Paramveer Singh

Background Of Paramveer Singh (CRD No. 5224401)

- Singh entered the securities industry in September 2009. Singh became registered with FINRA as a General Securities Representative in December 2009 and as a Research Analyst in March 2010 through his association with a FINRA member firm.

- From September 2009 through May 2019, Singh was associated with several FINRA member firms.

- On May 10, 2019, Singh became registered with FINRA as a General Securities Representative and a Research Analyst through his association with BofA.

- In October 2019, BofA filed a Uniform Termination Notice for Securities Industry Registration (Form U5) on behalf of Singh, stating that he was discharged due to “[c]onduct involving the use of a corporate credit card inconsistent with firm policy.”

- In December 2019, Singh became associated with another FINRA member firm. On July 20, 2020, that firm filed a Form U5 disclosing that Singh voluntarily terminated his association.

- Although Respondent is no longer registered or associated with a FINRA member, he remains subject to FINRA’s jurisdiction for purposes of this proceeding, pursuant to Article V, Section 4 of FINRA’s By-Laws, because (1) the Complaint was filed within two years after July 20, 2020, which was the effective date of termination of Respondent’s registration, and (2) the Complaint charges him with misconduct committed while he was registered or associated with a FINRA member and with providing false information to FINRA during the two-year period after the date upon which he ceased to be registered or associated with a FINRA member.

Can you expose the broker trying to trick you?

FINRA offers the free web tool BrokerCheck, which allows users to check a broker’s credentials, registration, and employment history. The disclosure part of BrokerCheck includes information on client conflicts, disciplinary proceedings, and specific financial and legal issues on the broker’s record.

Paramveer Singh Complaints & Reviews

On May 30, 2019, while registered through BofA Securities, Inc. (BofA), Respondent

Paramveer Singh converted and misused approximately $21,000 of BofA’s funds. On

that day, Singh intentionally charged personal expenses at an adult entertainment

establishment (the Adult Venue) to his BofA corporate credit card knowing that his firm

had the financial responsibility to pay for these charges. Singh’s use of the firm’s

corporate card in this manner was not authorized or consistent with firm policy. BofA

paid the credit card company for these charges, and Singh never returned the funds to

BofA. By converting and misusing approximately $21,000 of BofA’s funds, Singh

violated FINRA Rule 2010.

In addition, Singh violated FINRA Rules 8210 and 2010 by providing false information

to FINRA staff in writing in response to FINRA Rule 8210 requests, and during his on the-record testimony pursuant to FINRA Rule 8210. Specifically, Singh falsely told

FINRA staff, both in writing and orally, that he did not make or authorize the May 30,

2019 charges at the Adult Venue on his corporate credit card. He also falsely denied, both

in writing and orally, making a telephone call to the corporate credit card call center on

May 30, 2019, during which on a recorded line, Singh identified himself by name,

confirmed his email address and the card’s credit limit, and inquired why additional

charges on his BofA corporate credit card were declined at the Adult Venue on May 30, 2019.

Recent Activity(s)Of The Individual/Firm

A. Singh Charges Personal Expenses Incurred at the Adult Venue to his BofA Corporate Credit CardOn the evening of May 29, 2019, and continuing until the early morning of May 30, 2019, Singh attended the Adult Venue on a personal, non-business related visit.

