Who is Lee Bryan III (CRD#: 827673)?Everything you need to know about Lee Bryan III and their accolades

With more than 40 years of expertise in the investment field, Lee is a managing director. He started working with Alex. Brown in 1987 and has stayed with the company through its mergers with Banker’s Trust, Deutsche Bank, and now Raymond James.

He is currently employed at the Carolinas branch. Lee has received recognition from Barron as one of the top advisors in the United States and from Forbes as a Best in State Wealth Advisor each of the last five years.

The Securities Industry Institute, a three-year program at the Wharton School of the University of Pennsylvania, has certified Lee, a graduate of the University of North Carolina, in addition to other credentials. The Series 7, 63, and 65 securities registrations are held by Lee.

In this article, we will go deep into Lee Bryan III’s past, discovering hidden disclosures and analyzing the consequences of the lawsuits.

About Alex. Brown | Raymond JamesHistory, achievements, leadership, lawsuits, & disputes

Since its establishment in 1800, Alex. Brown has been an example of a distinctive approach to wealth management, utilizing their considerable knowledge and resources to maintain a laser-like focus on each client—individual, family, and institution. As they attend to the many and special demands of their clients, this tradition equips them to offer excellent investing knowledge and a rare level of individualized care. They are proud of their rich history as the country’s first investment bank, but they prefer to set even higher standards.

They are able to continue offering the depth and breadth of sophisticated services that their esteemed clients want and deserve because of our strong connection with Raymond James, all while utilizing cutting-edge information technology and many layers of account protection.

They commit to putting the needs of our clients first, putting a strong emphasis on providing attentive guidance and focused service. Their advisors are experts in asset and risk management, wealth management, investment banking, and traditional and alternative investment planning. They always strive for perfection. They adopt a consultative, deliberate approach to delivering a client experience that is above and beyond the norm while upholding the highest levels of service and assistance.

They are here to offer you a range of financial and investment planning services necessary to your success, whether you are an individual with personal and family aspirations or the person in charge of your organization’s financial goals.

Together, they will choose the service that best meets your needs. They’ll then use their financial knowledge and experience to customize the needed service to your particular circumstances and with your specific goals in mind.

Only residents of the states and/or jurisdictions where they are legally registered may do business with Raymond James financial advisors. As a result, a response to an information request can take longer.

History of Alex. Brown | Raymond James

- Alexander Brown, an Irishman, immigrated to Baltimore and established the nation’s first investment bank in 1800.

- 1808 – For the Baltimore Water Company, Alex. Brown arranges the first initial public offering in American history.

- The first worldwide traveler’s letter of credit was issued by an investment bank in 1824.

- The Baltimore and Ohio Railroad, the first significant American railroad, was built under Brown and his son George’s leadership and sponsorship in 1827.

- Alex. Brown enrolled in the New York Stock Exchange in 1933.

- To float Raymond James, the company joined a syndicate group in 1983.

- 1986 – For 10 days, Alex. Brown aids in the IPO launches of Microsoft, Oracle, and Sun Microsystems.

- The 1990s see Alex. Brown became a prominent underwriter, famous for high-profile IPOs like AOL and Starbucks.

- In 2016, Alex. Brown joined Raymond James, the seventh-largest financial management company in the country by assets under management.

Services offered by Alex. Brown | Raymond James

Their group offers advice to high-net-worth families, individuals, and institutional fiduciaries including retirement plans, endowments, and foundations. They provide customer services with a distinctive combination of talent. Their expertise spans a wide range of topics in the financial sector.

They are here to offer you a range of financial and investment planning services necessary to your success, whether you are an individual with personal and family aspirations or the person in charge of your organization’s financial goals.

Together, they will choose the service that best meets your needs. They’ll then use their financial knowledge and experience to customize the needed service to your particular circumstances and with your specific goals in mind. The following are provided by this firm:

Alternative Investment

Banking & Lending Solutions

Estate, Charitable Giving & Trust

Financial Planning

Institutional Consulting

Investment Solutions

Monetization Services

Portfolio Management

Retirement Planning

Risk Management

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate fairly and orderly, and facilitate capital formation.

