Is Rohit Garg a scammer? Does Smartcoin defraud its users? Find out the answers to those questions in this review.

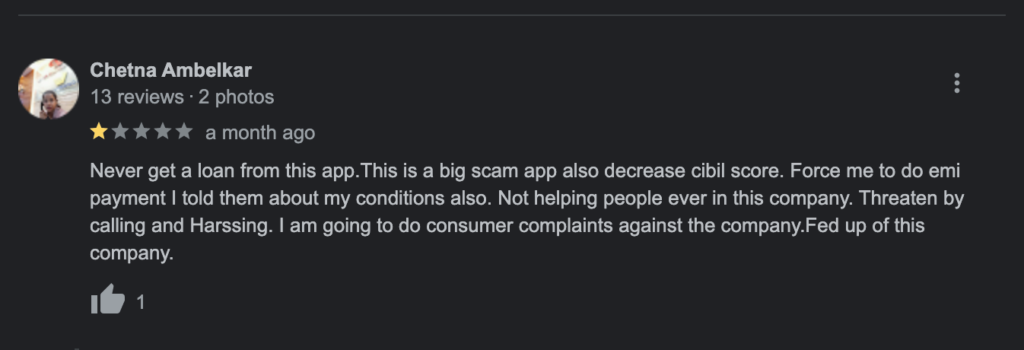

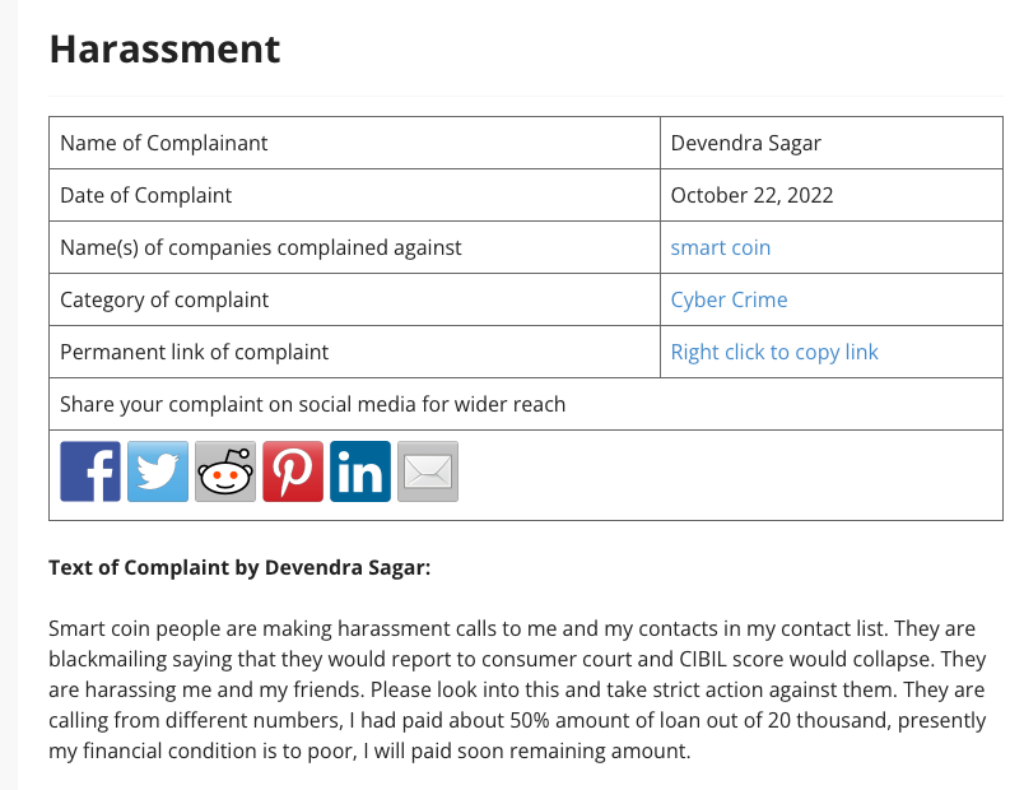

They were deceiving a bigger number of people since the reviewer noted in the review that there was a fall in the civil score, which was unsuitable for the people taking out the loan. Furthermore, they compelled individuals to pay EMI installments and did not listen to the people’s concerns; all they wanted was money from them. They came here just for financial gain, fully ignorant of the individual’s plight. Chetna also claimed that they were harassing people by making several spam calls to them. He stated that this was yet another of their strategies. After finally reaching his breaking point while working for this organization, he decided to file a lawsuit against the company for the issue.

