You can help us put a stop to online scams before they grow too big and end-up ruining thousands of lives. A scam is a scam, doesn’t matter if it’s big or small. Now that this is out of the way, let’s get started with the review.

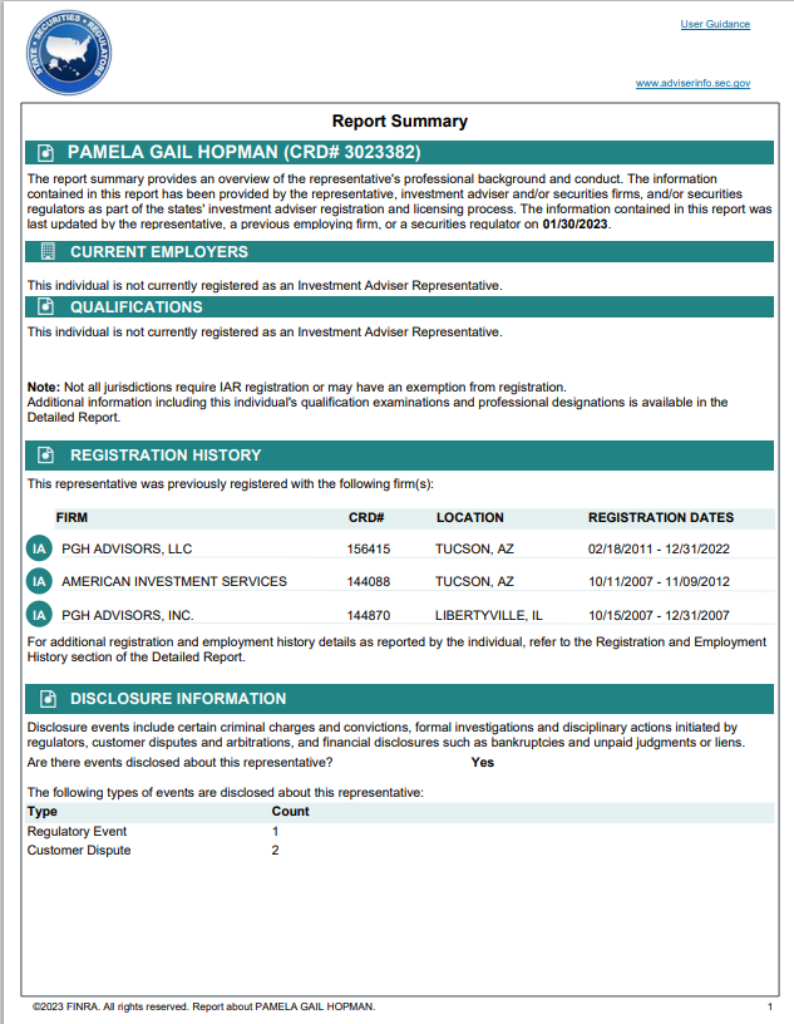

Pam Hopman, a resident of Tucson, and her firm, PGH Advisors, have been compelled by the Arizona Corporation Commission to fulfill financial obligations stemming from their unethical actions. This includes a restitution sum of $410,790 and an administrative penalty of $35,000. Furthermore, the Commission has taken the decisive step of revoking both Pam Hopman’s investment adviser representative license and the investment adviser license held by her affiliated company, PGH Advisors, LLC.

We look at 34 different data points when analyzing and rating online money-earning opportunities. Once the research on these data points is submitted, expert contributors reach out to the company’s customers and associates to get more insight into their operation. Finally, all the collected information is presented in the form of this expert review.

All the data is extracted from publicly available information and the sources are given in the transparency section at the bottom of every report.

These reports are made possible by the collective efforts of contributors like you. If you would like to become a contributor then contact us here.

The Commission’s investigation exposed disturbing misconduct on the part of Pam Hopman and PGH Advisors LLC. They were found to have marketed securities valued at a minimum of $1,562,392 from a company known as Deeproot and its related entities to their advisory clients. These clients believed they were investing in life settlement products. Notably, the Securities and Exchange Commission had previously raised allegations of Deeproot operating as a Ponzi scheme.

Moreover, the Commission discovered that Hopman, PGH Advisors, LLC, and another PGH investment adviser representative engaged in the sale of unregistered securities amounting to at least $10,040,526 from a firm named Premier Global Corporation to PGH advisory clients. These investors were lured into acquiring 12-month, unsecured promissory notes, which accrued interest payable to the investor. In a concerning parallel, the Oklahoma Department of Securities had made similar allegations about Premier Global Corporation’s operations being a Ponzi scheme.

A grave lapse in disclosure became apparent in the majority of cases. Pam Hopman and PGH Advisors, LLC failed to inform investors that they were receiving commissions for promoting these unregistered investment products.

