About Unionview Investment

Unionview Investment claims that its first step is to manage the money of its clients, whether they are individuals, banks, or institutions. What they claim is that because of their management, the ultimate consequence is that earnings and consistent income are generated in all market conditions. Unionview Investment claims to be using novel types of investment to offer optimum safety, transparency, professionalism, and rigorous risk management.

What further is claimed by Unionview Investment is that in March 2009, their founder advised many high-net-worth families on equities investments. The emphasis was on developing a disciplined investment strategy for the firm based on successful past techniques, with an emphasis on quality earnings, strong fundamentals, proprietary market positions, and appropriate values.

We look at 34 different data points when analyzing and rating online money-earning opportunities. Once the research on these data points is submitted, expert contributors reach out to the company’s customers and associates to get more insight into their operation. Finally, all the collected information is presented in the form of this expert review.

All the data is extracted from publicly available information and the sources are given in the transparency section at the bottom of every report.

These reports are made possible by the collective efforts of contributors like you. If you would like to become a contributor then contact us here.

But the actual reality is

Unionview Investment’s website lacks ownership and executive information.

On June 6th, 2023, Unionview Investment’s website domain (“unionviewinvestment.com”) was privately registered.

Unionview Investment provides two company addresses on its website, one in the United States and one in the United Kingdom, in an attempt to appear official.

The US address is a DaVinci Virtual virtual address that was purchased. The UK address appears to be for rentable office space unrelated to Unionview Investment.

Unionview Investment has an official YouTube channel, which is not linked to its website.

There are marketing videos with Fiverr actors standing in front of a green screen there.

This is typical of non-native English speakers in administration positions.

As always, if an MLM firm is not honest about who runs or controls it, consider twice before joining and/or turning over any money.

How exactly does a Ponzi scheme operate?

An investment fraud known as a Ponzi scheme draws investors with claims of great returns and no risk but fails to invest the money as stated. Instead, it pays off earlier investors with money from future investors while maybe keeping a portion of the profits. These schemes typically fail when recruiting investors becomes challenging or when multiple investors attempt to cash out. They depend on a steady flow of new buyers to operate. They are called after Charles Ponzi, who ran a similar scam using postal stamps in the 1920s.

Products from Unionview Investment

Unionview Investment does not offer any retailable goods or services.

Affiliates can only promote Unionview affiliate membership.

Unionview Investment’s Bonus Plan

Unionview Investment affiliates invest funds with the expectation of achieving the following returns:

- Basic – invest $100 to $19,999 and receive a weekly return of 3% to 5%.

- Invest $20,000 to $79,999 on a regular basis and receive 5% to 7% every week.

- Invest $80,000 to $499,999 and earn 8% to 10% every week.

- Premium – invest $500,000 to $1,000,000 and gain a weekly return of 11% to 15%.

- Enterprise – invest $1,000,000 to $5,000,000 and obtain an unspecified weekly ROI rate.

- Unionview Investment’s MLM business is based on the recruitment of affiliate investors.

Ranks of Unionview Investment Affiliates

Unionview Investment’s compensation scheme includes three affiliate ranks.

They are as follows, along with their respective qualification criteria:

Admin – persuade at least fifteen affiliates to each spend at least $5000.

Supervisor: persuade at least 25 affiliates to invest at least $3000 each Executive: persuade at least 45 affiliates to contribute at least $2000 each

Commissions for Recommendation

Unionview gives a referral commission on monies invested by affiliates who were personally recruited.

Invest in the Basic tier and you’ll get a 5% referral commission.

Invest in the Regular tier and you’ll get a 6% referral commission.

Invest in the Advanced and Premium tiers to earn a 7% referral commission.

Invest in the Enterprise tier and you will receive a 10% referral commission.