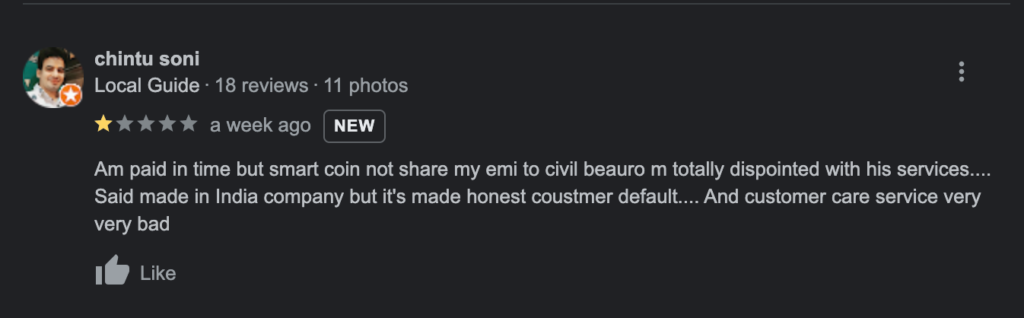

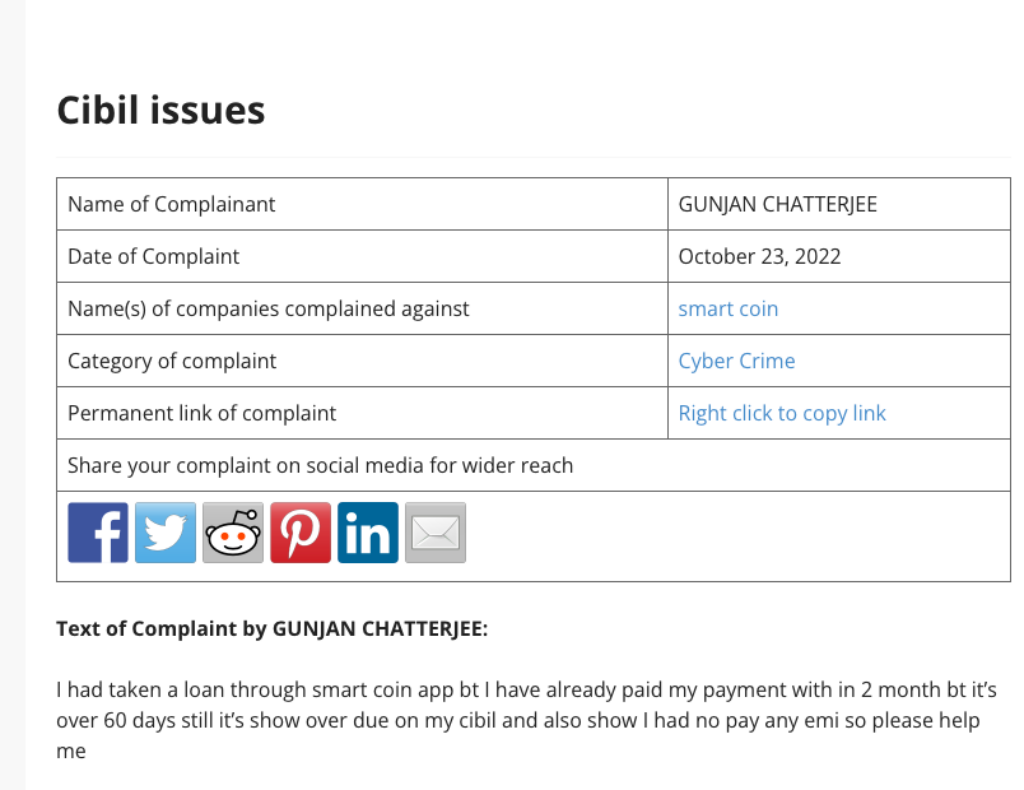

According to one reviewer, despite making timely payments, Smartcoin failed to submit his financial transactions to the right government organizations. He was dissatisfied with the services he received from Smartcoin because the company had advertised that the services they provided to their investors were made in India, but in reality, Chintu received the worst customer service possible. As a result, he was quite dissatisfied with the services provided by Smartcoin.

You can help us put a stop to online scams before they grow too big and end-up ruining thousands of lives. A scam is a scam, doesn’t matter if it’s big or small. Now that this is out of the way, let’s get started with the review.

Although some businesses used this strategy, the reviewer discovered that the general quality of customer service was deteriorating.

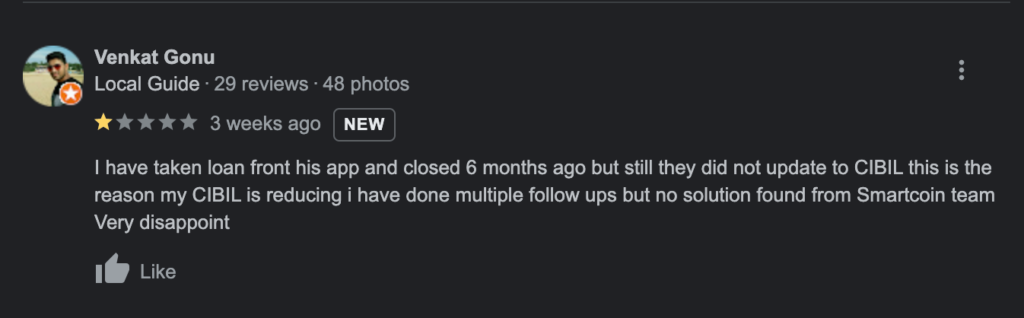

However, in the case of this reviewer as taken loan from this app and closed after 6 months but he faced the same problem multiple times which was quite disappointing after the whole experience. The decrease in the CIBIL scores is due to when there was non-payment of debts and when there was excessive credit utilization.

And he was unable to receive any kind of phone contact or email discussing this matter, which unequivocally demonstrates that they were deceiving their consumers by providing incorrect information and causing a fall in their CIBIL worth.

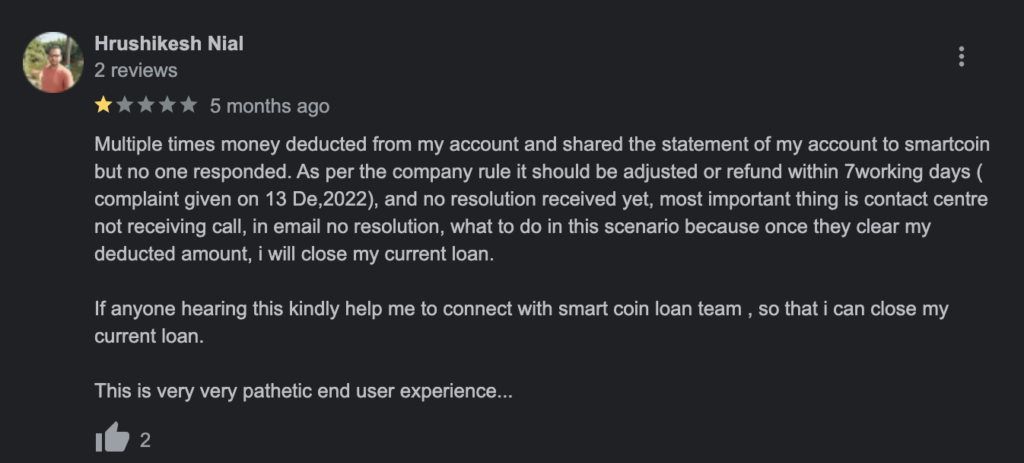

All of the clients who used this app had a negative experience because their accounts were debited without their knowledge and they received no messages, emails, or phone calls from the company. Nial has yet to get an explanation, despite the fact that the company’s policy requires that it be corrected or repaid within seven days.

