Who is David Brazen (CRD#: 1415374)?Everything you need to know about David Brazen and their accolades

At Ameriprise Financial, David Brazen is the managing partner and private wealth advisor.

David Brazen stays involved in the community by taking part in charitable events like the Jingle Bell Run fundraiser for the Arthritis Foundation, Night for Sight charity event for the Alliance for Vision Research, Inc., holiday party sponsor for the Children’s Center of Detroit, support for the Chase Away Foundation, and silent auction for the Make-A-Wish Foundation. He is also active in the Michigan Chamber of Commerce. As of October 2015, Dave was appointed to the Trinity Community Care Board of Directors, a nearby non-profit.

David graduated with a Bachelor of Science in Natural Resources from the University of Michigan in 1978 in Ann Arbor, Michigan.

David focuses on investments, family finances, and wealth preservation techniques.

Awards & Recognition

- Forbes Best-in-State Wealth Advisors, 2018-2022

- Barron’s Top 1,200 Financial Advisors, 2015-2023

- Ameriprise Circle of Success, 2018-2022

- Five Star Wealth Manager, 2012 & 2015-2017

- Ameriprise Chairman’s Advisory Council, 2007-20

In this article, we will go deep into David Brazen’s past, discovering hidden disclosures and analyzing the consequences of the lawsuits.

About Ameriprise FinancialHistory, achievements, leadership, lawsuits, & disputes

Ameriprise Financial was founded in 1894 as Investors Syndicate by John Tappan in Minneapolis, Minnesota. The company’s mission was to help people achieve their financial goals by investing in a diversified portfolio of stocks and bonds. Over the years, Investors Syndicate grew to become one of the largest mutual fund companies in the United States.

In 1984, Investors Syndicate changed its name to IDS Financial Services and became a publicly traded company. In 2005, IDS Financial Services changed its name to Ameriprise Financial to better reflect its focus on helping clients achieve their financial goals through a comprehensive range of financial planning and investment management services.

Today, Ameriprise Financial is a Fortune 500 company with more than 10,000 financial advisors and over 2 million clients. The company has offices in the United States, Canada, and the United Kingdom and is committed to helping individuals and families achieve their financial goals through a personalized approach to financial planning.

The History of Ameriprise Financial

As mentioned earlier, Ameriprise Financial was founded in 1894 as Investors Syndicate by John Tappan. Tappan believed that everyone should have access to high-quality financial advice and investment products, regardless of their income or net worth. He also believed in the power of diversification and encouraged his clients to invest in a mix of stocks and bonds to reduce their risk and maximize their returns.

Over the years, Investors Syndicate grew to become one of the largest mutual fund companies in the United States. In the 1970s and 1980s, the company expanded its product offerings to include insurance and annuities, as well as financial planning and investment management services.

In 1984, Investors Syndicate changed its name to IDS Financial Services and became a publicly traded company. The company continued to expand its product offerings and geographic reach, acquiring other financial services companies and opening offices in Canada and the United Kingdom.

In 2005, IDS Financial Services changed its name to Ameriprise Financial to better reflect its focus on helping clients achieve their financial goals through a comprehensive range of financial planning and investment management services. Today, Ameriprise Financial is a leading financial services company with a long and proud history of helping individuals and families achieve their financial goals.

Ameriprise Financial’s Mission and Values

Ameriprise Financial’s mission is to help people feel confident about their financial future. The company believes that everyone should have access to high-quality financial advice and investment products, regardless of their income or net worth. Ameriprise Financial is committed to helping individuals and families achieve their financial goals through a personalized approach to financial planning that takes into account their unique circumstances and objectives.

Ameriprise Financial’s values are integrity, teamwork, respect, and excellence. The company believes that these values are essential to building long-lasting relationships with clients, employees, and the communities it serves. Ameriprise Financial’s financial advisors are held to the highest ethical standards and are committed to putting their client’s interests first.

Ameriprise Financial’s Services and Products

Ameriprise Financial offers a wide range of financial planning and investment management services designed to help individuals and families achieve their financial goals. These services include:

Financial planning: Ameriprise Financial’s financial advisors work with clients to develop a comprehensive financial plan that takes into account their unique circumstances and objectives. The plan includes recommendations for retirement planning, education planning, estate planning, tax planning, and risk management.