Recurring Commissions

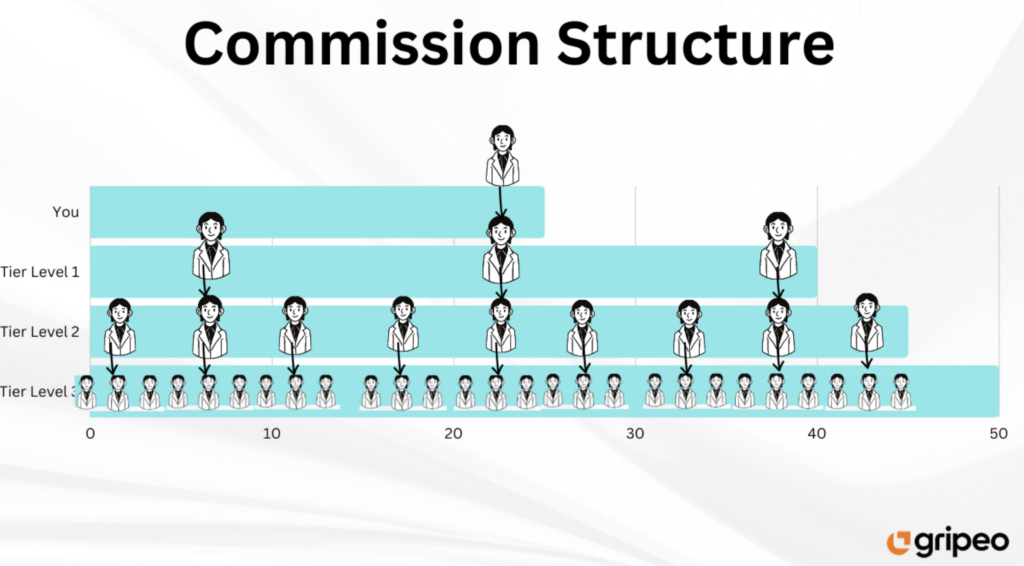

Unionview Investment provides residual commissions on invested assets at three recruitment levels (unilevel):

The rate of residual commission is determined by rank:

- Admins earn 5% on the first level (personally recruited affiliates), 2% on the second level, and 1.3% on the third level.

- Supervisors are paid 5% on level one, 3.5% on level two, and 1.7% on level three.

- Executives are paid 5% on level one, 4% on level two, and 2% on level three.

Investing with Unionview

- Affiliate membership in Unionview Investment is completely free.

- A $100 commitment is required to fully participate in the linked income opportunity.

- Unionview Investment accepts investments in USD (through wire transfer) and different cryptocurrencies.

Conclusion of Unionview Investment

The investment scheme and associated MLM compensation plan of Unionview Investment are hidden from the public view.

Instead, visitors to Unionview Investment’s website are bombarded with generic financial services advertising.

This is marketing to conceal Unionview Investment’s Ponzi scheme.

Unionview Investment’s MLM opportunity is a securities offering because it provides a passive returns investment scheme.

If we take Unionview Investment’s two corporate locations at face value, the firm is obliged by law to be registered with the SEC in the United States and the FCA in the United Kingdom.

Unionview Investment has failed to show proof of registration with either authority.

This suggests that, at the very least, Unionview Investment is committing securities fraud and operating illegally in the nations in which it is based.

Unionview Investment is the only provable source of revenue entering the company because it has not registered with financial regulators or issued audited financial reports.

Unionview Investment is a Ponzi scheme since it uses new investments to pay weekly returns. Unionview Investment’s linked MLM potential is a pyramid scheme because nothing is offered or sold to retail customers.

As with other MLM Ponzi schemes, once affiliate recruiting is exhausted, new investments will dry up.

Unionview Investment will be deprived of ROI revenue as a result, leading to its demise.

The arithmetic underlying MLM Ponzi schemes ensures that when they fail, the vast majority of participants lose money.

What is a Ponzi Scheme?

A Ponzi scheme is a type of investment fraud in which existing investors are paid using monies collected from new participants. Organizers of Ponzi schemes frequently promise to invest your money and earn huge returns with little or no risk. However, the fraudsters in many Ponzi schemes do not invest the money. Instead, they utilize the money to repay people who had previously invested and may keep part for themselves.

Ponzi schemes require a steady flow of new money to survive because they have little or no actual earnings. These schemes tend to fail when it becomes difficult to recruit new investors or when a big proportion of existing investors cash out.

Ponzi schemes are named after Charles Ponzi, who defrauded investors with a postage stamp speculating scheme in the 1920s.

Some of the Ponzi Scheme Red flags:

Many Ponzi schemes have elements in common. Look for the following warning signs:

- High rates of return with minimal or no risk. Every investment involves some level of risk, and higher-yielding investments often carry more risk. Be extremely skeptical of any “guaranteed” investment opportunity.

- Returns are exceedingly constant. Investments fluctuate in value over time. Be wary of an investment that consistently provides positive returns regardless of market conditions.

- Investments that are not registered. Ponzi schemes often involve unregistered investments with the SEC or state regulators. Investors benefit from registration since it gives them access to information about the company’s management, goods, services, and finances.

- Unlicensed vendors. Investment professionals and firms must be licensed or registered under federal and state securities regulations. The majority of Ponzi schemes involve unlicensed individuals or unregistered businesses.

- Strategies that are both secretive and intricate. Avoid making investments if you do not understand them or cannot obtain accurate information about them.

- There are paperwork issues. Account statement mistakes could indicate that funds are not being invested as promised.

- Receiving payments is difficult. If you do not receive a payout or have problems cashing out, be wary. Ponzi scheme promoters may attempt to keep members from cashing out by providing even larger returns for remaining in the scheme.

Bottom Line

It is critical that you understand any investment and who you are dealing with before giving over your money. If you receive an unsolicited investment proposal, proceed with caution. If you notice anything suspicious, report it to the authorities and let them determine whether it is legitimate or not.

Sure, you might lose out on a once-in-a-lifetime opportunity. But most likely not. “If it sounds too good to be true, it probably is.”