On its website, MuQuant (stylized as “Quant”) does not list ownership or executive information.

The domain name “muquant.com” for MuQuant’s website was privately registered on March 30, 2023.

28th June Update 2024 It seems Kancha Chora is responsible for MuQuant, according to a reader tip from Limbix in the comments below.

Earlier last month, Chora sponsored a MuQuant marketing event in Vietnam.

On stage at the occasion, Chora talked. He is said to have connections to Nepal and the UK.

Chora lists Maidstone, England as his place of residence on LinkedIn.

Chora was advertising the Gym Network Ponzi scheme prior to the debut of MuQuant.

DasCoin, Cloud Token, and uFun Club are some other failed Ponzi schemes that Chora marketed.

How exactly does a Ponzi scheme operate?

An investment fraud known as a Ponzi scheme draws investors with claims of great returns and no risk but fails to invest the money as stated. Instead, it pays off earlier investors with money from future investors while maybe keeping a portion of the profits. These schemes typically fail when recruiting investors becomes challenging or when multiple investors attempt to cash out. They depend on a steady flow of new buyers to operate. They are called after Charles Ponzi, who ran a similar scam using postal stamps in the 1920s.

Always consider joining and/or giving any money to an MLM firm very carefully if it is not transparent about who owns or runs it.

Their Products

No retailable goods or services are offered by MuQuant.

The only thing that affiliates can promote is MuQuant affiliate membership.

MuQuant’s Compensation Plan

Tether (USDT) investments are made by MuQuant affiliates. The promise of advertised monthly returns is used in this.

- Spend 10 to 4999 USDT and get 7% each month with a 300% maximum.

- Earn 10% every month with a maximum return of 350% when you invest 5000 to 9999 USDT.

- Receive 12% every month with a maximum return of 400% when you invest 10,000 to 29,999 USDT.

- Get 15% a month, up to a maximum of 500%, when you invest at least 30,000 USDT.

Returns are paid by MuQuant in their own MUQT coin. Keep in mind that investment tether has a minimum one-year lock.

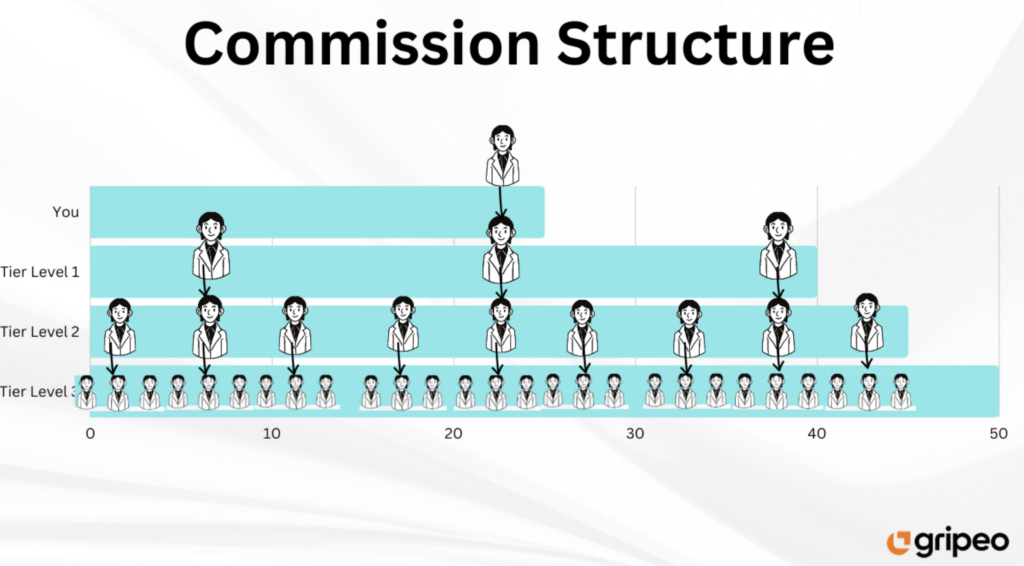

On invested funds down three tiers of recruitment (unilevel), MuQuant provides referral commissions:

- level 1 (affiliates that I directly recruited): 25%

- level 2 – 15%

- level 3 – 10%

Joining MuQuant

It costs nothing to become a MuQuant MuQuant affiliate member.

The linked income opportunity demands a minimum investment of 10 USDT to be fully participated in.

Review Summary

MuQuant claims that it makes money via trading in arbitrage.

There is no proof that MuQuant engaged in arbitrage trading or any other kind of earning money from outside sources.

In terms of regulation, The passive investing opportunity offered by MuQuant qualifies as a securities offering.

MuQuant is at the very least engaging in securities fraud since it fails to show proof that it has registered with financial regulators.

Currently, new investment is the sole provable source of income entering MuQuant.

MuQuant becomes a Ponzi scheme when new investments are used to pay for MUQT withdrawals.

As with all MLM Ponzi scams, fresh investment will cease as soon as affiliate recruiting does.

This will deprive MuQuant of ROI income, leading to its eventual collapse.

The mathematics underlying Ponzi schemes ensures that when they fail, the majority of investors lose money.

The preferred exit scam used by MuQuant is already built into its business model. A BEP-20 coin called MUQT can be generated quickly and for little to no money.

In MuQuant, all ROI payments are made in MUQT. Investors have an issue since MUQT has no value outside of MuQuant.

