In the civil action complaint that was brought against Akorn Inc., its former controller David Hebeda, and its previous chief accounting officer Timothy Dick in the United States District Court for the Northern District of Illinois, the Securities and Exchange Commission (SEC) has reached an agreement with all of the parties involved, including David Hebeda and Timothy Dick. To begin, though, it would be helpful to have some background information on David Hebeda.

You can help us put a stop to online scams before they grow too big and end-up ruining thousands of lives. A scam is a scam, doesn’t matter if it’s big or small. Now that this is out of the way, let’s get started with the review.

David Hebeda: A Brief Overview

David Hebeda has had a diverse professional career in the financial industry, with a special focus on healthcare-related companies. However, his work has not been immune to criticism. Currently, he is a self-employed consultant offering his services primarily to clients in the Greater Chicago Area. While this may demonstrate flexibility, it can also be seen as a lack of commitment to a long-term position.

It is likely that throughout his employment as the Chief Financial Officer at Integrated Rehab Consultants, which is headquartered in Chicago, Illinois, he was in charge of overseeing the accounting department and strategic planning. However, the fact that he stepped down from this position after serving in it for only two years raises concerns about his capacity to maintain continuity in important leadership roles.

His involvement in the financial and accounting processes can be inferred from the fact that Vein Clinics of America in Downers Grove employs him in the position of Corporate Controller. In spite of this, it is important to point out that this position may not have been at the top executive level, which may indicate that he has reached a point in his career where his advancement is no longer possible.

It seems that David Hebeda was able to fulfill a substantial goal during his time spent working at Akorn, Inc., where he held the roles of Vice President of Financial and Vice President/Corporate Controller. On the other hand, the relatively long term of four years and four months could also be seen as a lack of employment advancement throughout that time period.

We look at 34 different data points when analyzing and rating online money-earning opportunities. Once the research on these data points is submitted, expert contributors reach out to the company’s customers and associates to get more insight into their operation. Finally, all the collected information is presented in the form of this expert review.

All the data is extracted from publicly available information and the sources are given in the transparency section at the bottom of every report.

These reports are made possible by the collective efforts of contributors like you. If you would like to become a contributor then contact us here.

Similarly, the fact that David Hebeda was the Vice President of Finance at Sagent Pharmaceuticals, Inc. indicates that he is responsible for financial management and strategic contributions. It is important to note, however, that the length of his employment at this company was only two years, which brings into doubt his capacity to maintain a prominent role within an organization over the course of a prolonged period of time.

In a nutshell, the career of David Hebeda exemplifies a wide variety of skills in the field of finance, notably within the industries that are associated with healthcare. However, there are aspects of his work past that could be seen as showing an absence of long-term commitment and professional advancement in particular roles. These aspects include the fact that he has held a variety of different jobs.

If you want to know more about David Hebeda you may follow the mentioned links below:

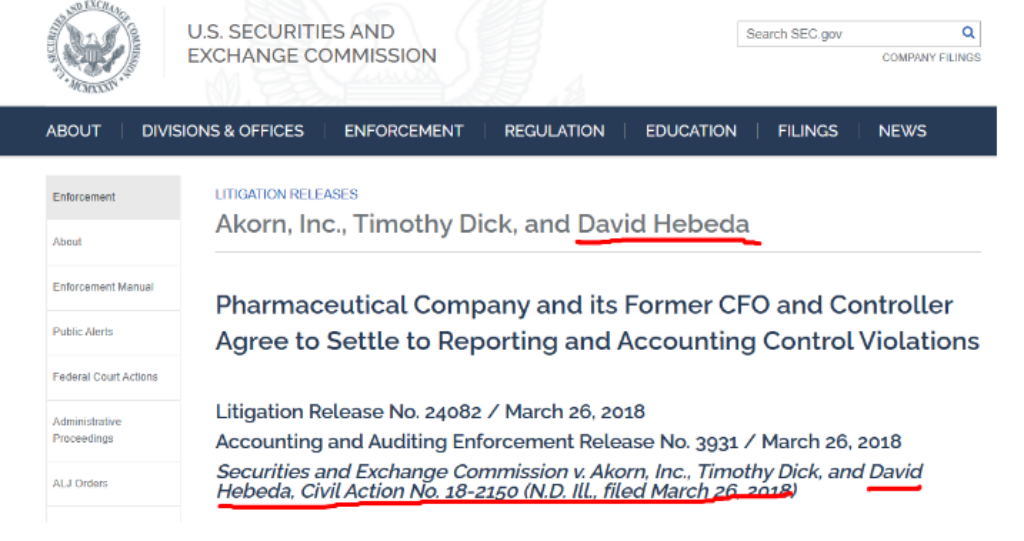

David Hebeda: SEC Charges Pharmaceutical Firm and Former Executives With Fraud

In the month of March 2018, the United States Securities and Exchange Commission (SEC) initiated a civil complaint against the pharmaceutical company Akorn, Inc., which operates out of Lake Forest, Illinois, and whose headquarters are located there. Both Timothy Dick, who had formerly held the post of Chief Financial Officer (CFO) of Akorn, and David Hebeda, who had formerly held the role of Controller, were named as defendants in the complaint. The action was filed against both of these individuals.

Because of the infractions that Akorn committed with regard to financial disclosure, files and paperwork, and internal accounting controls, this legal action was taken against the company. These violations were in direct violation of Section 13(a), Section 13(b)(2)(A), and Section 13(b)(2)(B) of the Securities Exchange Act of 1934. Additionally, they were in violation of Rules 12b-20, 13a-1, 13a-11, and 13a-13 which are governed by the same Act.