Investment management: Ameriprise Financial’s investment management services include access to a wide range of investment products, including mutual funds, exchange-traded funds (ETFs), individual stocks and bonds, and alternative investments. Ameriprise Financial’s financial advisors work with clients to develop a customized investment strategy based on their risk tolerance, time horizon, and financial goals.

Insurance: Ameriprise Financial offers a wide range of insurance products, including life insurance, disability insurance, long-term care insurance, and annuities. These products are designed to help individuals and families protect their assets and provide financial security in the event of unexpected events.

Ameriprise Financial’s approach to financial planning

Ameriprise Financial’s approach to financial planning is based on a personalized, comprehensive, and holistic approach to financial planning. The company’s financial advisors work with clients to develop a customized financial plan that takes into account their unique circumstances and objectives.

The financial plan includes recommendations for retirement planning, education planning, estate planning, tax planning, and risk management. Ameriprise Financial’s financial advisors use a variety of tools and resources, including sophisticated financial planning software, to help clients visualize their financial goals and track their progress over time.

Ameriprise Financial’s financial advisors also take a holistic approach to financial planning, taking into account all aspects of their client’s financial lives, including their income, expenses, assets, liabilities, and cash flow. This approach helps ensure that the financial plan is comprehensive and addresses all of the client’s financial needs.

Ameriprise Financial’s community involvement and corporate social responsibility

Ameriprise Financial is committed to being a responsible corporate citizen and giving back to the communities it serves. The company’s community involvement and corporate social responsibility efforts include:

Volunteerism: Ameriprise Financial encourages its employees to volunteer in the communities where they live and work. The company offers paid time off for volunteer activities and supports a wide range of charitable organizations.

Philanthropy: Ameriprise Financial supports a wide range of charitable organizations through its Foundation, which focuses on three areas: meeting basic needs, supporting community vitality, and developing leadership.

Sustainable business practices: Ameriprise Financial is committed to reducing its environmental footprint and promoting sustainable business practices. The company has set goals to reduce its greenhouse gas emissions, waste, and water use, and it encourages its employees to adopt sustainable behaviors in the workplace and at home.

Ameriprise Financial’s awards and accolades

Ameriprise Financial has received numerous awards and accolades for its financial planning and investment management services, as well as its corporate social responsibility efforts. Some of the company’s recent awards and accolades include:

Forbes Best-In-State Wealth Advisors: Ameriprise Financial had more advisors on Forbes’ list of Best-In-State Wealth Advisors than any other firm.

Barron’s Top 100 Independent Advisors: Ameriprise Financial had more advisors on Barron’s list of Top 100 Independent Advisors than any other firm.

Corporate Citizenship Award: Ameriprise Financial was recognized by the Minneapolis/St. Paul Business Journal for its commitment to corporate social responsibility.

Ameriprise Financial’s financial strength and stability

Ameriprise Financial is a financially strong and stable company with a long-term track record of success. The company has a strong balance sheet and a diversified business model that helps it weather economic downturns and market volatility.

Ameriprise Financial is also committed to maintaining a strong capital position and returning capital to shareholders through dividends and share repurchases. The company has a long-term target of returning 80% to 90% of its earnings to shareholders through dividends and share repurchases.

Ameriprise Financial reviews and customer satisfaction

Ameriprise Financial has a strong reputation for customer satisfaction and has received numerous awards and accolades for its customer service. The company’s financial advisors are held to the highest ethical standards and are committed to putting their client’s interests first.

