Who is Camper O’Neal(CRD#: 4942942)?

Camper O’Neal is a Certified Private Wealth Advisor® (CPWA®) practitioner. In March 2005, Camper O’Neal joined Merrill Lynch Wealth Management. Camper specializes in offering financial planning services to wealthy families and individuals, foundations and endowments, organizations, and retirement plans. Camper also possesses the Chartered Retirement Planning CounselorSM CRPC® approval from The College for Financial Planning Institutes Corp.

He assists clients plan for their pre- and post-retirement needs, with a focus on income and capital preservation. He also holds the Chartered Retirement Plans SpecialistSM CRPS® designation from The College for Financial Planning Institutes Corp.

Camper was nominated to On Wall Street’s “Top 40 Advisors Under 40” in 2015, 2016, 2017, 2018, and 2020. Rankings are based on data from September 30 to December 31.

This article will look into Camper O’Neal’s past, exposing hidden disclosures and analyzing the consequences of the lawsuits.

About Merrill Lynch Wealth Management:

Merrill Lynch Wealth Management is a division of Bank of America that offers financial planning and investment management services to individuals, families, and companies. The firm has a long history of serving clients’ financial needs, and it is well-known for its sophisticated investment products and services.

Merrill Lynch Wealth Management’s History

Charles Merrill and Edmund Lynch founded Merrill Lynch Wealth Management in 1914. The company was founded to provide investment banking services to middle-market enterprises. However, Merrill Lynch has now expanded its offerings to include retail brokerage, wealth management, and financial planning.

In 2009, Merrill Lynch was acquired by Bank of America, and the two companies merged to form one of the largest financial institutions in the world. Today, Merrill Lynch Wealth Management has over 14,000 financial advisors and manages over $2.3 trillion in client assets.

The key features of Merrill Lynch Wealth Management

Merrill Lynch Wealth Management provides a variety of services to help clients in managing their investments and planning for their financial future. Some of the firm’s key features are:

Financial Planning:

Merrill Lynch Wealth Management provides complete financial planning services to clients in order to assist them accomplish their financial objectives. Financial advisors at the firm work with customers to create customized financial plans based on their specific needs and aspirations.

Investment Management:

Merrill Lynch Wealth Management provides portfolio management, asset allocation, and investment research among other services.

Retirement planning:

Merrill Lynch Wealth Management provides a variety of retirement planning options to help clients in planning for their retirement. The firm’s financial advisors can help clients with creating a retirement savings plan, estimating retirement expenses, and evaluating retirement income sources.

Merrill Lynch Wealth Management Account Types

Merrill Lynch Wealth Management provides a variety of account alternatives to fit the specific needs of individual clients. The following are some of the account options provided by the firm:

Individual Retirement Accounts (IRAs):

Merrill Lynch Wealth Management offers traditional, Roth, and SEP IRAs to help clients save for retirement.

Brokerage accounts:

Merrill Lynch Wealth Management offers a range of brokerage accounts, including individual, joint, and custodial accounts.

Trusts and estates:

Merrill Lynch Wealth Management offers trust and estate planning services to help clients protect their assets and ensure that their wishes are carried out.

How to achieve financial success with Merrill Lynch Wealth Management

Achieving financial success with Merrill Lynch Wealth Management requires a proactive approach to managing your investments and planning for your financial future. Here are some tips to help you get started:

Set clear financial goals:

To achieve financial success, it’s important to set clear financial goals and develop a plan to achieve them. Work with your financial advisor to identify your short-term and long-term financial goals and develop a plan to achieve them.

Monitor your investments:

Regularly monitoring your investments is essential to ensuring that your portfolio remains aligned with your investment goals and risk tolerance. Work with your financial advisor to regularly review your portfolio and make adjustments as needed.

Diversify your portfolio:

Diversifying your portfolio is essential to managing risk and achieving long-term investment success. Work with your financial advisor to develop a diversified investment strategy that is tailored to your individual needs and goals.