Additionally, the Commission underscored how these sales commissions had engendered a substantial conflict of interest. This conflict compromised the alignment of clients’ best interests with Hopman’s self-interest in earning lucrative commissions, thus undermining the provision of impartial and objective investment advice.

In a resolution to this grave matter, the respondents have conceded to the Commission’s findings and agreed to the entry of a consent order, culminating in the outlined penalties and sanctions.

Who is Pam Hopman?

Pam Hopman serves as the founder and president of three distinct entities: The Hopman Group LLC, PGH Advisors LLC, and Hopman Tax Services. These encompass an insurance agency, an RIA (Registered Investment Advisor) firm, and a tax preparation firm, respectively. Pam Hopman’s extensive expertise in taxation, insurance, and investments empowers her to tailor her strategies, ensuring they align perfectly with her client’s unique financial goals and aspirations.

About The Hopman Group:

The Hopman Group is not accredited by the Better Business Bureau. You can check out their BBB rating, reviews, and complaints.

PGH Advisors LLC is a registered investment advisory firm under state supervision, committed to the fiduciary responsibility of prioritizing its client’s best interests. Having garnered the trust and satisfaction of numerous clients, the firm has refined its expertise in catering to the financial needs of individuals, both men and women, throughout all phases of life.

What do you understand about the Ponzi scheme?

A Ponzi scheme is a fraudulent investment scheme that promises high returns to investors but operates without legitimate underlying business operations. It is named after Charles Ponzi, who became infamous for orchestrating such a scheme in the early 20th century.

The basic structure of a Ponzi scheme involves the following key characteristics:

- The promise of High Returns: Ponzi schemes typically entice investors with the promise of unusually high returns on their investments, often significantly higher than what can be achieved through legitimate investment opportunities.

- Lack of Legitimate Investments: In reality, the scheme operator does not engage in any legitimate business or investment activities to generate the promised returns. Instead, returns are paid to earlier investors using the capital of new investors.

- Use of New Investor Funds: The operator uses the funds from new investors to pay returns to earlier investors, creating the illusion of profitability and attracting more investors.

- Continuation of the Cycle: Ponzi schemes can continue to attract new investors as long as there is a steady influx of fresh capital. This allows the operator to sustain the appearance of a successful investment opportunity.

- Inevitable Collapse: Ultimately, Ponzi schemes are unsustainable because they rely on an ever-increasing number of new investors to pay returns to earlier ones. When the scheme operator can no longer attract enough new investors or decides to abscond with the funds, the scheme collapses. As a result, many investors lose their money, and the later investors suffer significant losses.

Ponzi schemes are illegal in most jurisdictions because they involve fraud, misrepresentation, and financial harm to participants. Regulatory authorities and law enforcement agencies work to identify and shut down such schemes to protect investors. It’s important for individuals to exercise caution and conduct due diligence when considering investment opportunities to avoid falling victim to Ponzi schemes or other fraudulent schemes.

Tucson financial advisor blamed for Ponzi scheme losses by N4T investors:

Cindy Bryant painstakingly built her retirement savings over the years, but it took just one signature to lose it all. She lost $95,000 in an investment with Deeproot Funds, which the SEC is suing as a Ponzi scheme.

Bryant is devastated by the loss and finds it hard to sleep at night. The SEC alleges that Deeproot’s principal member, Robert Mueller, used investor funds for personal expenses, essentially treating it as his piggy bank.

Despite the serious allegations, there are no criminal charges against Deeproot or Mueller. However, Deeproot has filed for bankruptcy, which may leave investors like Bryant with little hope of recovering their money.

Bryant had trusted financial advisor Pamela Hopman of PGH Advisors and the Hopman Group with her money, and it was Hopman who invested her funds in Deeproot in 2019. Bryant believes that Hopman should have conducted better research on the investment. While she hasn’t filed a lawsuit against Hopman yet, she received a letter from Hopman’s attorneys, suggesting that suing Hopman might not lead to a successful recovery, as she had also suffered losses from Deeproot.

Several lawsuits have been filed against Hopman and PGH Advisors related to Deeproot. Attorneys Gail Boliver and Anthony Bingham are representing a Tucson family who claim they were encouraged to invest $100,000 in Deeproot by a financial advisor supervised by Hopman. They argue that financial advisors have a fiduciary duty to perform due diligence on investments, which was seemingly lacking in this case.

Deeproot’s investment in life insurance viaticals was inherently risky, and the SEC lawsuit revealed that Deeproot hadn’t purchased a policy since September 2017 but continued to collect millions. Any diligent financial advisor should have noticed these red flags, according to legal experts.

Attorney Marc Fitapelli, representing multiple clients who invested in Deeproot, asserts that Hopman failed in her fiduciary duty to her clients, and there were clear warning signs.

Cindy Bryant is now focused on rebuilding her retirement savings through hard work and determination.

