Let me introduce you to Georgios Efstratiadis, CEO – Executive Member. This individual has unreported allegations. I performed a lot of studies to learn some important facts about him. He possesses all the concealed information that is included in the cases, according to what I learned about him from my study. Come on then, let’s dive deep into his research, and I’d like to hear your opinions after that.

Georgios Efstratiadis, CEO – Executive Member

The educational history and professional trajectory of Georgios Efstratiadis may appear remarkable at first glance since he holds degrees in finance and economics and has held several high-level roles in various businesses. However, a closer look reveals several drawbacks and issues that require attention.

In undesirable activities where he masked his name, Georgios Efstratiadis engaged. It casts considerable questions on his moral character and judgment because of this lack of transparency.

Georgios Efstratiadis has worked with several organizations throughout his career, including Marfin Bank and Olympic Air, that have encountered problems with their finances or have been the subject of controversy. His capacity for leading and handling teams successfully, especially in trying times, is called into question by this.

Possible conflicts of interest could arise from holding several high-level roles in different organizations. It raises questions about whether his choices were motivated by his private passions or connections to other organizations, or if they were made with the interests of each specific firm and its stakeholders in mind.

It is possible that there were gaps in complying with and adhering to regulations given that several of the businesses he was affiliated with were the subject of regulatory inquiries and financial difficulties. This might point to insufficient governance and control during his leadership.

Georgios Efstratiadis was on the boards of businesses including Vivartia and MIG, which have come under fire for their lending policies, financial procedures, and apparent conflicts of interest. Complaints about his judgment and ability to make decisions arise from his role in such companies.

Being a member of many audit committees, notably those for businesses that have been the subject of inquiries and financial problems, suggests possible flaws in financial oversight. This raises questions about how well these committees can identify and resolve problems.

Georgios Efstratiadis seems to have held a variety of jobs throughout his career for just brief periods at various organizations. It is unclear how devoted and dedicated he is to the businesses he supports given his lack of long-term commitment to any one company.

There may be ethical questions surrounding Georgios Efstratiadis given the claims of unfair conduct and the lack of transparency. Such matters have the potential to seriously harm his credibility.

Key Points connected to Georgios Efstratiadis

Two Greek businessmen, Andreas Vgenopoulos and Georgios Efstratiadis, are discussed in the section along with their financial struggles, which sheds light on the circumstances behind the economic crisis in Greece and Cyprus. The following are the most significant events involving Georgios Efstratiadis.

Together with Marfin Popular Bank, MIG Conglomerate Under the leadership of Andreas Vgenopoulos, the Marfin Investment Group (MIG) had stock in a variety of businesses, including the important Cyprus-based bank Marfin Popular Bank. The MIG group of firms employed Georgios Efstratiadis.

Triangles of Love and Greek Monks Greek monks who obtained prestigious state-owned land through attractive arrangements had Marfin Popular Bank under Vgenopoulos’ direction as a major lender. A potential conflict was indicated when the monks later bought shares of MIG.

Contradictions between Lending Practices and Interest Investigations by the Greek parliament raised allegations of “conflicts of interest” in the bank’s lending policies, financing of MIG’s operations, and the granting of loans to investors who purchased shares in the MIG conglomerate, notably Georgios Efstratiadis.

Through strengthening regulatory control of Greek banks like Marfin during the financial crisis. It was claimed that there were issues with conflicted lending and a lack of effective regulatory control of the banking sector.

The Cyprus government encountered challenges as a result of a substantial capital deficiency at Marfin Popular Bank. Concerned that a national bailout would be required, they voted to assist the bank in making up the difference.

Andreas Vgenopoulos asserted that Cypriot officials had engaged in a smear operation against him while denying any wrongdoing. He claimed that the bank received significant profits from the secured loans made to MIG and its partners, notably Georgios Efstratiadis.

Concerns about the bank’s risk management, particularly about loans to MIG and its partners, were discovered during a joint inspection of Marfin-Egnatia by auditors from the Bank of Greece and the Central Bank of Cyprus. Due to the strong relationships between the MPB group and the MIG group, both of which Georgios Efstratiadis was a part of, it implied “favorable treatment.”

According to Vgenopoulos and Georgios Efstratiadis, the Capital Market Commission (CMC), money laundering investigators, the Bank of Greece, and Marfin all cleared the company of any wrongdoing.