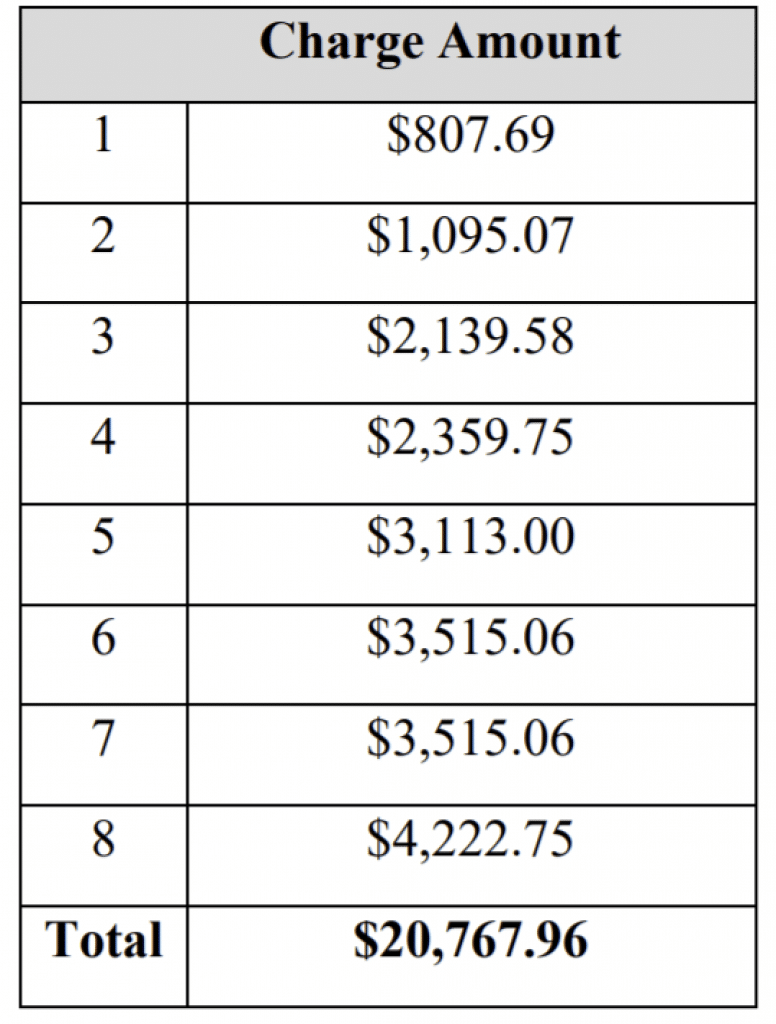

- On May 30, 2019, Singh made eight separate charges at the Adult Venue on his BofA corporate card, totaling $20,767.96.

- The following table shows the amount of each of Singh’s May 30, 2019 charges at the Adult Venue on his BofA corporate credit card:

- On May 30, 2019, Singh also made two charges on his personal credit card at the Aduli Venue totaling approximately $8,400.

- On May 30, 2019, at approximately 2:42 a.m., Singh called the corporate credit card ca center (Call Center) because certain charges on his BofA corporate credit card at the Adult Venue were declined. Singh’s call to the Call Center was recorded.

- During the recorded call, Singh advised the Call Center representative that he was with client and inquired about certain declined charges at the Adult Venue.

- During the recorded call, Singh verified his identity and provided specific details about his corporate credit card, including the card’s credit limit and his email address on file.

- On June 1, 2019, Singh again called the Call Center. This time, he claimed that he had lost his BofA corporate credit card at the Adult Venue. During this call, Singh claimed that the May 30, 2019 charges at the Adult Venue were fraudulent

- In addition, during July 2019 phone interviews BofA conducted of Singh, he falsely informed the firm that the May 30, 2019 charges at the Adult Venue were fraudulent ar that his corporate credit card had been stolen.

- Following an internal investigation by BofA, on October 18, 2019, the firm filed a Fort U5 indicating that it had terminated Singh as of September 20, 2019, for “[c]onduct involving misuse of a corporate credit card inconsistent with firm policy.”

- BofA’s policies at all relevant times prohibited the use of corporate credit cards for personal expenditures.

- The May 30, 2019 charges that Singh made on his BofA corporate credit card were personal expenditures.

- At all relevant times, BofA had the financial responsibility for Singh’s BofA corporate credit card. 22. BofA paid the May 30, 2019, Adult Venue charges totaling $20,767.96.

- Singh did not repay BofA for these improper charges. B. Singh Frequented the Adult Venue on Multiple Occasions 24. Singh frequented the Adult Venue multiple times both prior to and subsequent to May 29-30, 2019. Singh estimates he has visited the Adult Venue on at least 15 to 20 different occasions. On several occasions, Singh spent thousands of dollars on his personal credit cards at the Adult Venue.

- Between April 12, 2019, and June 14, 2019, Singh charged nearly $30,000 on his personal credit cards at the Adult Venue.

