Numerous claims that Aeonit is a deceitful MLM scheme have been made. Check out this review to see if you can trust them or not.

On their website, Aeonit omits to list ownership or executive details. The domain name “aeonitgroup.com” for Aeonit’s website was registered for the first time in April 2022.

On March 3, 2023, the private membership was last modified. The current owners gained ownership of the property on or about this date.

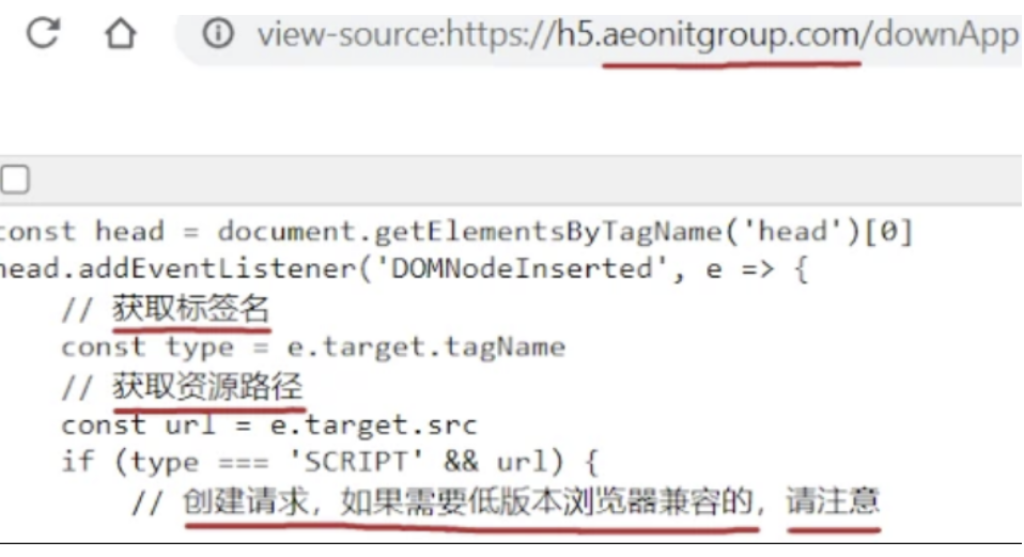

On their website, under the “APP download” area, we can locate Chinese in the source code as follows:

The person in charge of Aeonit may have connections to China, according to this.

Always consider joining and/or giving any money to an MLM firm very carefully if it is not openly forthcoming about who is in charge of or owns it.

Products of Aeonit

There are no sellable goods or services offered by Aeonit. The Aeonit affiliate membership itself is the only thing that affiliates can promote.

Compensation Structure for Aeonit

Tether (USDT) investments made by Aeonit affiliates are based on the assurance of the promised returns. The table below shows the various VIP levels, along with the price ranges and daily returns that correlate to each level:

| VIP Level | Investment Range (USDT) | Daily Return Range |

| VIP 1 | 30 – 5000 | 2.3% – 2.8% |

| VIP 2 | 300 – 3000 | 2.8% – 3.3% |

| VIP 3 | 500 – 10,000 | 3.3% – 3.8% |

| VIP 4 | 1000 – 99,999 | 3.8% – 4.3% |

| VIP 5 | 3000 – 999,999 | 4.3% – 4.8% |

| VIP 6 | 10,000 – 999,999 | 4.8% – 5.3% |

Not* Please be aware that making investments in schemes with high daily return expectations might be dangerous and may not necessarily be ethical or sustainable.

How exactly does a Ponzi scheme operate?

An investment fraud known as a Ponzi scheme draws investors with claims of great returns and no risk but fails to invest the money as stated. Instead, it pays off earlier investors with money from future investors while maybe keeping a portion of the profits. These schemes typically fail when recruiting investors becomes challenging or when multiple investors attempt to cash out. They depend on a steady flow of new buyers to operate. They are called after Charles Ponzi, who ran a similar scam using postal stamps in the 1920s.

Always use care and conduct an extensive study before putting money into any project. Before making any investment selections, it’s crucial to be aware of the potential risks and rewards. High-return investments are frequently high-risk.

