You can help us put a stop to online scams before they grow too big and end up ruining thousands of lives. A scam is a scam, doesn’t matter if it’s big or small. Now that this is out of the way, let’s get started with the review.

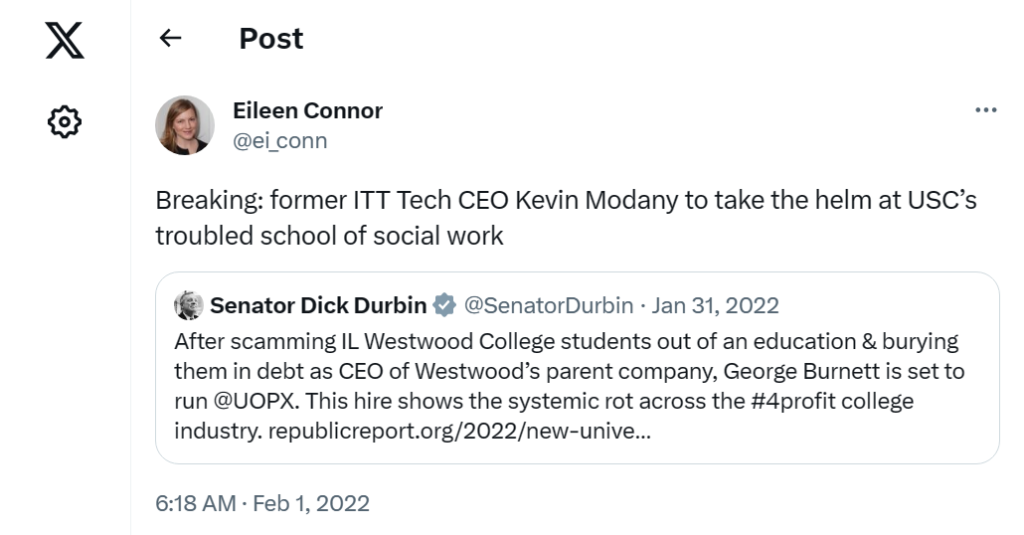

Kevin Modany is a culprit, as recently revealed in court documents. Kevin Modany, a former CEO of ITT, and eight former board members are defendants in a $250 million lawsuit brought by Deborah Caruso, an Indianapolis lawyer and bankruptcy trustee who is representing ITT’s creditors, including investors and students. Read this article to learn more about this fraudulent artist.

We look at 34 different data points when analyzing and rating online money-earning opportunities. Once the research on these data points is submitted, expert contributors reach out to the company’s customers and associates to get more insight into their operation. Finally, all the collected information is presented in the form of this expert review.

All the data is extracted from publicly available information and the sources are given in the transparency section at the bottom of every report.

These reports are made possible by the collective efforts of contributors like you. If you would like to become a contributor then contact us here.

SEC Allegations against Kevin Modany

In 2015, the SEC filed charges against Kevin Modany and Fitzpatrick, saying that they had illegally disguised the subpar performance and impending financial consequences of two student loan programs that ITT had financially guaranteed.

ITT had already resolved fraud accusations stemming from the same purported behavior. Kevin Modany and Fitzpatrick reached a settlement on the SEC’s allegations that they acted as control persons in ITT’s fraud and other crimes.

In the months following of the 1929 Wall Street Crash, the U.S. Securities and Exchange Commission was established as an independent agency of the American federal government. Enforcing the law against manipulation of markets is the SEC’s main objective.

ITT Educational Services Inc., its CEO Kevin Modany, and its CFO Daniel Fitzpatrick were charged with fraud on May 12, 2015, by the Securities and Exchange Commission.

The national for-profit college operator and the two directors were charged by the SEC of defrauding ITT’s investors by hiding the underwhelming results and impending financial consequences of two student loan schemes that ITT financially backed.

Following the demise of the private student loan market, ITT established both of these student loan programs, identified as the “PEAKS” and “CUSO” programs, to offer off-balance sheet loans for ITT’s students. ITT offered a guarantee that reduced the risk of bankruptcy from the student financing pools in order to persuade others to fund these riskier loans.

In the SEC’s case, which was filed in the Southern District of Indiana U.S. District Court, it was alleged that by 2012, the underlying loan pools were functioning so horribly that ITT’s guarantee commitments emerged and started to balloon.

ITT and its management used a number of steps to provide the impression that ITT’s exposure to these programs was considerably more limited than it actually was, rather than telling its investors that it expected to spend hundreds of millions of dollars on its guarantees.

ITT’s stock price dropped significantly, dropping by almost two-thirds over the duration of 2014 as ITT started to disclose the effects of its activities and the size of payments ITT was required for repayment of the guarantees.