- Singh made eight charges on April 12, 2019, totaling approximately $9,100; six charges on May 10, 2019, totaling approximately $7,400; two charges on May 30, 2019, totaling approximately $8,400; and five charges on June 14, 2019, totaling approximately $4,700. C. Singh Provided False Information to FINRA Staff

- On October 25, 2019, FINRA issued a request to Singh, pursuant to FINRA Rule 8210, seeking information and documents relating to the May 30, 2019 charges on Singh’s BofA corporate credit card and Singh’s termination from BofA.

- On November 27, 2019, Singh responded to the request in writing, acknowledging that he went to the Adult Venue with a friend after leaving a restaurant on May 29, 2019.

- However, in his written 8210 response, Singh denied using the BofA corporate credit card at the Adult Venue. Singh stated that he reported his corporate credit card missing and then became aware of the Adult Venue charges, which he referred to as “fraudulent.”

- In the same written 8210 response, Singh stated that he was “informed by BofA that he allegedly called BofA corporate card services that night to approve a charge and that he was with a client” and that he “made no such call.”

- Singh’s response was false because Singh in fact made the May 30, 2019 personal charges to his BofA corporate credit card at the Adult Venue, and he called the Call Center the same day inquiring why additional charges on his BofA corporate credit card were declined at the Adult Venue on May 30, 2019.

- On March 31, 2020, FINRA staff sent Singh a request pursuant to FINRA Rule 8210 to provide on-the-record testimony. Pursuant to that request, Singh appeared and provided testimony on April 17, 2020 (the “OTR”). 33. During the OTR, Singh repeatedly testified falsely that he did not make or authorize the May 30, 2019 charges at the Adult Venue on his BofA corporate credit card.

- During the OTR, in response to questions regarding the May 30, 2019 charges at the Adult Venue, Singh falsely stated, “I am 100 percent certain that I did not make the charges. . . . I did not authorize those charges and I have no idea who actually used it on that May 29th/May 30th.”

- Further, during the OTR, Singh falsely denied that the May 30, 2019 recorded call to the Call Center was him after listening to the recording at the OTR.

Conversion (First Cause Of Action): Violation of FINRA Rule 2010

- The Department of Enforcement realleges and incorporates by reference all preceding

paragraphs. - FINRA Rule 2010 requires that members and associated persons, in the conduct of their business, “observe high standards of commercial honor and just and equitable principles of trade.”

- Conversion is an intentional and unauthorized taking of and/or exercise of ownership over property by one who neither owns the property nor is entitled to possess it.

- Conversion of funds is a violation of FINRA Rule 2010.

- On May 30, 2019, Singh intentionally used his BofA corporate credit card to make eight personal charges at the Adult Venue totaling $20,767.96.

- Singh’s use of the corporate credit card to pay for personal expenditures was not authorized. As Singh knew, BofA’s policies prohibited the use of corporate credit cards for personal expenditures.

- BofA had the financial responsibility for these charges.

- Singh was not entitled to use these firm funds to pay for personal expenditures.

- BofA paid for Singh’s eight personal expenditures he charged to his corporate credit card. Singh has never repaid or reimbursed BofA for those charges.

- By virtue of the foregoing conduct, Singh committed conversion in violation of FINRA Rule 2010.

Misuse Of Funds(Second Cause Of Action): Violation of FINRA Rule 2010

- The Department of Enforcement realleges and incorporates by reference all preceding

paragraphs. - FINRA Rule 2010 requires that members and associated persons, in the conduct of the business, “observe high standards of commercial honor and just and equitable principl of trade.”

- Misuse of funds occurs when funds are not applied in the manner they were intended t, be applied.

- Misuse of funds is a violation of FINRA Rule 2010.

- On May 30, 2019, Singh made eight separate personal charges at the Adult Venue on 1 BofA corporate credit card, totaling $20,767.96. BofA’s policies prohibited the use of corporate credit cards for personal expenditures.

- By misusing his corporate credit card in the manner already described, in violation of firm policies, Singh made improper use of BofA’s funds.

- By virtue of the foregoing, Singh misused BofA’s funds in violation of FINRA Rule 2010.

