FinTokenAssets’ website lacks ownership and executive information. On May 5th, 2023, FinTokenAssets’ website domain (“fintokenasset.com”) was privately registered.

FinTokenAssets claims to be five years old while being in existence for less than a month.

How long has your company been in business?

Fintokenasset.com has been trading cryptocurrencies for the past 5 years.

FintokenAssets has a private Facebook group that is open to the public. Artemas Demchenko, Krisjkov Williams, and Alejandro Elias Caleb are the administrators.

All three accounts appear to have been hacked and/or acquired based on the content posted to their individual personal profiles.

FinTokenAssets publishes incorporation details for Fintoken Assets Management LTD on its website in an attempt to appear legitimate.

Fintoken Assets Management was established in the United Kingdom on June 8th, 2022.

Regardless of the fact that this exists eleven months before Fintoken Assets Management, an MLM organization functioning or claiming to operate out of the UK is a warning sign.

How exactly does a Ponzi scheme operate?

An investment fraud known as a Ponzi scheme draws investors with claims of great returns and no risk but fails to invest the money as stated. Instead, it pays off earlier investors with money from future investors while maybe keeping a portion of the profits. These schemes typically fail when recruiting investors becomes challenging or when multiple investors attempt to cash out. They depend on a steady flow of new buyers to operate. They are called after Charles Ponzi, who ran a similar scam using postal stamps in the 1920s.

In the United Kingdom, incorporation is dirt cheap and effectively unregulated. Furthermore, the FCA, the United Kingdom’s leading financial regulator, does not actively regulate MLM-related securities fraud.

As a result, the United Kingdom is a popular destination for scammers wishing to incorporate, operate, and market bogus businesses.

Incorporation in the UK or registration with the FCA are irrelevant for MLM due diligence.

As always, if an MLM firm is not honest about who runs or controls it, consider twice before joining and/or turning over any money.

Products by FinTokenAssets

FintokenAssets does not offer any retailable items or services.

Affiliates can only promote FinTokenAssets affiliate membership.

Compensation Scheme for FintokenAssets

Affiliates of FinTokenAssets invest assets on the promise of stated passive returns.

- Plan 1: Invest $200 to $19,999 and earn 7% every week for six weeks.

- Plan 2: Invest $20,000 to $100,000 and earn 10% per week for four weeks.

- Rudiment 1: Invest between $15,000 and $49,999 and receive 1% every day for 30 days.

- Second: invest $50,000 to $150,000 and collect 2% per day for 20 days.

- Bulk Plan 1: Invest $100,000 or more and receive a 20% monthly return for three months.

- Annual Plan – Invest $150,000 or more and receive a 300% return on investment each year.

FintokenAssets has a one-level reward structure for referral commissions.

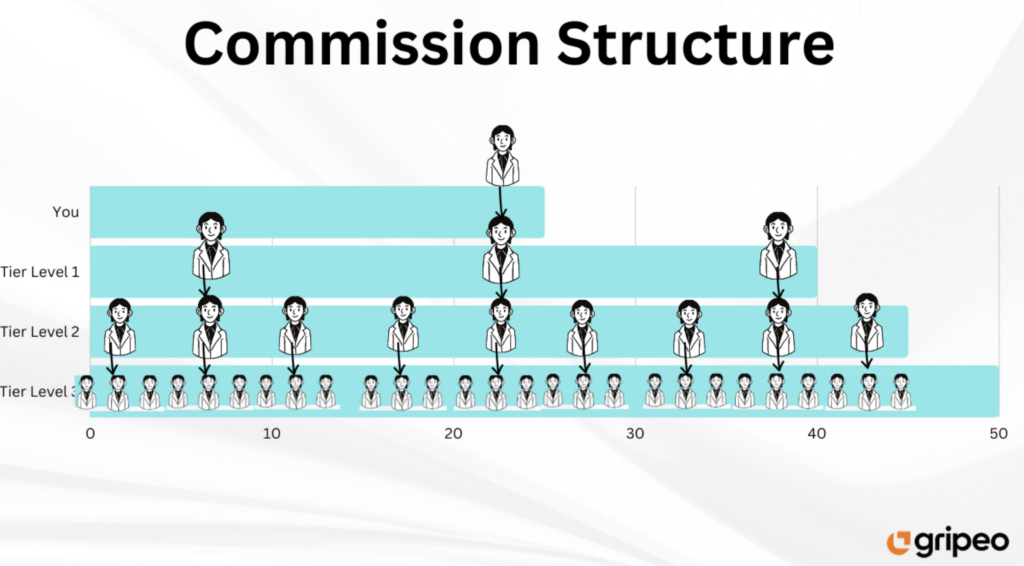

In a unilevel compensation system, an affiliate is put at the top of a unilevel team, with every personally recruited affiliate placed right beneath them (level 1):

If any level 1 affiliate acquires new affiliates, they are assigned to the original affiliate’s unilevel team at level 2.

If any level 2 affiliates recruit new affiliates, they are promoted to level 3, and so on for an unlimited number of levels.

FinTokenAssets has a limit of ten paying unilevel team levels.

Referral commissions are paid as a proportion of funds invested at each of these ten tiers, as shown below

- 7% for level 1 (personally recruited affiliates)

- 2% for level 2

- 1% for level 3

- 0.5% for level 4

- 5 to 10 – 0.1%

A FinTokenAssets associate who qualifies as a “Representative” earns higher referral commission rates:

- level 1 – 12%

- level 2 – 3%

- level 3 – 2%

- level 4 – 1%

- Level 5 to 10 – 0.1%

It should be noted that FinTokenAssets’ website does not include Representative qualification criteria.