To be able to finish off his existing loan, he requested that others contact the Smartcoin loan staff on his behalf. However, he was unsure about the further processes he needed to follow.

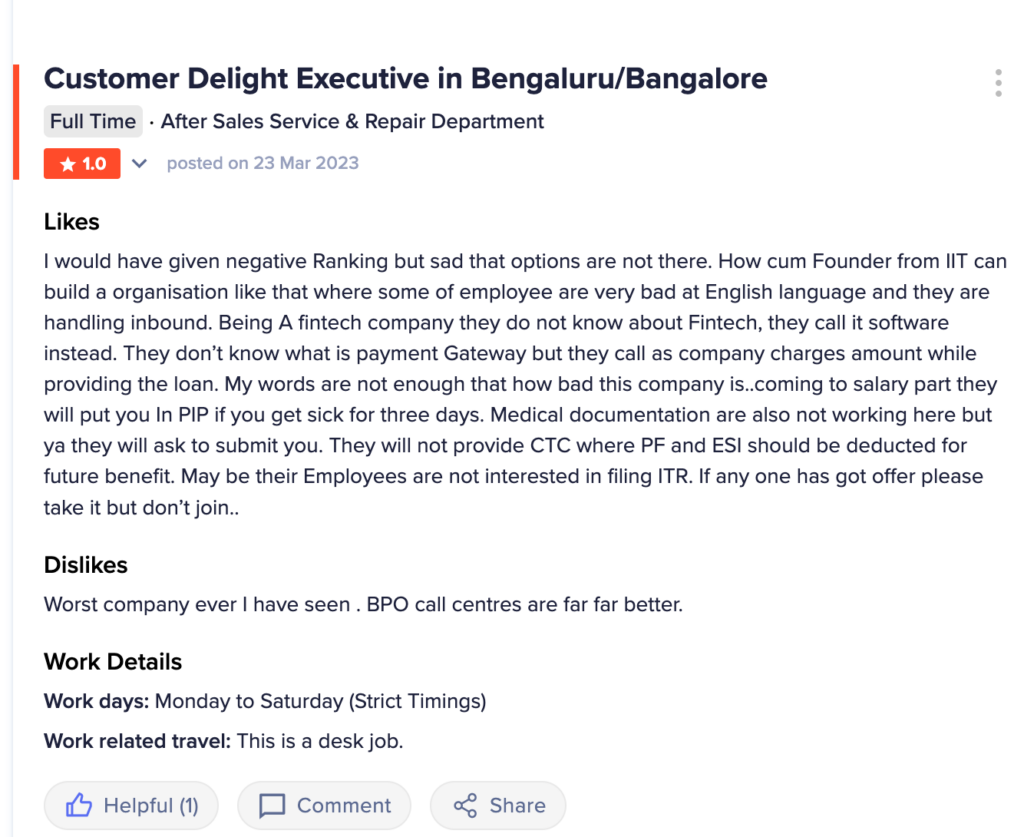

It’s difficult to believe that the founder of this company graduated from IIT; if that’s the case, it’s surprising that this company, while being a fintech platform, is unable to give PF and ESI. The reviewer was attempting to convey that the organization should be updated and make an effort to attract some highly educated employees with great command of the English language. She also stated that the company’s technical team will be in charge of developing this app.

Finally, Radhika admitted that she had terrible feelings about this business. According to the assessments, it is abundantly clear that enterprises urgently need to modernize and change the operational structure of the organization.

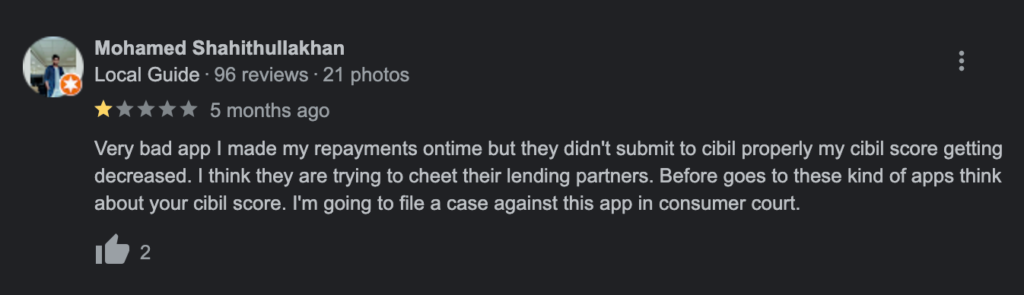

According to the reviewer, he was able to make his repayments on time; however, the company was unable to provide him with accurate CIBIL information, and as a result, his scores began to decrease, which was extremely discouraging for him. Mohamed added that they were attempting to defraud their landing companions, and he cautions many individuals to consider their CIBIL score before believing these first-year students.

Mohammad ultimately decided to pursue legal action against the corporation.