Providing False or Misleading Information to FINRA in Written Response to a FINRA Rule 8210 Request (Third Cause Of Action): Violation of FINRA Rule 2010 & 8210

- The Department of Enforcement realleges and incorporates by reference all preceding paragraphs.

- FINRA Rule 8210(a) provides that for purposes of an investigation, FINRA staff has the right to require a person associated with a member or any other person subject to FINRA’s jurisdiction to “provide information orally [or] in writing … with respect to any matter involved in the investigation.”

- Providing false or misleading information to FINRA in response to a request for information made pursuant to FINRA Rule 8210 violates FINRA Rule 8210.

- A violation of FINRA Rule 8210 also constitutes a violation of FINRA Rule 2010, which requires associated persons to “observe high standards of commercial honor and just and equitable principles of trade.”

- On October 25, 2019, FINRA sent Singh a letter, pursuant to FINRA Rule 8210, which requested that he describe the circumstances surrounding the May 30, 2019 charges on his BofA corporate credit card at the Adult Venue.

- On November 27, 2019, Singh submitted a response to FINRA’s Rule 8210 request that denied using the BofA corporate credit card at the Adult Venue.

- Singh also denied calling the Call Center on May 30, 2019 regarding the declined charges at the Adult Venue.

- Singh’s responses to FINRA were false. As alleged above, Singh made the charges at the Adult Venue on May 30, 2019 and called the Call Center on May 30, 2019 inquiring why additional charges on his BofA corporate credit card were declined at the Adult Venue that same day.

- By providing false information to FINRA staff in response to a Rule 8210 request, Singh violated FINRA Rules 8210 and 2010.

Providing False or Misleading Information to FINRA in Written Response to a FINRA Rule 8210 Request (Fourth Cause Of Action): Violation of FINRA Rule 2010 & 8210

- The Department of Enforcement realleges and incorporates by reference all preceding paragraphs.

- On March 31, 2020, in connection with its investigation, FINRA staff sent Singh a request, pursuant to FINRA Rule 8210, to provide on-the-record testimony.

- Pursuant to that request, Singh appeared and provided testimony on April 17, 2020.

- During his April 17 OTR, Singh testified that he did not make or authorize the May 30, 2019 charges on his BofA corporate credit card at the Adult Venue.

- During the OTR, Singh also testified that it was not him who made the May 30, 2019 recorded call to the Call Center after hearing the audio recording during the OTR.

- Singh’s testimony was false. Singh made the charges at the Adult Venue on May 30, 2019, and he called the Call Center on May 30, 2019 inquiring why additional charges were declined on his BofA corporate credit card at the Adult Venue that same day.

- By providing false information to FINRA during on-the-record testimony taken pursuant to FINRA Rule 8210, Singh violated FINRA Rules 8210 and 2010.

How To Spot A Fraud Finance Advisor (Infographic)

Help For Victims Of Paramveer Singh

If you have lost funds because of misrepresentation, unsuitable investment, or unsuitable investment strategy from Paramveer Singh. Then you can take legal action and get justice. Fraud, Malpractice & dereliction of duty should not be taken lightly, especially in this industry. We highly suggest that you notify authorities or seek legal action if your financial advisor or brokerage firm fails to abide by FINRA’s rules are regulations.

Similar Report: Dan Henry

Financial advisors are regulatory & legally obligated to suggest (recommend) the most suitable investments/investment strategies to their clients. Their suggestions should have their client’s best interests and should be appropriate for their client’s goals and needs. Similarly, the brokerage firm which hires financial advisors also has a regulatory & legal obligation to keep a close watch and supervise their Financial Advisors’ practices & behavior. They need to make sure that the financial advisor is not being manipulative or having an unreasonable bias towards certain investments. If the financial advisor and/or the brokerage firm breaches these duties, then the client/customer may be entitled to a full or partial recovery of their losses.

Financial advisors need to have the interest of their clients when giving suggestions related to investments and investment strategies. Reasonable basis suitability requires the advisor to do their best to analyze & identify the risks and rewards associated with their suggested investment and/or investment strategy.