Who is Tony Smith (CRD#: 2223813)?

Tony Smith is the Managing Partner of Stonegate Investment Group and has been advising wealthy families as well as organizations for over three decades. Tony is also the Chief Investment Officer at Stonegate. Tony worked 15 years at Smith Barney advising Ultra-High Net Worth family groups after beginning his career in corporate finance. Tony and his entire team joined UBS Financial Services in 2007, where he served as Managing Director – Investments and Senior Portfolio Manager.

Tony has been named one of the nation’s top financial advisors by Barron’s, the Financial Times, and Forbes, and he was named Barron’s top Financial Advisor in Alabama from 2018 to 2021. Tony’s team was named one of the top 100 Private Wealth Management teams in the country by Barron’s in 2021.

This article will look into Tony Smith’s past, exposing hidden disclosures and analyzing the consequences of the lawsuits.

About Stonegate Investment Group:

Stonegate Investment Group is a private equity firm that specializes in alternative investments. It was founded in 2001, the company has grown to become a major player in the financial world, with a focus on real estate, energy, and infrastructure investments. Stonegate Investment Group takes pride in its ability to recognize and capitalize on unusual market opportunities, which has resulted in outstanding returns for its investors.

Early Days of Stonegate Investment Group

Stonegate Investment Group was founded by a group of accomplished financial experts who saw an opportunity to establish a new type of investment firm. Rather than focusing on traditional investments such as stocks and bonds, they wished to establish a firm that specialized in alternative assets such as real estate and energy. They believed that these forms of investments may provide higher returns while minimizing risk.

Stonegate Investment Group has remained faithful to this idea over the years, and it has paid off. The organization has identified unique market opportunities that other investment firms have overlooked, resulting in outstanding returns for its investors.

Investment Strategies

Stonegate Investment Group’s focus on alternative investments separates them from other investment firms. The firm invests in a variety of assets such as real estate, energy, and infrastructure. Stonegate Investment Group offers a team of experienced professionals who specialize in these industries and can spot unique market opportunities that other firms might overlook.

The concentration on long-term investments is another important part of Stonegate Investment Group’s strategy. The company is not looking for short-term gains, but rather solid, long-term investments that can generate consistent profits over time. This strategy has resulted in a well-diversified portfolio of investments geared to withstand market volatility.

Understanding the Stonegate Investment Group Portfolio

Stonegate Investment Group’s portfolio is diverse, ranging with assets in real estate, energy, and infrastructure. The company concentrates on assets that have the potential for long-term growth and provide an ongoing source of income. Stonegate Investment Group’s portfolio contains the following investments:

- Commercial real estate properties

- Renewable energy projects

- Infrastructure projects, such as toll roads and airports

- Oil and gas exploration and production

Overall, Stonegate Investment Group’s portfolio is well-diversified and designed to provide consistent returns over time.

What is a Financial Advisor?

A financial advisor is a specialist who offers professional financial advice to people looking to accomplish particular financial goals. You work with a financial advisor to develop a thorough financial plan that is specific to your situation, much like you would hire an architect to construct the blueprint for your home. Understanding your existing financial condition, including your income, costs, savings, and spending patterns, is a requirement for this collaboration.

Performance and Track Record

Stonegate Investment Group has a proven track record of success. Over the years, the company has regularly beaten its benchmarks and provided excellent returns to its investors. Since its inception in 2005, the Stonegate Opportunity Fund has delivered an average annual return of 20%.

The success of Stonegate Investment Group can be attributed to its ability to discover unique investment possibilities as well as its concentration on long-term investments. The portfolio of the company is well-diversified and structured to generate stable returns over time, resulting in high performance even during times of market turbulence.

Future Plans

Stonegate Investment Group has big plans for the future. The firm is working to increase its portfolio of alternative investments and is looking into new prospects in fields such as healthcare and technology. Stonegate Investment Group is also trying to expand its global reach and is investigating opportunities in emerging markets.

Overall, Stonegate Investment Group’s growth strategy is centered on recognizing unique market possibilities and developing solid, long-term investments that can generate consistent returns over time.

Tony Smith Disclosures: BrokerCheck, FINRA, And SEC

BrokerCheck report of Tony Smith includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosure events.

There is no disclosure against Tony Smith.

BrokerCheck

Source: individual_2223813.pdf (finra.org)

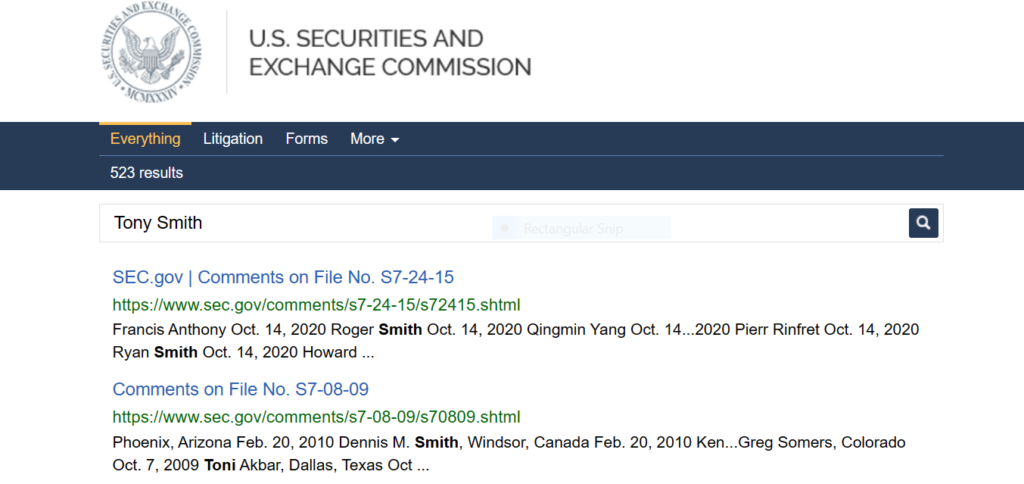

SEC Litigations & Forms

Source: Tony Smith – SEC Site Search Search Results

Tony Smith Lawsuits

The majority of court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, and Trellis. Law and Law360. If Tony Smith has been involved in any such lawsuits, the records can be found using the URLs below:

There might be more pending lawsuits against Tony Smith that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Tony Smith on these websites, then you can contact the local authorities and check if they have a physical copy of any lawsuits.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Tony Smith Complaints and Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Tony Smith using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

Better Alternatives To Tony Smith:

Manages Assets Worth

- $6,427,792,177

Services

- Financial planning

- Portfolio management

- Selection of other advisors (including private fund managers)

- Family office and consulting services

Manages Assets Worth

- $4,465,757,285

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors (including private fund managers)

Manages Assets Worth

- $302,000,000

Services

- Financial planning

- Portfolio management