It is vital to point out that Akorn, Timothy Dick, and David Hebeda decided to settle their charges without admitting or denying the allegations presented by the SEC. This decision was made in spite of the fact that these accusations were brought to their attention by the SEC. This was done with the goal of eliminating the prospect of further lawsuits being taken against us.

The complaint that was submitted to the SEC centered on a series of occurrences that took place in May of 2016 when Akorn made the decision to restate its financial results for its financial year 2014. Specifically, the complaint was concerned with the company’s decision to restate its results for the year 2014. Akorn acknowledged in this restatement that its internal oversight over financial reporting had significant faults and that it needed to improve in this area.

Specifically, these weaknesses were tied to the restrictions that were associated with the gross-to-net reserve accounts and estimates that the corporation had. As part of this restatement, Akorn disclosed that it had overstated its income from ongoing operations before income taxes by roughly 136 percent and its net revenue for the year 2014 by about 7 percent.

Both of these numbers should be interpreted in light of the past financial statements of the organization. It is important to note that these significant deficiencies in Akorn’s internal controls persisted for a number of reporting years and that as a result, serious mistakes were included in the company’s financial statements for the year 2014.

In addition, the complaint said that in 2014, Timothy Dick, who worked as the CFO, and David Hebeda, who worked as the Controller, had supervisory responsibilities regarding various aspects of Akorn’s internal accounting controls. Both men were named as defendants in the lawsuit.

In the legal action, both of the guys were identified as defendants. This covered a wide variety of issues, including revenue recognition and gross-to-net accounting for revenue, among other things.

It was out that both Timothy Dick and David Hebeda had a significant degree of influence and control over these activities within the company. As a direct result of this, the Securities and Exchange Commission (SEC) has taken legal action against both of these individuals, charging them with controlling person responsibility in violation of Section 20(a) of the Securities Exchange Act for the violations that were committed by Akorn.

As a result of the legal action, certain agreements were reached, and fines were imposed on anyone who disobeyed the conditions of those agreements. Akorn has indicated that it will comply with the stipulations of a permanent injunctive order, which forbids the company from violating the requirements of the Exchange Act related to financial disclosure, records and evidence, and internal accounting controls.

This agreement was reached after Akorn gave its consent to abide by the conditions of the order. In addition, the cases of Timothy Dick and David Hebeda both resulted in the individuals’ consent being given to the entry of orders in the case.

The two most significant elements of these orders are as follows:

- First, they granted a permanent injunction against both of the individuals, which forbids them from managing any person who may be accountable for breaches of the provisions of the Exchange Act related to reporting on finances, books and documentation, and internal accounting controls. Second, they issued a temporary restraining order against both of the individuals, which allows them to continue their management of any person.

- Second, a civil penalty in the amount of 20,000 dollars must be paid by each of them in order for the resolution to be enacted as a condition.

Michael Mueller and Timothy Tatman were the personnel at the SEC who were in charge of leading the investigation into the numerous concerns that were raised.

David Hebeda: Case Settlement with SEC

Akorn Inc., Timothy Dick, who served as the company’s former Chief Financial Officer, and David Hebeda, who served as the company’s former Controller, have reached a settlement regarding allegations that the generic drug manufacturer published misleading financial statements in 2014. The Securities and Exchange Commission of the United States (SEC) announced the completion of this transaction to the general public.

As part of the agreement, Akorn will not be responsible for making any financial contributions. Instead, it agreed to comply with a court order that prohibits it from violating any additional Securities Exchange Act standards regarding financial statements and internal controls for accounting. The order was issued after the company adhered to the terms of the order.

Timothy Dick, the former chief financial officer, and David Hebeda, the former controller, have both consented to pay a fine of $20,000 each, as required by the Securities and Exchange Commission. The dispute has been resolved, and as part of the agreement, all of the parties involved, including Akorn, Timothy Dick, and David Hebeda, did not acknowledge or deny any liability in the matter. Akorn and the attorneys representing Timothy Dick and David Hebeda have not made any public statements on this matter.

The investigation conducted by the SEC revealed that in May of 2016, Akorn altered its accounting records for the year 2014 and admitted that its internal controls were extremely deficient. The manner in which the corporation estimated and managed its gross-to-net reserve balances is what ultimately caused these issues. Akorn also stated that it overstated its net sales for 2014 by about seven percent and its earnings from daily operations prior to taxes by a significant 136 percent in the same year.

During this time period, Akorn’s internal financial controls were overseen by both Timothy Dick, who served as CFO, and David Hebeda, who was in charge of the company’s accounting and was known as the Controller. This indicates that they bear some degree of responsibility for the issues that were discovered by the SEC.

Particularly noteworthy is the fact that Fresenius intended to acquire Akorn in April 2017 for the sum of $4.75 billion. Creams, eye drops, and liquids for the mouth were among the many different kinds of medicinal products that were supposed to be part of the transaction. But a month earlier, the CEO of Fresenius, Stephan Sturm, stated that the business might not go ahead with the purchase if an inquiry into Akorn’s integrity of data found proof that the company had engaged in improper behavior.

As of this moment, Fresenius has not immediately commented on anything related to the recent incidents that have taken place.

Conclusion

The dispute that the SEC had brought against Akorn Inc., as well as against its former chief financial officer Timothy Dick and former controller David Hebeda, has now been resolved through a settlement. The case was filed due to alleged violations of financial reporting and internal control.

Akorn went back and reworked its financial records for 2014, and the results revealed that the company’s internal controls were not as effective as they should have been and that the company’s income and sales figures had been significantly inflated.

As part of the settlement, Dick and David Hebeda have been given permanent bans and punishments, while Akorn has committed to avoid breaking the law again. This case demonstrates how vital it is for publicly traded corporations to have reliable financial reporting as well as strong internal controls.