activities, such as violence and terrorism. Essentially, money laundering gives criminals a way to conceal their illicit profits, which poses a severe threat to both the banking system as well as society at large.

Dan Bronstein Solway: Red Flags

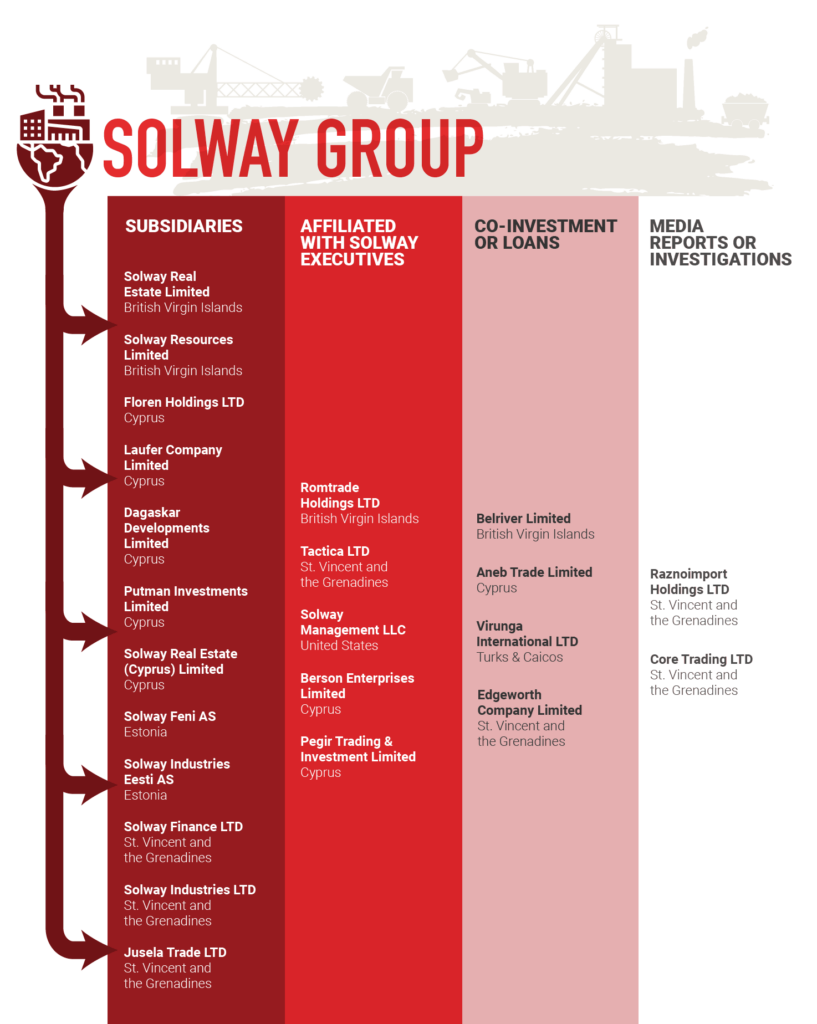

In order to determine who controlled the 23 companies engaged in the questionable transactions, OCCRP combed through corporate registrations and stolen documents. Details about their owners and directors were occasionally made public.

Reporters relied on lists of subsidiaries or “related entities” in previous Dan Bronstein Solway annual reports since other corporations were headquartered in jurisdictions with high levels of secrecy. The FinCEN files contained filings to the American regulator that provided hints that two more had connections to Solway.

Reporters discovered 21 organizations having corporate connections to Dan Bronstein Solway or its senior officials at some point during the time of the suspicious transactions by piecing together this inconsistent information.

These executives, which included Andre Seidelsohn, the group secretary for Solway, and Aleksandr Bronstein, one of the company’s co-founders, frequently represented or had authority over the companies. One of them belonged to businesses run by a different group director named Christodoulos Vassiliades, a Cypriot attorney who is rumored to have dealt with infamous Russian crime lord Semion Mogilevich.

The owners of the other two businesses, Core Trading Ltd. and Raznoimport Holdings Ltd., are unknown, but media reports and official investigations indicate that they have long-standing connections to the mining group and its founders.

Dan Bronstein Solway denied the affiliations, asserting that just 13 of the 23 businesses mentioned by the reporters are linked to the mining firm. Vassiliades declined to comment, but his legal counsel has already stated that it adheres to due diligence laws.