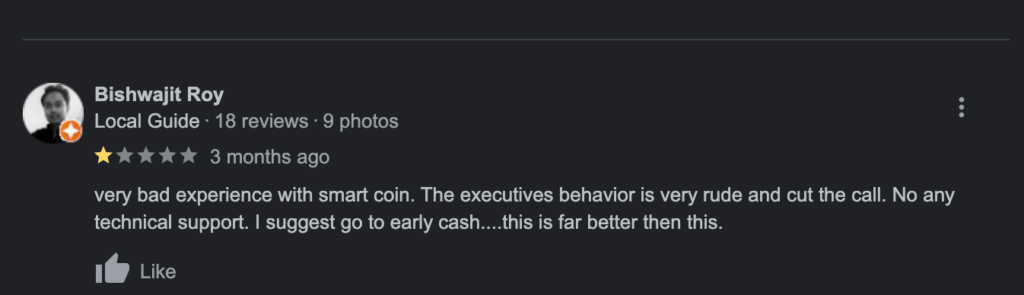

In a single instance, Roy had a bad experience while working with SmartCoin. The executive’s behavior irritated him, and he was quickly disconnected from the call, causing him considerable stress. Furthermore, he indicated that they were unable to provide any technical assistance.

Finally, he suggested that they contact another reliable source that would be beneficial to them. After reading the evaluation, it is clear that people were easily tricked by them, and once they were duped, they easily fell for their own tricks.

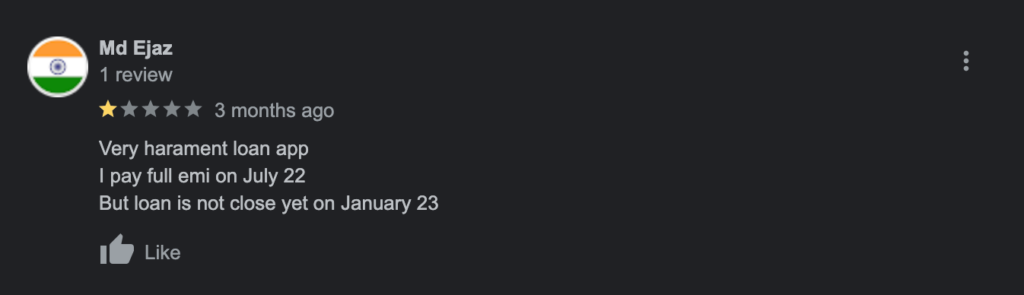

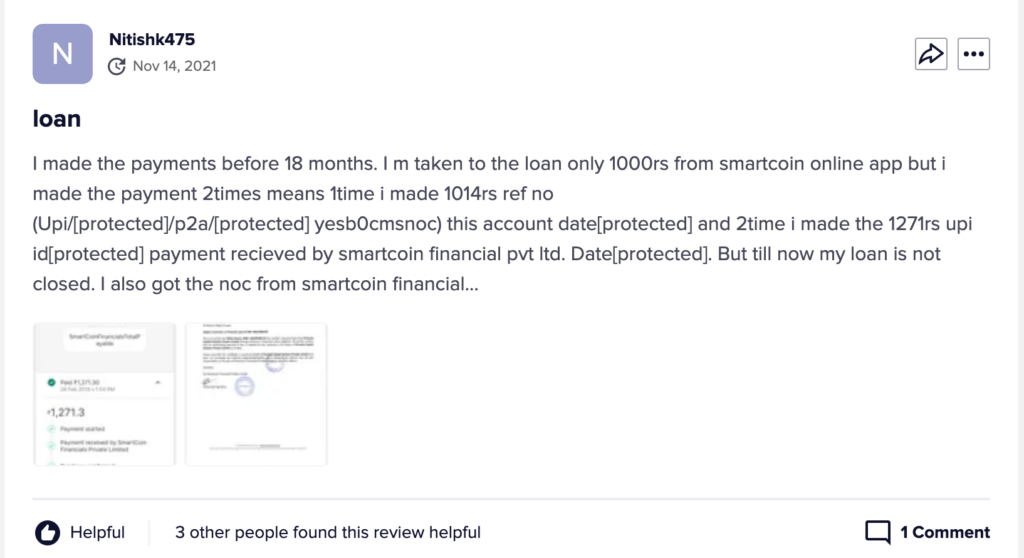

In this case, the reviewer is seeking to establish that even after paying the entire EMI, the loan has not yet been closed. He claims he paid the whole amount on July 22, but the loan was not terminated until January 23, demonstrating how readily the organization deceived its consumers and how difficult the software was to use.

What is a Ponzi Scheme?

A Ponzi scheme is a criminal deception investing fraud pledging increased rates of interest with less chance of loss to investors. On the other hand, a Ponzi scam is a deceitful investing fraud that induces retrievals for earlier investors with money carried from later investors.