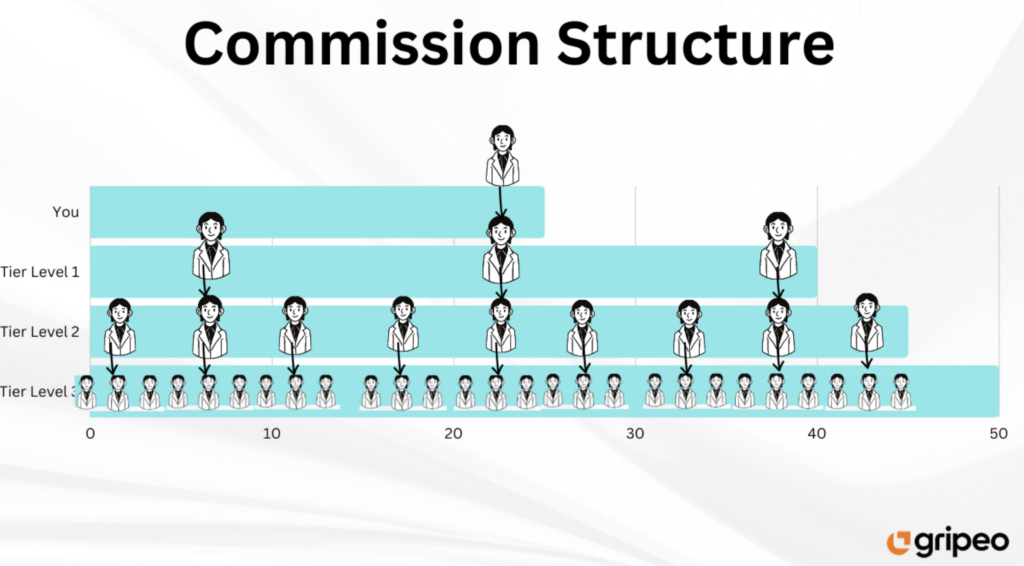

In accordance with the three tiers of recruiting down, Aeonit offers commissions for referrals on daily returns to downline affiliates (unilevel):

Level 1 (Affiliates personally recruited) – 18%:

The affiliates or direct recruits you directly recruit into the MLM business or network are referred to as Level 1 members. You will receive a commission of 18% based on these Level 1 affiliates’ sales or recruitment efforts when they bring in new members, as you are their direct sponsor. As a result, you will get 18% of the sales or incentive payments made by your Level 1 affiliate.

Level 2 – 6%:

The affiliates who were hired by your Level 1 affiliates are referred to as Level 2 affiliates. In other words, they make up the second level of your downline. You will receive a fee of 6% based on the sales or recruitment efforts of these Level 2 affiliates. You will only get a 6% commission because you are only one step behind their affiliates.

Level 3 – 3%:

Affiliates in Level 3 are those that your Level 2 affiliates recruited. In your downline, they are in the third tier. You will receive a 3% commission based on these Level 3 affiliates’ sales or recruitment efforts when they bring in new members or make sales. The commission is further decreased to 3% because you are two levels away from these affiliates.

Members are encouraged by the MLM pay structure to bring in new members as well as make sales. Members can benefit from the work of numerous layers of affiliates below them by assembling a team and pushing their downline to be productive and engaged.

It’s crucial to keep in mind that MLM organizations and their compensation schemes can differ greatly, and some MLM systems can be more sophisticated with deeper tiers and different commission rates.

MLM possibilities can have both potential rewards and risks, so as with any business opportunity, it’s important to do extensive research on the MLM firm and comprehend the compensation plan prior to getting involved.

Aeonit: Conclusion

The app “click a button” Ponzi schemes are a specific kind of fraudulent investment plan that poses as a reliable platform for quantitative trading. These scams often prey on gullible people who are seduced by the promise of quick money with little effort. In actuality, these programs are solely intended to mislead investors and have zero to do with quantitative trading.

As an example, consider how the conventional “click a button” software Ponzi scheme works:

The plan is touted as a cutting-edge robotic trading platform that produces substantial earnings through quantitative trading. Users are allegedly able to benefit by merely tapping a button inside the software, which is portrayed as the start of the trading procedure.

Affiliates are urged to bring on new members as investors to help the scheme expand. In exchange for attracting new members, these affiliates frequently get commissions or bonuses.

Once consumers have invested their money, the technique provides the appearance of trading activity. To give the impression that the software is making money through quantitative trading, it may show falsified trade charts and reports.

The plan runs like a standard Ponzi scheme, with no actual trade taking place. In order to provide returns to previous investors, the money from new investors is used, giving the impression that the business is profitable.

As long as there is enough money to pay out rewards to current members and as long as new shareholders continue to sign up, this cycle will continue.

Since they produce no actual earnings, “click a button” Ponzi schemes are unable to survive over time. The plan becomes unsustainable as a result of a decline in the number of new investors or when current participants start withholding more money than is being brought in by new investments.

The system eventually falls apart when the demand for withdrawals outpaces the flow of fresh money. The bulk of investors loses money at this point since the scheme’s organizers frequently abruptly shut offline the website and the app.

The app “click a button” Ponzi schemes are frequently run by the same con artists who keep inventing new ones with different names and marketing. They do this in order to avoid being discovered and to swindle fresh victims who might not be aware of their earlier frauds.

These scams are built on a deceptive and manipulative foundation. Scammers promise substantial returns with minimal effort, preying on people’s yearning for quick and simple wealth. But they are unrealistic and doomed to fail, just like other Ponzi schemes, leaving the great majority of participants with severe losses.

When presented with financial prospects that seem too ideal to be true, it’s crucial for people to exercise caution. Researching thoroughly, checking for correct registration and regulation, and getting guidance from financial experts can all assist you avoid falling for such shady schemes.