Who is Philippe Hartl (CRD#: 2526439)?

Philippe Hartl is a Managing Director and Private Wealth Advisor at Merrill Private Wealth Management. He has worked in the field of High Net Worth Client Management since 1994. Phil was at Goldman Sachs as a Vice President in the Private Client Services Group before joining Merrill in 2000. He is a Certified Private Wealth Advisor® professional who received his training at the Money, Meaning, and Choices Institute in San Francisco. He also served on the Coral Reef Alliance’s Board of Directors.

Phil received his PhD in Cellular and Molecular Biology from the University of California, San Diego. His postdoctoral research was carried out at the University of California, San Francisco, where he was a Cancer Research Institute Fellow.

This article will go further into Philippe Hartl’s past, uncovering hidden disclosures and SEC litigations, as well as analyzing the implications for law.

What is Merrill Lynch Wealth Management?

Merrill Lynch Wealth Management is a division of Bank of America that provides financial planning and investment management services to individuals, families, and businesses. The firm has a long-standing history of serving the financial needs of clients, and it is well-known for its sophisticated investment products and services.

The History of Merrill Lynch Wealth Management

Merrill Lynch Wealth Management was founded in 1914 by Charles Merrill and Edmund Lynch. The company was initially established to provide investment banking services to middle-market companies. However, over the years, Merrill Lynch expanded its services to include retail brokerage, wealth management, and financial planning.

In 2009, Merrill Lynch was acquired by Bank of America, and the two companies merged to form one of the largest financial institutions in the world. Today, Merrill Lynch Wealth Management has over 14,000 financial advisors and manages over $2.3 trillion in client assets.

The Benefits of Using Merrill Lynch Wealth Management

One of the primary benefits of using Merrill Lynch Wealth Management is the firm’s extensive resources and expertise. The company has a team of experienced financial advisors who work closely with clients to develop customized investment strategies based on their individual needs and goals.

Merrill Lynch Wealth Management also provides clients with access to a wide range of investment products and services, including mutual funds, exchange-traded funds (ETFs), stocks, bonds, and alternative investments. Additionally, the firm offers a variety of tools and resources to help clients monitor their investments and make informed decisions about their financial future.

How Merrill Lynch Wealth Management Works

The key features of Merrill Lynch Wealth Management

Merrill Lynch Wealth Management offers a range of features to help clients manage their investments and plan for their financial future. Some of the key features of the firm include:

Financial planning:

Merrill Lynch Wealth Management offers comprehensive financial planning services to help clients achieve their financial goals. The company’s financial advisors work with clients to develop customized financial plans based on their individual needs and goals.

What is a Financial Advisor?

A financial advisor is a specialist who offers professional financial advice to people looking to accomplish particular financial goals. You work with a financial advisor to develop a thorough financial plan that is specific to your situation, much like you would hire an architect to construct the blueprint for your home. Understanding your existing financial condition, including your income, costs, savings, and spending patterns, is a requirement for this collaboration.

Investment management:

Merrill Lynch Wealth Management offers a range of investment management services, including portfolio management, asset allocation, and investment research.

Retirement planning:

Merrill Lynch Wealth Management offers a range of retirement planning services to help clients plan for their retirement. The firm’s financial advisors can help clients develop a retirement savings plan, estimate retirement expenses, and evaluate retirement income sources.

Types of accounts offered by Merrill Lynch Wealth Management

Merrill Lynch Wealth Management offers a range of account options to meet the unique needs of individual clients. Some of the account options offered by the firm include:

Individual Retirement Accounts (IRAs):

Merrill Lynch Wealth Management offers traditional, Roth, and SEP IRAs to help clients save for retirement.

Brokerage accounts:

Merrill Lynch Wealth Management offers a range of brokerage accounts, including individual, joint, and custodial accounts.

Trusts and estates:

Merrill Lynch Wealth Management offers trust and estate planning services to help clients protect their assets and ensure that their wishes are carried out.

How to open an account with Merrill Lynch Wealth Management

Opening an account with Merrill Lynch Wealth Management is a straightforward process. Clients can either contact a financial advisor directly or visit the Merrill Lynch Wealth Management website to get started. The firm’s financial advisors will work with clients to determine their investment goals and risk tolerance and recommend an investment strategy that is tailored to their individual needs.

The fees and costs associated with Merrill Lynch Wealth Management

Merrill Lynch Wealth Management charges clients a fee based on the percentage of assets under management. The fee varies depending on the size of the account and the services provided. Additionally, some investment products and services offered by Merrill Lynch may also have additional fees and expenses.

The Merrill Lynch Wealth Management mobile app

Merrill Lynch Wealth Management offers a mobile app that allows clients to monitor their investments and access account information from their mobile devices. The app provides real-time market data, investment news, and alerts to help clients stay informed about their investments.

