Who is Andrew Palmer (CRD#: 2827779)?

Andrew Palmer is the Managing Partner at Evoke Advisors and a member of the Firm’s Executive Committee. He was a Partner at Bel Air Investment Advisors before joining the firm, where he sat on the firm’s Board of Directors and Management Committee. Andrew provides investment advice to individuals, families, and foundations, with a focus on assisting entrepreneurs through life and wealth transitions.

Andrew began his investment career in 1996 with Merrill Lynch & Co. and has been named one of Barron’s Top 100 Independent Financial Advisors several times. He received his B.A. from the University of Denver.

This article is going further into Andrew Palmer’s past, uncovering hidden disclosures and SEC litigations, as well as analyzing the implications for law.

About Evoke Advisors

Evoke Advisors is an independent investment firm founded by experienced advisors from well-known companies with decades of expertise advising ultra-high-net-worth individuals, families, and non-profit organisations. The company was created on the notion that investing should be based on a basic grasp of how economies and financial markets work.

Their experienced team claims they understand the value of proactive innovation and business evolution, and they try to lead clients beyond the conventional to identify unique alternatives for protecting and expanding their investable assets.

They apply this strategy to each customer individually, taking into account their investment objectives, income needs, and risk tolerance. Most significantly, they provide clients with ethical, intellectual, and deeply personal devotion.

Evoke Wealth Investment Philosophy

According to Evoke’s SEC-filed brochure, its investment methods “emphasise long-term ownership of a diversified portfolio of marketable and non-marketable investments designed to provide superior after-tax, inflation-adjusted economic returns.” Diversification is also provided by the firm through numerous asset classes, market capitalizations, market styles, and geographic locations.

Evoke primarily invests in stocks, corporate bonds, government and municipal debt securities in the United States, mutual funds, closed-end funds (CEFs), exchange-traded funds (ETFs), structured products, warrants, commercial paper, certificates of deposit (CDs), options contracts, and limited partnership interests.

What types of Services do Evoke Advisors offer?

Evoke Advisors offers a range of services to meet clients’ financial needs. As an SEC-registered investment adviser, they provide investment advisory services specifically tailored for retail investors. Their services are offered for an ongoing asset-based fee, which is determined based on the value of cash and investments in your account, or through a mutually agreed upon fixed amount.

When you choose Evoke Advisors, you can benefit from various advisory services. These include wealth management, investment management, portfolio management, financial planning, and consultations on important topics such as estate planning, retirement planning, education funding, and charitable gifting.

To ensure that they offer personalized advice and solutions, Evoke Advisors takes the time to understand your unique financial situation, existing resources, goals, and risk tolerance. By gaining this insight, they can recommend a portfolio of investments that aligns with your objectives.

Additional Services

They also provide regular monitoring of your investments, typically on a quarterly basis, and will make necessary adjustments through rebalancing to keep your portfolio in line with your changing needs and goals.

Depending on your preference, Evoke Advisors can manage your account on a discretionary or non-discretionary basis. If you opt for discretionary management, they have the authority to make investment decisions without requiring your approval for each transaction.

On the other hand, if you choose non-discretionary management, you maintain the final say in deciding when to buy or sell investments. Either way, you will enter into an investment management agreement that specifies the terms of the arrangement, and this agreement will remain in effect until either you or Evoke Advisors decides to terminate the relationship.

What is SEC?

The Securities and Exchange Commission (SEC) in the United States is a federal government regulatory agency that works independently. Its main responsibility is to safeguard investors, ensure the securities markets operate in a fair and orderly manner, and facilitate capital formation.

Andrew Palmer Disclosures: BrokerCheck, FINRA, And SEC

BrokerCheck report of Andrew Palmer includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosures events.

According to the BrokerCheck report, a customer dispute type of disclosure has been reported against Andrew Palmer. In this disclosure, customers alleged that purchases of investment-grade bonds amounted to errors in judgement. While no amount of damages was stated, the estimated such would be more than $5,000 based on the value of the instruments purchased.

BrokerCheck

Source: https://brokercheck.finra.org/individual/summary/2827779

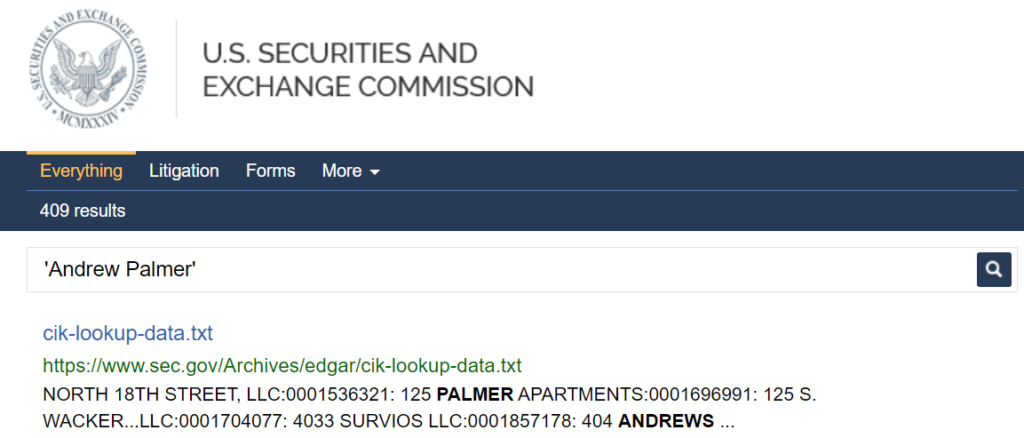

SEC Litigations & Forms

Source: https://secsearch.sec.gov/search?affiliate=secsearch&sort_by=&query=%27Andrew+Palmer%27

Andrew Palmer Lawsuits

Most court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, Trellis, law, and Law360. If Andrew Palmer has been involved in any such lawsuits, then you can find the documents using the links down below:

There might be more pending lawsuits against Andrew Palmer which are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Andrew Palmer on these websites, then you can contact the local authorities and check if they have a physical copy of any lawsuits.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Andrew Palmer Complaints and Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Andrew Palmer using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

Better Alternatives To Andrew Palmer:

Manages Assets Worth

- $6,427,792,177

Services

- Financial planning

- Portfolio management

- Selection of other advisors (including private fund managers)

- Family office and consulting services

Manages Assets Worth

- $4,465,757,285

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors (including private fund managers)

Manages Assets Worth

- $302,000,000

Services

- Financial planning

- Portfolio management