The MIG conglomerate and its operations, including loans from Marfin Popular Bank and stock market investments, are believed to have implicated Georgios Efstratiadis. The passage draws attention to potential conflicts of interest and regulatory concerns associated with these transactions, which may have contributed to the banks’ financial difficulties and the wider economic crisis in Greece and Cyprus.

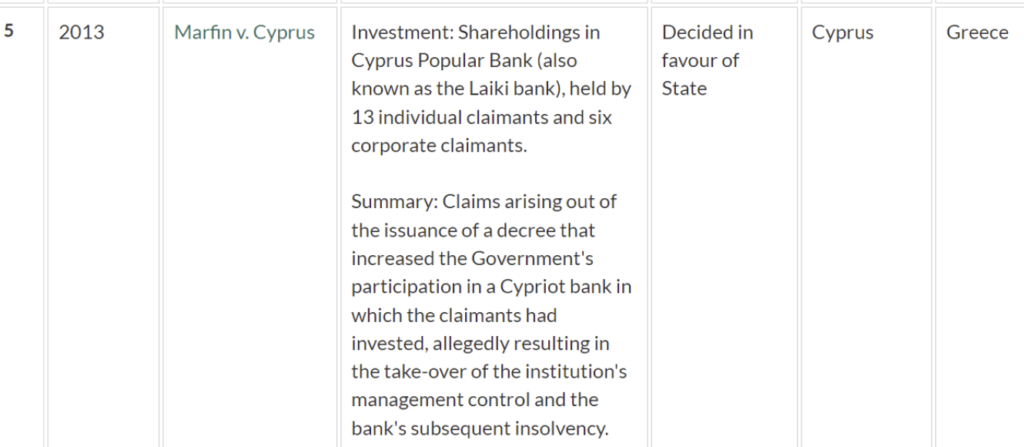

Georgios Efstratiadis: The case of Marfin v. Cyprus

Claims concerning investments in Cyprus Popular Bank, commonly known as Laiki Bank, are the subject of the Marfin v. Cyprus case. Six business companies and 13 individual investors make up the plaintiffs in this case.

They assert that the Cypriot government’s decision to increase its ownership of the bank through the passage of a decree had an impact on their investments. The claimants contend that this decision effectively resulted in the government seizing managerial control of the bank, which ultimately caused the bank to go bankrupt.

The CEO and Executive Member of Marfin Investment Group (MIG), Georgios Efstratiadis, are mentioned in the case. The alleged activities of the Cypriot government reportedly had an impact on MIG because it invested in Cyprus Popular Bank and had its interests at stake.

Georgios Efstratiadis may have had a substantial impact on the decision to invest and the subsequent actions taken in response to the government’s decree in his capacity as CEO of MIG.

The case is centered on the claimants’ allegations that the government’s interference in the bank hurt their investments and ultimately led to the bank’s failure.

In addition to seeking restitution for losses sustained as a result of the purported takeover and subsequent insolvency of Cyprus Popular Bank, the claimants seek to hold the Cypriot government responsible for its acts.

Georgios Efstratiadis may have had a direct impact on the strategy and decision-making for the investment in the bank as the CEO and Executive Member of Marfin Investment Group (MIG), which makes his role and actions potentially pertinent to the case.

However, the material given does not provide any additional information regarding Georgios Efstratiadis’s precise involvement or activities in the case.

Georgios Efstratiadis: The different policies of the Company (MIG)