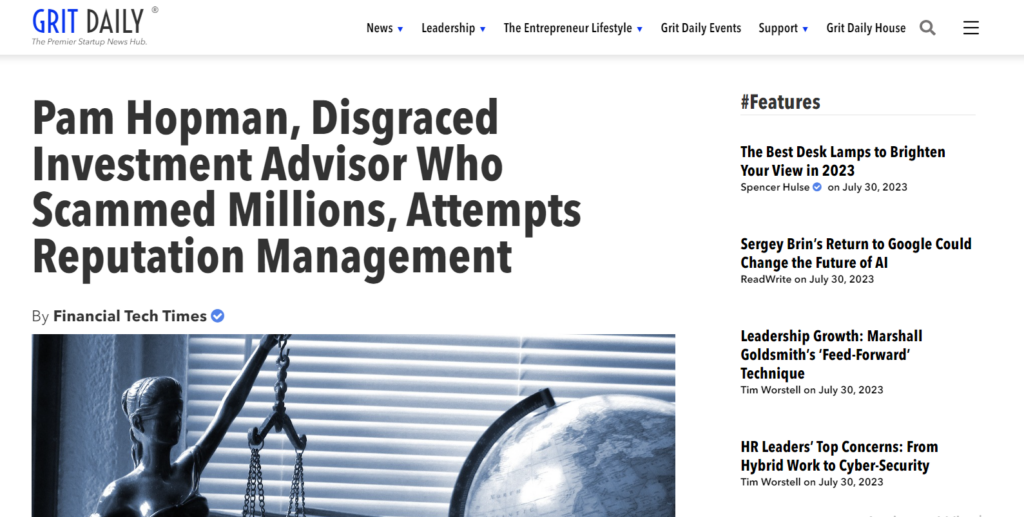

Former Investment Advisor Pam Hopman Involved in Scandal Tries to Repair Reputation:

In the turbulent world of finance, Pam Hopman, once a trusted investment advisor, is now embroiled in a scandal that has irreversibly damaged her standing. Accused of involvement in a scheme that cost her clients over $10 million, Hopman’s name is now synonymous with deception and betrayal. As the details of her manipulative practices emerge, shockwaves are rippling through the industry, casting a spotlight on issues of trust and ethics in financial relationships. Hopman is now desperately working to salvage her tarnished reputation, facing an uphill battle that will shape her future.

Background and Commission’s Findings:

The Arizona Corporation Commission conducted a thorough investigation into Pam Hopman and her company, PGH Advisors LLC, resulting in severe sanctions. This serves as a resounding condemnation of Hopman’s unethical behavior related to the sale of unregistered securities. The significant restitution and penalties, totaling nearly half a million dollars, underscore the depth of her misconduct.

Furthermore, the scandal led to the revocation of Hopman’s investment adviser representative license and her company’s license, effectively halting her legal capacity to exploit unsuspecting investors—a stark consequence of her fraudulent activities.

The Deceptive Schemes:

Hopman and PGH Advisors were heavily involved in peddling securities from Deeproot and its affiliated companies. The Securities and Exchange Commission’s allegations that Deeproot operated as a Ponzi scheme have raised serious concerns about Hopman’s judgment and her willingness to jeopardize her clients’ investments.

Further investigations revealed that Hopman sold at least $10 million worth of unsecured and unregistered promissory notes from Premier Global Corp. This company is currently facing legal battles, accused of orchestrating a Ponzi scheme that victimized over 500 investors across 19 states—an alarming indication of the scale of Hopman’s deception.

The Aftermath and Reputation Management Efforts:

As the scandal continues to unfold, the prospects of recovering investors’ lost funds appear increasingly grim. Mark Dinell, the director of the ACC’s Securities Division, acknowledged the challenges in retrieving funds entangled in the federal and state lawsuits involving Deeproot and Premier Global.

Undeterred by the mounting evidence against her, Pam Hopman has embarked on an aggressive campaign to manage her reputation. She portrays herself as another victim through statements by her attorney and even sells her house to contribute toward the ordered restitution and penalties. These are just a few of her efforts; she is actively promoting positive content online, attempting to distance herself from her past and rescue her reputation.

The path to redeeming her public image is steep and perilous, reflecting the profound impact of the scandal on her life. While the effectiveness of Hopman’s reputation management strategies remains uncertain, her story serves as a stark reminder of the enduring consequences of fraudulent actions on one’s reputation and the challenges inherent in reputation management.

Wrapping it up:

The Arizona Corporation Commission’s investigation into Pam Hopman and PGH Advisors LLC revealed significant misconduct and unethical actions. Pam Hopman and her firm were found to have engaged in the sale of unregistered securities from companies involved in alleged Ponzi schemes, resulting in substantial financial losses for their clients.

The Commission has imposed hefty fines and revoked licenses as a consequence. Hopman now faces the daunting task of repairing her tarnished reputation, as the scandal has cast a spotlight on issues of trust and ethics in the financial industry.