Take advantage of tax-efficient strategies:

Managing taxes is an important part of achieving financial success. Work with your financial advisor to identify tax-efficient investment strategies that can help you minimize your tax liability and maximize your investment returns.

Camper O’Neal Disclosures: BrokerCheck, FINRA, And SEC

BrokerCheck report of Camper O’Neal includes information such as employment history, professional qualification, disciplinary actions, criminal convictions, civil judgment, and arbitration awards as well as disclosures events.

There is no disclosure events against Camper O’Neal.

BrokerCheck

Source:individual_4942942.pdf (finra.org)

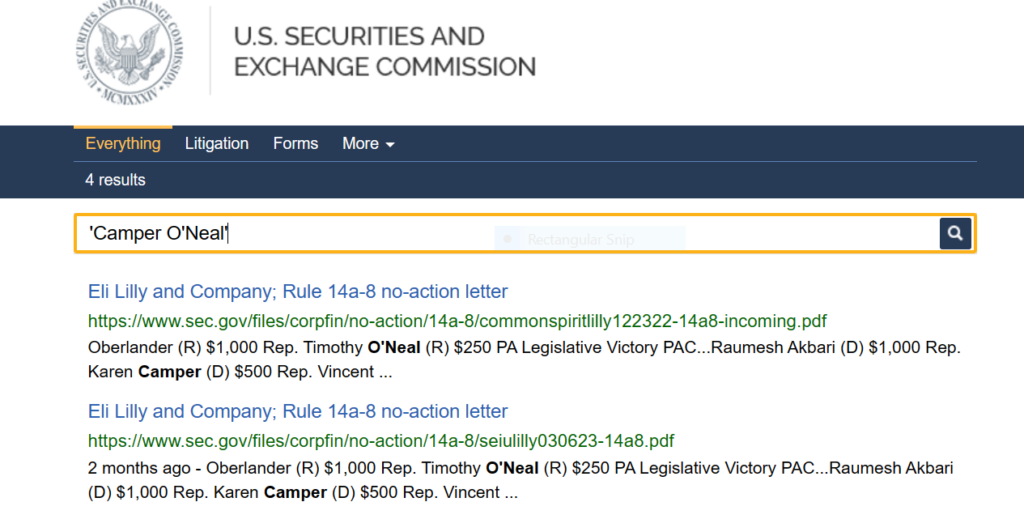

SEC Litigations & Forms

Source: Camper O’Neal – SEC Site Search Search Results

Camper O’Neal Lawsuits

The majority of court cases filed in the United States of America are archived on CourtListener, UniCourt, Law.com, Justia, and Trellis. Law and Law360. If Camper O’Neal has been involved in any such lawsuits, the records can be found using the URLs below:

There might be more pending lawsuits against Camper O’Neal that are not listed on these directories. Lawsuit files are often deleted from online directories. So if you cannot find any lawsuits against Camper O’Neal on these websites, then you can contact the local authorities and check if they have a physical copy of any lawsuits.

CourtListener

UniCourt

Law.com

Law360.com

Trellis.law

Justia

Camper O’Neal Complaints and Legal Battles

The following websites/directories are the best sources for finding complaints, litigations, and disputes against finance advisors. You can find all the complaints against Camper O’Neal using the websites down below:

Sonn Law Group

SEC.gov

White Law Group

MDF Law

Israels & Neuman, PLC

Klayman Toskes

Better Alternatives To Camper O’Neal:

Manages Assets Worth

- $6,427,792,177

Services

- Financial planning

- Portfolio management

- Selection of other advisors (including private fund managers)

- Family office and consulting services

Manages Assets Worth

- $4,465,757,285

Services

- Financial planning

- Portfolio management

- Pension consulting

- Selection of other advisors (including private fund managers)

Manages Assets Worth

- $302,000,000

Services

- Financial planning

- Portfolio management