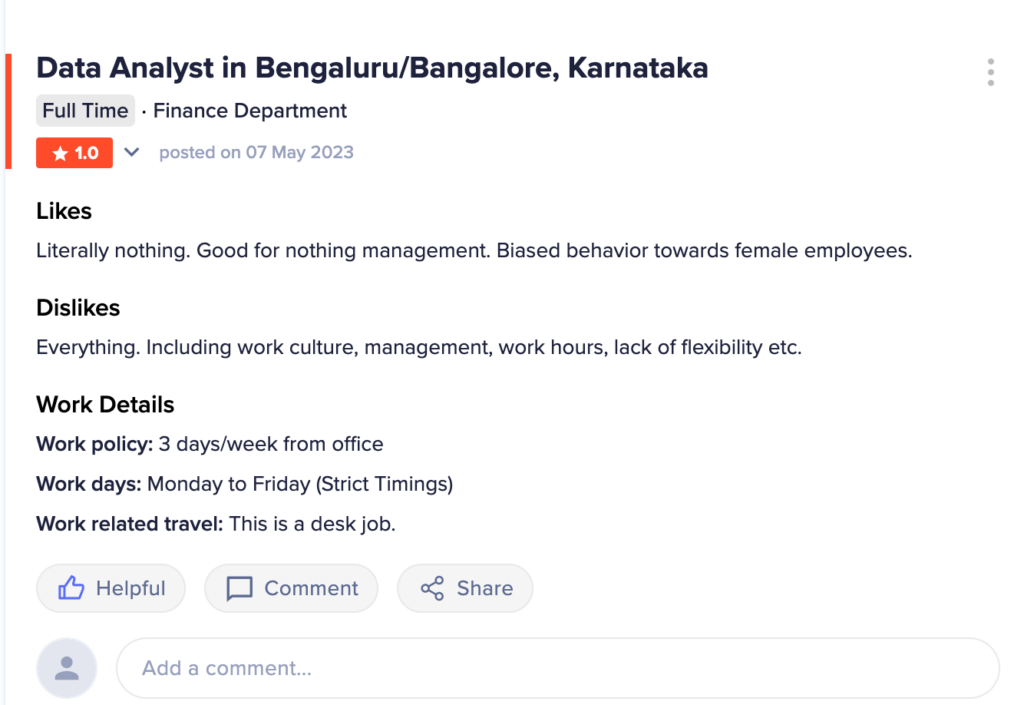

The reviewer, who had worked in the company’s financial department, states that there was no adequate management formed in the business. This is according to the reviewer’s statement. And there was a lack of flexibility and cooperation in the workplace, and there was biased behavior toward female employees. Reviewers also noted that the working days of the office were from Monday to Friday with a precise schedule, and the employment was a desk job.