The Merrill Lynch Wealth Management website

The Merrill Lynch Wealth Management website provides clients with access to a range of tools and resources to help them manage their investments and plan for their financial future. The website includes market data, investment research, and educational resources to help clients make informed investment decisions.

How to achieve financial success with Merrill Lynch Wealth Management

Achieving financial success with Merrill Lynch Wealth Management requires a proactive approach to managing your investments and planning for your financial future. Here are some tips to help you get started:

Set clear financial goals:

To achieve financial success, it’s important to set clear financial goals and develop a plan to achieve them. Work with your financial advisor to identify your short-term and long-term financial goals and develop a plan to achieve them.

Monitor your investments:

Regularly monitoring your investments is essential to ensuring that your portfolio remains aligned with your investment goals and risk tolerance. Work with your financial advisor to regularly review your portfolio and make adjustments as needed.

Diversify your portfolio:

Diversifying your portfolio is essential to managing risk and achieving long-term investment success. Work with your financial advisor to develop a diversified investment strategy that is tailored to your individual needs and goals.

Take advantage of tax-efficient strategies:

Managing taxes is an important part of achieving financial success. Work with your financial advisor to identify tax-efficient investment strategies that can help you minimize your tax liability and maximize your investment returns.

Common Misconceptions about Merrill Lynch Wealth Management

There are several common misconceptions about Merrill Lynch Wealth Management. Here are a few of the most common misconceptions:

It’s too expensive:

While Merrill Lynch Wealth Management charges a fee for its services, the firm’s fees are competitive with other wealth management firms. Additionally, the firm’s extensive resources and expertise can help clients achieve long-term investment success.

It’s only for wealthy clients:

While Merrill Lynch Wealth Management does serve high-net-worth clients, the firm also offers services to individuals with more modest investment portfolios.

It’s only for investment management:

While investment management is a key part of Merrill Lynch Wealth Management’s services, the firm also offers a range of financial planning services to help clients achieve their financial goals.

Philippe Hartl Disclosures: BrokerCheck, FINRA, And SEC

BrokerCheck report of Philippe Hartl includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosures events.

There is no disclosure against Philippe Hartl.

BrokerCheck

Source: https://brokercheck.finra.org/individual/summary/2526439

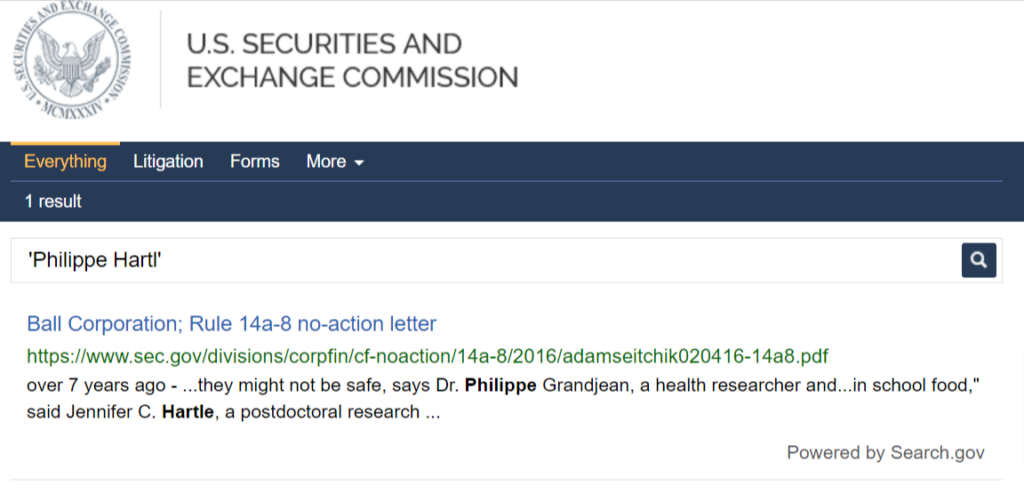

SEC Litigations & Forms

Source: https://secsearch.sec.gov/search?affiliate=secsearch&sort_by=&query=%27Philippe+Hartl%27

Philippe Hartl Lawsuits

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis.law, and Law360. If Philippe Hartl has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Philippe Hartl that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Philippe Hartl on these websites, then you can contact the local authorities and check if they have a physical copy of any lawsuits.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Philippe Hartl Complaints and Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Philippe Hartl using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

Better Alternatives To Philippe Hartl:

Manages Assets Worth

- $6,427,792,177

Services

- Financial planning

- Portfolio management

- Selection of other advisors (including private fund managers)

- Family office and consulting services

Manages Assets Worth

- $4,465,757,285

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors (including private fund managers)

Manages Assets Worth

- $302,000,000

Services

- Financial planning

- Portfolio management