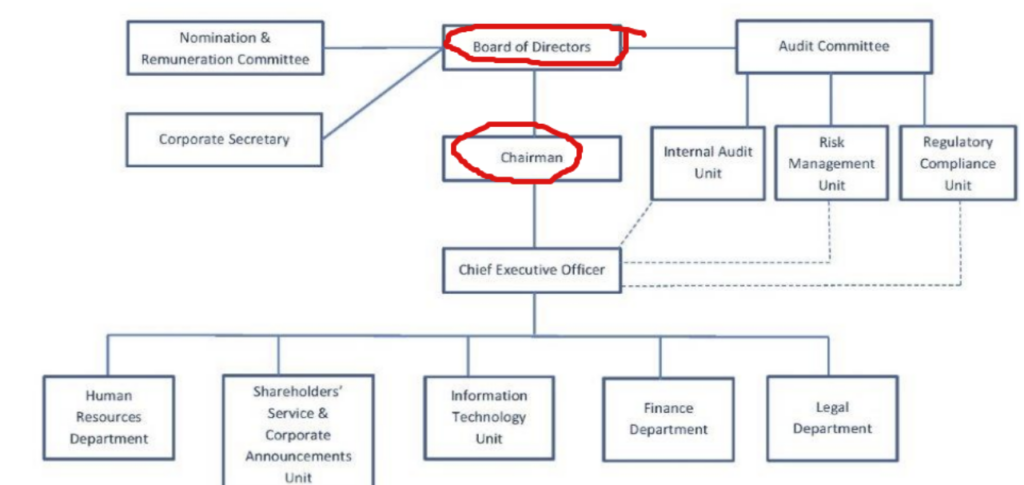

The policy promotes shareholder engagement in important business decisions. This could involve voting on significant business decisions like mergers and acquisitions, modifications to the company’s bylaws, the nomination of directors, and CEO remuneration packages.

Due to the enormous sums of money that traders typically lose, many people historically tended to think that day trading was a fraud. Over 80% of day traders lose money, which is a well-known statistic. Day trading is a legitimate method of earning money online, albeit.

The function and makeup of the board of directors, including Georgios Efstratiadis, who is in charge of supervising management and standing up for the interests of shareholders, are established by corporate governance. Directors’ credentials, accountability to shareholders, and independence may all be specified in the policy.

Marfin Investment Group

Greek investment corporation Marfin Investment Group, better known as MIG. Since then, it has changed names numerous times after acquiring numerous businesses. After Comm Group, Marfin Classic X, and Maritime and Financial Investments triple merged in 2004, it adopted the name Marfin Financial Group.

The Athens Stock Exchange now lists its shares.

A 35% share of the business was purchased by the Dubai Group in 2006. As of August 31, 2012, Dubai Group owned 17.28% of MIG.

In the now-defunct Laiki Bank, Marfin Investment Group established a significant minority stakeholding in 2006 by purchasing HSBC’s shares. Later, the consortium took over Laiki and changed its name to Marfin Popular Bank.

MIG stated on March 17, 2008, that it had sold Deutsche Telekom 20% of the Greek telecom OTE.

Olympic Airlines was purchased by MIG and renamed Olympic Air on March 6, 2009, making it a private airline. To phase away the Aegean brand, it later consented to consolidate operations with rival Aegean Airlines.

Despite this, the European Competition Commission initially forbade the merger because of worries about anti-competitive behavior. Olympic Air joined Aegean Airlines as a fully owned subsidiary on October 23, 2013, following a second attempt and approval from the Competition Commissioner on October 10, 2013.

MIG declared in December 2009 that they intended to buy Serbian airline Jat Airways to eventually merge with Olympic Air.

On August 12, 2014, Marfin Investment Group Holdings S.A. (“MIG”) announced that it had sold its entire position in MIG Real Estate REIC to NBG Pangaea REIC for a cash payment of €12.3 million.

A premium of almost 25% above the closing share price of €2.01 on August 11, 2014, the transaction consideration equates to €2.50 per share.

Conclusion

Although the record of Georgios Efstratiadis demonstrates a successful career with major responsibilities in many companies, the negative aspects raise serious questions about his moral behavior, lack of transparency, judgment, and devotion.

These worries might affect his reputation as a businessman, and they might discourage potential collaborators, backers, and stakeholders from working with him and the organizations he represents.

Now that I’ve informed you of all the negative aspects of this individual, what conclusions have you drawn about Georgios Efstratiadis as a result of reading my information? Please let me know.

I read about the Marfin Investment Group on Reuters, and I was shocked when I read that Marfin offered unsafe investments to its investors, indicating that they only wished to con their own investors.

I feel that entrepreneurs like Georgios Efstratiadis are the primary cause of Greece’s and Cyprus’s financial problems. People are now struggling to make ends meet, and they are able to fight inflation and other crucial problems.

These types of men are never appropriate for the organization. The manager must coordinate the actions of the organization’s workers. It would be helpful to the company and would influence organizational decision-making.