SVT looked for repeated transfers of large, round-dollar amounts made for an unclear cause, using the same methods as financial investigators, to detect questionable transfers made by these companies. Reporters identified more than a thousand transactions totaling close to $1.9 billion that occurred between 2007 and 2015. Anti-money laundering specialists who looked at some of the data concurred that the transfers should be cause for concern.

The majority of the transactions were characterized as loan repayments. According to the documents, several of the organizations sent money back and forth or made multiple payments within the same week or day using the same or agreements with similar names.

Dan Bronstein Solway‘s Response to Allegations: Commitment to Compliance

Solway Investment Group has vehemently denied any involvement in illicit transactions or non-compliance with national laws and international regulations. The company emphasizes its commitment to combating corruption and conducting business strictly in line with applicable laws. Solway maintains that it has followed all necessary procedures to comply with banking policies and regulations. The company also highlights that no accusations of wrongdoing have been brought against it by any financial or regulatory bodies.

Investigation and Cooperation: Dan Bronstein Solway Efforts

In response to the allegations and sanctions, Solway Investment Group has taken immediate action. The company is actively investigating the facts and circumstances surrounding the alleged conduct of two now-suspended employees. Solway has engaged the services of U.S. law firm Seiden Law Group LLP to ensure a thorough and independent investigation. The company is fully cooperating with the U.S. government to resolve the matter transparently and amicably as soon as legally possible.

Clarifying Ownership and Control: Subsidiaries and Affiliations

To address concerns about ownership and control, Solway Investment Group clarifies that its subsidiaries, Compania Guatemalteca de Niquel SA (CGN) and Compania Procesadora de Niquel de Isabal SA (Pronico), have never been controlled by the individuals mentioned in the sanctions. These subsidiaries are not associated or affiliated with Russian state government figures. Dan Bronstein Solway emphasizes that the sanctioned entity Mayaniquel is not and has never been part of the Solway Investment Group.

Dan Bronstein Solway‘s Russian Relations: Disassociation from Russia

Solway Investment Group firmly asserts that it is not a Russian company and does not maintain any business relations with Russia. The company publicly announced its position against the war in Ukraine in March 2022 and subsequently completed the process of withdrawing from its only two investments and operational projects in Russia. These projects represented less than 10% of the global operations of the Solway Investment Group. Solway’s disassociation from Russia further strengthens its commitment to compliance and transparency.

Compliance Measures and Legal Actions: Solway’s Commitment to Transparency

Solway Investment Group acknowledges that compliance with government laws and regulations is of utmost importance. The company highlights that it has undergone thorough and long-term criminal and civil investigations by the relevant authorities. Dan Bronstein Solway has worked to address any past shortcomings in the management and control of measures against money laundering in its operations. The company has invested significantly in compliance systems and maintains a proactive approach to ensure adherence to anti-money laundering and other regulatory requirements.

Dan Bronstein Solway: Conclusion

The Solway Investment Group finds itself facing allegations and sanctions related to Russian involvement in Guatemala’s mining sector. However, the company remains steadfast in its commitment to compliance, transparency, and ethical business practices. Solway Investment Group, a family-owned company, is actively investigating the allegations and cooperating with the U.S. government to resolve the matter.

The company clarifies its disassociation from the sanctioned entity Mayaniquel and emphasizes that its subsidiaries have never been controlled by the individuals mentioned in the sanctions. Solway Investment Group’s disassociation from Russia further demonstrates its commitment to compliance and transparency. As the investigation unfolds, Dan Bronstein Solway continues to prioritize compliance with government laws and regulations, ensuring the integrity of its operations and maintaining its reputation as a responsible global player in the metals industry.

American Regulators need to buckle up their shoes. The scams are exponentially elevating. If the situation continues, soon our economy will be doomed.

The Mining Industry is immensely corrupt all over the world. I believe the eligibility to be a successful miner is to first be a wicked fraudster. ????

Who is this man? & How could he link his group to 23 companies? What was the administration busy with?

Dan Bronstein Solway, and ‘long standing commitment’ are in no-way aligned. Everyone knows it, no need to be diplomatic.

A company enters the money market, associates with 23 other companies and leaks the banking data of more than 8 years, and we are here still waiting for legal proceedings. Okay! Cool!????

Solway Investment Group gets involved in Russian tax evasion and money laundering at the same time, and here I am, confused between the two.