ITT, Kevin Modany, and Fitzpatrick were accused of engaging in an illegal scheme and making a series of false and deceptive statements in order to cover up the size of ITT’s guarantee commitments for the PEAKS and CUSO programs, according to the SEC’s complaint.

For instance, without reporting this practice, ITT routinely made payments on past-due student borrower accounts to prevent PEAKS loans from failing and generating tens of millions of dollars in guarantee payments.

Without disclosing this methodology or its short-term cash implications, ITT also netted its predicted guarantee payments against returns it projected for several years in the future. Despite having control over the program’s financial performance, ITT further declined to include the PEAKS program in its financial statements. ITT and the management also gave false information and hide important details.

According to the complaint filed by the SEC, this behaviour violates the federal securities laws’ provisions against scams, disclosure, records and documentation, internal surveillance, lying to auditors, and fraudulent certification.

Additionally, according to the SEC’s complaint, Kevin Modany and Fitzpatrick were in violation of Section 304 of the Sarbanes-Oxley Act of 2002 (commonly known as “Sarbanes-Oxley”).

In addition to civil monetary penalties, the SEC is requesting perpetual restraining orders restitution with interest on prejudgment claims, and other relief. In accordance with Section 304 of Sarbanes-Oxley, the SEC also wanted to impose officer-and-director bans and award damages against Kevin Modany and Fitzpatrick.

Zachary Carlyle, Jason Casey, Anne Romero, and Judy Bizu worked together to carry out the SEC’s inquiry. The Complex Financial Instruments Unit’s Laura Metcalfe, Reid Muoio, and Michael Osnato have been overseeing the investigation. Nicholas Heinke, Polly Atkinson, and Mr. Carlyle will serve as the case’s leaders.

Kevin Modany: The Consequences of the SEC Charges

On the basis of comparable accusations of misbehaviour, ITT itself previously settled fraud-related charges. The SEC pursued Kevin Modany and Fitzpatrick because they were considered “control persons” with regard to ITT’s fraudulent actions and other regulatory infractions since they had considerable control and influence over ITT’s business activities.

Kevin Modany and Fitzpatrick did not acknowledge or refute the accusations against them in the SEC’s complaint in their settlement agreements with the agency. They did, however, consent to a number of steps as part of the agreement, such as:

Restricted from Leadership Positions: For a period of five years, both Modany and Fitzpatrick were barred from holding positions as executives and directors of public businesses. As a result, they are not permitted to serve as CEOs, CFOs, or board of director members of businesses that are publicly traded.

Financial Penalties: Modany was required to pay a $100,000 fine, while Fitzpatrick was required to pay a $200,000 fine. The financial repercussions of their alleged participation in the fraudulent actions are represented by these fines.

Future Conduct Restrictions: They were also banned from acting in a controlling manner that would result in a breach of the federal securities laws’ antifraud and annual reporting provisions. This implies they are not allowed to take part in any activity that might lead to the dissemination of incorrect or misleading information to investors or regulatory bodies.

Abandonment of Auditing Practice: Modany and Fitzpatrick additionally consented to a suspension from their respective roles as SEC-registered public accountants. This implies that they are unable to carry out audits, accounting services, or other tasks for firms subject to SEC regulation. They can choose to apply for reinstatement after the suspension, which is for a set amount of time, specifically five years.

Conclusion

I can easily sum up the story as I come to the point. Against two former executives of the now-defunct for-profit college operator ITT Educational Services Inc, the U.S. Securities and Exchange Commission (SEC) has reached a settlement.

Kevin Modany and Daniel Fitzpatrick, two of the company’s leaders, were accused of hiding the company’s true financial situation from potential investors. Just before the start of a federal court trial, the settlements were reached.

The commissioners of the SEC previously turned down an earlier settlement proposal. As part of the amended settlements, Kevin Modany and Fitzpatrick consented to a five-year restriction on holding office as officers or directors of publicly traded corporations. They also agreed to pay fines of $200,000 and $100,000, respectively.

Without admitting or disputing the SEC’s allegations, the executives reached a settlement. ITT, Kevin Modany, and Fitzpatrick were sued by the SEC in 2015 for falsely concealing potential harm in student loan programs. In 2016, ITT was unable to admit students who were receiving government financial help.

The company eventually closed all of its campuses and declared bankruptcy. The SEC reached a settlement with ITT in 2017, but disputes developed regarding the agreements with Modany and Fitzpatrick, which led to the SEC commissioners rejecting them. The involvement of Democratic Senators who demanded severe punishment for the CEOs made the case noteworthy.

Finally, I’d want to point out that by dragging the next generation into the fraud and bankruptcy stream, these individuals are merely destroying that generation’s future. Being aware of such fraudulent people is necessary.