When MuQuant inevitably collapses, investors will be left bag-holding yet another worthless Ponzi shit token.

Some people had their views on MuQuant as shown below:

MuQuant Review- What is a Ponzi Scheme?

A Ponzi scheme is a fraudulent investment scheme that entices investors with high rates of return and little risk. A Ponzi scheme is a fraudulent investment operation in which money is collected from later participants to pay returns to earlier investors. This is comparable to a pyramid scam in that both rely on new investors’ money being used to reimburse the previous funders.

When the influx of new investors stops and there isn’t enough money to go around, both Ponzi schemes and pyramid schemes finally hit their bottom. The plans then start to fall apart.

Key Takeaways:

- The Ponzi scam brings in new investors by promising them a substantial payoff with little to no risk, which creates returns for previous investors.

- The fraudulent investment scheme’s basic idea is to reimburse the initial backers with money from future investors.

- Companies that run Ponzi schemes concentrate all of their efforts on finding new investors because, without them, the scheme will run out of money.

- The SEC has provided advice on potential Ponzi scheme red flags, such as guarantees of returns or unregistered investment vehicles with the SEC.

- Bernie Madoff perpetrated the largest Ponzi scam, defrauding thousands of investors of billions of dollars.

MuQuant Review- Origin of the Ponzi Scheme

After a con man by the name of Charles Ponzi, the phrase “Ponzi Scheme” was first used in 1920. However, the earliest known instances of this type of investment fraud date to the middle to late 1800s and were carried out by Sarah Howe in the US and Adele Spitzeder in Germany. In reality, two different works by Charles Dickens—Martin Chuzzlewit, which was released in 1844, and Little Dorrit, which was published in 1857—described the techniques of what later came to be known as the Ponzi Scheme.

The US Postal Service was the primary target of Charles Ponzi’s inaugural fraud in 1919.

Journal of the Smithsonian. “In Ponzi, We Trust.”

International reply coupons, created at the time by the postal service, allow a sender to buy postage in advance and include it in their message. The recipient would use the coupon to purchase the priority airmail postage stamps at their neighborhood post office in order to reply.

Arbitrage is the term for this type of exchange, which is a legal activity. But Ponzi grew avaricious and increased his attempts.

He offered returns of 50% in 45 days or 100% in 90 days under the name of his business, Securities Exchange Company.

Investors became interested in him right away as a result of his success with the postage stamp plan. Ponzi simply transferred the funds without investing them, telling the investors they had made money. The Boston Post started looking into the Securities Exchange Company in August 1920, just as the scam was coming to an end. Following the newspaper’s investigation, federal agents detained Ponzi on August 12, 1920, and he was charged with many charges of mail fraud. Ponzi received a five-year prison sentence in November 1920.

Some of the red flags in the Ponzi Scheme are as follows:

Regardless of the technology used in the Ponzi scheme, most share similar characteristics. The Securities and Exchange Commission (SEC) has identified the following traits to watch for:

- A promise of large returns with little risk that is guaranteed

- A steady stream of returns irrespective of market conditions

- Unregistered investments with the Securities and Exchange Commission (SEC)

- Clients are not permitted to read the formal paperwork for their investment because it is hidden or too hard to explain

- Customers had trouble withdrawing their money

MuQuant Review- Why it is called a Ponzi Scheme?

Charles Ponzi, a businessman in the 1920s who successfully persuaded tens of thousands of people to deposit their money with him, is credited as the inventor of the Ponzi scheme. Ponzi’s plan involved buying and selling discounted postal reply coupons in order to guarantee a certain profit after a certain period of time. Instead, he was using newly invested funds to settle debt from the past.

MuQuant Review- How to Detect a Ponzi Scheme?

The SEC has noted a few characteristics that frequently indicate a shady financial plan. It’s critical to realize that almost all investing strategies involve some level of risk, and many of them don’t guarantee results. The SEC warns against investing if an investment opportunity (1) promises a specific return, (2) promises that return by a specified date, and (3) is not registered with the SEC as these are signs of fraud.

MuQuant Review- Bottom Line

Customers anticipate some sort of fiduciary duty when they give money to their financial advisors or investing companies. Unfortunately, Ponzi schemes can be used to fraudulently mismanage those funds. Ponzi schemes aren’t real investment plans because they use the money from one investor to pay another. They are dishonest investment schemes that cost billions of dollars in losses.

It is very traumatic for people when individuals lose their hard-earned money in these types of Ponzi schemes. It is advised for people to research it properly before investing in any online platform.

These schemes are a nightmare for the investors. They are targeting those naive investors who are new to the market and after collecting money they were refused to give them back.

The curiosity of the people put them into these fake investment firms. The main intentions of these scammers are to defraud investors and earn money.

The websites had no information about the owner and were found to be suspicious. It raises the concern whether MuQuant is reliable for investment or not.

The regulatory authority has to take some strict actions against these fraudsters whose primary motive is to defraud investors.

They offered the worst product to their customers. MuQuant had many allegations of deceiving the individuals.

These people are the reason why most of the people don’t want to do online trading. Due to these schemes, there are the most reliable who are unable to attract investors and who really care about their clients.

They are just increasing the percentage of the ROI to attract individuals from the market and earn money. In the majority of the cases, it would be seen that many people were duped by these fraudsters because they didn’t research it properly and easily trust them.