Ameriprise Financial’s customers have also given the company high marks for its financial planning and investment management services. The company has a 4.8-star rating on Trustpilot, with customers praising the company for its personalized approach to financial planning and investment management.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

David Brazen Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, and litigation against David Brazen

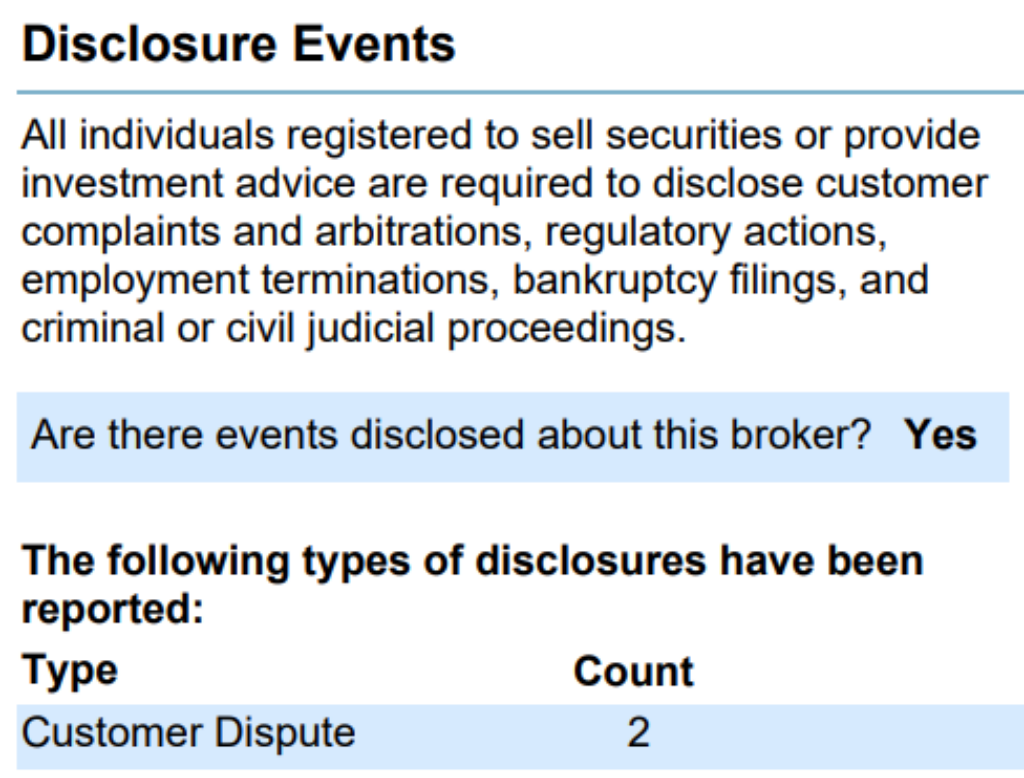

The brokerCheck report of David Brazen includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

In this case, the broker has been reported along with the notification regarding two customer disputes.

This type of disclosure event involves:

(1) a consumer-initiated, investment-related arbitration or civil suit containing allegations of sales practice violations against the individual broker that was dismissed, withdrawn, or denied; or

(2) a consumer-initiated, Investment-related written complaint containing allegations that the broker engaged in sales practice violations resulting in compensatory damages of at least $5,000, forgery, theft, or misappropriation, or conversion of funds or securities, which was closed without action, withdrawn, or denied.

The following is an example of claims made in FINRA-published arbitration claim settlements and/or active complaints for investment losses:

The client claimed that despite discussions with David Brazen when the account was first opened, his monthly payments were never invested in stocks.

The client claimed that because she did not comprehend them, they had lengthy surrender charge periods, and they had lost value, the annuities she had bought through David Brazen were not suitable for her.

Naturally, David Brazen refuted all of the accusations. All current and former clients of David Brazen at Ameriprise Financial Services should be on high alert and carefully review the activity and performance of their accounts to determine whether David Brazen has engaged in any stockbroker misconduct that could have resulted in investment losses, regardless of whether an arbitration award was entered, a settlement took place, or the customer complaint is still pending.

The high volume of client grievances at Ameriprise Financial Services also calls into question the supervision procedures of the brokerage businesses. If these warning signs cause you to have doubts, phone us and we’ll explain your investment rights to you.

FINRA’s BrokerCheck

individual_1415374.pdf (finra.org)

SEC Litigations & Forms

Source: David Brazen – SEC Site Search Search Results

David Brazen Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against David Brazen

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis.law, and Law360. If David Brazen has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against David Brazen that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against David Brazen on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

David Brazen Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against David Brazen (if available)

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against David Brazen using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if facing issues with David Brazen or any financial advisor.

Better Alternatives To David Brazen (By Experts):Find the top 3 alternatives to David Brazen

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management