How Do I Become A Company Representative?

You must complete the form and submit an application.

FinTokenAssets affiliate membership is completely free.

A minimum investment of $200 is required to fully participate in the attached income opportunity.

FinTokenAssets accepts investments in USD via Perfect Money as well as numerous cryptocurrencies.

FinTokenAssets Summary

FinTokenAssets indicates that it generates external money through trading.

Fintokenasset.com ensures an increase in your income by utilizing a variety of cutting-edge trading tools.

There is no proof that FinTokenAssets are being traded. There is also no proof of any other external revenue creation source.

FinTokenAssets’ passive investment opportunity is clearly a securities offering. This necessitates FinTokenAssets registering with financial regulators.

FinTokenAssets has failed to produce evidence of registration with any financial regulator in any jurisdiction.

FinTokenAssets, on the other hand, misrepresents its UK shell company incorporation:

Is Your Company’s Operations Legal?

Of course, yes. Fintokenasset.com is a legally incorporated company with the registration number 14159589 that operates within the requirements of the law. If you click on the link, you will be able to view the papers.

FinTokenAssets’ business model fails the Ponzi logic test as well.

FinTokenAssets’ top offer is 2% per day. What do they need your money for if FinTokenAssets can legitimately generate 2% each day on a constant basis, as claimed?

As of now, new investment is the sole verified source of revenue entering FinTokenAssets.

FinTokenAssets is a Ponzi scheme since it uses new investments to pay out claimed returns.

As with other MLM Ponzi schemes, once affiliate recruiting is exhausted, new investments will dry up.

This will deprive FinTokenAssets of ROI revenue, leading to a collapse.

Ponzi schemes’ math ensures that when they fail, the vast majority of participants lose money.

What is a Ponzi Scheme?

A Ponzi scheme is a deceptive investment strategy that promises high rates of return with no risk to investors. A Ponzi scheme is a fraudulent investment scheme in which money is collected from later participants to produce profits for earlier investors. This is comparable to a pyramid scam in that both rely on new investors’ finances to pay off previous investors.

Both Ponzi and pyramid schemes inevitably fail when the influx of new investors stops and there isn’t enough money to go around. The plots begin to crumble at that time.

Key Takeaways

- By recruiting new investors who are promised a huge payoff with little to no risk, the Ponzi scheme produces returns for existing investors.

- The fraudulent investment strategy is based on using funds from new investors to pay off previous donors.

- Companies that run a Ponzi scheme concentrate their efforts on enticing new clients to make investments; otherwise, their system will become illiquid.

- The SEC has provided recommendations on what to look for in suspected Ponzi schemes, such as guaranteed returns or investment vehicles that are not registered with the SEC.

- Bernie Madoff perpetrated the greatest Ponzi scheme, duping thousands of investors out of billions of dollars.

Recognizing Ponzi Schemes

A Ponzi scheme is a type of investment scam in which clients are promised a high profit with little or no risk. Companies that run a Ponzi scheme devote all of their resources to acquiring new investors.

This new revenue is utilized to pay original investors’ returns, which are labeled as a profit from a valid transaction. Ponzi schemes rely on a steady stream of new investments to keep paying out profits to older investors. When this flow runs out, the scheme crumbles.

Ponzi Scheme Red Flags

Regardless of the technology utilized, the majority of Ponzi schemes have similar characteristics. The Securities and Exchange Commission (SEC) has recognized the following characteristics to be on the lookout for

- A promise of high rewards with no risk.

- A steady stream of returns regardless of market conditions

- Unregistered investments with the Securities and Exchange Commission (SEC)

- Clients are not permitted to access official papers for their investment strategies that are kept secret or described as too hard to comprehend.

- Clients who are having difficulty withdrawing their funds

What Is the Distinction Between a Ponzi and a Pyramid Scheme?

A Ponzi scheme is a method of attracting investors by promising future rewards. The operator of a Ponzi scheme can only keep the scheme going as long as fresh investors are brought in.

A pyramid scheme, on the other hand, recruits others and incentivizes them to bring in more investors. A member of a pyramid scheme receives only a percentage of their earnings and is “used” to produce profits for members higher up the pyramid.

Why is it referred to as a Ponzi scheme?

Ponzi scams are called after Charles Ponzi, a businessman who enticed tens of thousands of clients to invest their money with him in the 1920s. Ponzi’s plan promised a certain amount of profit after a certain amount of time by purchasing and selling discounted postal reply coupons. Instead, he was utilizing newly invested funds to pay off previous debts.

How Can You Spot a Ponzi Scheme?

The SEC has discovered a few characteristics that frequently indicate a fraudulent financial plan. It is critical to remember that almost all types of investment involve some level of risk, and many do not offer assured results. If an investment opportunity (1) offers a certain return, (2) guarantees that return by a specific period, and (3) is not registered with the SEC, the SEC recommends investors proceed with care because these are indicators of fraud.

In Conclusion,

Clients anticipate fiduciary obligation when they give money to their financial advisers or investment firms. Unfortunately, those monies can be mismanaged fraudulently through Ponzi schemes. Ponzi schemes aren’t actual investment plans because they use one investor’s money to repay another. They are deceptive investment schemes that have resulted in billions of dollars in losses.