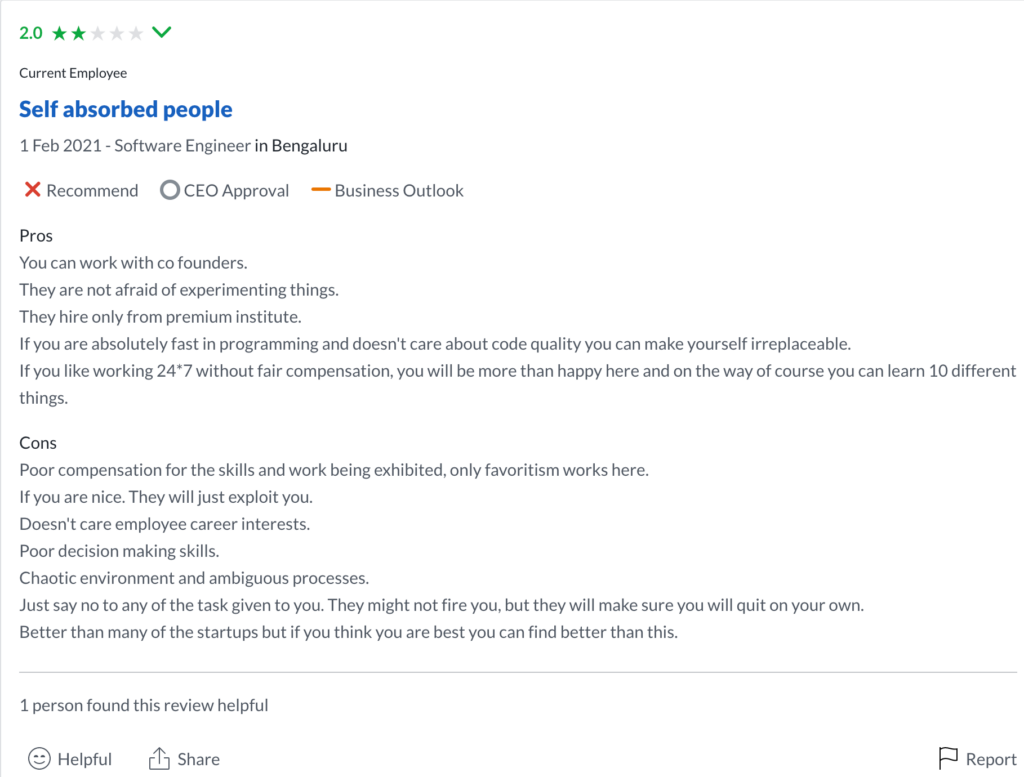

Worst Working Experience with SmartCoin

SmartCoin provided an awful experience

Smartcoin workers appear to be unprofessional and difficult to work with

They are the most difficult company to deal with

Smartcoin has a poor life cycle

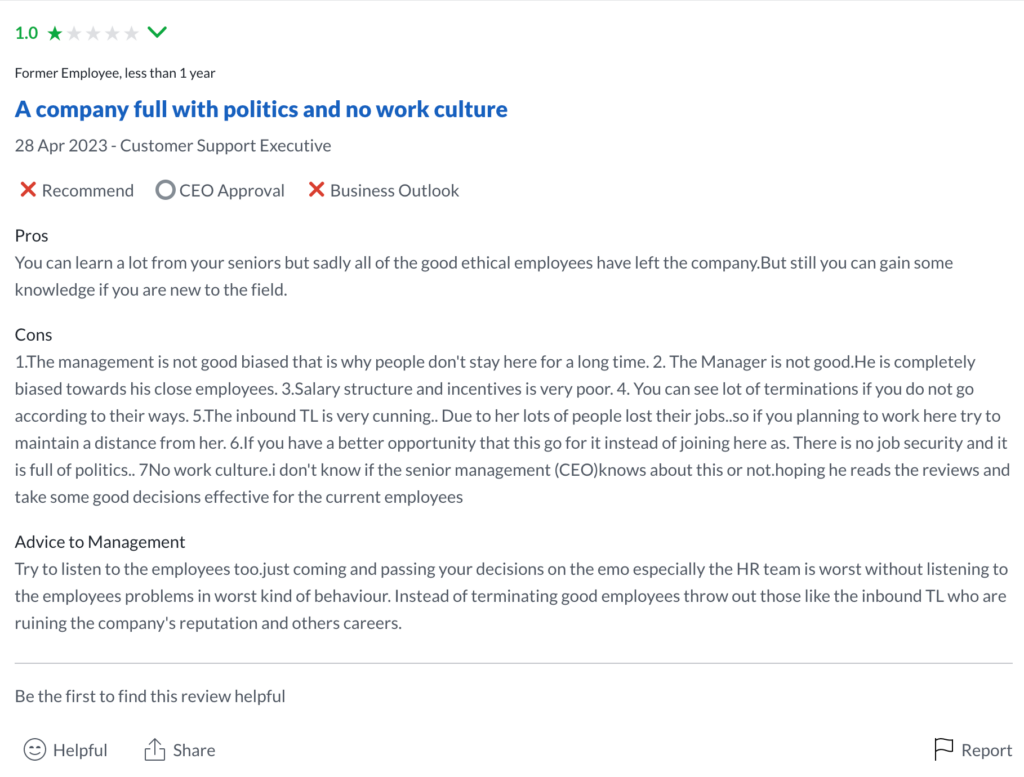

The company has issues of politics, and mismanagement is widespread

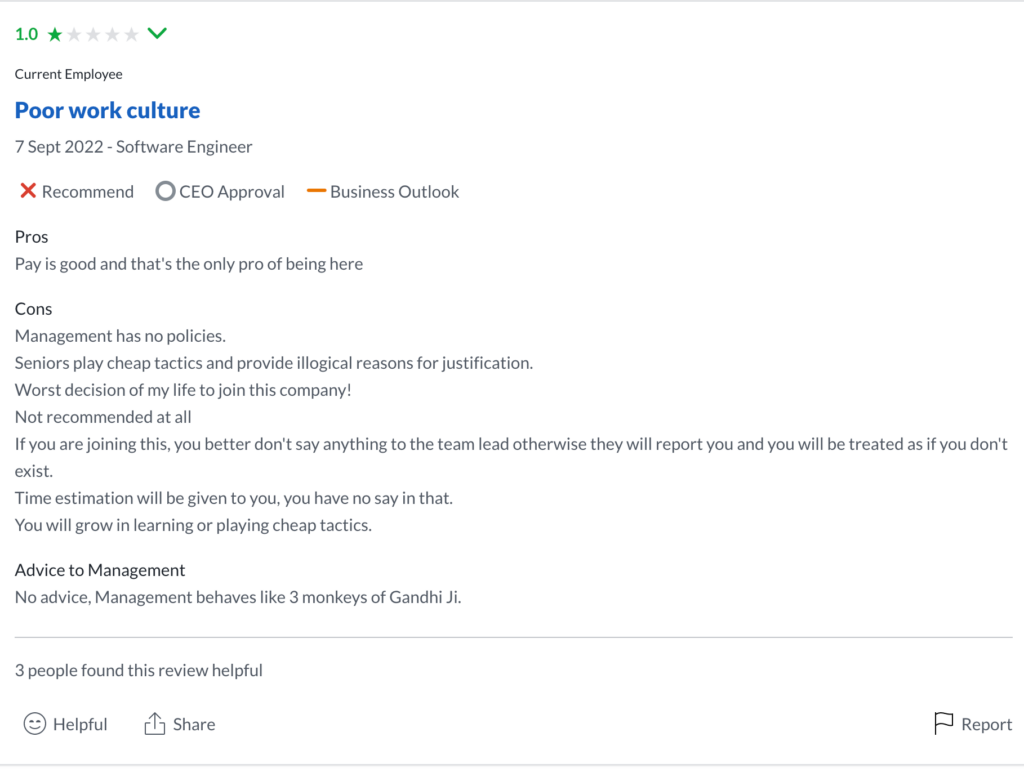

Poor workplace culture Seniors utilized cheap Justification methods

Smartcoin made poor decisions and does not value its employees’ abilities

Smartcoin reduced CIBIL scores

They were not answerable to their clients