Lee Bryan III Disclosures: BrokerCheck, FINRA, And SEC ReportsEvery complaint, disclosure, litigation against Lee Bryan III

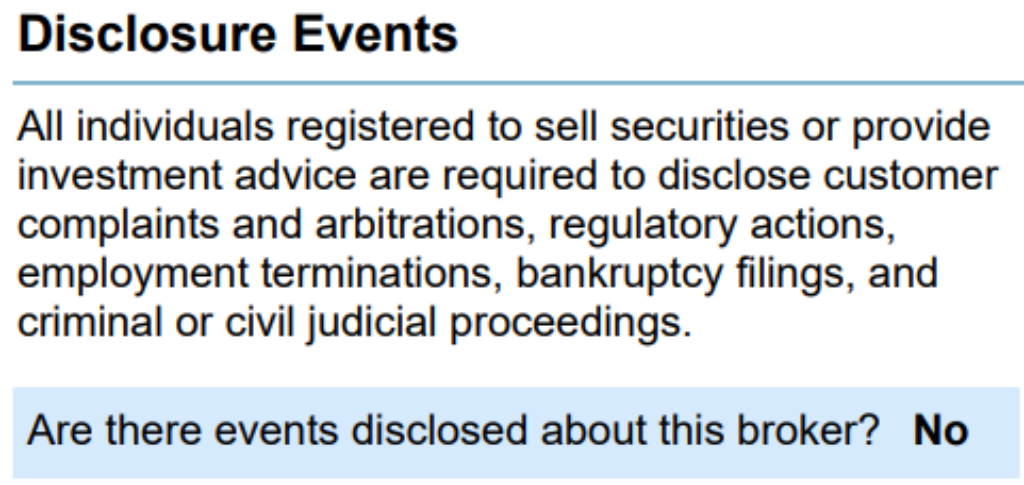

The brokerCheck report of Lee Bryan III includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

No disclosures have been mentioned about Lee Bryan III.

FINRA’s BrokerCheck

individual_827673.pdf (finra.org)

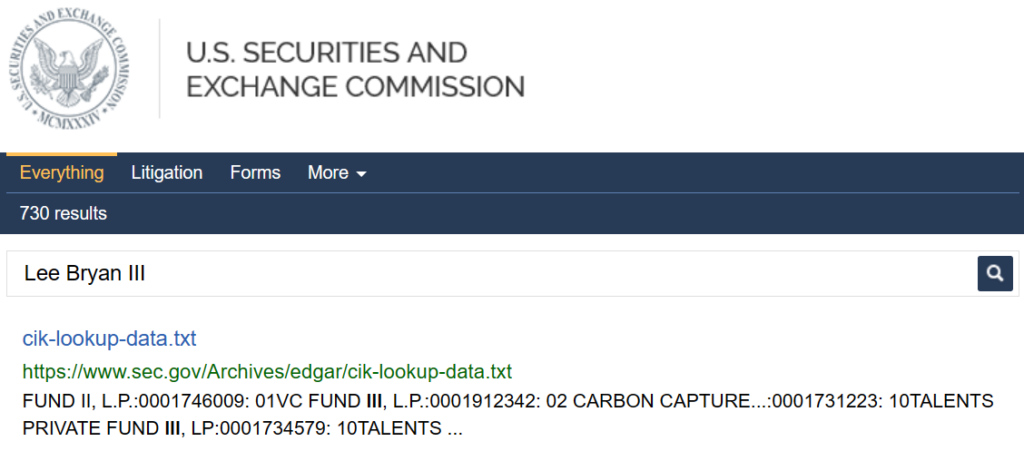

SEC Litigations & Forms

Source: Lee Bryan III – SEC Site Search Search Results

Lee Bryan III Lawsuits, Legal Battles, & DisputesActive database of all lawsuit documents (subject to availability) against Lee Bryan III

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis.law, and Law360. If Lee Bryan III has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Lee Bryan III not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Lee Bryan III on these websites, you can contact the local authorities and check if they have a physical copy of any cases.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Lee Bryan III Complaints, Class Action Lawsuits & Legal BattlesRead all class action lawsuits and SEC complaints against Lee Bryan III (if available)

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Lee Bryan III using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

You can contact the law firms mentioned above if you are facing issues with Lee Bryan III or any financial advisor.

Better Alternatives To Lee Bryan III (By Experts):Find the top 3 alternatives to Lee Bryan III

Manages Assets Worth

- $714,587,898,072

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors

- Publication of periodicals

Manages Assets Worth

- $173,418,270,044

Services

- Financial planning

- Portfolio management

- Portfolio assessment

Manages Assets Worth

- $46,803,858,104

Services

- Portfolio management