Who is Mark T. Curtis (CRD#: 1019695)?

Mark T. Curtis is a Managing Director of investments and wealth Management at Graystone Consulting, a subsidiary of Morgan Stanley. His advising services include wealthy investors, foundations, endowments, and corporate services for public and private companies. Leading industry publications, including Barron’s Magazine, Registered Rep. Magazine, San Francisco Bizjournal, Financial Times, and American Top Advisors, have consistently ranked Mark. He serves on the boards of Riverwood Capital and Formation 8. He formerly served as co-chairman of Morgan Stanley’s Director Advisory Group and as president of the Association of Professional Investment Consultants (APIC). Mark is a Stanford University graduate with a UCLA MBA.

This article goes further into Mark T. Curtis’s past, uncovering hidden disclosures and SEC litigations, as well as analyzing the implications for law.

About Graystone Consulting | Morgan Stanley

Graystone Consulting, situated in Potomac, Maryland, is a Morgan Stanley institutional investment consulting company. The firm provides institutional clients with a comprehensive range of investment advisory services. Foundations and endowments, corporate retirement plans, Taft-Hartley funds, healthcare organizations, state and local governments, family offices, and private individuals are among the clients served by the firm.

Graystone Consulting is a one-of-a-kind blend of an institutional consulting boutique and the global resources of one of the world’s leading financial institutions. Graystone Consulting’s institutional advising assets are more than $380 billion1. Graystone Consulting’s boutique structure is built on highly experienced local teams that provide institutional clients with customized solutions and personalized services, such as non-profit groups, endowments, and foundations.

Graystone Consulting Services

Graystone Consulting offers a wide range of services including:

Institutional Investment Consulting

Graystone Consulting, a separate institutionally-focused investment consulting business of Morgan Stanley, is one of the country’s largest and oldest institutional consulting practices of its kind. Their consulting approach is structured to provide unbiased, objective advice and guidance – delivered in an exceptionally cost-effective manner which helps their clients potentially drive greater performance to support their goals.

Endowment Management

Their team subscribes to a philosophy that reaches beyond the investments and is designed to help their endowment clients ultimately redefine success, manage risk, and focus on the real result – their ability to meet their goals. Regardless of client type or size, the Graystone Consulting team employs the same holistic institutional investment process which seeks to generate strong risk-adjusted returns, tailored to each client’s objectives, risk tolerance, and social impact parameters.

Custom Investment Outsourcing Solutions

Graystone Consulting, a business of Morgan Stanley, offers a range of consulting solutions involving varying degrees of service and fiduciary support, providing our clients with maximum flexibility to define the servicing model and level of discretion that best meets their needs today and into the future. To help meet the needs of sophisticated investors, their team provides tailored strategies and a wholly integrated investment approach that allows clients to outsource their investment and fiduciary responsibilities.

Impact Consulting

Once considered a niche investment trend, sustainable and impact Investing has evolved into one of the top areas of interest for individual investors and institutions alike. Launched in 2012, the Investing with Impact Platform is designed to help its clients invest in products and solutions that target market-rate financial returns alongside positive environmental and/or social impact.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

Mark T. Curtis Disclosures: BrokerCheck, FINRA, And SEC

BrokerCheck report of Mark T. Curtis includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

According to the BrokerCheck report, a customer dispute type of disclosure has been reported against Mark T. Curtis. In this disclosure, the client’s attorney alleges inter alia and unsuitability with respect to the managed accounts.

BrokerCheck

Source: https://brokercheck.finra.org/individual/summary/1019695

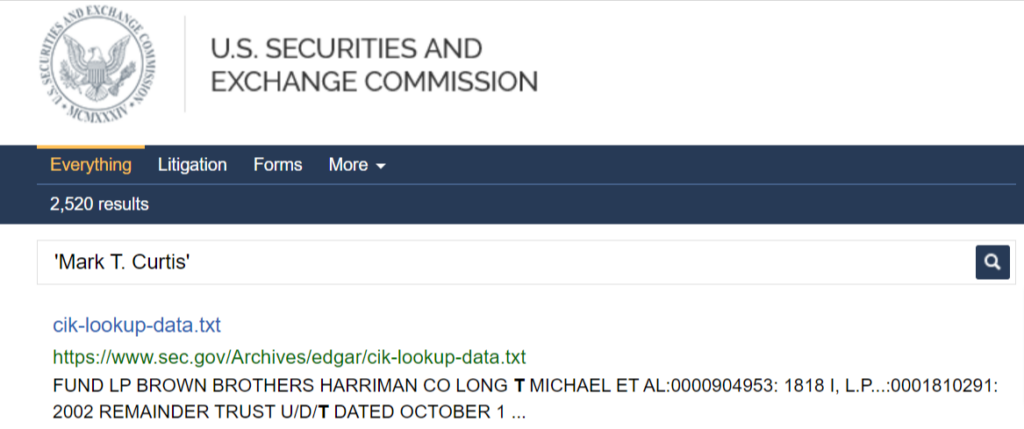

SEC Litigations & Forms

Source: https://secsearch.sec.gov/search?affiliate=secsearch&sort_by=&query=%27Mark+T.+Curtis%27

Mark T. Curtis Lawsuits

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis, law, and Law360. If Mark T. Curtis has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Mark T. Curtis which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Mark T. Curtis on these websites, then you can contact the local authorities and check if they have a physical copy of any lawsuits.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Mark T. Curtis Complaints and Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Mark T. Curtis using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

Better Alternatives To Mark T. Curtis:

Manages Assets Worth

- $6,427,792,177

Services

- Financial planning

- Portfolio management

- Selection of other advisors (including private fund managers)

- Family office and consulting services

Manages Assets Worth

- $4,465,757,285

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors (including private fund managers)

Manages Assets Worth

- $302,000,000

Services

- Financial planning

- Portfolio management