Working with Smartcoin presented several technological challenges

Smartcoin is unable to provide their consumers with a fresh loan

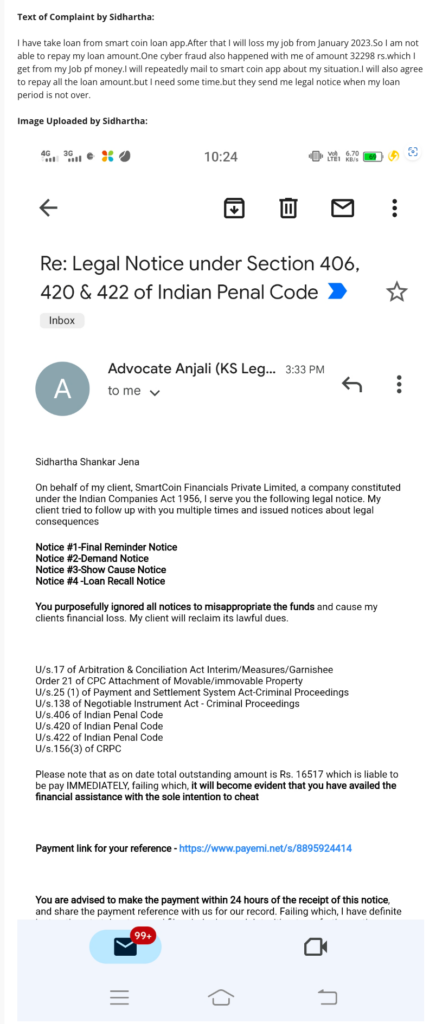

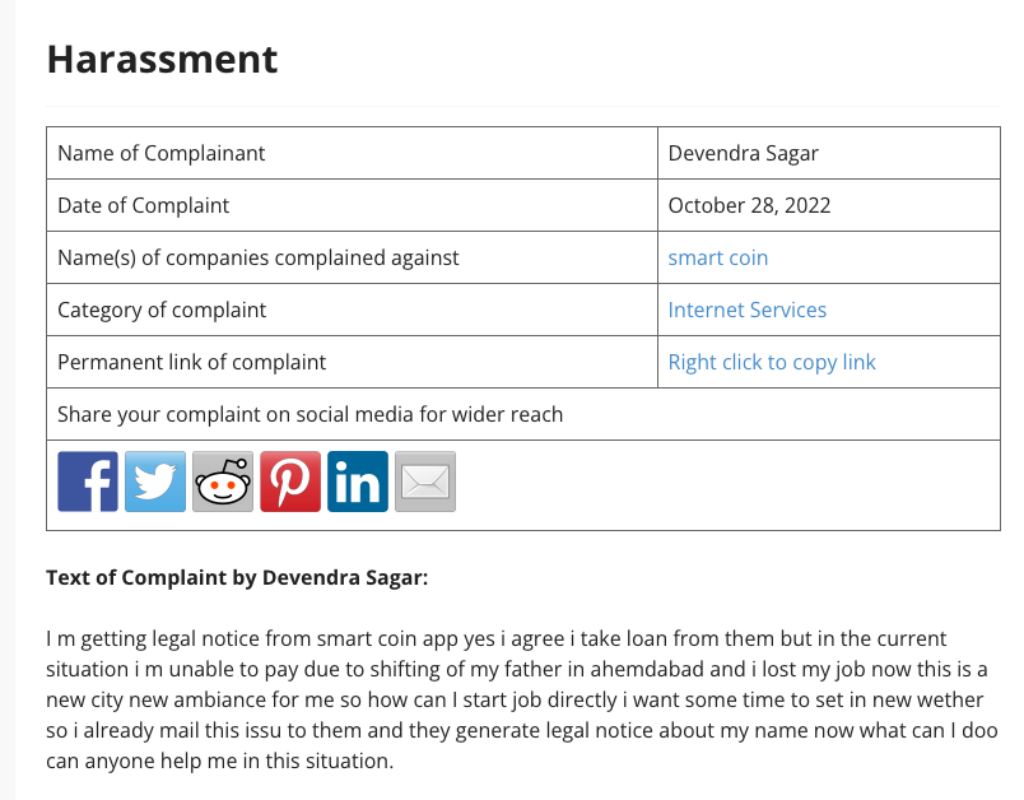

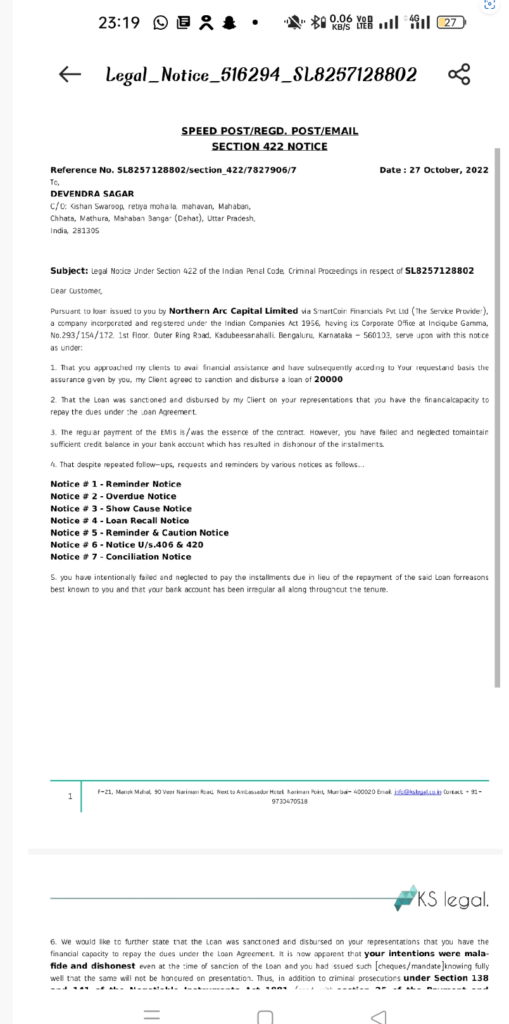

They issue legal notifications to their clients

They were unable to deposit the funds in the account

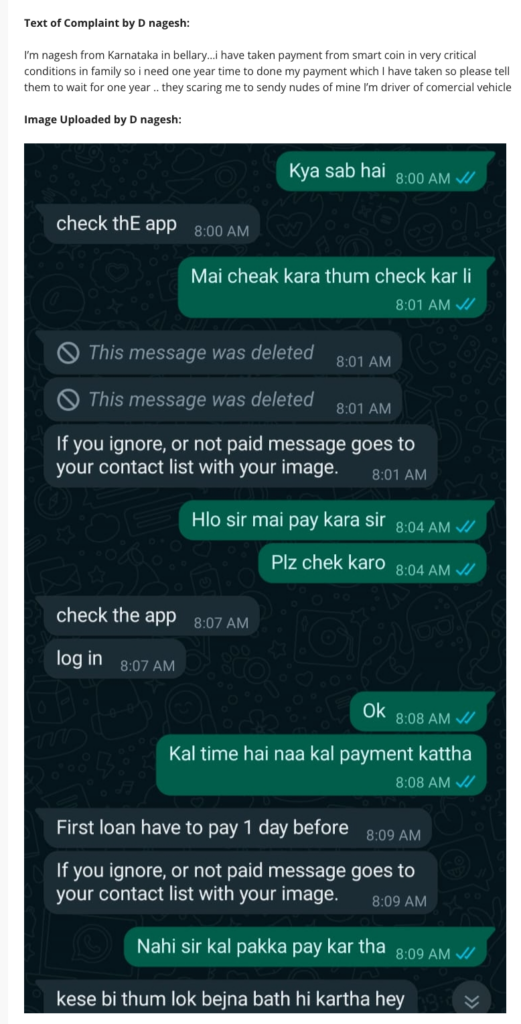

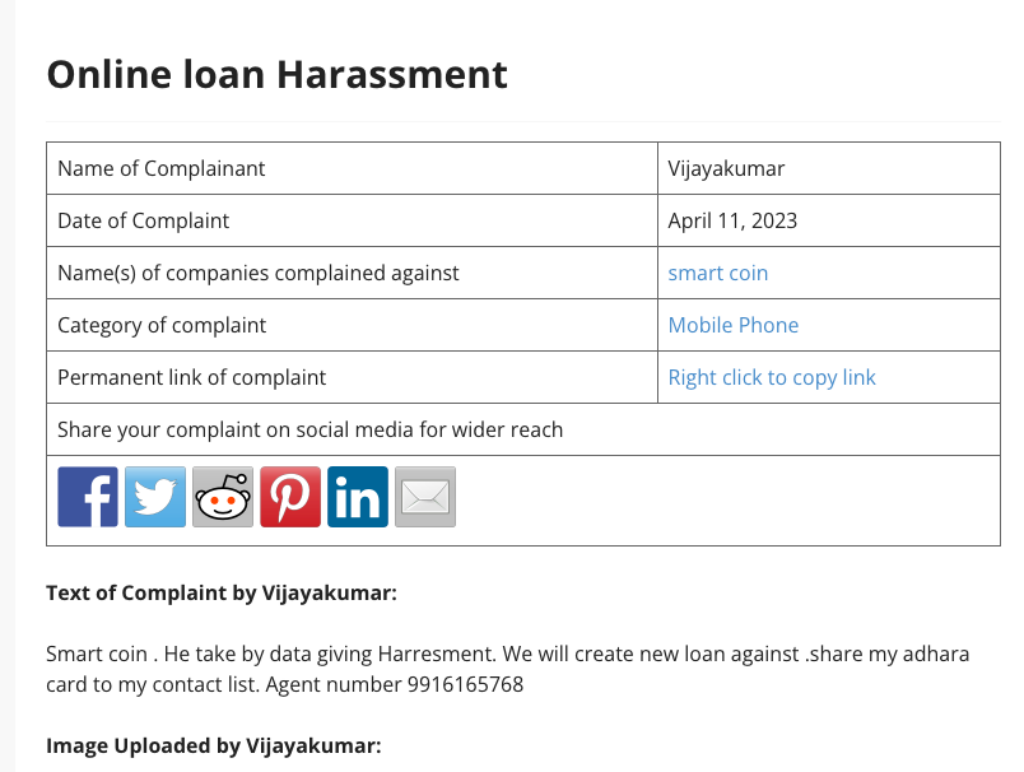

Smartcoin torchers and harassed people

There was an issue with issuing the Noc Certificate

Worked with Smartcoin and paid twice the loan amount

They misled individuals by sending them unwanted messages

Smartcoin is using spam calls and emails to target people

They were enforcing loan repayment by delivering legal notifications

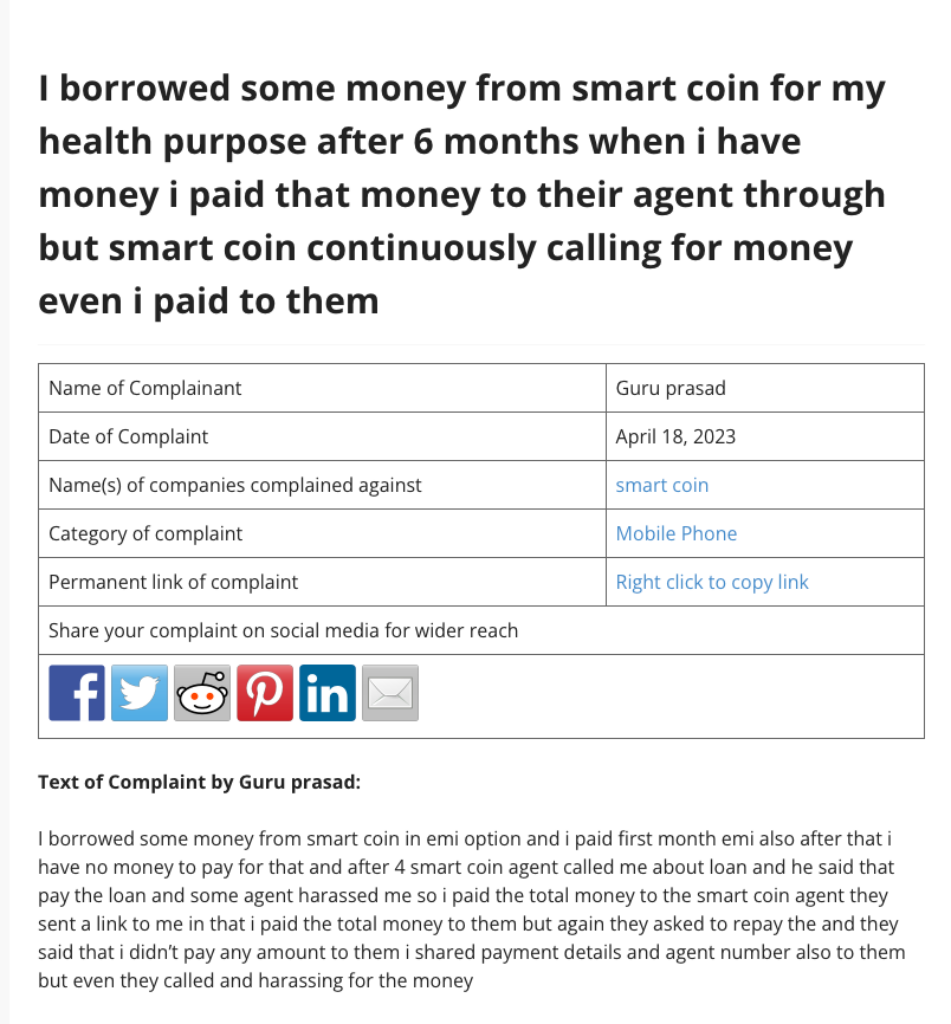

They were still contacting their clients to request a repayment of the loan

Smartcoin continues to compel By way of an online financing plan

Rohit Garg Smartcoin uses predatory practices

Rohit Garg Smartcoin sends out legal notices to victims

They showed outstanding payments even after the payment was entirely made

Smartcoin use spam calls to blackmail their clients

They charged their client’s high rates of interest